Oil and oil and gas stocks are surging for a second day after members of the Organization of the Petroleum Exporting Countries (OPEC) and its allies – a coalition commonly known as OPEC+ – decided to prolong a historic cut to their crude output as demand recovery continues to be fragile.

OPEC’s decision went in the opposite direction of the market’s expectations, as analysts had predicted an output hike of around 1.3 million barrels as vaccinations have continued to move forward in most of the developed world.

Members of the cartel convened to prolong a reduction of 7.05 million barrels in their daily output compared to pre-pandemic levels at least until April while Saudi Arabia – the second largest oil producer in the world behind the United States – agreed to extend a voluntary cut of 1 million barrels per day.

Russia and Kazakhstan were permitted to increase their production by 130 and 20 thousand barrels per day respectively – which would reduce the daily output cut from 7.2 million barrels to 7.05 million.

Oil prices jumped on Thursday as a result of this decision, with futures of the West Texas Intermediate (WTI) surging for a third day as they gained 4.2% while posting a 2.2% gain today in early commodity trading action at $65.23 per barrel.

Meanwhile, Brent futures also reacted positively to the news, with the global crude benchmark surging more than 3% yesterday and another 3.3% this morning at $68.33 per barrel.

Oil ETFs and stocks

Oil stocks have also caught the tailwind of higher oil prices, as reflected by the performance of the Energy Select Sector SPDR Fund (XLE) – the largest exchange-traded fund (ETF) holding a basket of oil & gas companies including Exxon Mobil (XOM) and Chevron Corporation (CVX).

The price of XLE moved 2.4% higher yesterday while gaining 2.4% in pre-market stock trading action today at $52.27 per share.

Meanwhile, other important ETFs covering the sector such as the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) has posted even bigger gains, with the fund surging 3% yesterday and another 2.6% in pre-market trading activity.

Noticeably, the three largest funds covering the oil & gas industry – including the two mentioned above – have taken around $1.8 billion in inflows in the past 30 days, according to data from ETF Database, as investors bet on the recovery of the energy market despite the long-term headwind of a rapid shift towards renewable sources of energy.

For now, the energy sector is posting some of the most eye-popping gains since the year started, with XLE jumping 35% and XOP posting a 48% gain in roughly two months.

This performance is quite similar to that seen by oil prices, as both crude benchmarks have posted gains above the 30% threshold.

What’s next for oil and O&G stocks?

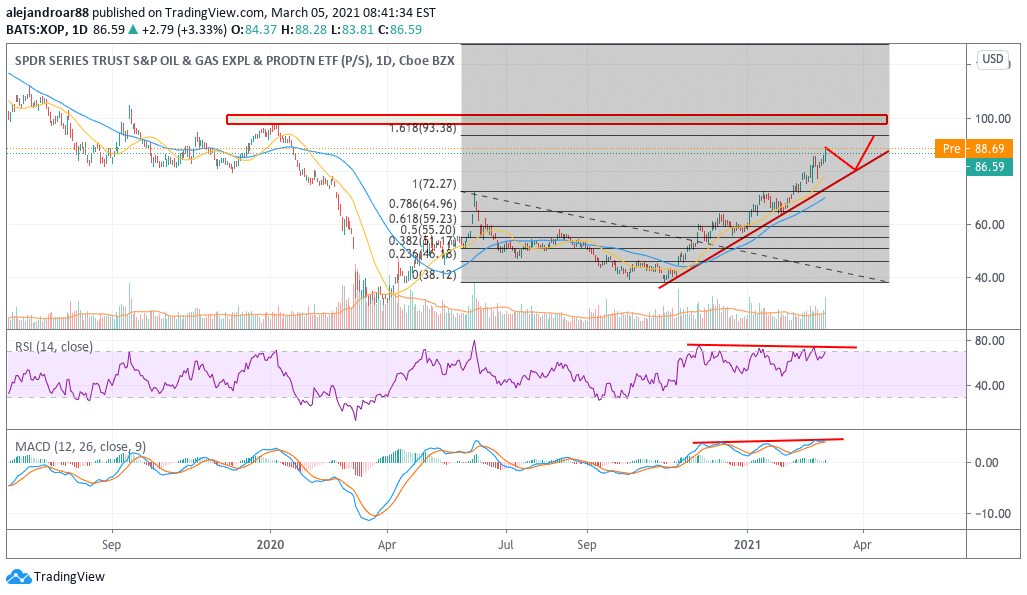

The SPDR S&P Oil & Gas ETF (XOP) is currently offering the strongest exposure to O&G stocks, which is a good reason to analyze this particular fund to possibly draft a forecast as to where oil stocks might be heading soon.

According to the chart shown above, the price of XOP seems headed to hit the 1.618 Fibonacci extension at $93.3 per share – that being a plausible short-term target if the market’s sentiment towards oil continues to be as bullish as it has been in the past few weeks.

Reinforcing this view, we have a MACD posting higher highs while the RSI remains near overbought levels. This indicates that the positive momentum for oil stocks continues to be strong yet it also means that they could face a strong pullback shortly as market participants take some profits off the table now that this decision from OPEC has cleared the air.

If that were to happen, the price of XOP could land at the lower trend line highlighted in the chart. In that scenario, a bounce from that particular landmark could be an interesting buying opportunity as it would result in a potential 10% to 15% upside for traders if the $93 target were to be hit.

Question & Answers (0)