Next shares are trading 3% higher at 6,378p per share in today’s late stock trading activity in London after the company upped its profit outlook for the year to £300 million, which is 54% more than what the company expected to earn according to a previous forecast released in July.

Next (NXT) revealed this positive outlook in today’s interim earnings report, which covers the six months ended on July 2020, a period during which it managed to bring £1.36 billion in sales, 34% less than the £2.06 billion it sold during the same period last year.

The retail segment – comprised of the company’s nearly 700 stores – took a dramatic blow, with sales dropping by 61% during the six-month period as a result of store shutdowns and lockdown measures attributed to the pandemic, both in the UK and overseas.

Moreover, the online segment – which accounts for more than 60% of the company’s sales – was also down 14% due to a 33% drop in full-price sales across the board.

After-tax profits, excluding the effect of IFRS 16 accounting policies, ended the semester at £15 million, which is 94% less than the £246 million the company brought in the year before.

Next managed to reduce the blow that its full-price sales took on its profitability by reducing the cost of its inventory, along with other measures like staff reduction, lower marketing expenditures, and reduced occupancy costs.

The company’s positive outlook follows some positive guidance provided by Next rivals including H&M and Inditex.

Next increases its profit outlook for the year

Next’s report indicated that the company has been seen an improvement in full price sales over the last thirteen weeks, which will have a positive impact on the group’s revenues and profitability during the next few months.

The retailer attributed this improvement to fewer people taking overseas trips during August and cool weather during the month.

As a result, Next is now assuming that its sales will be down only 12% for the year, although the management team also recognizes the possibility that sales could drop by as much as 34% if another wave of lockdowns and store shutdowns hits Europe – which is a strong possibility at the moment due to the surge in virus cases the region has seen lately.

In this regard, the company’s central scenario anticipates a profit before taxes of £300 million while the downside scenario estimates a figure of only £110 million. In both cases, this would represent a strong blow to Next’s earnings, as the company generated almost £750 million in profits during its last fiscal year – before the pandemic stroked.

What’s next for Next shares?

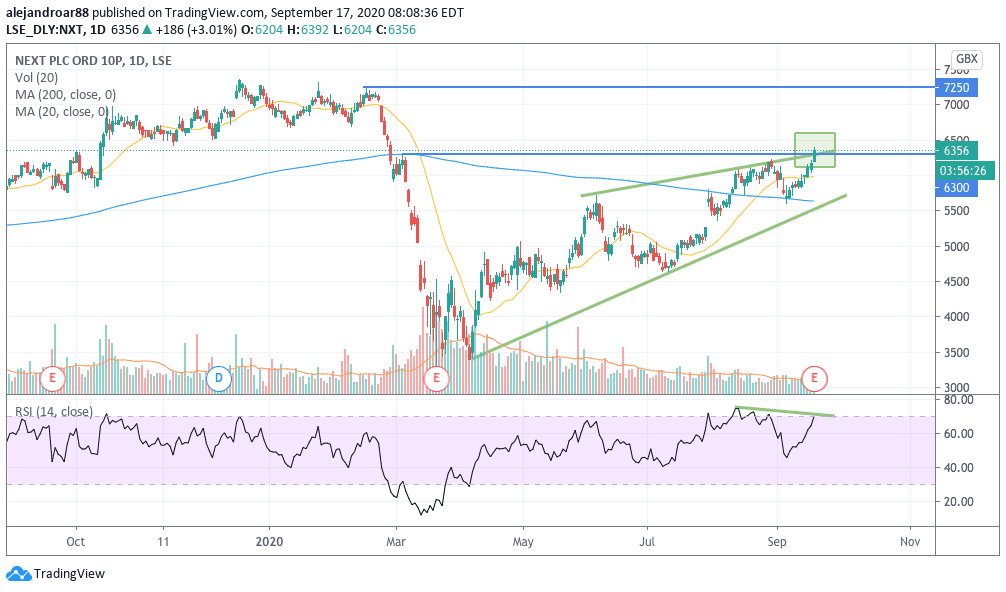

Next shares are surging above a rising wedge that started forming since their June highs, although the RSI is showing a bearish divergence that could actually indicate that a reversal is coming.

One of the elements that backs this bearish outlook is the resurgence of the virus in the UK, which, as we saw in the company’s scenarios, would have a dramatic impact on the group’s earning-generation capacity if another wave of lockdowns and shutdowns is to hit the Eurozone.

Moreover, the MACD is also not overly bullish, although the indicator is still in positive territory and it has just moved above the signal line.

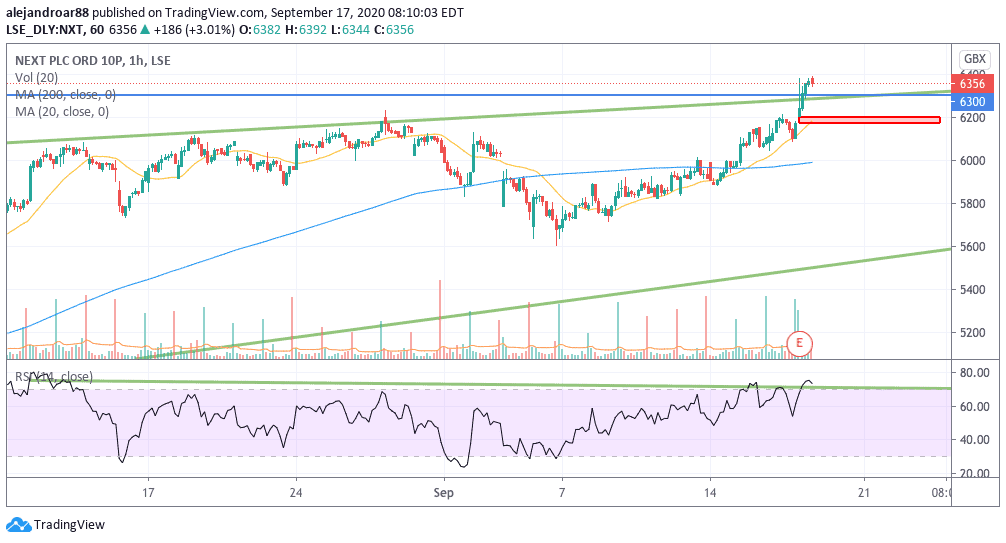

The hourly chart shows that the price action turned negative after failing to move above the 6,400 level and there’s also an open gap at 6,200 that could end up being filled if today’s positive momentum fades.

Stock traders should keep an eye on how the virus situation evolves in the UK and overseas, as the company has already warned about the negative impact that this would have – and investors have probably taken notice of this as well.

Question & Answers (0)