Micron Technology shares went down during yesterday’s stock trading session a day after the company released its earnings report covering the third quarter of its 2021 fiscal year despite beating analysts’ estimates for the period.

Micron revenues landed at $7.42 billion during the three months ended on 3 June 2021, resulting in a 36.4% jump in its top-line results while exceeding analysts’ forecasts for the period by $160 million.

The company cited higher sales of its DRAM and NAND products as the primary driver for this quarter’s upbeat results amid “strong demand across key markets”. The firm also emphasized low-double-digit price increases in the DRAM product line as another cause for this latest uptick in its top-line figure.

Higher average selling prices across Micron’s entire ecosystem of products and solutions led to a significant improvement in gross margins, with the percentage moving 1600 basis points higher during these three months compared to the previous quarter to land at 42% while also surging 1000 basis points compared to the same period a year ago when the company reported gross margins of 32%.

As a result, Micron’s operating income almost tripled during the third quarter compared to the previous three months, moving from $663 million to $1.8 billion. This also resulted in a 102% jump compared to the same period a year ago.

Finally, the company reported non-GAAP earnings per share of $1.88, effectively beating analysts estimates of $1.71 for the period while GAAP EPS came in at $1.55 per share, resulting in a 115.2% advance compared to the previous quarter and a 45% drop compared to a year ago.

Guidance for the fourth quarter of 2021 came in line with analysts’ expectations, with sales expected to land at $8.2 billion while non-GAAP earnings per share should end the three months at $2.30.

Shortages and analysts’ downgrades

Shares of Micron Technology (MU) dropped 5.7% following the release of this quarterly report to end the session at $80.11. So far this year, the stock is accumulating a 6.6% gain following last year’s pronounced 40% jump.

Micron has benefitted from an ongoing chip shortage, as the pandemic has resulted in a sudden surge in the demand for chip units that producers were not fully prepared for.

Sanjay Mehrotra, the Chief Executive of Micron, predicted that this shortage could last until 2022. The top executive cited increased demand across multiple markets including data center, gaming, industrials, and automotive.

This environment is particularly favorable for the company as it would allow it to gradually increase prices while maintaining production at elevated levels. However, some analysts including Summit Insights believe that this dynamic should peak during the second semester of 2021, which opens up the possibility that most of Micron’s shortage-prompted growth might already be priced into the stock at the moment.

Overall, analysts are bullish on Micron based on data from Seeking Alpha, with a total of 26 out of 33 analysts covering the stock holding a buy rating while the 12-month consensus price target for the stock currently stands at $114.2 for a 42.5% potential upside if that target is reached.

What’s next for Micron Technology shares?

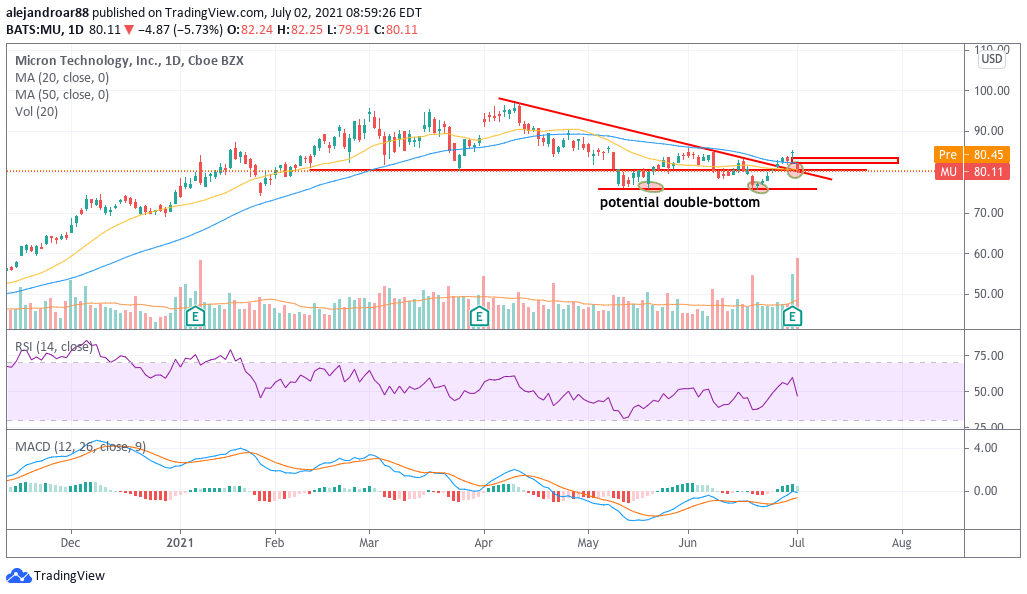

Yesterday’s price action seen by Micron Technology shares has resulted in a tag of two important support areas for the stock at the $80 level. The outlook for Micron in the short-term appears to be bullish if this support holds as the stock has bounced strongly off a double-bottom formation at the $76 level.

A rebound off this support could indicate the continuation of this latest uptrend while a break below could result in a sharp drop toward the $76 level for a 5% downside risk. If the stock bounces, the reward-to-risk ratio seems quite appealing with a first target set at $90 per share.

Yesterday’s trading volumes were quite high, with over 53 million shares exchanging hands, which is more than twice the daily average. Meanwhile, this was the second high-volume trading session for Micron, which reinforces the importance of the current level to forecast the stock’s future path.

For now, momentum seems to be on the side of bulls as the MACD has sent a buy signal already while climbing to positive territory. Meanwhile, the RSI has just dropped below the 50 level at 47 but overall the uptrend is intact as the oscillator posted a higher low despite the stock price holding its previous low at $76.

Question & Answers (0)