The price of Metrobank shares is sliding almost 8% in this morning stock trading action in London after the regional bank reported a staggering £271 underlying pre-tax loss last year, attributed to the impact of the pandemic and a persisting low-interest-rate environment.

The COVID-19 crisis led to a £126.7 million credit loss expense as higher unemployment levels raised concerns about a wave of potential defaults in the bank’s loan portfolio – primarily comprised of commercial credit and retail mortgages.

In this regard, non-performing loans increased to 2.1% during the year, up 0.53% the bank reported in 2019, reflecting the impact of the pandemic in customers’ ability to remain current with their financial obligations.

During the year, net interest margins (NIM) declined 1.22%, representing a 29 basis points drop compared to 2019, while underlying interest income fell 19% to £250.3 million.

That said, CET Capital remained strong during the year, standing at £1,192 million for a pro-forma CET1 ratio of 16.3% – almost four times above the regulatory minimum of 4.5%.

To put the bank’s underlying pre-tax loss into context, in 2019, Metrobank lost £11.7 million, which means that last year’s losses were almost 23 times higher than those seen during the preceding year, while statutory pre-tax losses ended the year at £311.4 vs. £130.8 million the bank reported in 2019.

Metrobank loan portfolio deteriorating

Moreover, last year losses almost exceeded the market capitalisation of Metrobank shares, which is perhaps the reason why market participants are reacting so negatively to the results released this morning,

Meanwhile, the bank’s total loans retreated 18%, ending the year at £12.09 billion, while the loan-to-deposit ratio dropped to 75% – down 2,600 basis points from the 101% reported by the bank during 2019.

This deterioration in Metrobank’s loan portfolio is also a cause for concern, as the future profitability of the bank is at stake, especially given today’s low-interest-rate environment.

In regards to the challenges faced by the regional bank, Metrobank’s Chief Executive Daniel Frumkin highlighted the strategic initiatives the bank has took to possibly overturn its disappointing performance.

The head of the bank stated: “our transformation strategy is firmly on track and we have accelerated initiatives to shift our asset mix, bringing higher yield and improving net interest margin, as evidenced in the second half”.

As part of this restructuring, the bank recently completed the disposal of its £3.1 billion residential mortgage portfolio, which had an average yield of 2.1% per year.

Meanwhile, in August 2020, Metrobank acquired peer-to-peer lending platform RateSetter for £2.5 million as a way to grow its unsecured lending activities – a segment that is, by nature, more profitable although riskier as well.

What’s next for Metrobank shares?

Similar to other financial institutions in the United Kingdom such as Barclays and HSBC, Metrobank shares lost almost a third of their value last year as the pandemic prompted banks to hike their loan loss reserves in anticipation of a shockwave of defaults that didn’t fully occurred.

That said, as part of the government’s effort to contain the financial and economic fallout caused by the virus, the Bank of England – along with most central banks around the world – went on to inject billions in liquidity into the markets, which resulted in a strong drop in interest rates.

Given the fragility of the markets at the moment amid the persisting uncertainty generated by the health crisis, it is unlikely to see a turning point in these accommodative policies at least for what remains of 2021, which means that banks’ profits will remain under pressure.

So far this year, Metrobank shares have advanced 7%, although they remain severely depressed compared to their pre-pandemic levels.

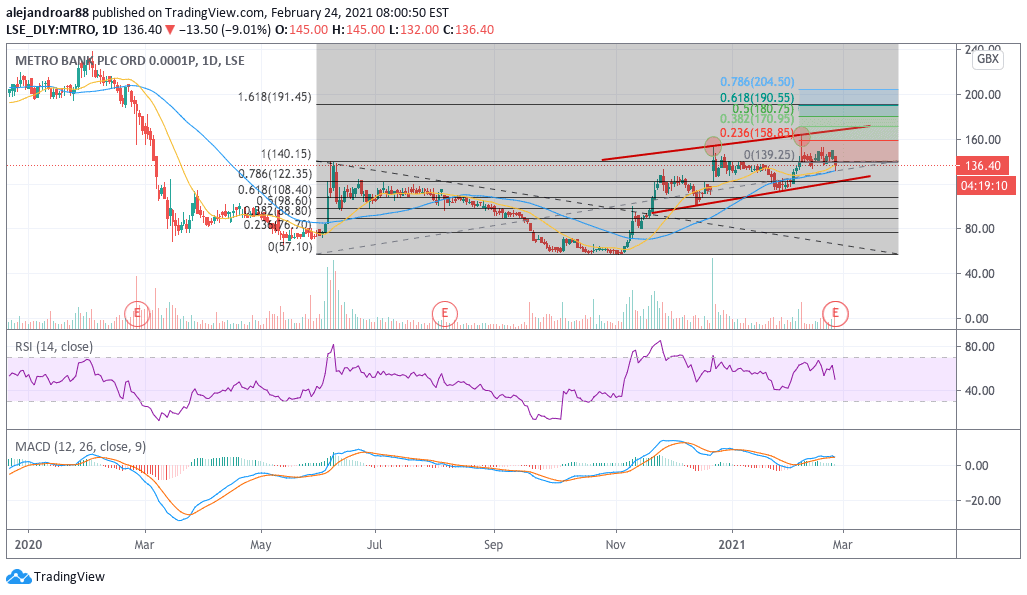

This slight uptrend is reflected in the daily chart above, with Metrobank’s share price advancing within a symmetrical price channel that could lead to a first target of 160p for the bank.

However, it is important to note that today’s downtick could end up reversing this uptrend. At this point, traders should keep an eye on the stock’s short-term moving averages and lower trend line as important support areas for the price action.

A move below these markers could be signalling the beginning of a downtrend, possibly as market players see a challenging path ahead for the bank as it struggles to remain profitable in the current environment.

Question & Answers (0)