Lyft shares saw a strong uptick yesterday following the release of a trading update from the company in which the management highlighted a better-than-expected recovery in ride volumes compared to the previous quarter, with vaccinations possibly boosting consumer’s confidence in the United States.

The company’s update indicated that average daily rideshare volumes during the first three weeks of February increased 5.4% compared to the same period in January while the week ended on 28 February was the best one for the company since the pandemic started.

Lyft (LYFT) also expects to report its third consecutive month of consistent average daily rideshare growth, reflecting an important shift in the business’ situation compared to the fourth quarter of last year as ride volumes consistently dropped during the months of November and December.

Meanwhile, the San Francisco-based firm previously expected to see a decline of 4% in average daily ride volumes during the first quarter of 2021 – compared to the previous quarter – but has now adjusted that estimate to a 1.2% drop, reflecting an improvement in business conditions.

As a result, Lyft has trimmed its Adjusted EBITDA estimates for the first quarter of 2021 to a $135 million loss, down from a previous $145 to $150 negative EBITDA the company anticipated back when its fourth-quarter results were released.

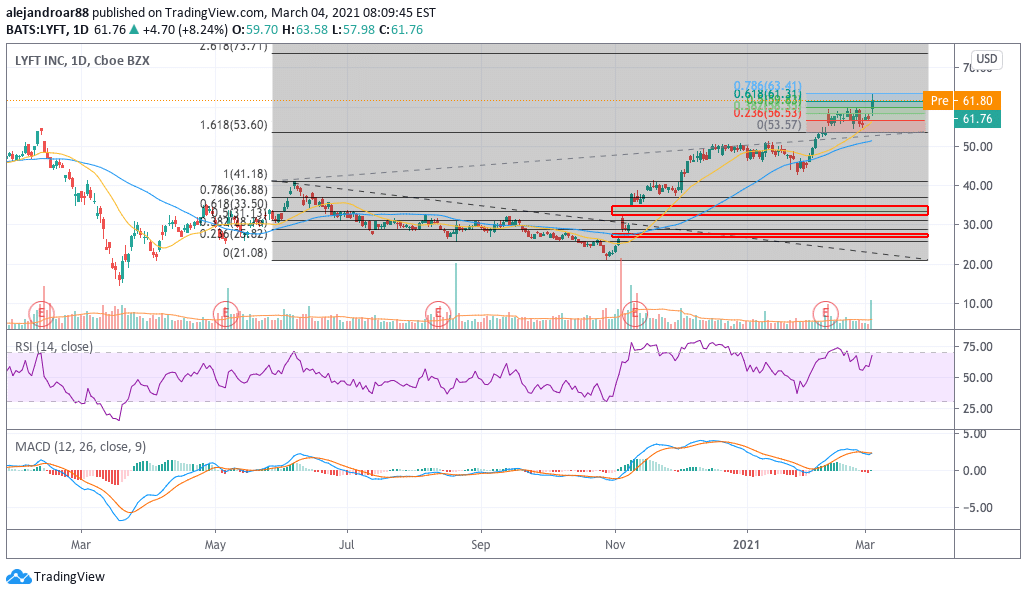

The update seems to have excited market participants, as Lyft shares went up as much as 8.2% during yesterday’s stock trading session after spiking 11% during the opening to then close the day at $61.76 per share. Meanwhile, the stock price is flat in pre-market action today.

How have Lyft shares performed recently?

Lyft shares have risen 25.7% since the year started, more than doubling the gains seen by its rival Uber Technologies (UBER), as the firm’s outlook continues to improve with multiple states now moving to lift their COVID-related restrictions.

Meanwhile, the progressive rollout of vaccines in the United States and other corners of the developed world is also lifting the market’s sentiment towards Lyft’s stock, as ride volumes should continue to recover in the coming quarters while a bigger percentage of the population gets inoculated.

In regards to Lyft’s outlook, analysts from security analysis firm CFRA commented: “We believe LYFT is poised to show an inflection towards positive year-over-year growth starting the week of March 21, which we think will accelerate into the summer months barring any setbacks with vaccine roll-outs”.

What’s next for Lyft shares?

Trading volumes for Lyft shares were almost three times the daily average yesterday, reflecting the sentiment boost provided by this latest trading update.

That said, although there was some significant buying activity there was also a fair share of selling, with the price closing the session almost 3% below its daily high.

For now, technical indicators are not sending any clear signals, yet it is worth noting that Lyft shares started to retreat once the price tagged the 0.786 Fibonacci extension shown in the chart – a plausible short-term resistance that the price action should overcome in the next few days for the uptrend to continue.

At this point, traders should keep an eye on both the RSI and the MACD, as both indicators may post a higher high over the next few days as a result of the encouraging news flow.

If that is not the case, chances are that a fair number of investors could be tempted to push the price lower, as they take some profits off the table before the uptrend resumes.

In the long run, Lyft shares seem poised to continue their upward path on the back of an improved outlook for the business as the vaccines roll out gathers pace in the US.

Question & Answers (0)