Lucid Group, Inc. (NYSE: LCID) shares are trading sharply lower in US price action today after the company announced the pricing of a private offering of $875 million aggregate principal amount of 7.00% Convertible Senior Notes due 2031. This significant financing move is primarily aimed at refinancing existing debt and supporting the company’s general corporate purposes as it continues to navigate the capital-intensive scale-up of its electric vehicle (EV) production.

Lucid prices convertible note offering

The notes are being offered in a private placement to qualified institutional buyers. The initial conversion price of $20.81 represents a premium of approximately 22.5% over Lucid’s closing price on November 11.

Lucid plans to use the majority of the estimated net proceeds, which are approximately $863.5 million (or $962.4 million if the option is fully exercised), to manage its existing debt structure. The remaining net proceeds will be used for general corporate needs, which could include further investment in manufacturing, research and development, and expansion of its retail and service networks.

The EV industry is capital-intensive

Notably, the EV industry is quite capital-intensive, and startup players have had to raise capital at regular intervals to fund their burgeoning cash burn. Lucid, like many high-growth EV makers, faces enormous capital expenditure demands. The consistent and structured investments from the public investment fund (PIF), Saudi Arabia’s sovereign wealth fund, reflect a deep, strategic partnership that goes beyond mere financial support, aligning directly with the Kingdom’s Vision 2030 goals for economic diversification.

The PIF, through its wholly-owned affiliate Ayar Third Investment Company, is Lucid’s majority shareholder, giving it significant influence over the company’s trajectory. This relationship is cemented by a series of massive capital infusions, structured to provide flexibility and long-term stability.

Lucid is backed by Saudi Arabia’s PIF

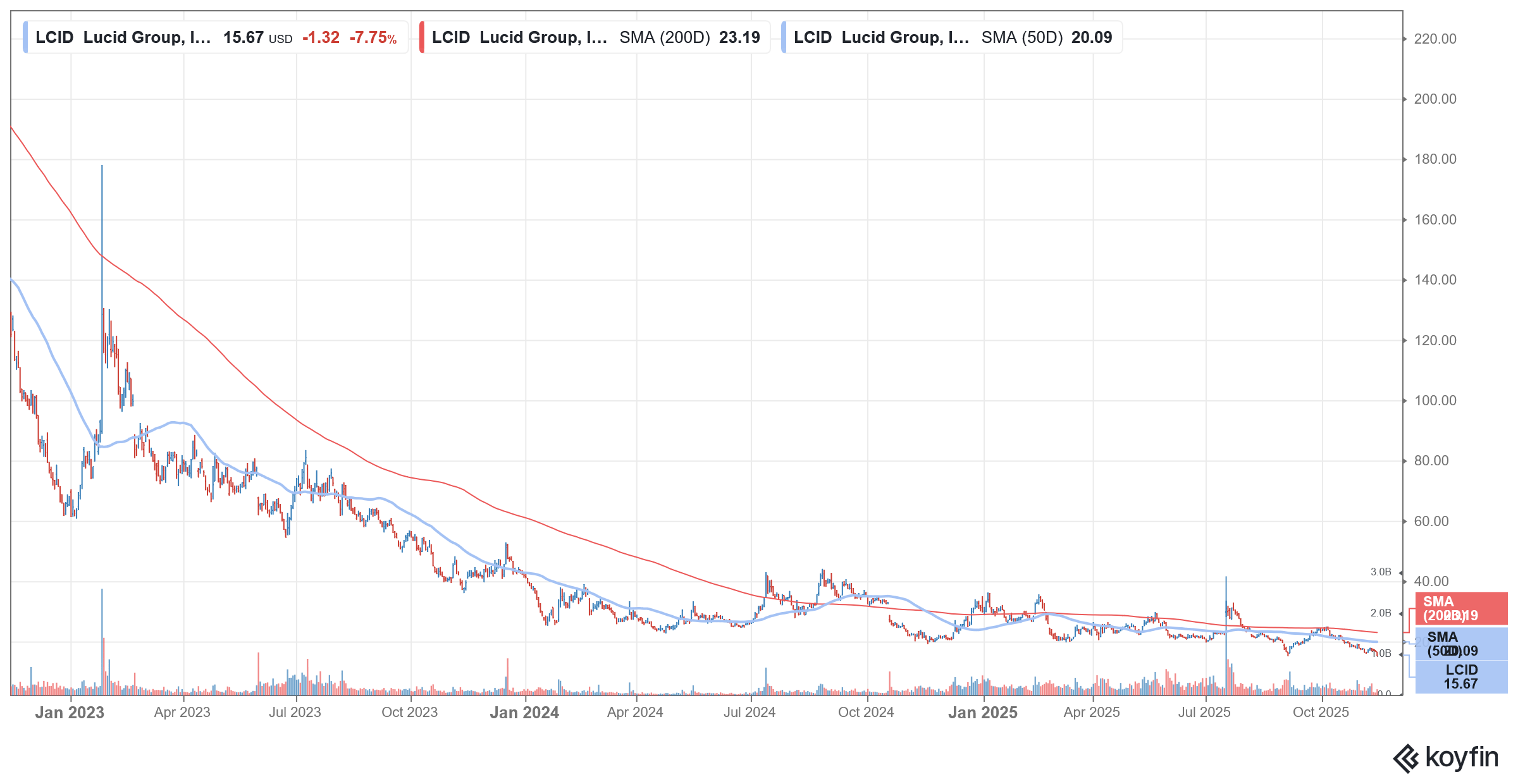

Lucid Motors was the biggest special purpose acquisition company (SPAC) merger when it went public in 2021. It was among the most hyped SPAC mergers as it was touted as the “next Tesla.” Lucid Motors’ market cap reached almost $100 billion that year amid the euphoria towards EV shares.

However, that bubble has since burst, and many of the high-flying EV startups of that time have gone bankrupt. While Lucid remains in business, in part due to the backing from a cash-rich Saudi sovereign wealth fund, which has poured billions more into the company since it went public, the shares trade at a fraction of their all-time highs.

The PIF first invested in Lucid in 2018, long before the company went public via a special purpose acquisition company (SPAC) merger, providing essential seed funding that proved critical for the company’s survival and growth. It has since ploughed billions more into the company and has participated in all the stock sales that Lucid has done since it went public in 2021.

During the Q3 earnings call, Lucid said that PIF has agreed to increase the existing delayed draw term loan credit facility from $750 million to approximately $2.0 billion.

Lucid completed a reverse stock split

In August, Lucid Motors completed a 10-for-1 reverse stock split, which helped it escape from the penny stock category, which it had been in with its share price below the threshold of $5.

Meanwhile, the EV industry is battling a slowdown in sales, which has led to a price war with companies cutting prices to boost shipments. The price cuts have dented the margins and made things even problematic for startup EV companies like Lucid Motors.

The price cuts have not helped lift shipments much, and even Tesla reported a yearly fall in deliveries last year and looks set to report a yearly decline in 2025 also.

Lucid’s performance has been somewhat better, even as it is coming from a much lower base. It delivered 4,078 vehicles in Q3, a YoY rise of 47%. Moreover, the company’s deliveries have increased sequentially for eight straight quarters.

Lucid lowered 2025 production guidance

The company has a target of producing 18,000 vehicles this year, which, while being lower than the previous guidance, is almost twice the 2024 production. A key component of this guidance is the successful ramp-up of the Lucid Gravity SUV. Deliveries of the Gravity began in April 2025, and its production volume is crucial for Lucid to hit its full-year target. Gravity is expected to broaden Lucid’s market appeal beyond the Air sedan.

In Q3, Lucid Motors reported a net loss of $1.03 billion, which was the largest quarterly operating loss for the company in four years, underscoring the high cost of production and R&D for the upcoming Gravity SUV.

Lucid has partnered with Uber for robotaxis

Meanwhile, Lucid has been looking at other avenues to boost its revenues and, in 2023, partnered with Aston Martin to supply its cutting-edge electric vehicle powertrain and battery systems to power Aston Martin’s electrification strategy.

Earlier this year, it announced a partnership with autonomous tech company Nuro, Inc., and Uber Technologies (NYSE: UBER) to launch a next-generation premium global robotaxi program, exclusively for the Uber platform.

This strategic collaboration aims to deploy 20,000 or more Lucid vehicles, specifically the new Lucid Gravity SUV, equipped with Nuro’s Level 4 autonomous “Nuro Driver” system, over the next six years. The initiative is expected to first launch in a major US city in late 2026, marking a significant step towards widespread robotaxi adoption. In its release, Lucid said that the prototype of the first Lucid-Nuro robotaxi is currently operating on a closed circuit at Nuro’s Las Vegas proving grounds.

Under the terms of the agreement, Uber will invest $300 million into Lucid, with additional multi-hundred-million-dollar investments planned for Nuro. This capital injection will support Lucid’s efforts to integrate Nuro’s hardware seamlessly into the Lucid Gravity on its assembly line, while Nuro will provide its advanced AI-powered self-driving software.

Question & Answers (0)