The Chinese electric vehicle (EV) market showcased its accelerating momentum in October 2025, with several major domestic manufacturers reporting record-breaking delivery figures, underscoring the fierce competition and growing consumer adoption in the world’s largest EV market.

Xpeng Motors’ EV deliveries rise to record high

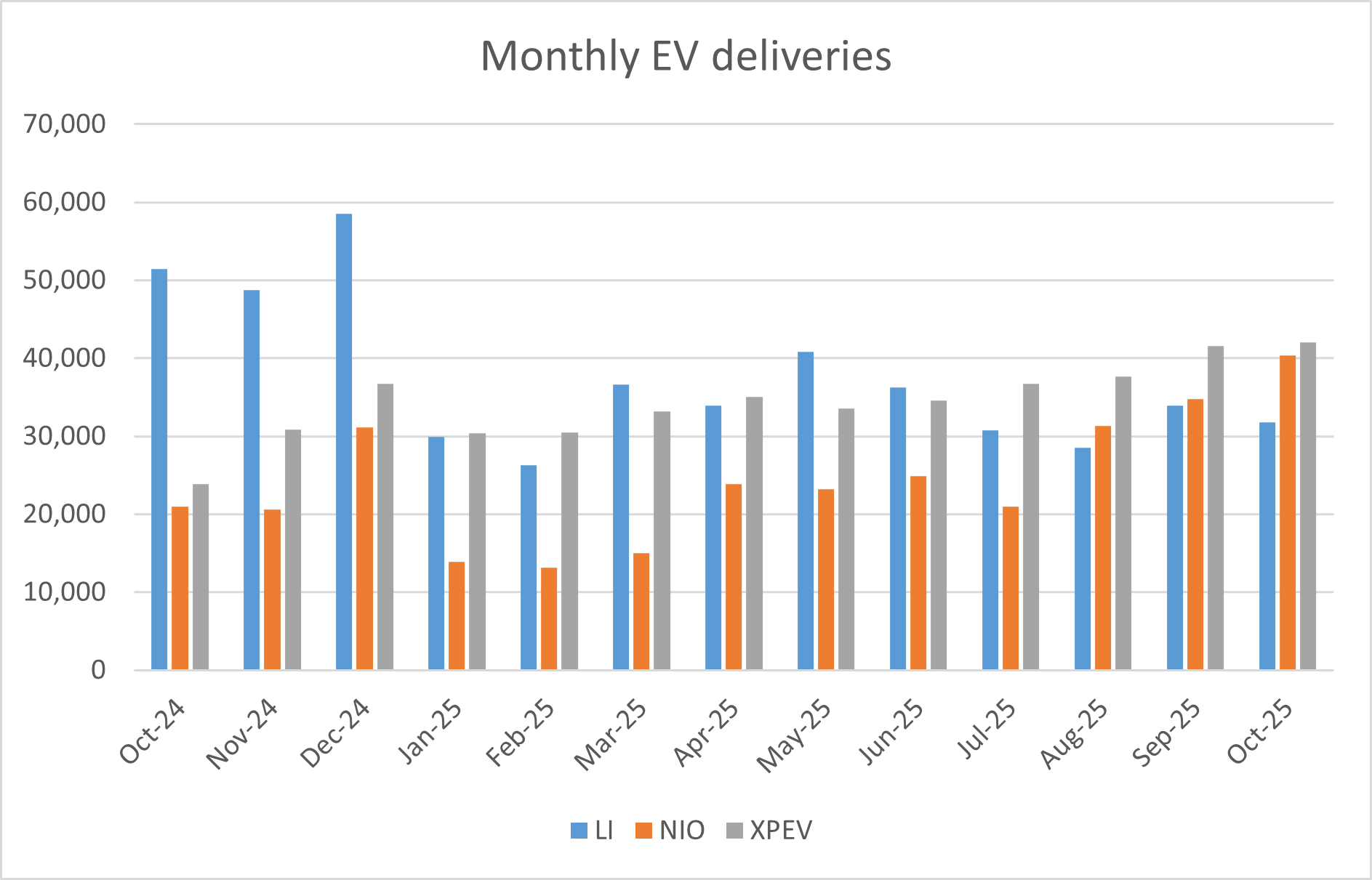

Leading the charge among the prominent ‘new-force’ brands was Xpeng Motors, which delivered an all-time high of 42,013 EVs in October. This monumental result represents a massive 76% increase year-over-year and marks the second consecutive month that the company’s deliveries have surpassed the 40,000-unit milestone.

In the first ten months of 2025, Xpeng Motors delivered 355,209 EVs, which is 190% higher than the corresponding period last year. Its cumulative deliveries stood at 945,610 at the end of September, and looking at the sales momentum, the company appears on track to reach 1 million units in cumulative sales by the end of this year.

Xpeng’s continued strong performance, driven by models like the MONA M03 and its popular SUV family (G6/G7/G9), highlights its accelerating growth trajectory. The company also pushed its global expansion, entering seven new markets across Europe, Asia, and Africa during the month.

Along with EVs, Xpeng Motors is also working on humanoids and flying cars. It will hold its AI day later this week, where it will provide updates on AI products like robotaxi and humanoids.

NIO’s EV deliveries rise above 40,000 for the first time

NIO also shattered its own monthly record and delivered 40,397 EVs in October, a stunning surge of over 92% compared to the same month last year, and a 16% sequential gain from September. For the first time, Nio has exceeded the 40,000-unit mark in a single month. This record was largely attributed to the robust performance of its sub-brands. The family-oriented Onvo brand delivered 17,342 vehicles, with the Onvo L90 large SUV maintaining strong momentum by topping 10,000-unit sales for the third month in a row. The high-end Firefly sub-brand also hit a new peak, contributing 5,912 vehicles to the total.

NIO’s EV deliveries rose 41.9% year-over-year in the first ten months of the year, and its cumulative deliveries stood at 913,182 at the end of October.

Li Auto continues to underwhelm

Meanwhile, the picture for Li Auto was slightly more subdued compared to its peers. The extended-range electric vehicle (EREV) pioneer delivered 31,767 vehicles in October, which was down both on a yearly as well sequential basis. Li Auto’s deliveries have been falling on a yearly basis for the last few months. Despite the drop, Li Auto continues to see strong underlying demand for new models like the Li i6, which has accumulated over 70,000 orders since launch, and the company is actively ramping up deliveries to meet this substantial backlog. Furthermore, Li Auto is making strides in global expansion, opening its first overseas retail store in Uzbekistan in October.

BYD’s deliveries fall

BYD’s global vehicle sales reached 441,706 units in October. While this was actually the highest monthly total for the company in 2025 and an increase from September, it represented a 12% drop compared to its record sales of 502,675 vehicles in October 2024. This marks BYD’s second consecutive month of year-over-year decline as the Chinese new energy vehicle (NEV) giant continues to battle slowing sales. Notably, Q3 2025 marked BYD’s first quarterly revenue decline in over five years, which was accompanied by an almost 33% plunge in third-quarter profit.

In a clear sign of the mounting challenges, BYD had previously slashed its 2025 sales target by about 16%, from 5.5 million to 4.6 million units. This is the first time in years the company has reined in its ambitions.

BYD’s EV sales rise

Notably, the battery electric vehicle (BEV) segment remains a strong growth engine for BYD. The segment recorded a robust double-digit year-over-year increase, continuing its trajectory as a reliable source of expansion. This growth is a crucial positive signal, demonstrating that BYD is successfully competing in the fully electric space against domestic rivals like Xpeng and Nio, as well as against Tesla. The overseas push also primarily leverages BEV models, providing an additional layer of stable, expanding demand.

The plug-in hybrid (PHEV) segment has been a major drag on BYD’s overall year-on-year performance in recent months, and a staggering one-third of the company’s PHEV sales volume from October 2024 evaporated this month. This severe contraction is part of a deliberate strategy, coupled with market headwinds. BYD is actively clearing out older-generation PHEV inventory in anticipation of new, stricter Chinese regulatory standards that will take effect in early 2026, requiring a much longer electric-only range for tax benefits.

BYD now sells more EV than hybrids

In July 2025, for the first time since the company’s pivot to NEVs, BYD’s BEV sales surpassed its PHEV sales. This shift continued in October, with EVs now outselling hybrids, making pure electric vehicles the company’s new primary domestic volume driver.

Notably, in a move that marks the end of a legendary investment chapter, earlier this year Berkshire Hathaway disclosed that it has fully sold its stake in BYD, a holding that grew from a modest initial investment into one of the conglomerate’s most profitable international wagers.

The divestment, which began in 2022, brings to a close a 17-year-long partnership that was a testament to the foresight of the late Charlie Munger, Warren Buffett’s long-time business partner.

Berkshire has exited BYD

Berkshire’s journey with BYD began in 2008, when the company was a relatively unknown battery manufacturer. At the urging of Charlie Munger, Berkshire invested $230 million for 225 million shares, acquiring a 10% stake in the Shenzhen-based company. While the move seemed out of character for Buffett’s typical investment playbook, Munger defended it, calling BYD founder Wang Chuanfu a “damn miracle.”

That assessment proved remarkably accurate. Over the next decade and a half, BYD’s shares surged by thousands of percent, as the company transformed into a global powerhouse in electric vehicles and batteries. The original $230 million investment swelled to a peak value of nearly $9 billion, delivering an extraordinary return that underscored the brilliance of the initial call.

Berkshire’s decision to exit was not abrupt. The company began trimming its position in August 2022, capitalising on a significant run-up in BYD’s stock price. The sell-down was gradual, and by mid-2024, Berkshire’s holdings had fallen below the 5% disclosure threshold in Hong Kong, allowing subsequent sales to go unreported. The final confirmation of the full exit came from a quarterly filing by Berkshire Hathaway Energy, which listed the value of its BYD stake as zero as of March 31, 2025.

Question & Answers (0)