Chinese EV (electric vehicle) companies have released their November delivery reports. Despite all the noise around the slowdown in China, the country’s NEV (new energy vehicle) sales have been strong. Here are the key takeaways from leading companies’ November delivery reports.

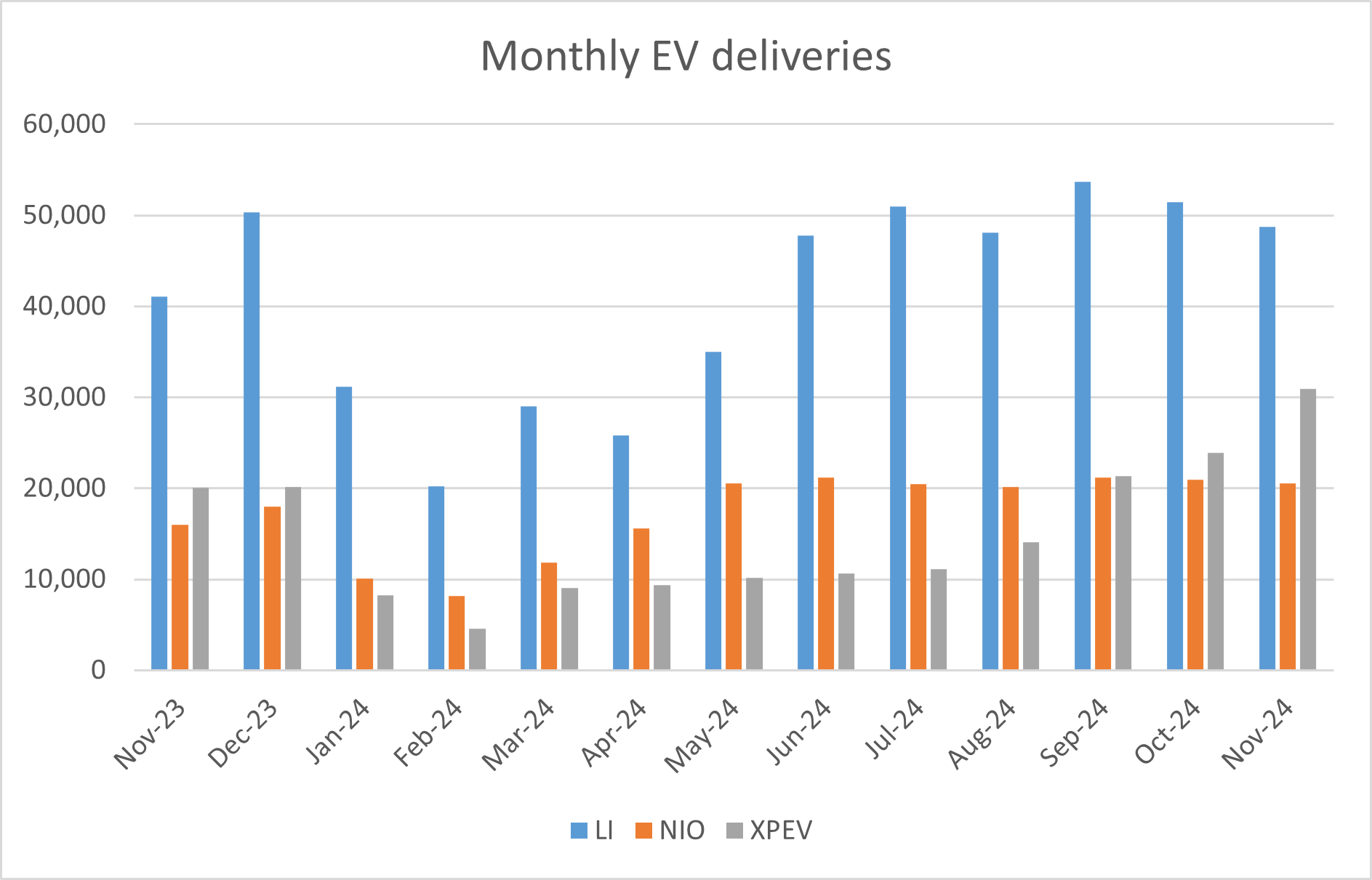

NIO delivered 20,575 vehicles in November, which was 28.9% higher YoY. In the first 11 months of 2024, the company delivered 190,832 EVs which is 34.4% higher YoY.

Its deliveries have been over 20,000 for seven consecutive months now, and its cumulative deliveries reached 640,426 at the end of November. NIO’s monthly deliveries peaked earlier this year and have since been stagnant.

Analysts are turning bearish on NIO shares

NIO forecast deliveries between 72,000 to 75,000 for the fourth quarter. The company’s earnings and guidance fell short of estimates and Macquarie downgraded the share from an “outperform” to “neutral” while cutting its target price to $4.80. Goldman Sachs also downgraded NIO from a “neutral” to “sell” and cut its target price to $3.90 as the brokerage is apprehensive about the slow ramp-up of its production which it says is also dampening its path to becoming sustainably profitable.

Xpeng Motors’ EV deliveries rise to record highs

Xpeng Motors delivered 30,895 EVs in November which was 54% higher YoY and a new record monthly high. Importantly, it was the first time that the company’s monthly EV deliveries topped 30,000. In its release, Xpeng Motors said that monthly deliveries of its Mona MO3 were over 10,000 for the third consecutive month.

The company delivered 153,373 vehicles in the first 11 months of 2024 which is 26% higher than the corresponding period last year. Its cumulative deliveries stood at 553,704 at the end of November.

Xpeng Motors also has autonomous driving capabilities which are among the most advanced in China. In its release, the company said “In November, XNGP‘s (its autonomous driving software) monthly active user penetration rate in urban driving reached 85%.”

The company entered the UK market in the month. Notably, while Chinese EV companies were banking on the EU market, the region has imposed tariffs on EV imports from China.

Li Auto’s deliveries rose YoY in November

Li Auto delivered 48,740 vehicles in November which was 18.8% higher YoY. The company delivered 441,995 vehicles in the first 11 months of the year while its cumulative deliveries stood at 1,075,359 at the end of November.

In its release, Li Auto said, “Li Auto maintained its best-selling position among Chinese automotive brands in the RMB200,000 and above passenger vehicle market for eight straight months. Li L6 achieved over 160,000 cumulative deliveries, retaining as the sales champion among Chinese brand models priced above RMB200,000 since June. Additionally, the Company’s continuous advancements in autonomous driving technologies have boosted demand for models equipped with Li AD Max.”

Zeekr’s EV deliveries doubled in November

Zeekr delivered 27,011 vehicles in November which was over twice what it delivered in the corresponding month last year. In the first 11 months of the year, Zeekr’s deliveries rose 85% to 194,933 and its cumulative deliveries reached 391,566 at the end of November.

Zeekr, which went public in the US earlier this year only, has reported impressive growth in deliveries over the last few months even as deliveries of some of the other Chinese EV companies have sagged.

BYD had yet another record month

BYD delivered 504,003 vehicles in November and while the sales were up by just about 0.7% as compared to October, it was a record high and the second consecutive month when the company’s deliveries were above 500,000 units.

The company delivered 198,065 BEV (battery electric vehicles) in November which was 4.5% higher as compared to October but its PHEV (plug-in hybrid) vehicle sales fell 1.6% to 305,938 units. Notably, prior to November, BYD’s PHEV sales rose to record highs for eight consecutive months. While sales dipped on a sequential basis in November they were still over 13% higher YoY.

Analysts turn cautious on Chinese shares

While Chinese shares rallied in late September after the country started announcing a series of stimulus measures, the rally has come to an abrupt halt.

In their note, Morgan Stanley analysts wrote, “We see a low limited chance that China’s government will front-load enough fiscal stimulus to target consumption and housing in 2025 due to concerns over moral hazard and a premature transition into a ‘welfare state.’” They added it presents “even stronger headwinds on corporate earnings and market valuation in the coming months.”

Goldman Sachs is also cautious on Chinese shares and sees CSI300 at 4,600 by the end of 2025 even as it expects weakness in Hong Kong-listed shares and downgraded them to underweight.

“Although valuations are not demanding, Hong Kong does not offer much economic or earnings growth,” said Goldman analysts in an Asia-Pacific portfolio strategy note.

While China’s stimulus created quite a hype among market participants, the subsequent announcements in October and November mostly fell short of market expectations. China announced the most recent stimulus last month after the parliament meeting concluded. The package, which is worth 10 trillion yuan (around $1.4 trillion) and is spread across five years, is meant to tackle the burning issue of local government debt and would allow them to borrow more to spur growth.

However, the mega debt swap program fell short of market expectations which expected the country to announce more measures, especially with Donald Trump set to return to the White House next year.

December could be another record year for Chinese EV companies

Coming back to Chinese EV companies, looking at the guidance of NIO, Li Auto, and Xpeng Motors, December could be another record month for all three companies. While several sectors of the Chinese economy, particularly real estate, are in a severe downturn, the country’s NEV industry has been strong with penetration rates topping 50% which is much higher than Europe and the US.

Question & Answers (0)