Chinese EV (electric vehicles) companies including NIO, Xpeng Motors, Li Auto, and Zeekr have released their July deliveries. Here are the key takeaways from the reports and what the data tells us about the health of the world’s largest electric car market.

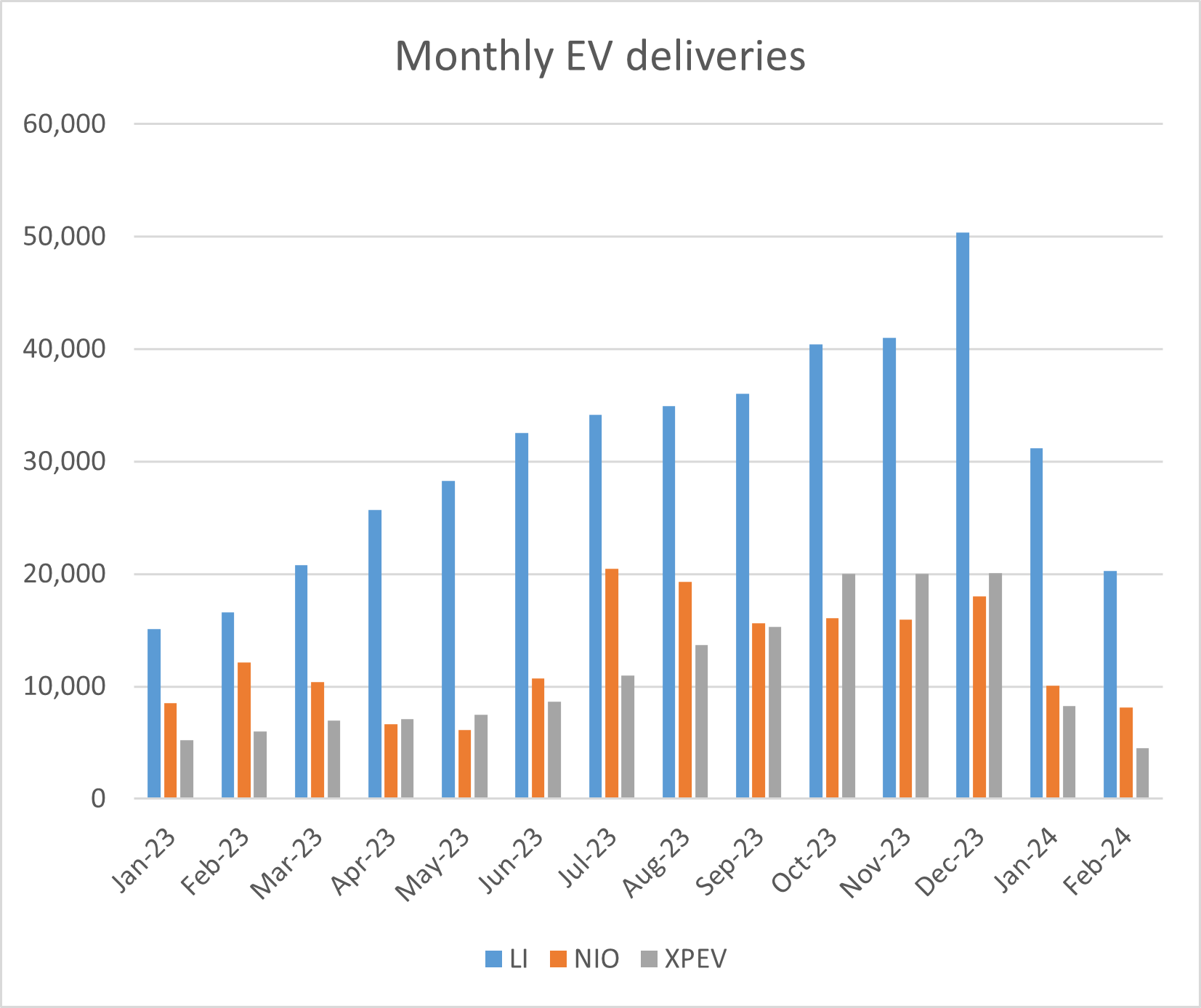

NIO delivered 20,498 vehicles in July was slightly below the record deliveries of 20,462 in the corresponding month last year. While the company’s deliveries were below the 21,209 vehicles that the company delivered in June 2024, it was nonetheless the third consecutive month when its deliveries topped 20,000.

NIO reported a YoY fall in its EV deliveries

NIO has delivered 107,925 vehicles so far in 2024, which is 43.9% higher than the corresponding period last year. NIO’s cumulative EV deliveries reached 557,518 at the end of July.

NIO stock is trading around 5% lower in US price action today as markets seem to give a thumbs down to its July delivery report.

Xpeng Motors had yet another tepid quarter

Xpeng Motors delivered 11,145 EVs in July which was up a mere 1% as compared to July last year and 4% higher than June. In the first seven months of the year, the Chinese company delivered 63,173 EVs which was 20% higher than the corresponding period last year.

Notably, Xpeng Motors’ deliveries were quite tepid in the first half of 2023 and came in below 10,000 in all the months. While the 20% YoY growth looks strong when looked at in isolation, it might not tell the real story due to the low base effect. Xpeng Motors’ cumulative deliveries reached 463,504 at the end of July.

While Xpeng Motors’ EV deliveries have sagged the company has been making progress in its autonomous driving business. In its release, it said, that in July, XNGP’s monthly active user penetration rate rose to 84% in urban driving.

It added, “By the fourth quarter of 2024, XNGP aims to deliver a “door-to-door” smart driving experience, addressing current gaps in smart driving, such as ETC toll stations on expressways, parking lots, U-turns, roundabouts, private roads in campuses, and narrow paths.”

Mona EV to be available in showrooms

Xpeng Motors also announced that beginning today, its MONA M03 EV hatchback coupe would be available for display across its showrooms in China. The budget EV brand is being launched as part of the partnership with Chinese ride-hailing giant Didi and would feature vehicles in the RMB150,000 price range.

Last year only, Volkswagen partnered with Xpeng Motors to build two EVs on its platform and also buy a stake in the company. The deal was a milestone for the Chinese EV ecosystem as it reflected the confidence of Volkswagen in a startup EV company. It was also a testimony to Xpeng Motor’s self-driving capabilities which the company intends to further build upon.

Xpeng Motors shares are also trading almost 3% lower in US price action today as the company’s monthly EV deliveries yet again failed to cheer markets.

Li Auto reports record deliveries

Li Auto, which sells EVs as well as hybrids, delivered 51,000 vehicles in July. The company’s deliveries rose 49.4% YoY and were a new record high. It has delivered 239,981 vehicles so far in 2024 while the cumulative deliveries are 873,345 which is the highest among emerging new energy vehicle companies in China.

“Li L6 sustained its robust sales performance with monthly deliveries continually exceeding 20,000, and has become a blockbuster model in the RMB200,000 to RMB300,000 price range. With the rollout of OTA versions 6.0 and 6.1 in July, Li L series and Li MEGA have undergone major upgrades, achieving comprehensive enhancements in product strengths across autonomous driving, smart space, and smart electric features,” said Li Auto’s CEO Xiang Li.

Li Auto shares are trading nearly flat today despite impressive deliveries.

Zeekr falls to record lows after reporting July deliveries

Zeekr delivered 15,655 EVs in July which was 30% higher YoY. In the first seven months of 2024, it has delivered 103,525 EVs which is 89% higher than the corresponding period last year. In July, it reached the milestone of delivering its 300,000t vehicle and its cumulative deliveries now stand at 300,158.

Zeekr which is backed by Geely went public in the US in May. It priced the issue at the top end of the guidance and issued more shares than initially planned. However, the shares have since fallen amid the broad-based selling in Chinese EV shares. The stock is trading over 3% lower today and hit its record lows after reporting its July deliveries.

BYD’s EV deliveries fall

BYD delivered a record 342,383 vehicles in July led by strong growth in its PHEV (plug-in hybrid vehicle) portfolio whose sales rose to a record high for the fifth consecutive month. However, its July EV sales were almost 10.5% lower than in June. OTC-traded shares of BYD are down almost 3% today despite reporting record deliveries for July.

Sales of EVs have been tepid in the US also. Tesla’s deliveries have fallen YoY for two consecutive quarters and the Elon Musk-run company has failed to boost shipments despite cutting prices.

While Tesla’s Q2 revenues were ahead of consensus estimates, its adjusted EPS of 52 cents fell short of the 62 cents that analysts were expecting. The company’s operating margin was 6.3% which while being higher than the Q1 trough of 5.5% is still well below what it was posting about a year back.

The shares fell by over 12% after the company disappointed markets with its Q2 earnings. The EV industry is battling a massive overcapacity in the US as well as China even as demand growth has slowed down considerably.

Question & Answers (0)