TUI shares were trading lower in early London price action today after having surged yesterday on renewed hopes of a resumption in travel. Is TUI a good reopening share to buy now?

TUI shares had spiked yesterday after the UK released a new travel list. Among the European destinations, the country added Malta, Madeira and the Balearic Islands to the green list. Travellers arriving from the green list countries don’t have to follow the quarantine norms. Grant Shapps, UK travel secretary also said that the country will remove the quarantine norms for people arriving from countries on the amber list “later in the summer”.

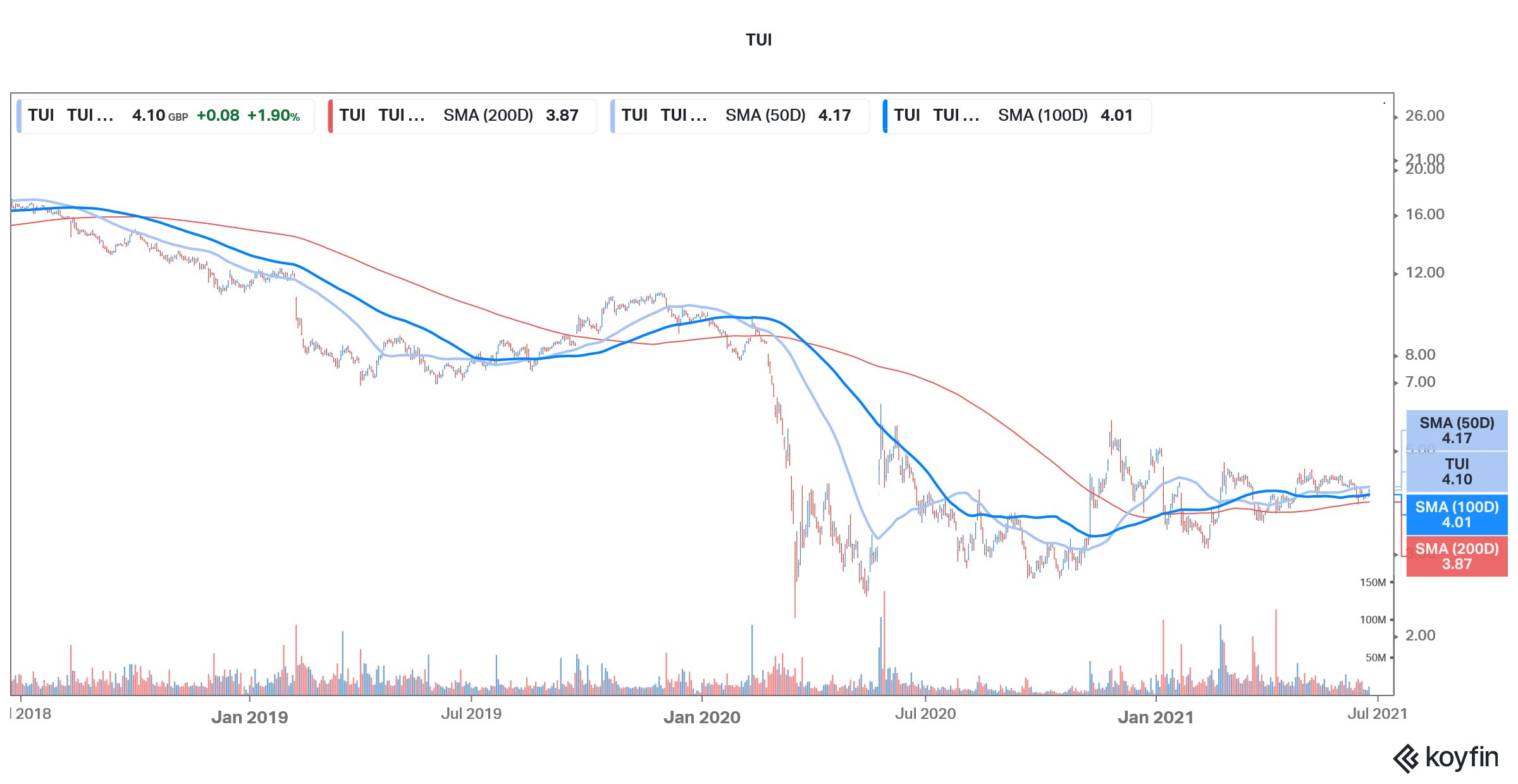

TUI shares have plummeted

Travel related shares have been very volatile in 2021. While the shares had plummeted in 2020 amid travel restrictions, they have recovered some of the lost ground. However, the market opinion is quite mixed on travel shares like TUI. On the one hand, we have a genuine pent-up demand for travel after the crippling lockdowns of 2020. On the other hands, countries in Europe have been conservative with the reopening amid the emergence of new variants. The rising inflation which could lead to higher prices for travellers could also play a dampener.

The tourism industry has been hit hard

Meanwhile, the travel and tourism industry has been protesting amid the slow pace of approvals for travel. “The pandemic has been a catastrophe for the travel industry, closing borders, and even making most travel to and from the UK illegal for months on end,” said ABTA (Association of British Travel Agents). The group estimates that almost 200,000 UK jobs are at a risk due to travel-related restrictions. ABTA also said that other countries “are forging ahead with pragmatic, risk-based schemes that allow safe travel”

TUI has been looking to shore up the balance sheet

Meanwhile, TUI has been looking to shore up its balance sheet. In April, it completed a €400 million convertible bond offering. Like other companies in the travel and tourism industry, TUI also took aid from the government to survive the pandemic. Earlier this month, Bloomberg reported that TUI is looking at additional funding measures including a share sale to raise almost $1.2 billion.

Commenting on the report, TUI said that “Our general statement that we are continuously looking at all possible scenarios with regard to the pandemic and refinancing has not changed.” It added, “Additional financing measures have not yet been decided and no banks have been mandated.”

Asset sales

TUI has also sold its minority interest in RIU Hotels. The company would raise €540 million from the transaction. TUI has adopted an “asset right strategy” which it had embarked upon before the pandemic. As part of the strategy, the company has been selling some of the assets to raise cash.

According to TUI, “the Group intends to grow primarily with its international hotel brands TUI Blue, RIU, Robinson, TUI Magic Life and the management of these hotels, but in doing so will tie up less capital in property and real estate in the future.”

Analysts are bearish on TUI shares

Meanwhile, analysts are bearish on TUI shares. Its median target price of 182.5p is a discount of over 55% over current prices. The highest target price of 623.8p implies an upside of over 52% while the lowest target price of 77.13p is a discount of over 81%. Of the 14 analysts covering the shares, only two have a buy rating while three have a hold rating. The remaining nine analyst rate TUI shares as a sell or some equivalents.

Outlook

While the outlook for the travel industry is looking strong amid the global vaccination drive, TUI might also look at ways to address the balance sheet issues. While a capital raise through share issuance will help the company bolster its finances, it also comes with long term costs of dilution.

TUI shares have fallen below the 50-day SMA of 417p and might find support near the 100-day SMA which is currently at 401p. The next support for the shares could be near the 200-day SMA.

TUI shares look overvalued

Looking at the fundamentals, TUI shares currently trade at an NTM (next-12 months) EV (enterprise value) to sales multiple of 0.97x which is over twice what the multiple has averaged over the last ten years. While the current revenues look depressed which is leading to higher multiples, the shares nonetheless look overvalued.

The company had a net debt of €6.8 billion at the end of March which is way about its current market capitalization. While the increased borrowings helped the company survive the pandemic they would have to be repaid. For now, the company looks quite overleveraged and equity issuance looks like a likely possibility.

TUI shares were trading 1.5% lower at 11:55 am London time today. The shares are down over 10% so far in 2021 and are underperforming the markets.

Question & Answers (0)