IBM shares are down almost 6% at $117.8 per share during today’s early stock trading activity on Wall Street following the company’s earnings report covering the third quarter of 2020, in which the tech business saw its third consecutive drop in revenues amid the pandemic.

International Business Machines (IBM) saw its revenues decline 2.5% during the quarter at $17.65 billion, although they remained in line with analysts’ estimates for the three-month period.

The firm’s Systems segment saw the biggest slide, with sales heading down 15% compared to the same period last year at $1.26 billion, followed by Global Business Services and Global Technology Services – the largest segment for the firm – which dropped 3.7% and 4.7% respectively.

This multi-segment drop in IBM’s top line was partially offset by a 6.8% growth in the firm’s Cloud & Cognitive Software segment. Meanwhile, gross profit margins improved by 180 basis points to end the quarter at 48%.

On the other hand, the company managed to grow its net income during the quarter by $26 million compared to a year ago despite the lower sales, primarily due to a significant reduction in operating expenses, as sales, general, and administrative expenses were down 7.5%.

The company attributed a deceleration in revenues during the year to reduced capital expenditures from businesses across the world as the pandemic has led to the prioritization of operating expenses and liquidity while major infrastructure projects have been put on hold while the virus situation persists.

How have IBM shares been performing lately?

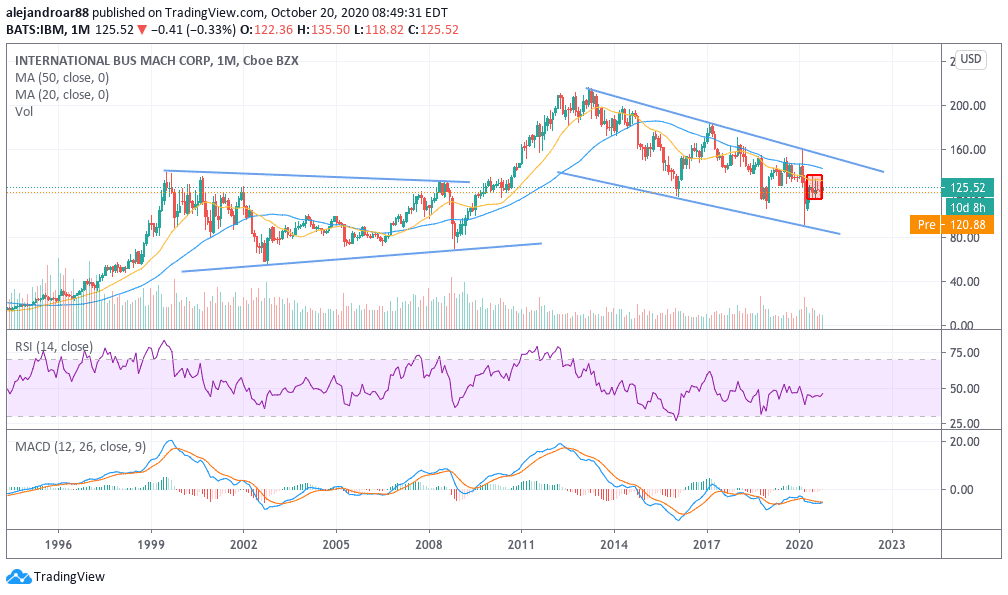

IBM shares have been heading down since reaching all-time highs in April 2013, as a shift towards cloud-based computing and other important technological trends have challenged the firm’s long-standing market strength and goals.

IBM’s management continues to bet on hybrid cloud solutions – which involve both on-premise data storage along with third-party services – although the market seems to be shifting towards full-blown cloud services.

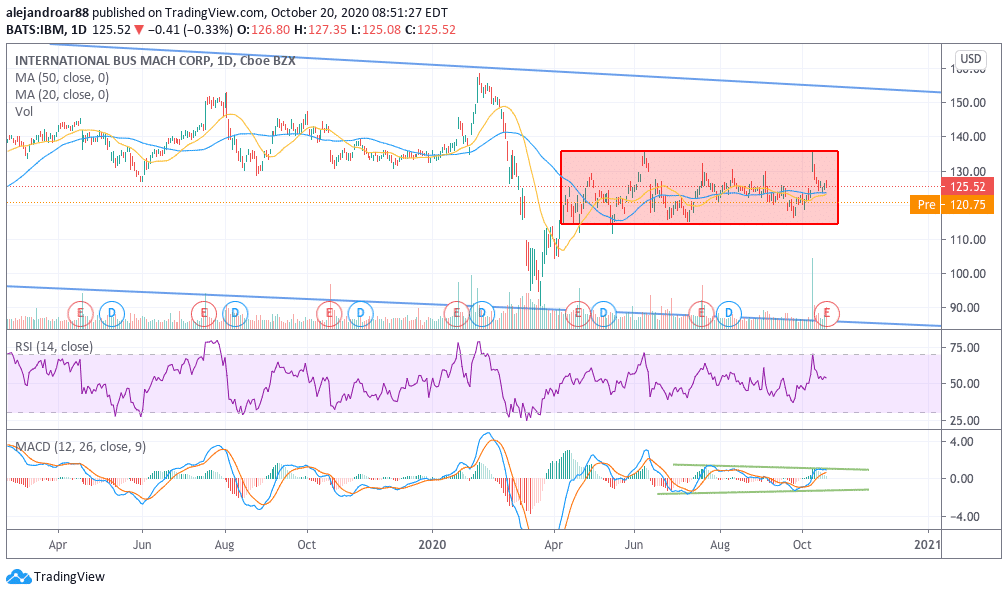

This bet is potentially the reason behind the stock’s latest price action, as IBM shares have failed to move higher after rebounding off their March lows.

IBM shares are down 2.85% for the year while the Nasdaq 100 tech-heavy index is up 33.3% since the year started.

What’s next for IBM shares?

The daily chart shows that IBM shares have been trading range-bound since April, with the stock attempting to break both below and above that range multiple times without success.

That same consolidation is seen in the MACD, as the momentum for IBM has stalled, with the oscillator moving within a tight range and the line making only slight crosses above and below the signal.

Market participants seem to be undecided about where IBM’s business is headed and this consolidation is showing exactly that. In this regard, a break above or below that box could mean that market players have made up their minds as to where things may go.

On the other hand, in the context of the monthly chart, which currently shows that IBM shares are on a long-term downtrend, whatever the short-term movements are in the next few weeks, the stock remains on that downward channel, which is something long-term investors should take into account before taking a position on the stock.

Question & Answers (0)