IBM shares are sliding in today’s pre-market stock trading action following the release of the company’s financial results covering the last quarter of 2020, as the technology giant reported its fourth consecutive quarter of declining revenues.

Total revenues during the three-month period fell to $20.37 billion, down 6.5% from the $21.77 billion a year ago. IBM’s Systems segment was one of the most affected during the quarter, with sales slipping 17.8% during the period, moving $3.04 billion last year to $2.5 billion this year as a decline in the demand from enterprise clients amid the pandemic affected the unit’s top-line.

Meanwhile, IBM’s largest revenue segment – Cloud & Cognitive Software – dropped 4.5% during the fourth quarter of last year, as a 39% jump in Cloud revenues failed to offset a sustained decline in other sub-segments such as Transaction Processing.

Total revenues for the company were slightly off analysts’ expectations for the quarter, missing Wall Street’s consensus target of $20.67 billion by roughly $300 million.

That said, investors seem to be worried that the company’s performance may continue to disappoint in the near future, as a strong shift to cloud-based computing during the pandemic could have a long-lasting impact on the demand for IBM’s non-cloud solutions.

On the other hand, gross profit margins jumped 70 basis points during the period, landing at 51.7%, while the firm’s net income slipped by 63% to $1.35 billion amid a $2 billion pre-tax charge resulting from “structural actions”.

This one-time expense fell short of the firm’s own forecast, as IBM had anticipated that it would come in at $2.3 billion back in October. The charge is associated with the spin-off of a business unit that offers web hosting and other similar services, as the company focused on growing the Cloud segment.

IBM shares reacted negatively to the earnings report, slipping almost 7% in pre-market action on Wall Street to $122.6, while they are also declining 7.5% in Germany, trading at EUR 99.80 per share.

How have IBM shares been performing lately?

The value of IBM shares slipped 1% last year, lagging the tech-heavy Nasdaq 100 index by roughly 48% as the tech giant has not been quick enough in responding to an accelerated digital transformation triggered by the pandemic.

In this regard, the growth of IBM’s Cloud segment – one of its top performers – has failed to offset the decline seen by other legacy revenue streams, which presents a challenging outlook for the firm’s growth as these underperforming units can weigh on its results for a long period.

Meanwhile, the cost of restructuring a company the size of IBM in response to the changes seen in the IT landscape, presents investors with a daunting prospect. The $2 billion charge is perhaps the best illustration of how costly those moves will be for a mammoth company like IBM.

What’s next for IBM shares?

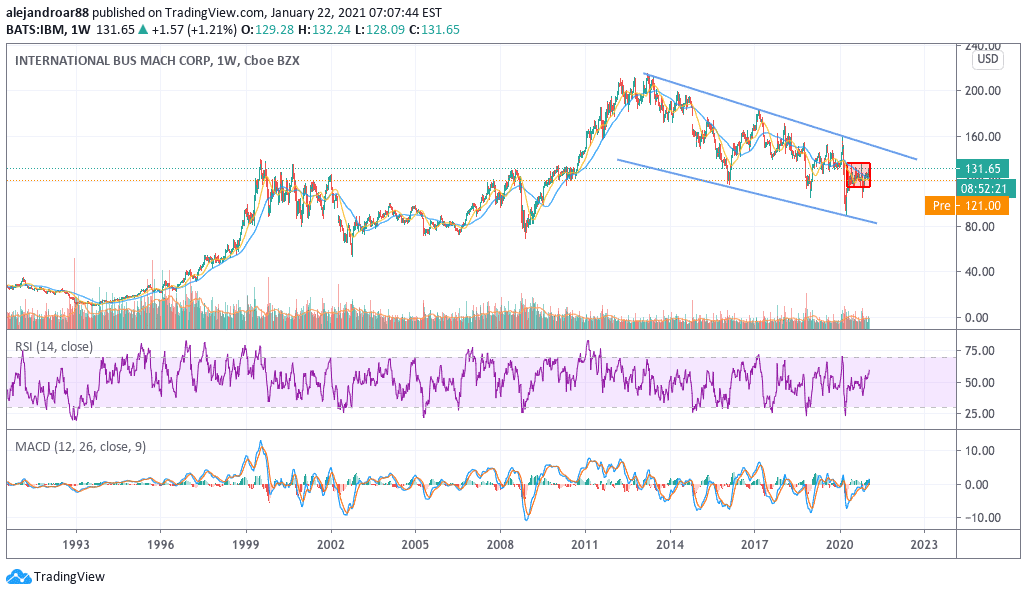

This latest downtick in IBM is merely the latest bearish episode when seen in the context of the broader downtrend in which the stock price has been since 2013.

This downtrend should be considered the most worrisome formation at the moment, especially if one considers that it has been the result of a sustained decline in revenues for the firm and the potential loss of a competitive edge in the wake of a seemingly imminent shift to cloud-based computing.

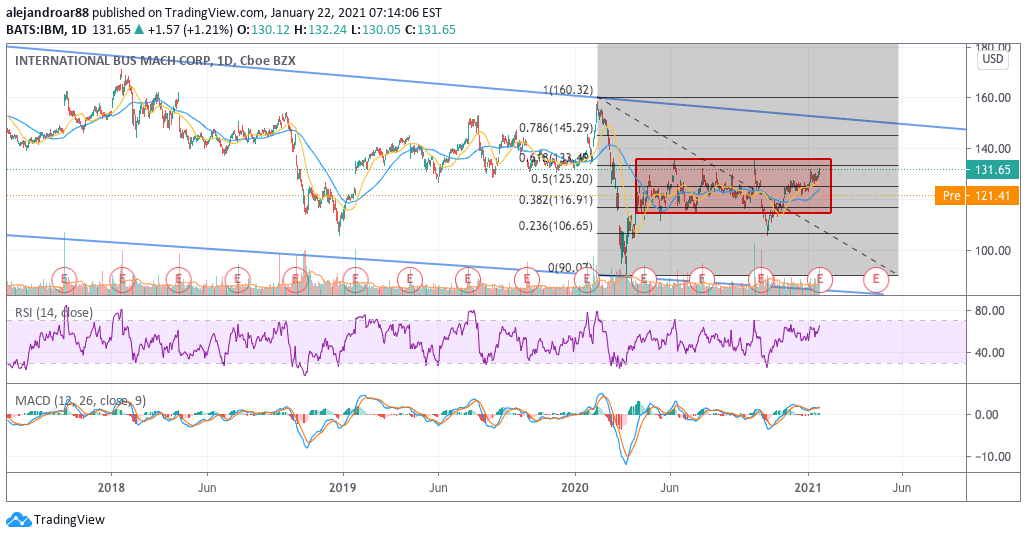

Meanwhile, the daily price action shows that the price has been trading range-bound since the pandemic hit, while today’s plunge in the share price could end up pushing IBM below its short-term moving averages and down the 0.5 Fibonacci.

If such a move were to be materialised today, chances are that the stock price might keep falling in the following weeks, possibly aiming for the 0.236 Fibonacci shown in the chart while not fully discarding the possibility of seeing the stock going down to its post-pandemic low of $90 per share if the negative momentum gains traction.

Question & Answers (0)