Shares of International Consolidated Airlines Group SA (IAG) were trading higher in early London trading today, after the company released its 2020 earnings which showed an operating loss of €7.4 billion, the worst in the company’s history.

The COVID-19 pandemic is possibly the biggest challenge that the global aviation industry has ever faced. The industry has taken a massive hit from the pandemic which is even bigger than what it faced in the 2008 Global Financial Crisis and in the aftermath of the World Trade Tower terrorist attack in 2001.

IAG’s 2020 earnings

IAG’s 2020 earnings are a bleak reminder of how bad the aviation industry has been hit by the pandemic. The company’s total revenues tumbled 69.4% year over year to €7.8 billion in the year, with passenger revenues faring even worse, tumbling 75.5% in the year to €5.5 billion.

Airlines globally were grounded for a long period in 2020 due to COVID-19 related restrictions. Even when travel resumed, the occupancy was quite low as compared to pre-COVID levels. For IAG, which is the holding company of British Airways, the troubles were only compounded by the second wave of infections in the UK and the new COVID strain that led to lockdowns towards the end of the year.

IAG’s 2020 operating performance

According to IAG, its passenger capacity in 2020 was 33.5% of what it had in 2019. In the fourth quarter of 2020, the capacity was 26.6% while in the first quarter of 2021, it plans to operate at a capacity of only about 20%. Notably, airline companies have high operating and financial leverage. Therefore, if they operate at a lower capacity, their earnings take a big hit.

IAG reported a £1.7 billion operating loss in the fourth quarter of 2020 to take its full-year loss to €7.4 billion. It is the biggest loss in the company’s history. To get a sense of the loss, consider the fact that it is only €400 million lower than the total revenues that the company posted in the year.

Tough year

“Our results reflect the serious impact that Covid-19 has had on our business,” said IAG’s CEO Luis Gallego. He added, “The group continues to reduce its cost base and increase the proportion of variable costs to better match market demand. We’re transforming our business to ensure we emerge in a stronger competitive position.”

IAG on a capital raising spree

All the companies in the aviation ecosystem have been hit by the COVID-19 pandemic. This includes aircraft manufacturers like Boeing and Airbus, engine producers like Rolls-Royce, component makers like Precision Castparts, as well as airline companies.

To survive the pandemic and the massive cash burn, almost all the companies in the aviation industry have raised capital last year. This includes debt as well as equity issuance. IAG also took on debt last year to fund its cash burn. The company’s net debt (total debt minus cash) was €9.7 billion at the end of 2020 which was €2.2 billion higher than the previous year.

Earlier this month also, the company announced a £2.45 billion cash injection that included a pension contribution deferral and a loan that was partially guaranteed by Britain’s UK Export Finance.

IAG outlook

Sounding an optimistic note, Gallego said “We know there is pent-up demand for travel and people want to fly.” He added, “Vaccinations are progressing well and global infections are going in the right direction. We’re calling for international common testing standards and the introduction of digital health passes to reopen our skies safely.”

However, citing the “uncertainty on the impact and duration of COVID-19” the company did provide the profit guidance for 2021.

Analysts are not too optimistic

Meanwhile, analysts are not too impressed with the company’s outlook. “These results from IAG really do bring out just how painful the last year has been for the airline industry,” said Jack Winchester, an analyst at Third Bridge. He added, “Investors have been willing to plug IAG’s finances on the assumption of an eventual recovery but when the dust settles we are likely to see that low-cost carriers like Ryanair and Wizz Air have come out of 2020 in far better shape.”

IAG shares in 2021

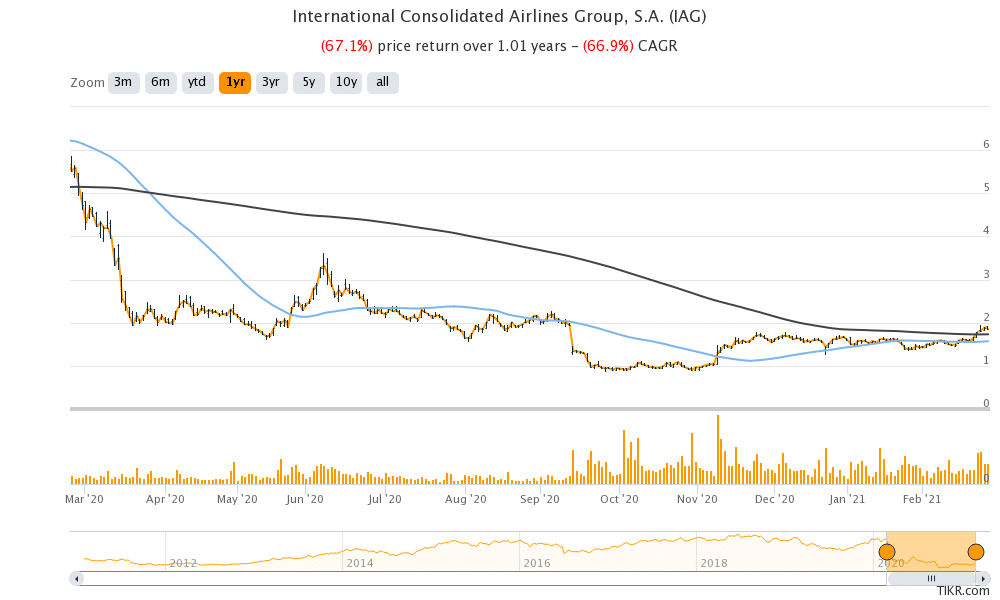

IAG shares have gained almost 17% so far in 2021 amid optimism that the global vaccination drive and the pent up travel demand would help revive the company’s fortunes. However, despite the recent surge, the shares are down 67% over the last year.

IAG shares were trading 3.3% higher at 192.44p at 11:45 AM London time today. While the shares made an intraday high of 199.50p, they could not hold on to higher price levels and pared gains.

Question & Answers (0)