HSBC shares are down 2.5% today in mid-day stock trading activity in London at 394.7p, as reports of a potential sale of the bank’s US retail arm seem to have triggered a selling spree.

This would be the third losing session in the past four days for HSBC (HSBA) shares, after the bank’s stock failed to climb the 400p threshold on 25 November.

According to market chatter, HSBC’s management will submit the proposal to the Board for its approval in a move that aims to increase the firm’s focus on Asian markets, while keeping their investment banking operations in the North American country.

The company’s 2019 annual report discloses that HSBC’s North American operations brought 11% of the bank’s revenues during the year while the firm held 90,834 accounts for its clients in the United States.

The bank’s retail operations in the country generated a $323 million pre-tax loss last year and a similar $205 million loss in 2018, dragging the firm’s results in the region during both years, while other operations including Commercial Banking and Global Banking and Markets generated a $758 million gain for the bank last year.

According to the banks’ annual report, a total of 16,615 people were employed in the North American region by the end of December 2019 and it can be assumed that most of these are employed by the banks’ Retail Banking & Wealth Management operations, as this segment accounts for almost 60% of HSBC’s payroll.

Sources familiar with the deal also cited bank plans to expand its Wealth Management division in the country.

How have HSBC (HSBA) performed so far this year?

HSBC shares are down 33% so far this year, as a series of negative developments have hit the bank’s top and bottom line.

First of all, the coronavirus pandemic has led to a plunge in interest rates around the world, as central banks have acted swiftly to contain the financial fallout caused by the virus situation by printing massive amounts of inorganic liquidity used to buy assets, in an effort to save the markets from falling down a cliff.

Meanwhile, socio-political turmoil in Hong Kong amid the approval of China’s security law has also led to a plunge in business volumes in the Asian region, while the risk of a no-deal Brexit in the United Kingdom keeps looming despite the latest advance in negotiations.

Although investors don’t seem to be reacting positively to today’s news, from a purely financial standpoint, the sale of the US retail banking operation would likely have a positive impact on the company’s short-term financial performance, based on the fact that the unit has been losing millions in the past two years.

What’s next for HSBC shares?

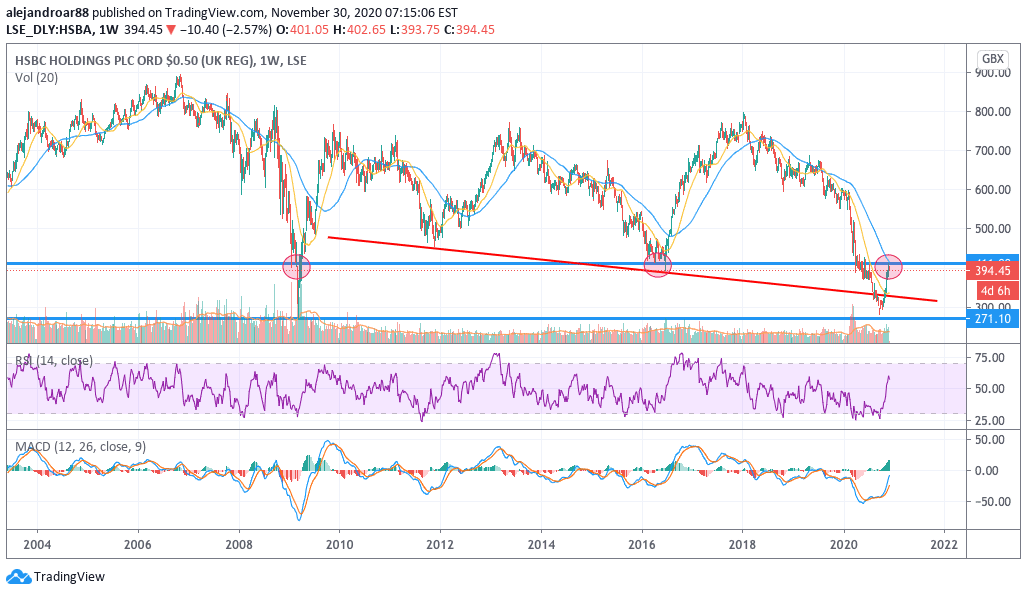

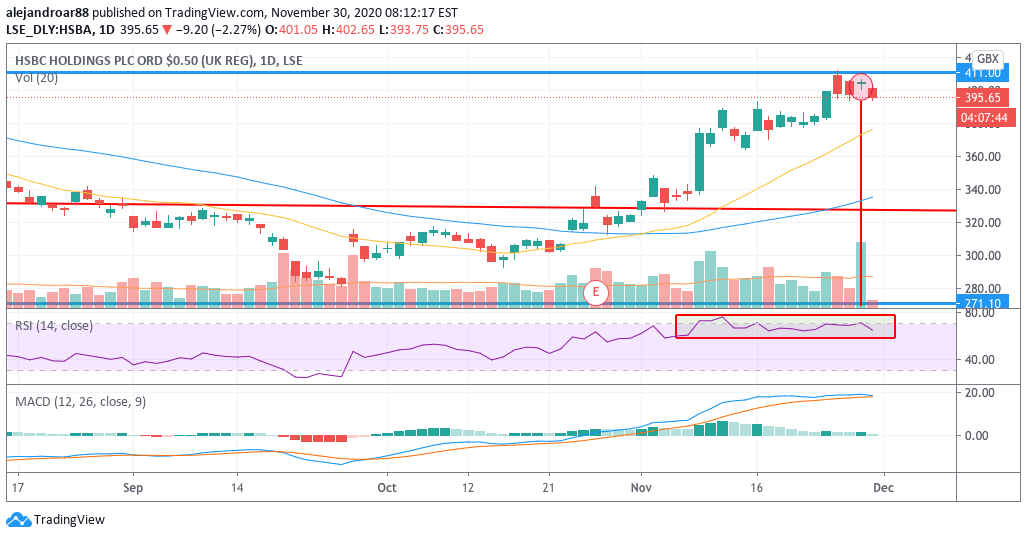

The weekly chart above shows how today’s downtick coincides with a rejection of a long-dated support at the 400p level, which puts into question the assumption that markets are reacting negatively to the news.

That said, this rejection does affect the short-term outlook for the stock, as a failed move above that threshold could mean that the shares may be due for a breather after surging nearly 40% since their 25 September lows.

This view would be reinforced by the fact that the RSI has been hovering at overbought territory since early November, while the MACD is moving closer to the signal line, pointing to a decreased momentum for HSBC shares.

Friday’s session was quite interesting as well, as trading volumes surged to their highest levels since June, although the price action barely held the 400p level despite this significant effort from bulls.

For now, the latest down draught looks more like a move to take profits rather than a full-blown reversion. However, the next few sessions are likely to provide more hints as to where HSBC shares might be headed since bulls could have exhausted their guns last Friday. Bears could use the current news to plunge the price below the 400p threshold for a while – possibly aiming for the 375p 20-day moving average as a first target.

Question & Answers (0)