HSBC shares have been hurting recently because of the bank’s Asia exposure and the turmoil in Hong Kong, but they held up well today, despite Hong Kong arrests and Chinese sanctions on US politicians.

A storm of bad news led to a substantial plunge for HSBC shares (HSBA) in recent months, with the price of the stock nearly halving since mid-February to 331 today, down from the 600p.

The stock was up 1.6% in the London session and is currently 1.3% higher on Wall Street.

The company’s latest interim report – covering the first half of 2020 – has served as an important catalyst for this downward move, as shares of the London-based bank have fallen 2% since it disclosure of a 65% drop in its pre-tax profits during the first six months of the year.

HSBC – heavily exposed to Asian markets – has also been seeing downward momentum as a result of the approval of Hong Kong’s national security law enforced by China, with investors fearing that the bank’s operations may be affected by the geopolitical turmoil caused by these measures.

The arrest of Hong Kong tycoon Jimmy Lai, founder of Next Digital, has turned up the temperature, and so has the tit-for-tat sanctioning by China of US politicians. It is China telling everyone in Hong Kong that “we can arrest the most powerful people in Hong Kong, so watch your step”, say analysts.

Lai’s Apple Daily news outlet in one of the most popular in Hong Kong. The share price of Next Digital fell as rumours flew that this arrest was coming. However, after a campaign by pro-democracy activists, the share price has jumped three fold today after Hong Kongers were urged to buy the stock.

Highlights from HSBC’s latest interim report

- Revenues: HSBC reported revenues of $26.7 billion for the first six months of 2020, down 9% from the $29.4 billion the company generated the year before. The company granted borrowers with 700,000 payment holidays during this period amid the COVID-19 pandemic including relieves for roughly 65,000 mortgage accounts and 153,000 personal credit accounts – credit cards and personal loans included.

- Loan-loss provisions: HSBC took a large $6.7 billion charge to increases its reserves for loan losses, up from the $1.14 billion it took the year before, as the pandemic has increased the risk of default across the bank’s entire portfolio.

- Margins: Net interest margins saw a reduction of 18 basis points compared to the same period in 2019, ending the six-month period at 1.43%, down from 1.61%. Meanwhile, the company’s return on equity was 2.4%, down from 10.4% it generated for shareholders a year ago.

- Profitability: Profit before taxes plunged to $4.3 billion, down 65% from the $12.4 billion the company reported the year before, as the COVID-19 pandemic led to higher expenses in the form of provisions for loan losses.

- Expense: HSBC reported $1 billion in impairments coming from intangible assets and goodwill, however it managed to offset the impact of these write-offs by reducing its operating expenses by $800 million as a result of reduced discretionary expenditures and lower performance-based compensation for its employees.

- Solvency: The bank reported a 15% CET1 capital ratio, up from the 14.3% the company reported a year ago, while leverage ratios stood at 5.3%, essentially unmoved compared to 2019.

Outlook

At the moment, according to the bank’s interim report, HSBC sees certain major risk factors affecting its operations. These include:

- COVID-19: HSBC highlighted that the pandemic has resulted in weakened GDP forecasts in many of its markets, which translates into lower economic activity and potentially higher unemployment levels, posing a risk for its portfolio of consumer and commercial loans.

- Situation in Hong Kong: The national security law enacted by China for Hong Kong has resulted in an escalation in tensions between the Asian country and the United States, which is threatening to disrupt the firm’s business in both regions, especially after considering the fact that Hong Kong is the primary geographical source of revenue for HSBC.

- Low interest rates: Massive liquidity injections from central banks across the world have resulted in lower interest rates – negative rates in some cases – which weighs on the bank’s ability to increase the profitability of its lending operations.

What’s next for HSBC shares?

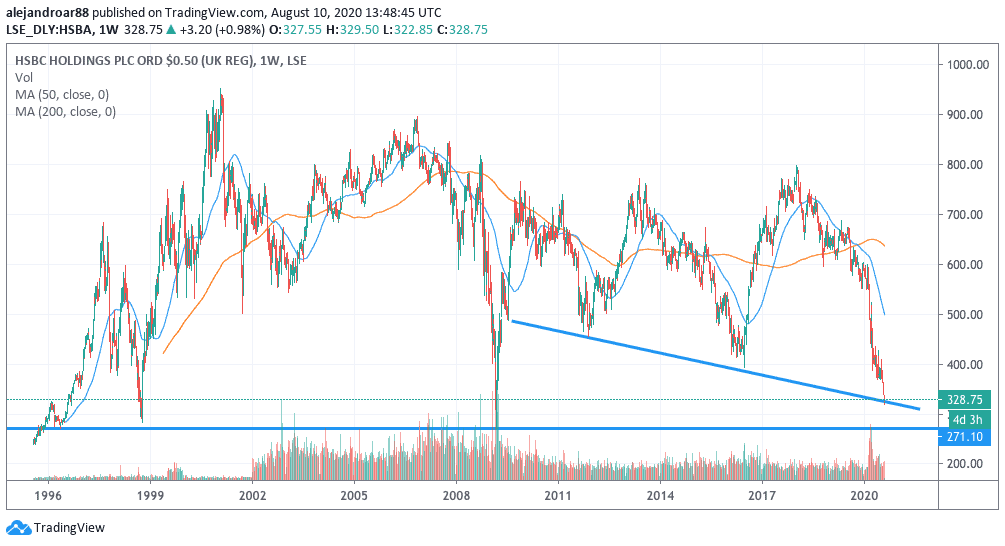

HSBC shares are trading at 328.75p during today’s stock trading session, which puts the bank’s shares at levels previously seen during the financial crisis of 2007-2008.

According to the weekly chart shown above, HSBC shares are currently trading on a downward trend line that has served as support during 2012 and 2016, which means that the price action in the next few weeks will provide critical hints of what’s next for HSBC.

A move below this trend line could be the beginning of another big push down, possibly aiming towards the 300p – 270p levels, which have served as support during times of extreme distress for the global bank.

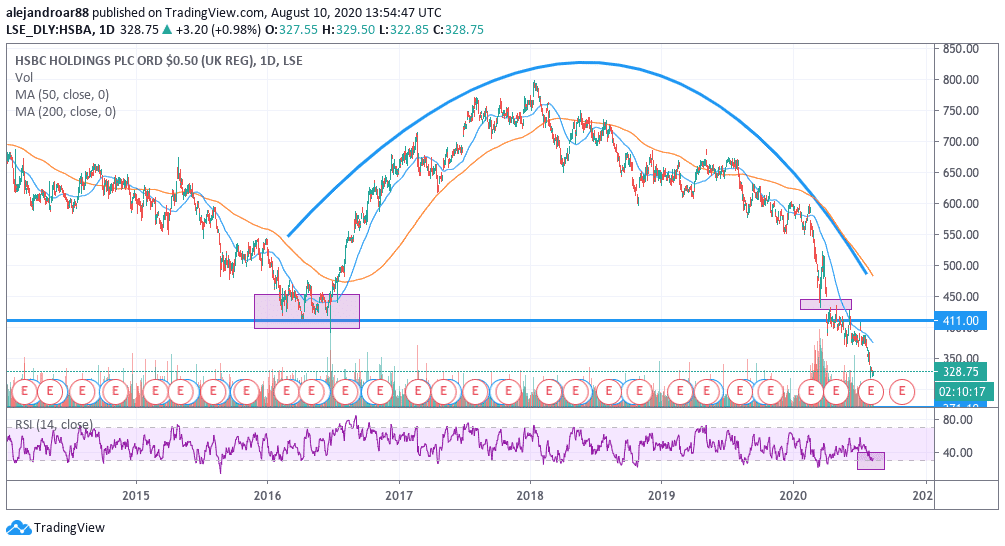

Meanwhile, the 1-day chart seems to show that HSBC shares have been forming a rounded top since the stock touched a bottom in mid-2016, and this pattern seems to have triggered a major sell-off once the price moved below the neckline (blue line) sending the shares down from 411p to their current levels.

Moreover, even though the stock has seen strong downward pressure, the RSI indicator is only just touching the oversold level, which indicates that there’s still room for another push below the current price.

Perhaps the most worrying element at the moment is the situation in Hong Kong. Traders should keep an eye on how that situation develops.

Further deterioration of Hong Kong’s internal situation, or more drastic moves between the US and China, could spark another big stock sell-off.

Question & Answers (0)