Chinese electric vehicle (EV) companies have reported their August delivery reports. Here are the key takeaways from the report and the winners and losers last month in the world’s largest market for NEVs (new energy vehicles).

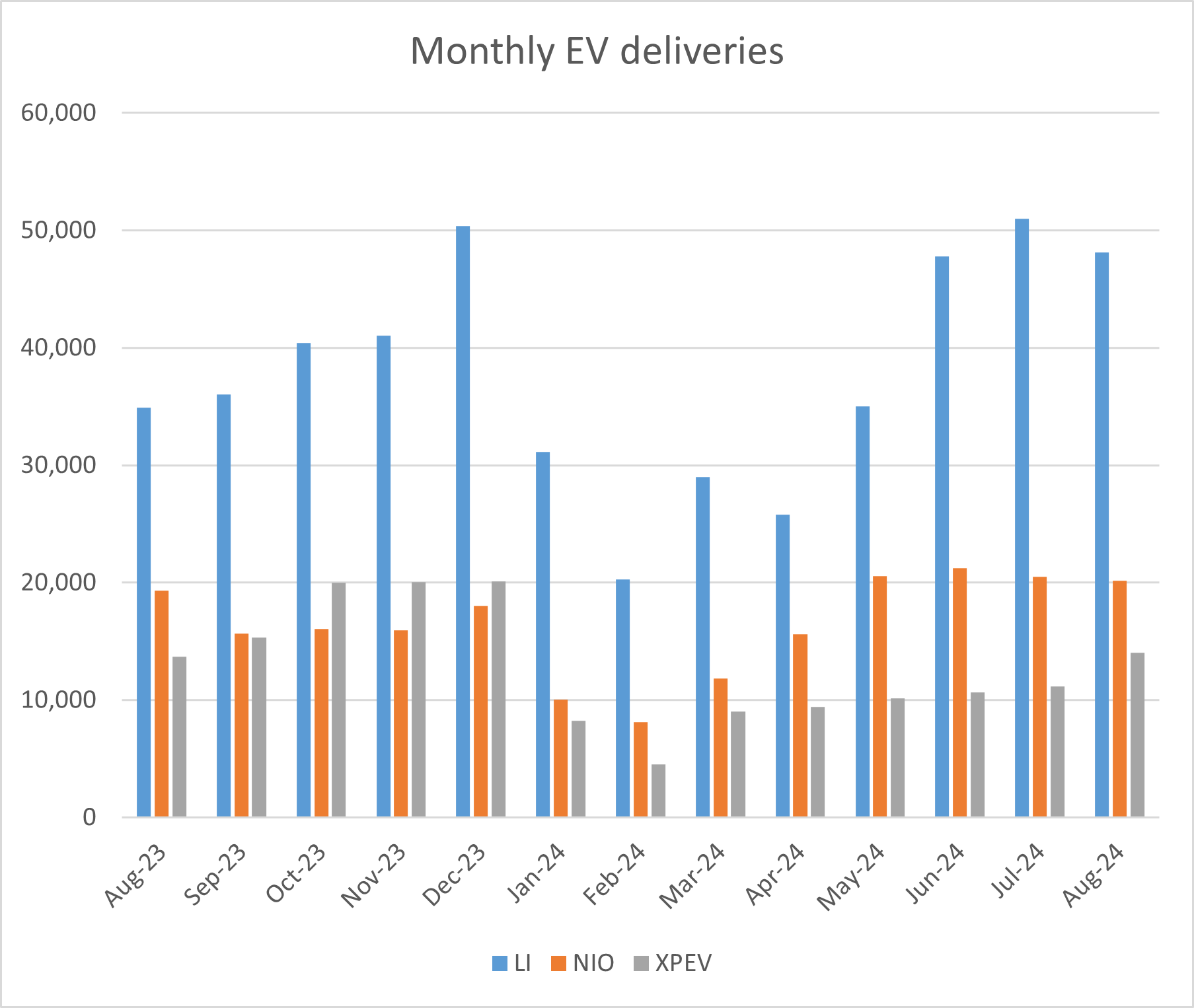

NIO delivered 20,176 vehicles in August which was 4% higher YoY. The company’s deliveries have topped 20,000 for four consecutive months. In the first eight months of the year, the Chinese EV company’s deliveries rose 35.8% to 128,100. NIO’s cumulative EV deliveries reached 577,694 at the end of August.

NIO would release its Q2 earnings on September 5 where it should provide its Q3 delivery guidance. Notably, NIO stock is down sharply this year as investors have been wary of the perennially loss-making EV company.

Zeekr reported a sharp rise in its EV deliveries

Zeekr delivered 18,015 EVs in August which was 46% higher YoY. In the first eight months of the year, its deliveries rose 81% to 121,540 while its cumulative deliveries stand at 318,173.

Zeekr is the latest addition to US-listed Chinese EV companies and went public in May through a traditional IPO. Late last month, Zeekr said that its new batteries can go from 10% to 80% charge in a mere 10.5 minutes. According to the company, it can achieve the feat in 30 minutes when the temperature drops to -10 degrees Celsius. Tesla Model 3 on the other hand can charge upto 175 miles in 15 minutes.

Fast charging, access to more charging stations, and a higher range are among the factors that can boost EV adoption and get more fence-sitters into buying an electric car. Importantly, a battery is the most important hardware component of an EV and is the costliest as well.

Xpeng Motors continues to disappoint with its EV deliveries

Xpeng Motors delivered 14,036 EVs in August which was 3% higher YoY. Its YTD deliveries have risen 17% to 77,209 while cumulative deliveries stand at 477,540. Xpeng Motors expects to ship around 43,000 EVs in the third quarter at the midpoint, to meet this, it would need to ship around 18,000 cars in September.

Recently, the company revealed the pricing for its Mona M03 and the budget model would start below $17,000.

In its release, Xpeng Motors said, “As the first model to usher in XPENG’s second decade, MONA M03 boasts attractive styling, advanced intelligence and superior drivability surpassing those commonly found in the above-RMB200,000 market segment, affordably bringing a new flagship for the AI-defined smart mobility era to younger audiences.”

The budget EV brand is being launched as part of the partnership with Chinese ride-hailing giant Didi and would feature vehicles in the RMB150,000 price range.

Last year only, Volkswagen partnered with Xpeng Motors to build two EVs on its platform and also buy a stake in the company. The deal was a milestone for the Chinese EV ecosystem as it reflected the confidence of Volkswagen in a startup EV company. It was also a testimony to Xpeng Motor’s self-driving capabilities which the company intends to further build upon.

BYD reported record deliveries in August

BYD delivered 370,084 vehicles in August which was 35% higher than the corresponding month last year. The record deliveries were led by the steep rise in PHEV (plug-in hybrid vehicles) whose sales soared to 222,384 and accounted for nearly two-thirds of its total deliveries.

Notably, BYD delivered a record number of cars in July as higher sales of PHEVs more than offset the slowdown in EV sales. In the US also, companies like Ford are doubling down on hybrids while cutting down their EV capex.

Li Auto’s deliveries fell in August

Li Auto delivered 48,122 vehicles in August. While its deliveries fell nearly 38% YoY they were lower than the record July deliveries. However, if Li Auto achieves its Q3 delivery forecast, its September deliveries should top 50,000.

Li Auto has raced ahead of emerging NEV companies in China and its YTD deliveries were 288,103. The company’s cumulative deliveries have reached 921,467 and it looks on track to hit the milestone of 1 million cumulative deliveries over the next couple of years.

China’s EV price war has intensified

Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales.

Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan. Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

As new EV models hit the road, the price war might only escalate in the coming months as companies try to push sales through aggressive pricing. These price cuts have meanwhile taken a toll on the margins of all companies – including Tesla, whose margins were once the envy of the automotive industry.

US share markets are closed today on account of the Labor Day holiday. However, Chinese EV shares closed lower in Hong Kong price action. Meanwhile, more than any reaction to their deliveries, their price movement mirrored the slump in Hong Kong shares with the Hang Seng index falling around 1.65% today.

Question & Answers (0)