Negative momentum seems to be continuing for gold today, as the price of the yellow metal is sliding 1.9% at $1,679 per ounce following a spike in US Treasury yields.

The combination of fast-advancing vaccine rollouts in the United States, along with expectations about a strong jobs report to be released this Friday, could be contributing to today’s uptick in yields, with the benchmark 10-year yield jumping to its highest level in 14 months at 1.756% in early bond trading action.

Higher US Treasury bond yields represent a threat to the short-term performance of the yellow metal as traders are increasingly attracted to the higher interest rate offered by these instruments – which are universally accepted as low-risk investments.

Moreover, the US dollar has been steadily rising since 18 March, as reflected by Bloomberg’s US dollar index, while the benchmark is surging 0.3% today at 93.215, reaching its highest level in roughly 5 months.

Gold’s appeal as an investment vehicle is typically reduced in a positive economic environment as other more profitable opportunities emerge.

In this regard, the pace at which the United States is deploying COVID-19 vaccines across the country seems to be playing a key role in depressing gold prices.

As of today, data from the Centers for Disease Control and Prevention (CDC) indicates that more than 145 million doses have been administered, representing almost half the country’s population. Thus far, gold prices have seen a 14% drop since the Pfizer (PFE) vaccine news hit.

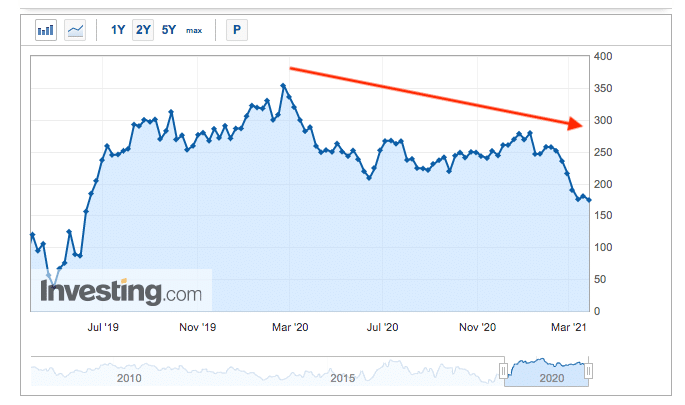

Meanwhile, the largest exchange-traded funds (ETF) offering exposure to gold, including the SPDR Gold Trust (GLD) and iShares Gold Trust (IAU), have seen strong outflows in the past three months, with investors pulling out more than $8 billion during that period according to data from ETF Database, with market participants apparently chasing more profitable opportunities in today’s markets.

Furthermore, Bitcoin’s latest rise as a potential substitute for gold as a store of value in a scenario of higher inflation seems to be contributing to this latest downtrend as well, although the debate about the cryptocurrency’s potential of becoming “gold 2.0” has not yet concluded.

What are analysts saying about gold?

According to the latest Commitments of Traders (CoT) report from the Commodity Futures Trading Commission (CFTC), speculative gold traders have been cutting back on their long positions in light of the strong decline in the price of the yellow metal.

Historical data indicates that the size of net-long speculative positions held in gold futures has gone down from 279,300 to 174,100 contracts in roughly three months. This drop has been fueled by increased short-selling interest, with short positions being two times larger than long ones during the week ended on 23 March compared to the previous week.

For now, analysts seem to remain bullish about gold, although Goldman Sachs cuts its price target for the yellow metal to $2,000 for 2021 recently while Morgan Stanley did the same, now forecasting a price of $1,800 per ounce for this year.

One of the elements supporting these bullish forecasts – compared to today’s price – includes gold’s appeal as a store of value in the event that inflation accelerates in the US, and possibly at a global scale, as a result of central banks’ highly-accommodative monetary policies.

What’s next for gold?

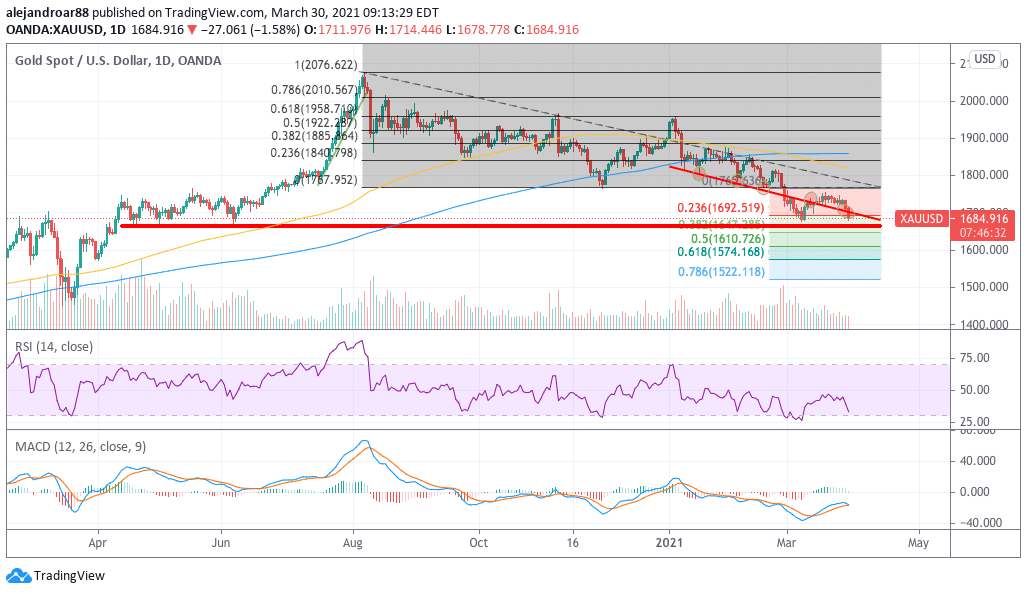

Today’s slide in gold prices is pushing the yellow metal to retest its 8 March lows. At this point, gold seems poised to decline to the $1,660 area of support highlighted in the chart as the momentum continues to be quite negative.

This view is reinforced by both the RSI and the MACD, with the two oscillators currently being neck-deep into negative momentum territory while gold is trading below both its short-term and long-term moving averages.

That said, from a fundamental perspective, the tailwinds that helped gold in surging to all-time highs during the pandemic remain intact, including a potentially inflationary environment caused by massive liquidity injections from the Fed.

However, if bond yields continue to surge in the coming weeks without further intervention from the Fed, chances are that the current downtrend could accelerate – possibly pushing gold below to the low 1,600s.

Question & Answers (0)