The price of gold is climbing to its highest level in four months in early commodity trading action this morning, with the precious metal advancing in 11 out of the 12 past sessions as inflation fears keep mounting.

Gold appears to be on its way to overturn its early 2021 slide, as the price is only 4.8% away from its January peak of $1,959 per troy ounce. As of this morning, spot gold prices are flat at $1,870 even though the US dollar – as tracked by Bloomberg’s US Dollar Index (DXY) is down 0.2% at 89.987.

Last week, gold’s uptrend picked up the pace after the US Bureau of Labor Statistics revealed that the inflation rate in the country had reached its highest level in the past 11 years at least, landing at 4.6% while surpassing analysts’ estimates of 3.6% for the period.

Meanwhile, other indicators including the Inflation Expectation Survey from the University of Michigan (MoU) and the Producer Price Index (PPI) also exceeded the market’s forecasts – a situation that accelerated widespread fears that accommodative monetary policies and supply shortages might be pressuring prices.

Investors seem to have turned to gold as a potential refuge, as the price of the yellow metal has advanced 2.9% since the inflation reading came out. Moreover, inflation has also shown signs of accelerating in other countries, with the United Kingdom recently reporting a 1.5% annualized uptick in prices by the end of April – effectively doubling the rate reported the month before.

Gold ETFs see positive inflows during May

Interestingly, the two largest exchange-traded funds (ETF), the iShares Gold Trust (IAU) and the SPDR Gold Trust (GLD), have both reported positive monthly net inflows in May according to data from ETF Database, with IAU receiving a total of $81 million from investors by 17 May while GLD has received a total of $1.13 billion during the same period.

This appears to be an early indication that investors are turning to gold to protect their net worth from eroding in case that inflation spins out of control on a global scale as a result of the government’s response to the pandemic. It is important to note that, before May, gold ETFs have been reporting net outflows almost every single month since the Pfizer (PFE) vaccine news came out.

Meanwhile, although yesterday minutes from the Federal Reserve indicated that the US central bank might contemplate the idea of tapering its asset purchase program at some point in the future if the economy keeps showing signs of progress, the disappointing employment figures reported by the country last month may postpone that discussion for longer.

Inflation set to accelerate?

In this context, inflationary pressures would likely accelerate as a result of the accommodative conditions imposed by the central bank and this provides a positive backdrop for gold prices.

On the other hand, the appeal of cryptocurrencies as a potential store of value appears to be fading as indicated by money flows. In this regard, JP Morgan analysts reported the following: “The bitcoin flow picture continues to deteriorate and is pointing to continued retrenchment by institutional investors”.

The investment bank added: “This suggests that institutional investors appear to be shifting away from bitcoin and back into traditional gold, reversing the trend of the previous two quarters”. The continuation of this trend would result in higher inflows moving to gold ETFs in the near future – a situation that could push the price of the yellow metal higher.

Meanwhile, gold mining stocks have also seen their fair share of upside during the month, with the VanEck Gold Miners ETF (GDX) advancing 21.6% since May started.

What’s next for gold?

So far this month, gold prices have advanced 10.9% as a result of the inflation trade. The fact that ETFs are starting to show a turning point in terms of net inflows along with a run-for-the-mill toward gold and out of cryptocurrencies could support further upside for the precious metal in the near future.

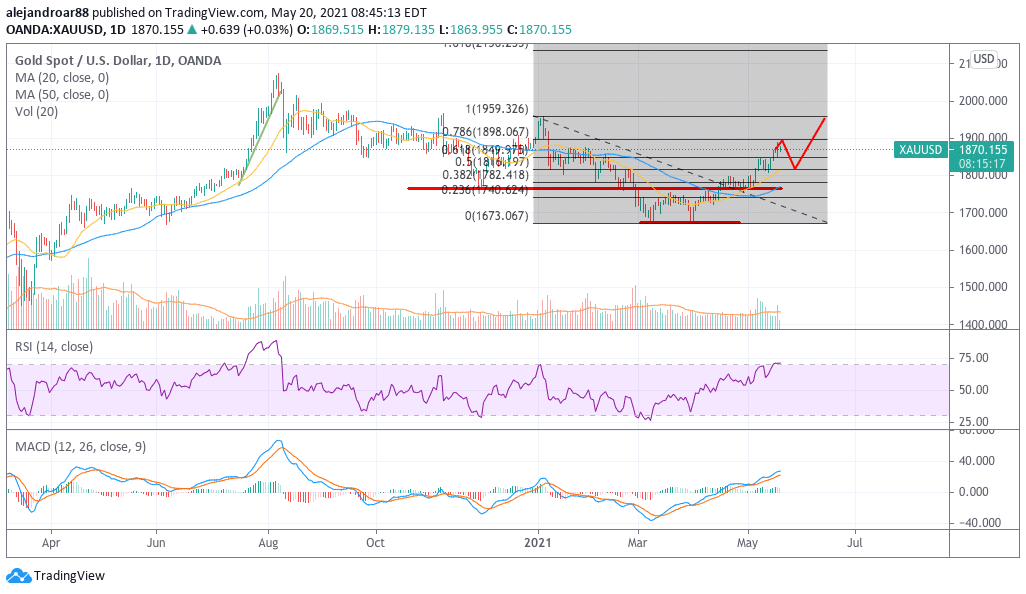

The technical setup currently displayed by the price action in spot gold suggests a bullish outlook as well, as the price has already trespassed the 61.8% Fibonacci retracement shown in the chart – an indication that the uptrend is accelerating.

Meanwhile, the rally has solid legs as this latest jump in gold is coming off a double-bottom pattern confirmed in late March, when prices bottomed at $1,675.

Moreover, both momentum oscillators show that gold’s momentum is quite positive. That said, the price of the precious metal could suffer a short-term pullback at any given point as traders take some profits off the table but that should only add further gasoline to the fire as late buyers could step in to push it higher.

Question & Answers (0)