Glencore shares opened today’s stock trading session in the green zone at 162.6p. The rise comes despite news of a lawsuit from Italian bank UniCredit amid a fake oil deal the company entered into with bankrupted Asian trading firm Hin Leong, owned by former billionaire Lim Oon Kuin.

The lawsuit document, filed with the Singapore High Court and first seen by Reuters, indicates that UniCredit extended an $85 million credit line to Hin Leong on November 2019 that was partially backed by 150,000 tonnes in high-sulphur fuel oil sold by Glencore (GLEN) – although the cargo was immediately sold back to the British miner.

The bank stated that it was not aware of these transactions at the moment the credit line was extended, which resulted in the transfer of the collateral that backed the loan without their knowledge or consent. Court documents showed that the goods passed from Glencore to Hin Leong and backwards at the same time on 2 December.

Meanwhile, a report from PwC – Hin Leong’s judicial manager – pointed that there were at least 18 letters of credit valued at $503 million that were opened by following the same procedure – although Glencore was reportedly involved in only one so far.

The auditing firm further highlighted that these letters were not part of any commercial transaction as they were only used by the Asian firm to raise liquidity to pay back its significant debt burden – which amounted to nearly $4 billion according to the firm’s bankruptcy papers.

Hin Leong’s situation keeps spilling over other firms

This recent lawsuit points to yet another modus operandi followed by Hin Leong to raise liquidity, as the company’s founder has already been charged on the account of forgery by Singaporean authorities after being accused of forcing one of his firm’s employees to falsify a document from UT Singapore Services to use it as collateral to obtain financing.

The total amount owed by the firm keeps mounting, with the latest tally putting the total debt at $3.85 billion that the company owes to at least 23 banks including HSBC (HSBA), Standard Chartered, and Société Générale.

Although the financial impact of this lawsuit on Glencore’s bottom line may be limited, it points to a potentially unlawful practice carried on by the mining firm that could raise concerns among industry regulators in the UK if the firm is found guilty of arranging these sort of deals.

Glencore lost $2.6 billion during the first six months of 2020 as a result of lower commodity prices and asset impairments taken by the firm amid the pandemic.

What is going on with Glencore shares?

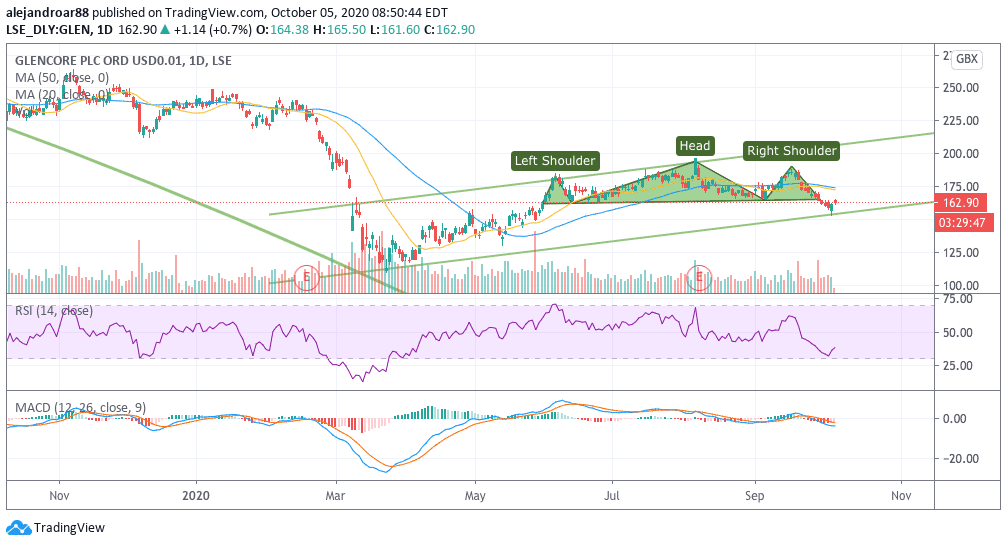

Glencore shares are trading slightly higher today at 162.72p per share after seeing a sharp 15% drop from 190p they were trading for almost 15 days ago.

The combination of plunging oil prices and the news cited above seem to be serving as a catalyst for this latest downturn, while technical elements suggest that more pain is ahead for the British miner.

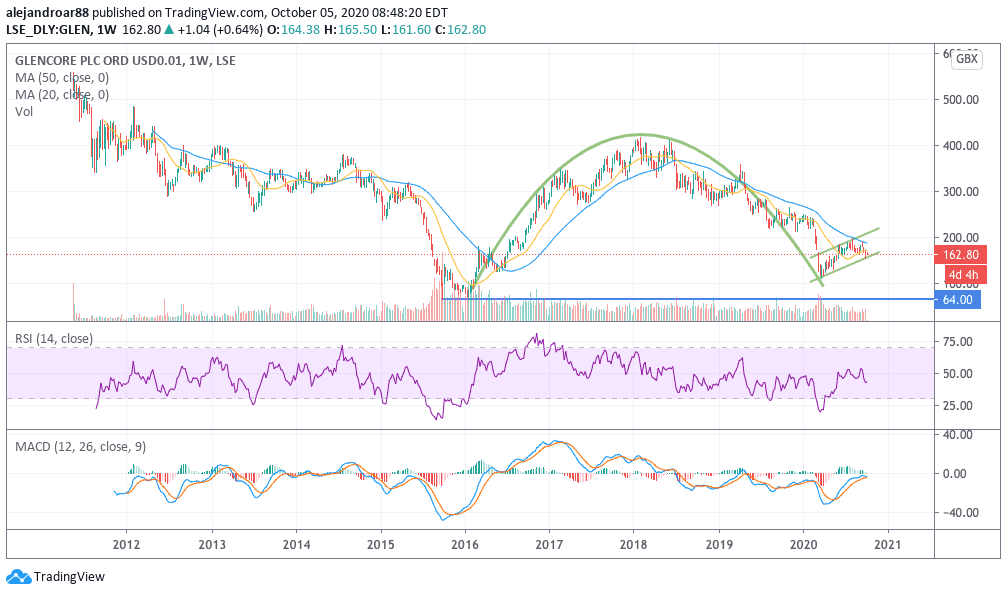

In this regard, the weekly chart shows that an inverse cup and handle formation has been emerging since the stock touched its all-time low of 64 per share in early 2016, with the handle taking shape after Glencore’s rebound off its March 2020 lows.

Meanwhile, the latest price action seen in the 1-day chart shows that a head and shoulder pattern is currently in play after the stock price fell below the 165p neckline, although a retest of those levels may be expected in the next few sessions.

A confirmation of the inverse C&H would come if the price slips below 150p – the lower trend line of the handle – and given the height of the cup’s top the downturn could lead to a retest of the 64p bottom in the next few weeks or months if the pattern is confirmed.

At this point, a strong catalyst would be required for such a move, but given the significant uncertainty that looms in the backdrop of the commodities market, the likelihood of such an event is not necessarily low.

Question & Answers (0)