Generac stock is moving higher in pre-market stock trading action this morning after the company announced that it acquired Chilicon Power, a California-based solar company that manufactures microinverters for residential use.

According to the press release published by the company yesterday, the deal will help Generac in strengthening its presence in the promising residential energy technology market while it “dramatically increases the company’s total addressable market opportunity”, said the management team.

In regards to the deal, the founder of Chilicon Power, Alex Kral, stated: “We are thrilled to be joining Generac, which has a like-minded strategy in developing innovative and technologically advanced products for the solar plus storage market”.

Meanwhile, Generac’s Chief Marketing Officer, Russ Minick, said: “Adding Chilicon’s robust microinverter solutions alongside Generac’s current PWRcell® solar and storage product offerings will create one of the broadest product offerings in the residential clean energy market”.

The specific terms of the deal have not been disclosed yet but the company stated that the transaction was settled on 2 July.

This would be the fourth acquisition made by Generac in the past 12 months, including the purchase of West Coast Energy Systems, Mean Green Products, and Enbala Power Networks. The cost of these acquisitions has been relatively small, amounting to around $65,000 for the three companies according to Generac’s latest 10-K filing.

According to data from LinkedIn, Chilicon Power employed 5 people as of yesterday, which means that this acquisition might be another move from Generac to acquire the patents held by the company on the products it manufactures.

Generac has been seeking to introduce itself in the solar market in the past two years or so as reflected by the launch of its PWRCell product line following the acquisitions of Neurio Technology and Pika Energy.

Meanwhile, the acquisition of Chilicon Power would help the firm in expanding its product line by incorporating inverters used by residential customers to power their homes.

Residential products accounted for 71.5% of the company’s total revenues by the end of its 2020 fiscal year. The contribution of this segment to Generac’s top-line results increased almost 9% in 2020 compared to the previous year.

How has Generac stock performed lately?

So far this year, Generac shares accumulate an 89% advance as the company has managed to grow both its revenues and bottom-line profitability at a fast pace in the past few years. Last year, sales jumped 12.7% compared to a year ago, landing at $2.49 billion, while net income for the firm ended the year at $349.33 million, up 38% compared to 2019.

This incredible performance is almost shadowed by the gains reported by Generac stock in 2020, as shares gained as much as 126% as companies that focused on the renewable energy sector were highly favored by investors.

According to data from Seeking Alpha, analysts are bullish on Generac at the moment, with a total of 15 buy ratings from the 17 analysts who are currently covering the stock.

Meanwhile, the consensus price target for Generac stock stands at $425.9 or 3.4% lower than today’s pre-market price.

What’s next for Generac shares?

Analysts are forecasting earnings per share of $10.09 for Generac this year, which results in a forward price-to-earnings ratio (P/E) ratio of 43 based on yesterday’s closing price.

In the past three years, the firm has managed to grow its net income by 30% while these forecasted earnings would result in an 84% jump in the firm’s bottom-line profitability.

Despite this P/E ratio appearing to be quite stretched, the company’s estimated earnings growth as per data from Seeking Alpha shows that the market is pricing a significant jump in the firm’s profitability in the following two to three years.

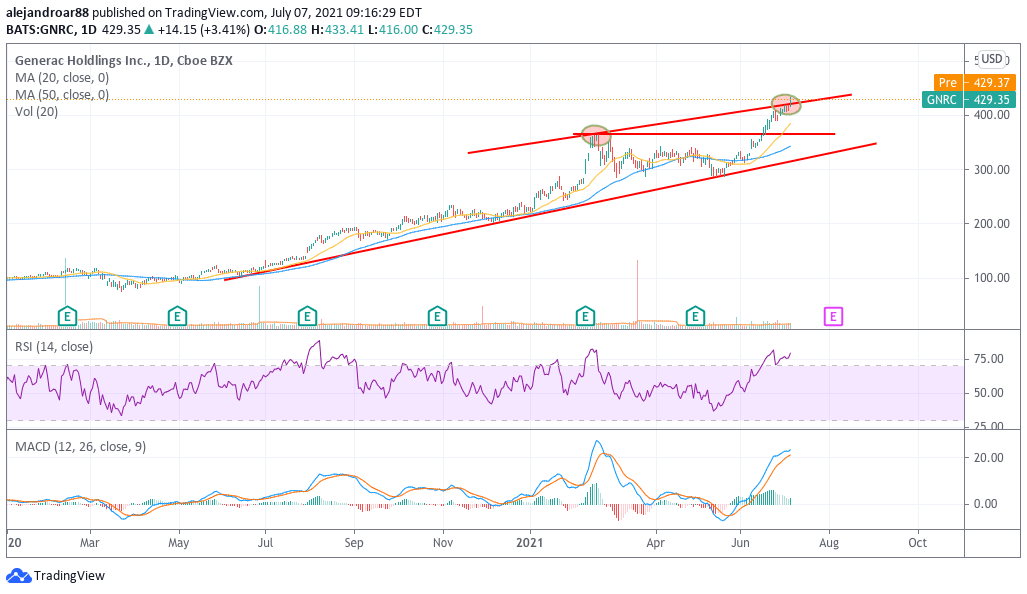

Meanwhile, from a technical standpoint, the stock has surged 18% above its all-time highs already in the past three weeks or so, with momentum oscillators already flashing overbought while the stock is trading 11.3% above its 20-day moving average.

Technical indicators seem to be pointing to the potential exhaustion of this latest rally but the stock continues to be quite appealing at its current valuation based on the business’ growth prospects. With that in mind, a pullback could provide an opportunity for late buyers to enter a long position on the stock at a more attractive price.

Moreover, the acquisition of Chilicon Power could open up a whole new revenue stream for Generac that could continue to support the firm’s growth for years to come as the company keeps pivoting toward the solar energy market.

Question & Answers (0)