Shares of gaming retailer GameStop were trading sharply lower in US premarket trading today after it provided its first quarter business update and said it plans to issue 3.5 million shares to raise cash.

The company said that it “intends to use the net proceeds from any sales of its Common Stock under the ATM (at-the-money) Offering to further accelerate its transformation as well as for general corporate purposes and further strengthening its balance sheet.”

GameStop to issue more shares

Meanwhile, the timing and amount of share issuance would be decided by the company. While the shares were trading sharply lower on the announcement of the share issuance, it should not have come as a surprise to the markets.

Last month, in a filing with the SEC, GameStop had dropped hints that it plans to go for a share issuance. “{Since January 2021, we have been evaluating whether to increase the size of the ATM (at-the-market) Program and whether to potentially sell shares of our Class A Common Stock under the increased ATM Program during the course of fiscal 2021, primarily to fund the acceleration of our future transformation initiatives and general working capital needs,” said the company in its filing.

The meme stock rule book

Also, GameStop is simply borrowing from the rule book of many other so-called meme stocks that have used the short squeeze driven rally to issue more shares and strengthen their balance sheets. Even electric vehicle makers like Tesla and NIO have issued shares thrice over the last year in an apparent bid to capitalise on the surge in their shares.

At least in Tesla’s case, the company did not need the $13 billion that it raised in 2020 and eventually ended up investing $1.5 billion into bitcoins. That said, the massive capital raise helped Tesla strengthen its balance sheet and turn negative on the net debt.

GameStop business update

GameStop also released the business update for the first quarter today. In the nine weeks ended 3 April 2021, its total sales increased 11% as compared to the corresponding period in 2020. The sales increased 5.3% in February and a healthy 18% in March. However, it is worth noting that the increase in March sales is coming from a lower base effect. In March 2020, its business was “negatively impacted due to temporary store closures and other government mandated restrictions that resulted in limited operations.”

While there are still some restrictions especially in Europe, and GameStop has lowered its retail footprint over the period, the impact is not as severe as we saw during the lockdowns last year.

Online sales soar

Interestingly, the company did not provide data about same-store sales and online sales. Soaring online sales have helped GameStop offset forced store closures as well as its reduced retail footprint where it has reduced its store base by 13% over the last year.

GameStop’s online sales have been increasing gradually. Its online sales rose 175% in the fiscal fourth quarter of 2020 and accounted for 34% of its total sales in the quarter. To put that in perspective, online sales accounted for 12% of its total global sales in the fourth quarter of the fiscal year 2019.

Another positive aspect of the company’s fiscal fourth quarter 2020 earnings was the 6.5% rise in comp sales.

Is GameStop a good stock to invest in?

GameStop is a turnaround candidate especially as activist investor Ryan Cohen is taking an active interest in the company. The company is working on expanding its target market. During the fiscal fourth quarter 2020 earnings call it said “We are continuing the work to expand our addressable market by growing GameStop’s product catalog. This includes growing our product offerings across PC gaming, computers, monitors, game tables, mobile gaming and gaming TVs, to name only a few.” It has also hired a COO with a background in tech companies like Amazon and Alphabet.

All said, given the bloated valuations and the dilution from the share issuance, GameStop does not look a good buy at these prices. While the company is turning around its business, it does not mask the fact that gaming is moving online which is a major headwind for GameStop.

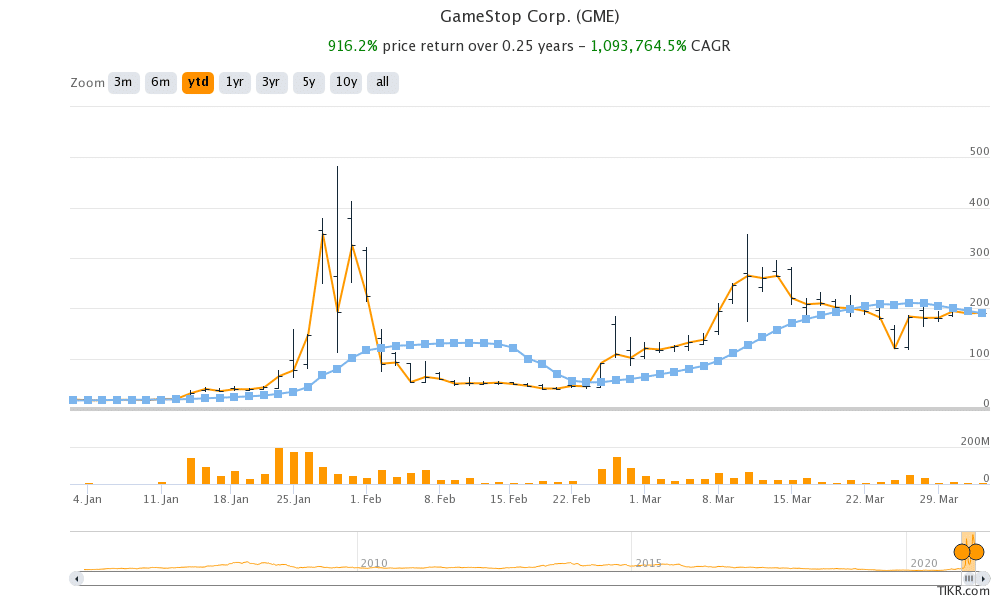

GameStop shares were trading almost 10% lower in US premarket trading today. The shares have risen 916% so far in 2021 and have a 52-week trading range of $2.57-$483.

Question & Answers (0)