Major European stock indexes including the German DAX and the French CAC 40 climbed to all-time highs today, after the European Commission (EC) revealed that approval has been given to its ambitious multi-billion stimulus package called NextGenerationEU.

In a tweet released last Friday, the President of the EC, Ursula von der Leyen, announced the initiative, which consists of €800 billion ($980 billion) in stimulus injected to the economic block to pivot towards a “greener, more digital, and more resilient” model.

The head of the commission also informed the public that member states have already approved the stimulus while the multilateral body expects to tap the markets in the following weeks.

According to the EC website, bonds will be issued between mid-2021 and 2026 to finance the ambitious plan, which includes €728 billion extended in the form of grants and loans extended to member states who present their recovery plans to the commission while the remaining funds will be invested into programs built to boost certain specific activities within the region’s economy.

The Commission plans to repay these bonds in full by 2028 and multiple primary dealers have already been selected to start selling the issues including regional banks like Banco Santander, Barclays, Societe Generale, and Deutsche Bank and US-based institutions such as JP Morgan, Goldman Sachs, and Citigroup.

European stock indexes are responding positively to strong economic data

Major European stock indexes have climbed today following the release of further details about the plan, with the German DAX leading the scoreboard with a 1.5% gain while trading at an all-time high of 15,658.

Meanwhile, the British FTSE 100 Index, the Italian FTSE MIB, and the French CAC 40 are all posting gains above 1% while the pan-European STOXX 600 is advancing to all-time highs as well at 451.94 with a 1.2% gain so far this morning.

Other factors pushing these indexes higher include an uptick in oil prices, with Brent crude futures trading 1.9% higher in early commodity trading action at $70.82 per barrel, while precious metals are continuing their upward path on the back of inflation concerns.

Moreover, historically high readings in the region’s economic indicators including the IHS Markit Manufacturing Purchasing Manager Index (PMI) have also turned sentiment to the positive side as the final reading for May came in at 63.1 – this being the highest reading ever recorded by the Eurozone in the history of the benchmark.

What’s next for European markets?

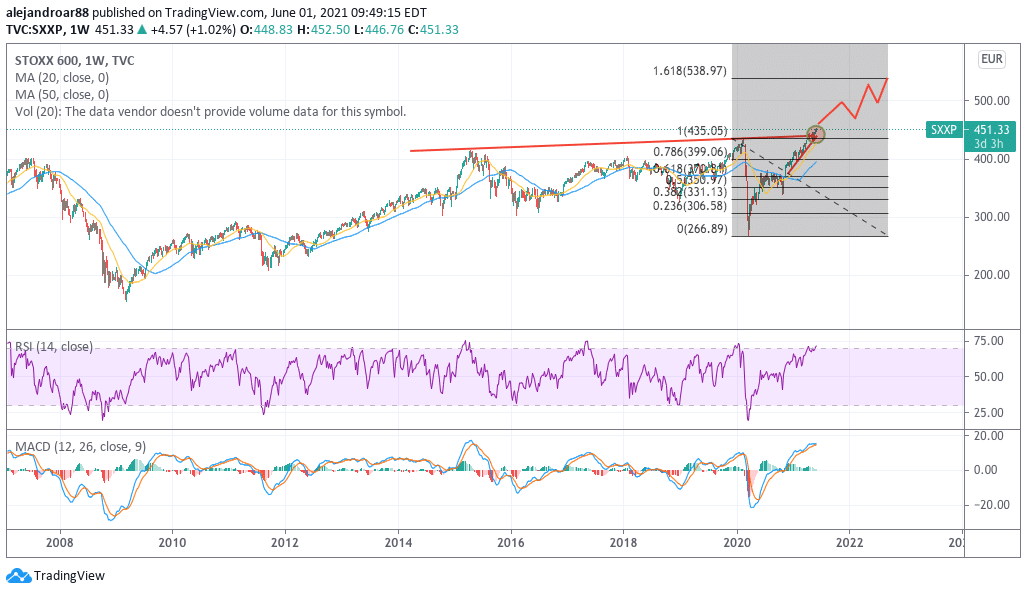

Using the pan-European STOXX 600 index as a gauge of the region’s stock trading action, we can see how the benchmark has broken a long-date trend line resistance, which indicates that European markets as a whole could be entering a new bullish cycle on the back of this historical stimulus package.

Meanwhile, an acceleration in inflation readings might not be as bad news for Europe as some would expect as the region’s economy has been undergoing multiple years of stagflation/deflation. In this regard, a somehow controlled spike in inflation rates could boost corporate profits, which should ultimately improve economic conditions and employment.

Based on the Fibonacci retracement shown in the chart above, a first target for the index could be set at EUR 540 for a potential 19.4% gain. That said, some degree of care is advised as weekly momentum readings have already stepped on oversold levels, which means that European equities might be getting a bit crowded.

One way to get exposure to European stock indexes is through Vanguard’s FTSE Europe Index Fund, which tracks the FTSE Developed Europe All Cap Index. This fund has delivered a similar – and sometimes even better – performance than the STOXX 600 Index in the past 5 years at least which makes it an ideal vehicle for those who would like to get exposure to European equities.

Question & Answers (0)