A Delaware judge has voided Elon Musk’s mammoth $56 billion Tesla pay package for the second time this year despite the company getting it ratified by shareholders. As expected, the billionaire has lashed out at the move calling it “totally crazy.”

For context, in January Chancery Court Chancellor Kathaleen McCormick voided Musk’s 2018 compensation plan which was worth over $56 billion and was the largest pay ever in US corporate history.

The package was challenged by Tesla shareholder Richard Tornetta and the judge ruled against Musk who does not get any fixed salary or bonus from Tesla and his compensation was tied to metrics like the company’s profitability and market cap.

In her ruling in January, Judge Kathaleen McCormick said the board’s approval of the pay was “deeply flawed” and that Musk effectively “controlled Tesla” when the compensation was approved.

Delaware Judge Voided Musk’s Compensation Plan in January

“In addition to his 21.9% equity stake, Musk was the paradigmatic “Superstar CEO,” who held some of the most influential corporate positions (CEO, Chair, and founder), enjoyed thick ties with the directors tasked with negotiating on behalf of Tesla, and dominated the process that led to board approval of his compensation plan. At least as to this transaction, Musk controlled Tesla,” she said in her ruling.

After Musk’s 2018 compensation was voided, Tesla approached the shareholders to ratify it again. Despite some proxy firms advising shareholders to reject the proposal, it was approved with a supermajority.

Meanwhile, the ratified compensation plan was also rejected by Judge McCormick who said, “Even if a stockholder vote could have a ratifying effect, it could not do so here.” She added, “Were the court to condone the practice of allowing defeated parties to create new facts for the purpose of revising judgments, lawsuits would become interminable.”

“The large and talented group of defense firms got creative with the ratification argument, but their unprecedented theories go against multiple strains of settled law,” says the recent court filing.

Tesla Plans to Appeal the Decision

In a tweet, Tesla said that the decision to overturn Musk’s pay was “wrong” and it plans to appeal. “This ruling, if not overturned, means that judges and plaintiffs’ lawyers run Delaware companies rather than their rightful owners – the shareholders,” said the EV giant.

Musk too lashed out at the order and said “Shareholders should control company votes, not judges.”

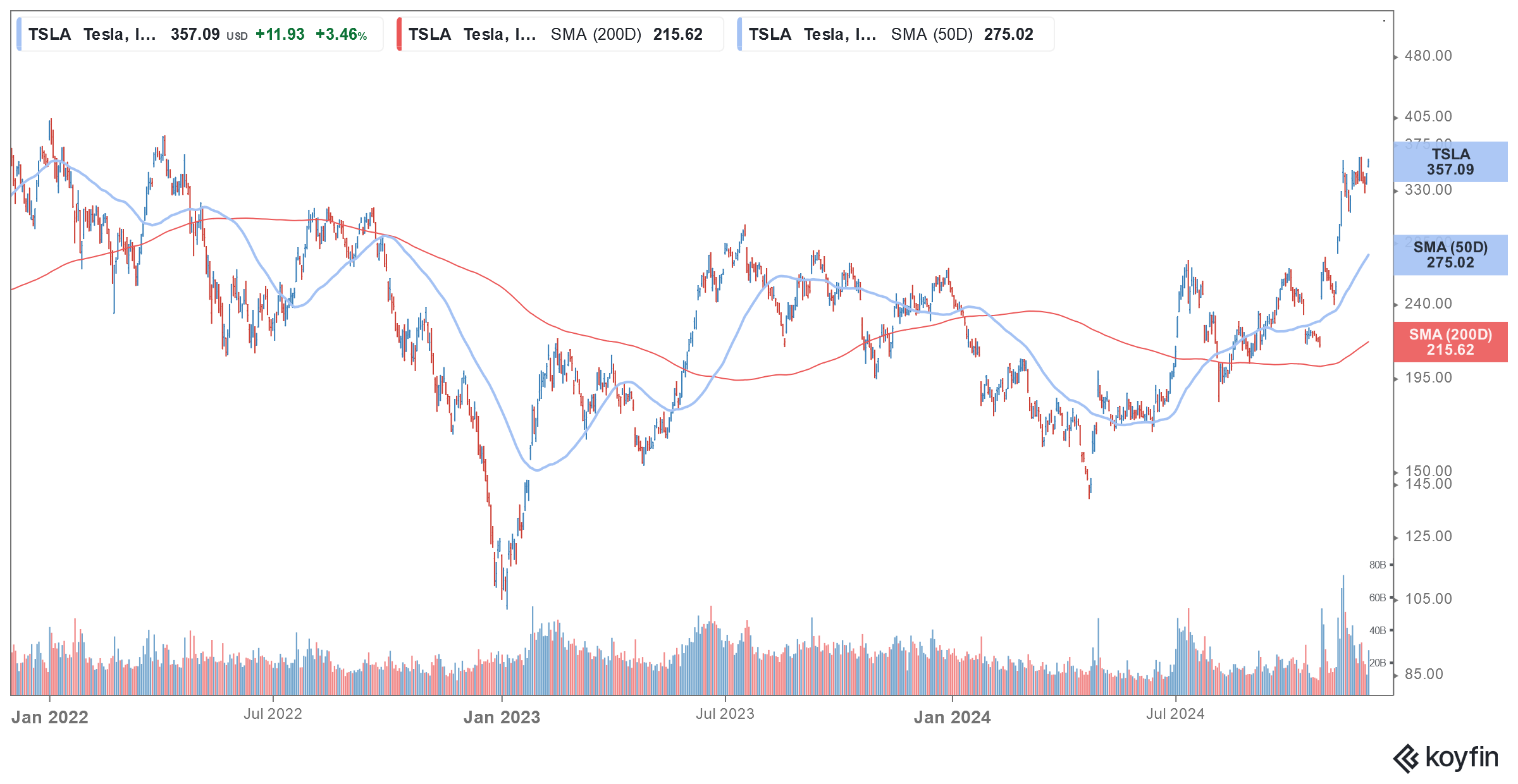

Tesla has rallied since Trump’s election

Tesla shares have been rallying since Donald Trump’s election and rose around 38% in November to have their best month since January 2023.

November was the 10th best month overall for Tesla and in absolute terms, the company added more than $300 billion to its market cap. Tesla CEO Elon Musk is a close confidante of Trump and the president-elect has appointed him along with Vivek Ramaswamy to head the Department of Government Efficiency (DOGE).

TSLA is the rare green energy company that rallied in November. Trump’s pro-fossil fuel policies are no secret and he has vowed to end the electric vehicle (EV) “mandate” on the very first day of his presidency.

A section of the market believes that given Musk’s proximity to Trump, Tesla stands to benefit from enabling regulations from his administration – particularly on autonomous driving.

Concerns over Musk spending adequate time at Tesla

Among others, the lawsuit against Musk’s pay alleged that despite providing the billionaire with a fat package, the board failed to seek more time commitment from him.

Notably, apart from Tesla, Musk also heads several other companies including SpaceX, x.AI, and Neuralink. Also, while he selected Linda Yaccarino to head X (formerly Twitter) he continues to be involved with the company. Musk also co-heads DOGE which would also consume some of his time.

Gerber Kawasaki Wealth & Investment Management president Ross Gerber who was once a Tesla bull has also been concerned about Musk’s other commitments. According to Gerber, “We all know where Elon is right now, and he’s at Mar-a-Lago. So, he hasn’t worked at Tesla for a long time.” He added, “I get that Elon is now vice president of the United States, but that doesn’t necessarily help Tesla.”

Meanwhile, attorneys from Bernstein, Litowitz, Berger & Grossmann, the firm representing the plaintiff, have welcomed the decision to block Musk’s pay package. “We are pleased with Chancellor McCormick’s ruling, which declined Tesla’s invitation to inject continued uncertainty into Court proceedings and thank the Chancellor and her staff for their extraordinary hard work in overseeing this complex case,” they said in a statement.

Analysts on TSLA stock

Roth MKM analyst Craig Irwin upgraded Tesla to buy and increased his price target on the stock to $380 and said, “The stock is responding to the Trump bump.”

“I don’t see very many negative catalysts if estimates are going to positive revisions. … Things are going to look a lot like they did 11, 12, 13 years ago, where they can literally invent their own milestones and knock them down,” said Irwin speaking on CNBC.

According to Irwin, “Musk’s authentic support for Trump likely doubled Tesla’s pool of enthusiasts and lifted credibility for a demand inflection. … Catalysts should drive valuation. It’s real, the world has changed, so we are upgrading.”

He added, “We expect Tesla to see rebounding growth from an expanded pool of enthusiasts and the sunset of other more subsidy-dependent brands.”

Not everybody buys the story of TSLA benefiting from a Trump presidency though. Bernstein – a long-standing Tesla bear – said in its note, “Trump is anti-EVs, but TSLA is on a tear. Tesla’s stock is up 28% since Trump’s election victory, despite the fact that the new administration will likely end IRA consumer and battery manufacturing tax credits, potentially lower emissions standards and could increase tariffs on Chinese batteries.”

Question & Answers (0)