Eli Lilly shares jumped higher in pre-market stock trading action – 11% to $188 – in New York after the company revealed that its experimental Alzheimer drug Donanemab slowed the decline in cognition and daily functions during an early stage of the disease.

The company announced these findings in a press release published this morning, highlighting that the experimental drug, which is currently undergoing Phase 2 trials, met its primary endpoint as it effectively slowed down the disease’s advance by 32% in the patients who took the drug relative to those that took a placebo.

Donanemab targets the N3pG amyloid plaque that contributes to the advance of the degenerative disease, causing a reduction in the speed at which new amyloid plaques are formed.

“This unique mechanism and antibody for clearing plaques, discovered at Lilly, has the potential to provide high levels of durable amyloid plaque clearance after limited duration dosing”, said the company’s chief scientific officer Daniel Skovronsky.

He added: “The positive results we have obtained today give us confidence in donanemab and support its rapid and deep plaque clearance for the potential treatment of Alzheimer’s disease”.

The Phase 2 trial, called TRAILBLAZER-ALZ 2, started back in October 2020, enrolling a total of 500 patients with early-stage Alzheimer’s, with the study being carried out in 87 different sites spread across the United States, Canada, Japan, Poland, and the Netherlands. The trial should be concluded in early 2024.

Alzheimer’s drugs are a big deal

According to data from the World Health Organization (WHO), Alzheimer’s is the leading form of dementia in the world, accounting for roughly 70% of all diagnosed cases.

Nearly 10 million people are diagnosed with dementia every year, which means that a total of 7 million Alzheimer’s patients would require early-stage treatment every twelve months.

With that huge market in mind, Eli Lilly’s recent findings in regards to the effectiveness of this treatment could be quite impactful, as the firm stands to gain financially if the treatment is ultimately approved as a feasible one for the deadly disease.

Meanwhile, these positive results are a much-needed win for Eli Lilly after the company’s solanezumab Alzheimer’s treatment failed to meet its primary endpoint during late-stage trials in February last year.

What’s next for Eli Lilly shares?

Eli Lilly’s pre-market uptick could end up pushing the firm’s next-twelve months price to earnings ratio to 23, up from a previous multiple of 20, which is still a fairly decent number if one also considers the 2% dividend yield the stock currently offers.

That said, the past few years have been a bit bumpy for Eli Lilly’s profitability, as the firm has seen its earnings per share move up and down from $4.3 in 2013 to $2.59 in 2016 and then to $3.4 and $8.93 in 2018 and 2019 respectively.

This volatility in the company’s bottom-line makes it a bit difficult to forecast where earnings might land over the coming years, although investors seem to be optimistic about the prospect of larger earnings coming from the drugmaker’s R&D pipeline.

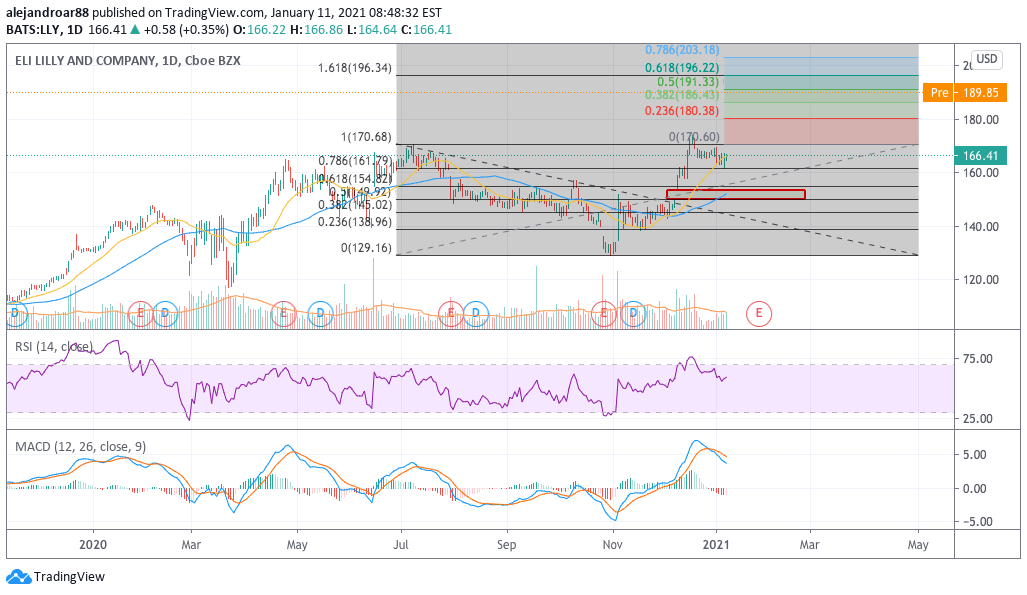

Meanwhile, from a technical standpoint, today’s uptick would push Eli Lilly shares near the 1.618 Fibonacci extension shown in the chart above while it could also end up reversing the latest downtrend seen in both the RSI and the MACD.

The market’s response to the news – both today and onwards – would ultimately determine if this will be the beginning of a new bullish phase for the American pharmaceutical company, while there is an interesting bullish price gap left behind on 9 November on the day that the company announced the efficacy of another drug called tirzepatide, which treats type 2 diabetes.

The combination of these two positive results in up-and-coming drugs could serve as a catalyst for further upward moves, with the stock possibly eyeing the $200 level once market players finish digesting the data.

Question & Answers (0)