EasyJet shares are moving higher today in mid-day stock trading action after the company’s chief executive reported that the firm’s Holidays unit saw a 250% rise in demand for the upcoming summer season.

During an interview with the BBC, EasyJet’s boss Johan Lundgren highlighted that strong pent-up demand has always followed the introduction of pandemic restrictions, such as the ones the UK is currently under, as passengers want to get out from confinement as soon as it is permitted.

“We know that people want to go on holiday as soon as they can”, said Lundgren, while emphasising that the company has seen a 250% uptick in summer bookings during the month of January compared to the same period a year ago.

Meanwhile, the top executive also mentioned that May is generally “the most popular month for holiday bookings”, although that trend could change temporarily as passengers move earlier to lock in better deals offered by the airline during lockdowns.

EasyJet’s Holidays arm – which was officially launched in November 2019 – allows passengers to book travel packages for different months and seasons of the year through a portfolio of more than 5,000 beach and city destinations offered by the firm.

These packages can be easily purchased through the firm’s official website and include flight tickets, hotel bookings, and a 23kg luggage per passenger.

Last year, the pandemic disrupted the operation of the Holidays unit for EasyJet (EZJ), hitting the company with £24 million in losses on roughly £18 million in revenue.

How did EasyJet shares perform last year?

By the end of 2020, EasyJet shares lost roughly 40% of their value as the pandemic ravaged the travel and leisure sector amid lockdowns and travel bans imposed by governments to contain the spread of the virus.

Meanwhile, the stock has also retreated another 1.7% since 2021 started while the FTSE 100 index has advanced 4% during the same period, as the short-term outlook for the travel sector in Europe remains gloomy amid the new strain of the virus that is circulating in most countries within the continent and nearby.

Moreover, the United Kingdom has recently imposed a 10-day mandatory quarantine for passengers coming from anywhere outside the country, Ireland, the Channel Islands, and the Isle of Man, to prevent imported cases from further spreading the disease.

On the other hand, the UK government said just yesterday that around four million people out of the country’s 66 million residents have been inoculated, putting the nation at the top of the list in terms of the speed at which vaccines are being deployed, only preceded by Israel and the United Arab Emirates.

Vaccinations remain an important step to help the economy – and the travel and leisure sector for that matter – in recovering from the economic fallout caused by the health emergency, while airlines expect to resume near-normal activities during the second quarter of the year and forward, although industry experts have mentioned that it could be years before the demand gets back to pre-pandemic levels.

In most countries, pre-departure COVID-19 tests are currently mandatory, which according to EasyJet’s head is a somehow “prohibitive” measure that limits mobility and effectively raises the cost of traveling for passengers in the UK.

What’s next for EasyJet shares?

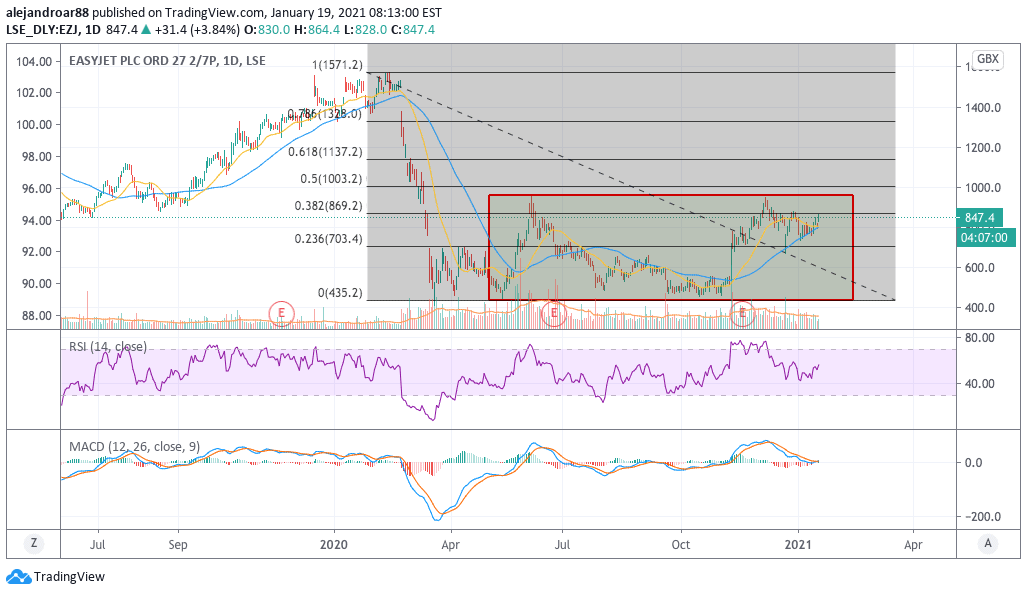

The chart above shows the EasyJet share price currently approaching the June highs, as the UK vaccine roll out accelerates.

That said, the fact that Europe as a whole continues to see a higher number of cases can limit the speed of the recovery for EasyJet’s business, because the number of available destinations might be limited, depending on the virus situation in various parts of the continent. On the other hand, it would be plausible to see a recovery in domestic trips once restrictions are eased.

If the current uptrend continues, a break above the 1,000p level – corresponding to the 0.5 Fibonacci – could indicate that market players have grown more optimistic about the short-term outlook of the firm, which could end up pushing the stock to higher levels in the following months.

Meanwhile, the MACD is sending a buy signal for the first time since early December, which indicates that the stock is seeing some positive momentum lately.

Question & Answers (0)