Diageo shares are up 1.2% today at 2,708p per share in late stock trading activity in London following a double ratings upgrade from Jefferies, as the spirits maker continues riding higher on the back of a positive trading update released on 28 September.

The New York-based investment bank lifted its price target for the parent company of the Johnnie Walker brand to 3,300p – up from a previous target of 2,200p it had forecasted for the firm earlier this year, citing the fact that the world is “nearer to the end of the pandemic than the beginning”.

The firm further emphasized that the beverage sector has moved from being a naturally defensive industry to one that has been treated as “pseudo-cyclical”, which gives it the potential for a strong comeback once an ultimate solution to the virus situation is found.

Diaego sees improved outlook for 2021

Jefferies moved its recommendation for the stock to “Buy” – two notches higher than the previous “Underperform” rating it had assigned the firm amid pandemic headwinds.

This latest upgrade is providing another confidence boost for the British spirits maker, accompanied by a trading update released by the firm a few days before its Annual General Meeting in which the management provided an upbeat commentary on its 2021 outlook for the business.

“Our outlook for the first half of fiscal 21 has improved since the year-end, reflecting the good start to the year, particularly for our US business. We continue to expect sequential improvement in organic net sales and operating profit compared to the second half of fiscal 20”, said Ivan Menezes, Diageo’s CEO, in the firm’s regulatory press release.

On the other hand, positive sentiment towards Diageo may have been temporarily capped by news of a COVID-19 outbreak among employees working at one of the company’s factories located in Scotland, with 12 employees testing positive so far despite the “stringent protocols and procedures” the company said it has enforced to prevent contagions.

Investors may be hesitant to push the stock higher today as a situation of this nature could disrupt their supply chain to some extent if health authorities demand a complete factory shutdown.

What’s next for Diageo shares?

Diageo shares are down 18% for the year, as the pandemic has persisted for longer than expected, which casts a veil of uncertainty over the recovery of the demand for alcoholic beverages in key geographical regions like Europe and the US.

Meanwhile, a resurgence of the virus situation in key countries like Spain, Germany, and the United Kingdom poses a risk for the short-term performance of Diageo’s business, as alcohol consumption is not considered positive among virus-sensitive age groups.

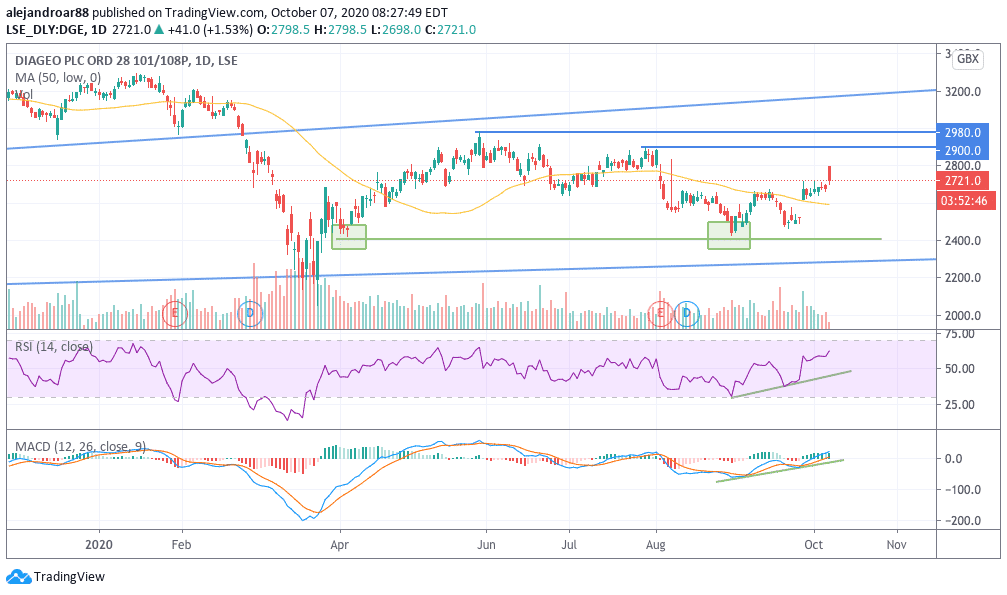

Diageo shares are potentially presenting a buying opportunity now that they have made a double-bottom at 2,400p per share, with the stock rebounding strongly off those levels in the past few weeks.

With shares trading at 2,708p this morning, a move towards the 2,900 resistance from August seems to be on the table, with positive tailwinds provided by both the latest trading update and Jefferies upgrade.

Both the RSI and the MACD are posting higher highs as the stock price continues to advance, which strengthens the possibility of a push to those levels in short notice.

Question & Answers (0)