Bitcoin's last 5 years ROI is 70x higher than the average return of five major indices

Nearly $600 billion evaporated last week from the market capitalisation of cryptocurrencies after the Chinese government imposed a ban that prohibited payment processing companies and other financial institutions from offering crypto-related products or services to customers within the country.

The price of Bitcoin (BTC) – the largest crypto token by market cap – slid 25.3% from Monday to Sunday to close the week at $34,706 per coin although the token moved to a weekly low of $30,000 per coin at some point on Monday. This also resulted in a 46.6% accumulated loss for BTC since its price peaked at $64,895 in mid-April this year.

On the other hand, the price of the second-largest cryptocurrency – Ethereum (ETH) – slid to its lowest levels since late March, with the value of the coin dropping to a weekly low of $1,730 at some point yesterday even though it settled higher at almost $2,100 for a 42.5% weekly loss.

Meanwhile, the so-called “altcoins”, which are alternative versions of Bitcoin, reported sharper drawdowns for the week with the price of XRP (XRP), Cardano (ADA), and Binance Coin (BNB) booking a 40%, 48%, and 53% drop respectively.

On-chain data indicates that bulls capitulated last week while thousands of traders received margin calls from their respective brokers. According to bybt, a blockchain data provider, the amount of long positions liquidated as a result of the meltdown totaled $13 billion from Monday to Sunday as the price progressively collapsed.

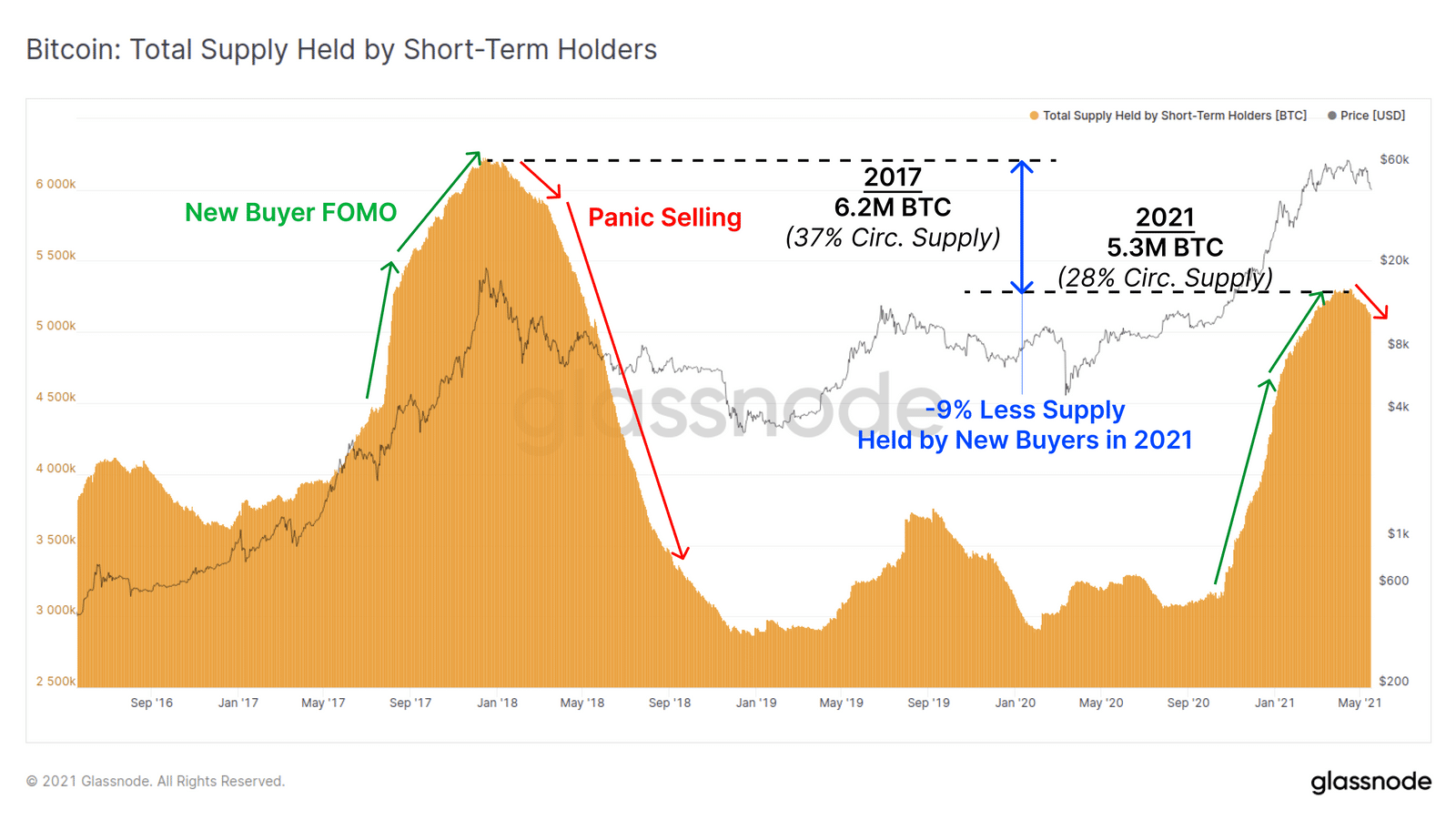

A report from the well-known blockchain research company Glassnode released last Tuesday indicated that “a pattern of panic selling” was in play, emphasizing that the percentage of Bitcoin’s total circulating supply held by short-term holders (STH) showed a sustained drop for the first time since the indicator started a pronounced climb back in October last year – the month when PayPal announced the launch of its cryptocurrency trading feature.

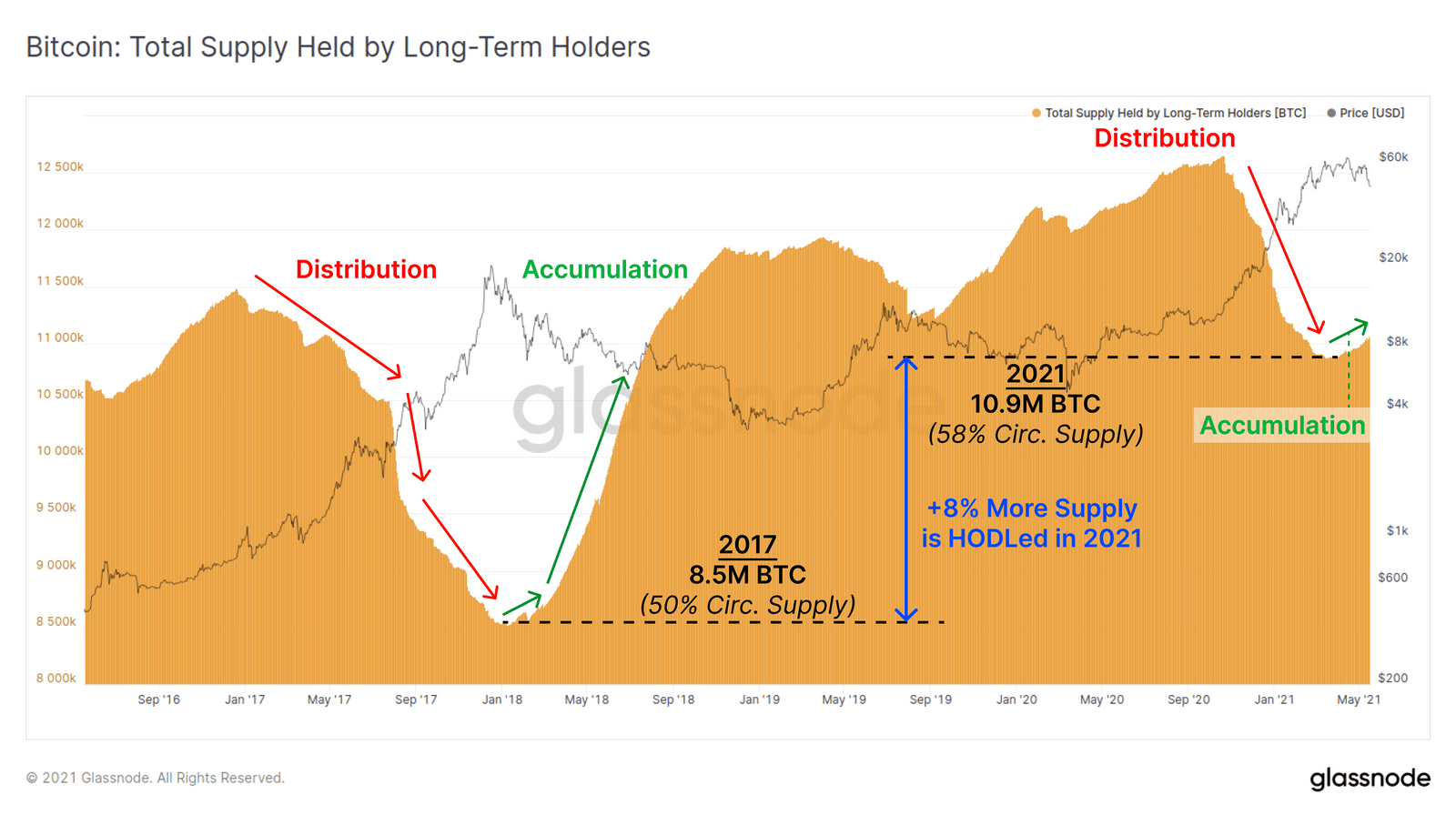

Meanwhile, the report also highlighted that long-term holders started to accumulate Bitcoin (BTC) once again after weeks of consistent selling. Although the data has not yet been updated to cover all the developments from last week, it appears that an important transfer is taking place from weak to strong hands as a result of the meltdown.

Why does this news from China have so much influence on cryptocurrencies?

China accounts for more than 75% of the world’s crypto mining industry while trading volumes within the country are at the top of the list as well. This crackdown on crypto-related offerings has been the latest step in a series of measures taken by the government to curve the advance of this growing industry, possibly as Beijing seeks to strengthen the credibility and usage of its very own digital token – the digital yuan.

Last Friday, the government’s hostile attitude towards cryptos seems to have reached new levels as Chinese authorities informed that they aimed to “clamp down on bitcoin mining and trading activity” – a situation that prompted another broad-market scare during the weekend.

Major mining companies including HashCow – one of the largest operators of mining rigs in the world – reported that they will halt their operations in the Asian country as a result of the crackdown.

Moreover, the founder of BTC.TOP, another major miner located in China, stated that his firm planned to move its operations to North America as well.

“In the long term, nearly all of Chinese crypto mining rigs will be sold overseas, as Chinese regulators crack down on mining at home”, said Jiang Zhuoer in a blog post released only a few hours ago.

Even though crypto exchanges have been banned in the country since 2017, mining operations have continued to exist until now. However, the situation appears to be shifting and could now threaten to disrupt an important supply source for Bitcoin and other tokens.

Is the crypto crash over?

It is still too early to tell if the worst for cryptocurrencies has already passed as only a month and a half have gone since the price started to move lower from its 14 April peak.

If we use the 2017-2018 crypto winter as guidance for what could happen to the market if this is the start of a new bearish cycle, history shows that it took BTC a bit more than a year to reach a bottom after experiencing an 84% loss.

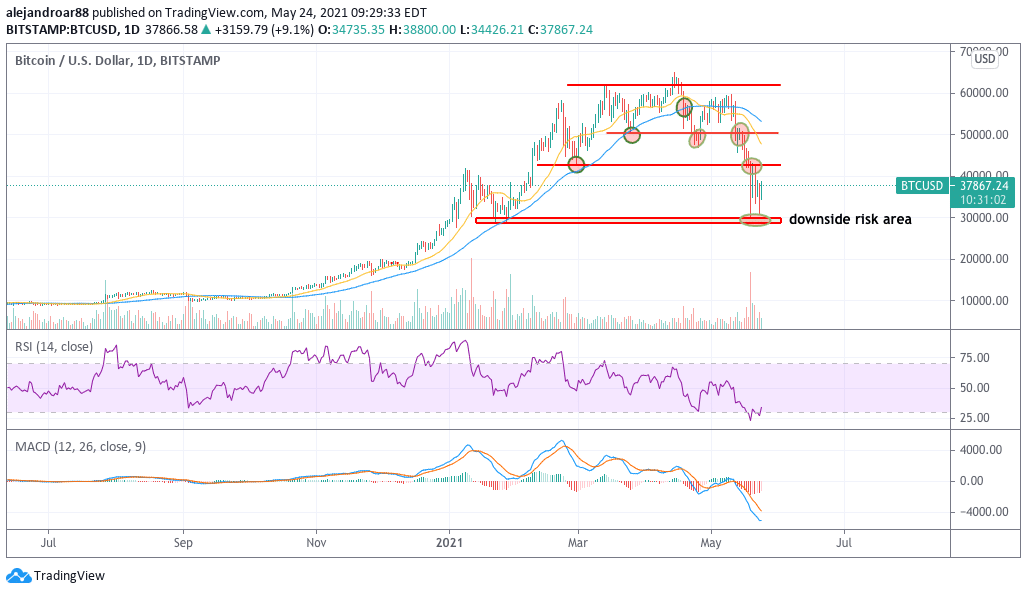

Even though nobody can really tell if things are going to get uglier moving forward, the short-term outlook is not necessarily bearish as Bitcoin has bounced off the low 30,000s two times already in the past 7 days, meaning that the token may have found a temporary floor.

That said, momentum indicators remain bearish with the RSI plunging below 30 for the first time since the March 2020 crash while the MACD is posting its worst daily reading for the past five years at least.

To fully overturn the current bearish setup, Bitcoin would have to move above its latest high of around $60,000 per coin. If that doesn’t happen, chances are that the market will continue to drift lower as the trend will be in full reverse on the back of another lower high.

Question & Answers (0)