Countrywide shares are trading almost 40% higher today at 202p per share after the company received a bid from rival Connells to acquire its shares at a price of 250p per share in an all-cash deal.

The offer represented a 72% premium compared to Countrywide’s Friday closing price of 145p per share, although the success of the transaction is contingent to the completion of the required due diligence and the approval of Countrywide’s Board of Directors.

This takeover proposal comes only a couple of weeks after Countrywide announced that it was planning to improve its liquidity position by launching a £90 million equity offering that was fully underwritten by private equity firm Alchemy, along with £75 million obtained from a four-year term loan.

These measures were part of the company’s effort to reduce its net debt, which amounted to almost £92 million by the end of the first half of 2020.

Connells’ board said in a statement that “Countrywide needs a new management team, with real estate agency expertise, and a new strategy to turnaround the business”.

The board further cited the challenging conditions that the business currently faces, as it has lost nearly £500 million pre-tax in the past three calendar years.

Connells stated that the Alchemy-backed share offering represented “a material dilution” in the value of Countrywide shares and did not assure the firm’s survival amid an uncertain strategy and high borrowing costs.

The deadline to announce a firm intention to make an offer expires on 7 December this year in accordance with Rule 2.6(a) of the City Code on Takeovers and Mergers.

How have Countrywide shares performed so far this year?

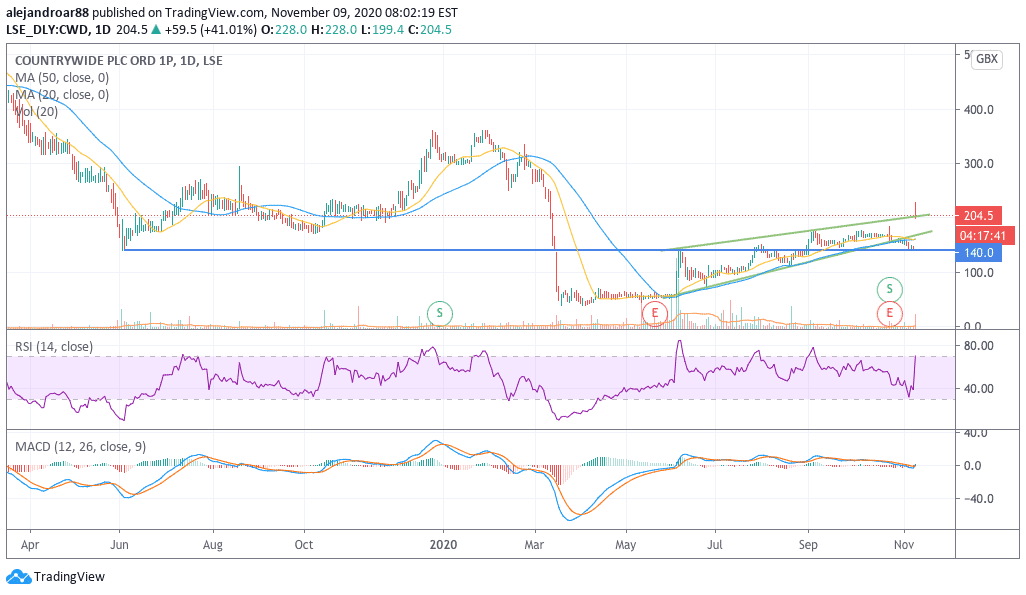

Prior to today’s uptick, Countrywide shares were losing 54% of their value as a result of a deterioration of the firm’s fundamentals, with the group seeing its revenues plunge by nearly 28% during the first half of the year amid the pandemic while losses grew to £44 million, up from a previous figure of £38 million last year after exceptional items.

If the deal with Connells comes to fruition as is, shareholders will be able to trim those losses to just 20% – a number that is more in line with the overall performance of the British FTSE 100 index – which currently trades 18% lower compared to its 31 December closing price.

This takeover would be the latest chapter in Countrywide’s troubled history, as the firm’s share price has lost roughly 17,800p since its early-2014 peak at 18,000p per share.

What’s next for Countrywide shares?

Countrywide shares were bouncing off their June 2019 low this last Friday, although the firm’s shares are trading near their session’s low.

The successful completion of this takeover would be the most important event for the stock in the following weeks and it could represent a 25% upside for traders at the current 204p level if the deal comes to fruition.

Since the deal is still subject to the completion of due diligence and to the approval of the offering by Countrywide’s board, there is still a chance that the takeover may not go through – a scenario that could plunge the shares even below their Friday’s closing price.

For now, the price action is likely to remain in consolidation mode until further news about the deal start to come in. Positions can be taken in any direction at this point depending on how traders perceive the likelihood that the transaction will be completed.

Question & Answers (0)