Clorox (CLX) shares surged more than 4% yesterday to $216 per share in post-earnings stock trading activity on Wall Street, after the firm raised its sales and earnings guidance for its 2021 fiscal year.

Clorox, which reported its financial results for the first quarter of its 2021 fiscal year yesterday, saw revenues jump by 27% compared to a year ago, with eight out of 10 of the firm’s business units seeing double-digit growth during the period amid higher demand resulting from the pandemic.

Sales landed at $1.9 billion at the end of the quarter ended on 30 September compared to $1.5 billion the company sold during the same period a year ago. The household segment advanced 39% during the quarter, followed by the health & wellness unit, which posted a 28% jump in revenue during the period – these two are the largest revenue segments for the Oakland-based manufacturer.

Meanwhile, the company’s gross margins moved higher during the quarter as well, landing at 48% during the three-month period compared to 44% the company reported a year ago.

Earnings per share surged as a result of these positive top-line results, with EPS moving to $3.22 per share – almost twice what the firm earned a year ago and nearly $1 per share higher than the Street’s estimate of $2.26 for the period.

Clorox has benefitted from stricter cleaning protocols am id the pandemic, as households, businesses, hospitals, and many other facilities have increased their usual consumption to keep their premises properly sanitized.

Now with the pandemic situation potential lasting longer than expected in the United States and across Europe, Clorox shares remain favorably positioned to see more upside over the coming months.

As a result of this positive outlook, the management team decided to upend their sales and earnings guidance for the company’s 2021 fiscal year, now seeing revenues surging by 5% to 9% during the period while earnings per share are now forecasted to land in a range between $7.70 and $7.95.

This refreshed outlook is a strong improvement from the firm’s previous guidance, which forecasted flat to low-single-digit sales growth during the fiscal year.

How have Clorox shares performed so far this year?

Clorox shares have outperformed the three main broad-market indexes in the United States, delivering a strong 43% gain since the year started compared to the 2.6% and 27% gains seen by the S&P 500 index and the Nasdaq 100 during that period respectively.

The firm is currently trading at 28 times its next-twelve-months earnings while offering a dividend yield of 2% – which seems fairly safe given the positive financial performance the company is seeing amid the pandemic.

The firm’s fairly conservative valuation and favorable position in the current environment make Clorox shares an attractive buy, with Wall Street consensus price target for the next twelve months currently sitting at $221 per share.

This represents a 3% upside compared to yesterday’s closing price although upward revisions could come over the next few weeks on the back of this improved guidance.

What’s next for Clorox shares?

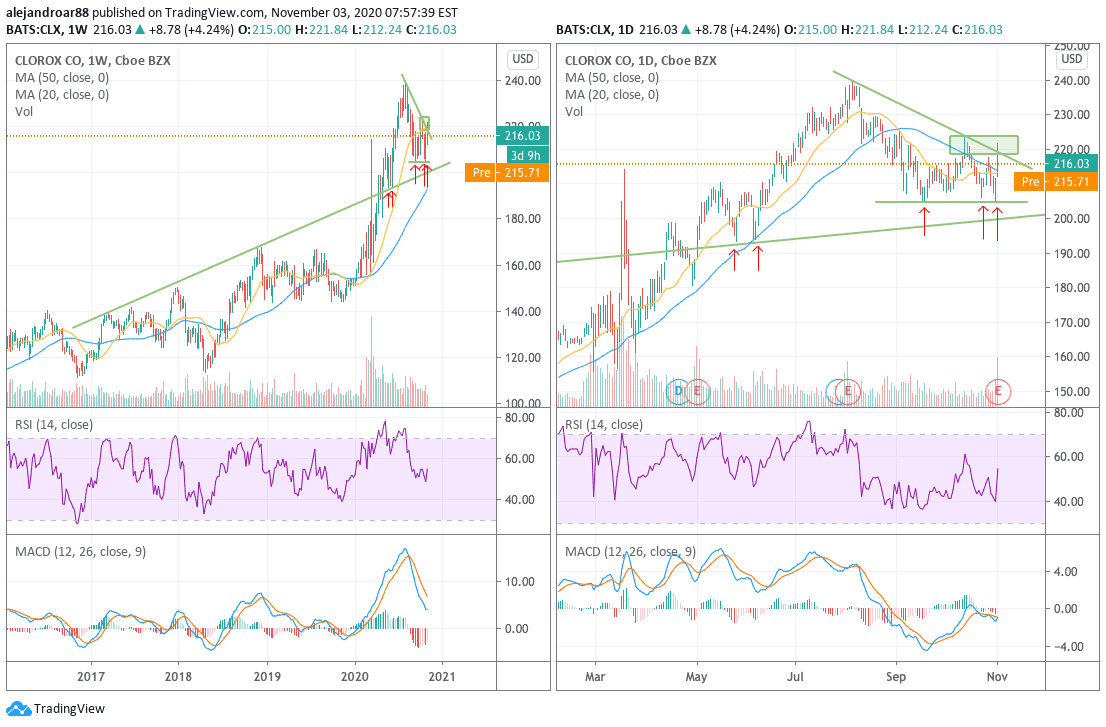

Clorox shares have been finding support lately in an upper trend line dating back to 2017 while the most recent price action has also formed a traditionally bearish descending triangle with the stock finding support at the $205 level while making a series of lower highs since August.

Market participants failed to push the stock above the triangle’s upper trend line yesterday – even after the company posted such positive results.

However, the outlook for Clorox shares seems bullish given the presence of multiple potentially positive catalysts that could push the price higher over the next few weeks. These include decent valuation multiples, an attractive dividend yield, and positive sales momentum.

A move above the $225 level – above the triangle’s upper trend line – could confirm a bullish break if it is followed by strong volume – possibly after a price target hike.

Question & Answers (0)