Citigroup shares continue to trade at levels seen four years ago as the banking sector struggles to shine in a challenging environment of higher unemployment and near-zero interest rates.

Meanwhile, the US-based bank recently agreed to pay $400 million as part of a fine imposed by the Federal Reserve and the Office of the Comptroller of Currency (OCC) for failing to address operational issues.

The report from the OCC stated that Citi’s risk management unit was not sufficiently prepared to deal with the complexity and size of an institution of systemic importance such as Citigroup, currently the third largest bank in the United States by assets.

This latest fine comes after an incident in August where an employee of the bank mistakenly sent $900 million to lenders of beauty product maker Revlon, which resulted in a refusal from the receiving parties to return the money to the bank. Citi has filed a lawsuit against these lenders in an attempt to recoup the money.

The bank’s risk management and operational issues can be traced back to its acquisition spree – including those made during the 2008 financial crisis – which has resulted in significant challenges to the senior management to maintain the bank’s culture, internal proceedings, and other operational aspects in check.

This fine represents 3% of the $14.6 billion in revenues Citi reported during the second quarter of 2020 and 31% of the $1.32 billion in net income the bank reported during that same period.

Citi shares ended yesterday’s stock trading session in New York at $44.84, up 0.97%.

How have Citigroup shares performed this year?

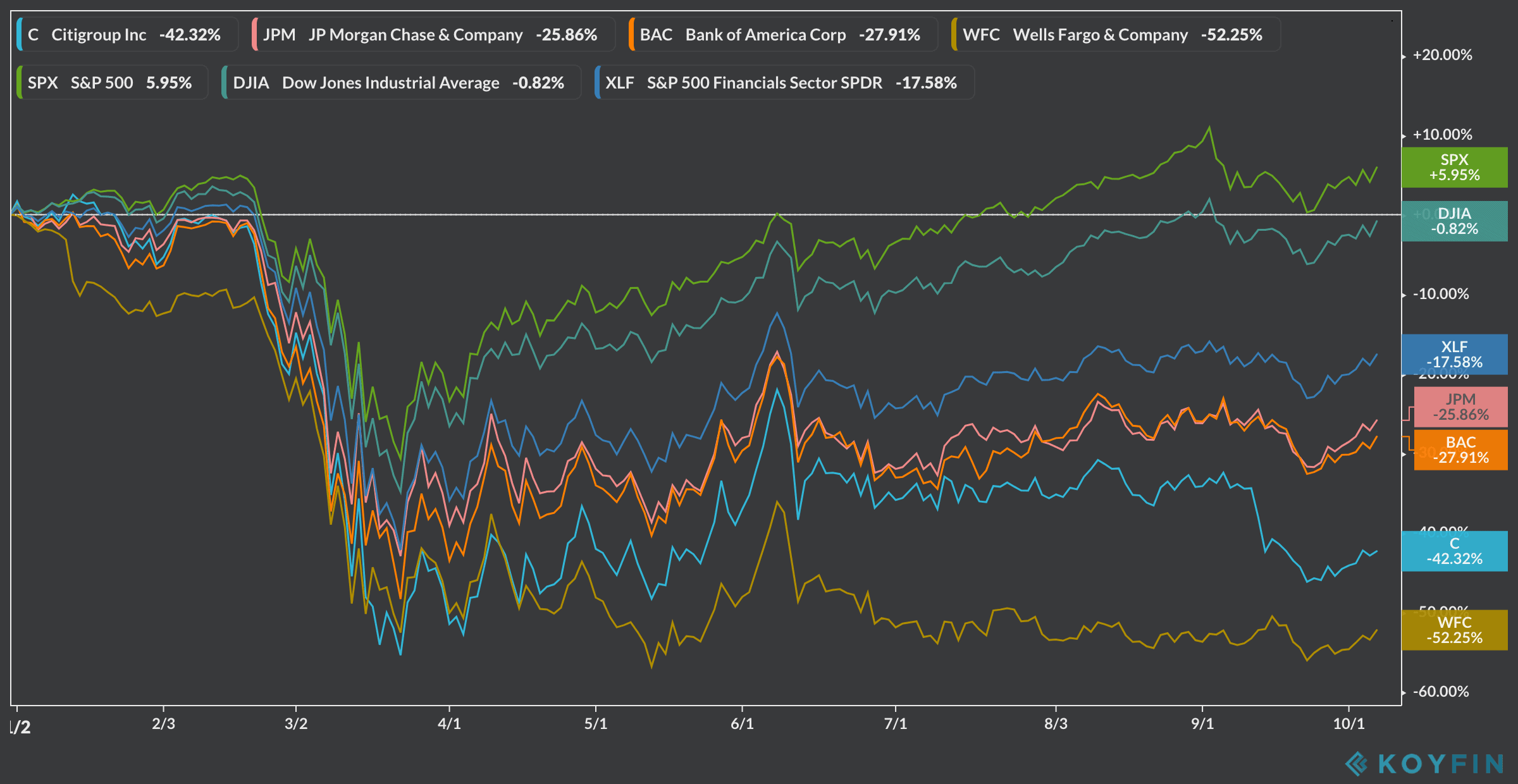

Citigroup shares have lost roughly 42% of their value this year, underperforming two of its strongest rivals – JP Morgan & Chase and Bank of America – whose shares have shed 15% less than Citi since the year started.

Meanwhile, Citi shares are underperforming industry-specific benchmarks as well, with the S&P SPDR Financials ETF (XLF) – which track a basket of bank stocks – losing only 17.5% during the year or 25% less than C’s shares.

The banking sector remains one of the most battered by the pandemic as higher unemployment and near-zero interest rates continue to cap their ability to generate revenues, while investors remain concerned about a spike in defaults in both personal and commercial debt amid the prolonged economic fallout caused by the virus outbreak.

Where are Citigroup shares headed?

Citigroup shares, similar to what has been seen in most bank stocks, has recently fallen off an uptrend that started since the shares rebounded off their March lows, following the so-called FinCEN leaks, which exposed that nearly $2 trillion in money from criminal organizations was moved across major banks in the US and the United Kingdom.

Although Citigroup was not specifically mentioned in the reports, these latest findings of the bank’s weak internal controls and operational procedures could be creating room for concerns that Citi may be involved in the same situation without even knowing.

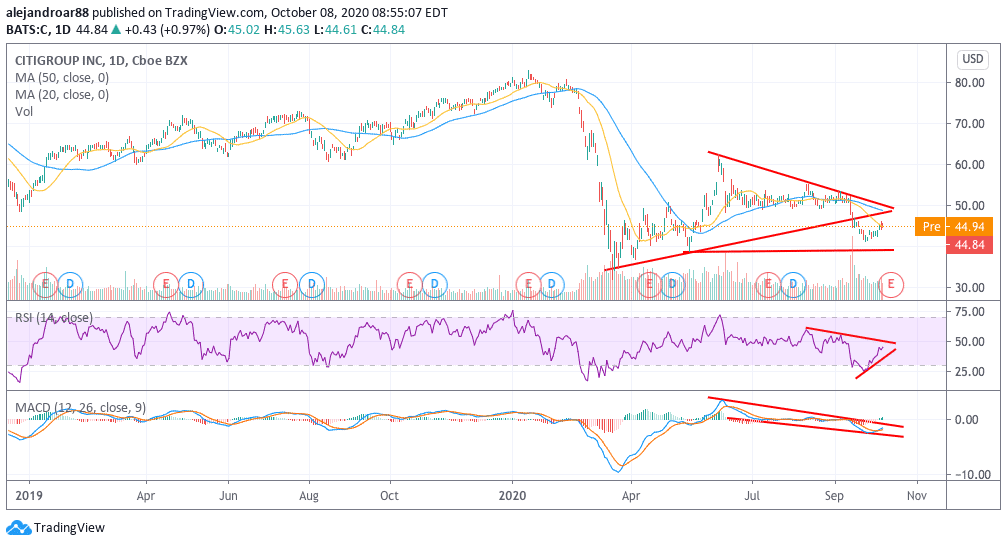

The daily chart shows how the price action broke below the lower trend line of a symmetrical triangle formation, with the stock finding support at $41.5 and moving higher since then.

Given the limited impact of this fine to Citi’s financials, it is unlikely that these news will serve as a potential catalyst for another downward movement.

However, the chart shows a divergence in the MACD oscillator since the stock’s June post-pandemic highs, which indicates that Citi’s positive momentum has been fading.

A retest of the lower trend line of the triangle may be expected in the next few days. If that were to happen, a rejection of that line – which has now become resistance – could send the stock down to the $40 level.

Question & Answers (0)