The Chinese electric vehicle (EV) market demonstrated robust performance in August, with several leading manufacturers announcing impressive delivery figures that highlight sustained consumer demand and a dynamic competitive landscape. While the market continues to face a competitive pricing environment, key players like BYD, Xpeng, and NIO have managed to post strong results.

NIO’s EV deliveries rose to a record high in August

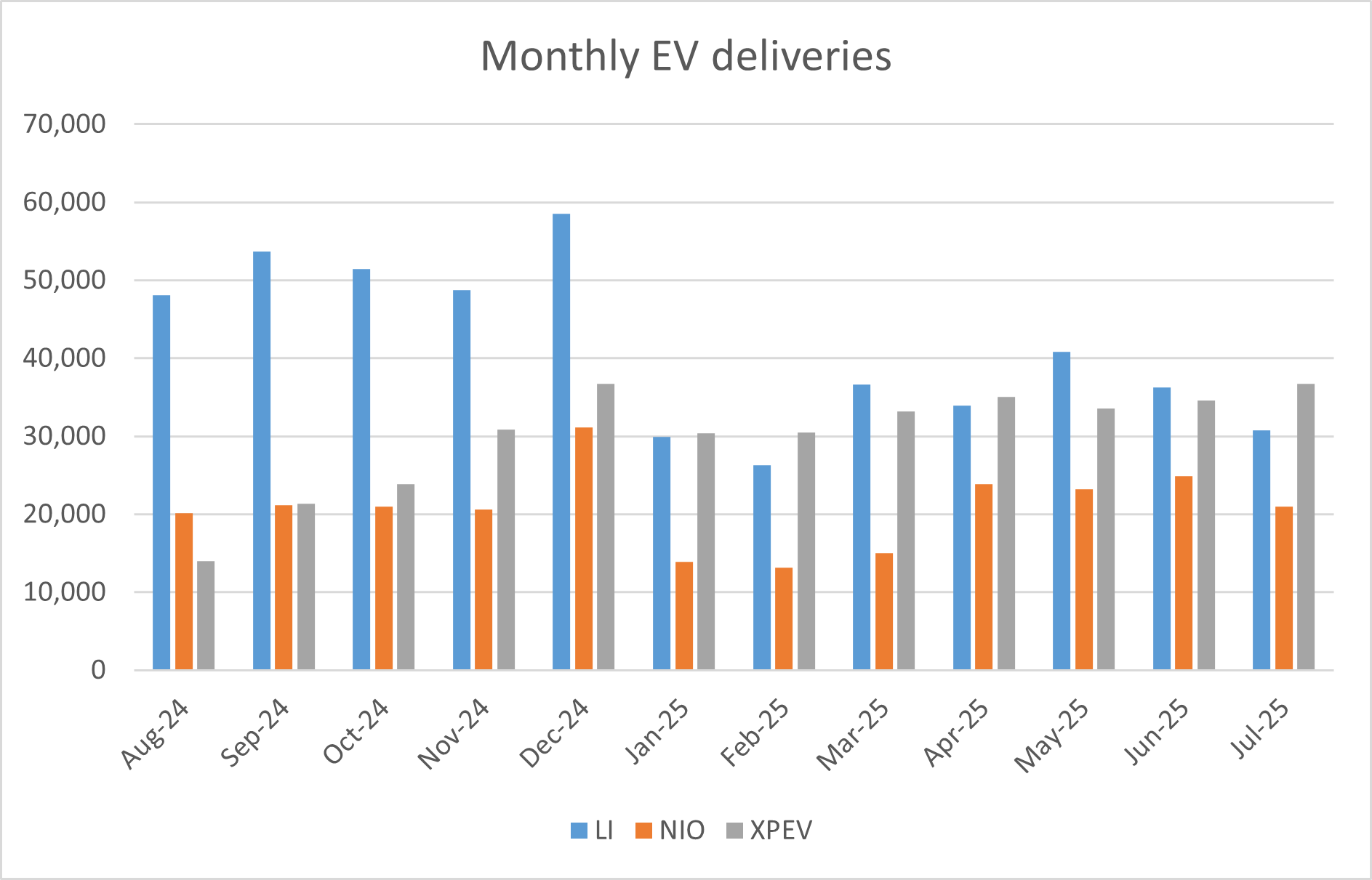

NIO delivered 31,305 vehicles in August, a year-over-year rise of 55.2% and a new monthly high for the company. Of these, 10,525 deliveries were for its premium NIO brand, 16,434 from the family-oriented ONVO brand, and 4,346 from the small, high-end FIREFLY brand.

In the first eight months of 2025, NIO’s deliveries rose 30% YoY to 166,472, while its cumulative deliveries at the end of August were 838,036.

While the company hasn’t provided the breakdown by models, the steep rise in August sales was likely led by higher sales of its ONVO L90, which received strong interest from buyers. The company is set to report its Q2 2025 earnings tomorrow, where it is expected to provide a sales breakdown and give guidance for the current quarter.

Xpeng Motors’ deliveries continue hitting new records

Xpeng Motors also achieved a new monthly record, delivering 37,709 Smart EVs in August. This represents a staggering 169% year-on-year increase and a 3% rise from the previous month.

In the first eight months of 2025, its EV deliveries rose to 271,615, 252% higher than the corresponding period in the previous year, while the cumulative deliveries reached 862,016 by the end of August.

Xpeng Motors is believed to have among the most advanced autonomous driving capabilities among Chinese EV companies. The company’s focus on its XNGP advanced driver-assistance system is gaining traction, achieving an 85% monthly active user penetration rate in urban driving.

The Zeekr Group, which includes both Zeekr and Lynk & Co brands, delivered 44,843 vehicles in August, a YoY rise of 10.6%. Specifically, the Zeekr brand delivered 17,626 vehicles, while the remaining deliveries were for Lynk.

BYD’s sales rise after July hiatus

BYD, the market leader in China’s new energy vehicle (NEV) sector, sold a total of 373,626 NEVs in August. This figure represents a slight year-on-year increase, but a more significant month-on-month rise. Notably, BYD lost momentum in July and its deliveries fell 10.6% compared to June. The company’s sales, however, recovered in August.

BYD looks set to surpass Tesla in EV deliveries

A closer look at BYD’s numbers reveals an ongoing shift in its product mix. BYD’s plug-in hybrid vehicle (PHEV) sales continued their downward trend, falling by 22.7% year-on-year to 171,916 units in August, marking the fifth consecutive month of decline in what was once a high-growth segment for the company.

However, BYD’s battery electric vehicle (BEV) sales saw a strong 34.43% year-on-year increase, with 199,585 units sold in August. BYD looks all set to grab the crown of biggest EV seller from Tesla after having previously surpassed the Elon Musk-run company in terms of total deliveries and revenues.

BYD’s profits dip on price cuts

BYD also released its Q2 earnings today, and while the company’s revenues rose 14% year-over-year, its net profits tanked 30%, far worse than expected. Moreover, it was the first time in three years that the company’s profits fell in any quarter.

In order to spur sales, BYD slashed vehicle prices in May. The price cuts, which lasted until June, were quite aggressive, and the company slashed the price of its Seagull hatchback by 20%. The model, which is the cheapest from BYD, would now cost just about 55,800 yuan (around $7,780). The biggest cut was for the Seal dual-motor hybrid sedan, whose price was slashed by 34%.

Analysts are divided on BYD’s prospects for the remainder of the year. Some believe the second quarter represents a “deep margin trough,” with profitability expected to improve in the second half as pricing discounts narrow. Others are more cautious, pointing to the company’s ambitious annual sales target of 5.5 million units, which it is currently behind on. The company’s ability to balance its aggressive pricing strategies with maintaining healthy profit margins will be crucial for its future success in an increasingly competitive global market.

Li Auto’s sales continue to fall

Li Auto reported deliveries of 28,529 vehicles in August, 40.7% lower than the corresponding month last year. The company’s sales had plunged in July as well. Li Auto’s focus on Extended-Range Electric Vehicles (EREVs) was a key part of its strategy, which helped it surpass the milestone of 1 million cumulative deliveries, becoming the first emerging Chinese NEV company to do so.

The company’s EV models haven’t received the same kind of reception as its hybrid models, which has taken a toll on its sales. It is, however, working on new models that can help it complement its product portfolio in the competitive Chinese EV market.

Xiaomi’s EV sales top 30,000

Xiaomi said that it delivered more than 30,000 EVs in August. This achievement marks the second consecutive month that Xiaomi has crossed this significant threshold, cementing its position as a major player in the Chinese market.

The stellar performance is largely attributed to the immense popularity of the new Xiaomi YU7 electric SUV, which has been a runaway hit since its launch in June. The company previously announced that the YU7 received over 200,000 firm orders in just three minutes, demonstrating the brand’s immense draw among consumers. The high demand, however, has led to significant production challenges, with some customers facing delivery wait times of up to 56 weeks, as reported on the company’s ordering app.

In response to the overwhelming demand, Xiaomi has been aggressively ramping up its EV production capacity. The company’s first-phase factory is now running close to its maximum output, and a second-phase facility is being prepared for mass production. These efforts are crucial for Xiaomi to meet its ambitious sales targets and capitalize on the strong market reception.

Question & Answers (0)