Bumble stock jumped to $76 per share during its first day of trading, making the dating app one of the most successful initial public offerings (IPO) of 2021 with the market capitalisation of the firm ending the day at $7.7 billion.

The company, founded in 2014 by its current Chief Executive Whitney Wolfe, currently operates two of the world’s most successful dating apps – Bumble and Badoo – with a total of 40 million users registered with both platforms.

According to Bumble’s S1 filing, its online dating service is currently available in more than 80 countries, with the company generating a total of $488.9 million in revenue during 2019 and around $376.6 million during the first nine months of 2020.

Meanwhile, during the first nine months of last year, Bumble (BMBL) generated a net loss of $84 million while it had negative free cash flows of $4.7 million.

The Bumble app, known for its distinct approach to match-making where women have to take the lead in messaging male individuals first, had a total of 12.3 million monthly active users by the end of September 2020 while the Badoo app, an older dating app launched in 2006, is one of the pioneers of the online dating market with a total of 28.4 million monthly active users during the same period.

The company’s business model works as a freemium subscription service in which users can enjoy most of the dating app’s features without having to pay a dime while the firm also offers premium access packages starting at $12.99 per week to get access to more advanced features within the platform.

Additionally, Bumble earns money through in-app purchases of third-party products and services, along with affiliate links and online advertising.

Bumble’s first day of trading boosts valuations beyond expected

Bumble sold a total of 50 million shares for $43 a share – exceeding its initial estimates of around $37 to $39 per share. The stock was listed under the ticker “BMBL”.

According to the firm, a total of nine million bumble shares will be used to repay a portion of the company’s secured long-term debt, while the remaining proceeds will be used to purchase or redeem an equivalent portion of equity held by entities affiliated with The Blackstone Group.

With the share price closing the day at $76 per share, the market’s appetite for the dating app’s shares seems to have exceeded the company’s expectations, with the listing price falling behind by roughly 56%.

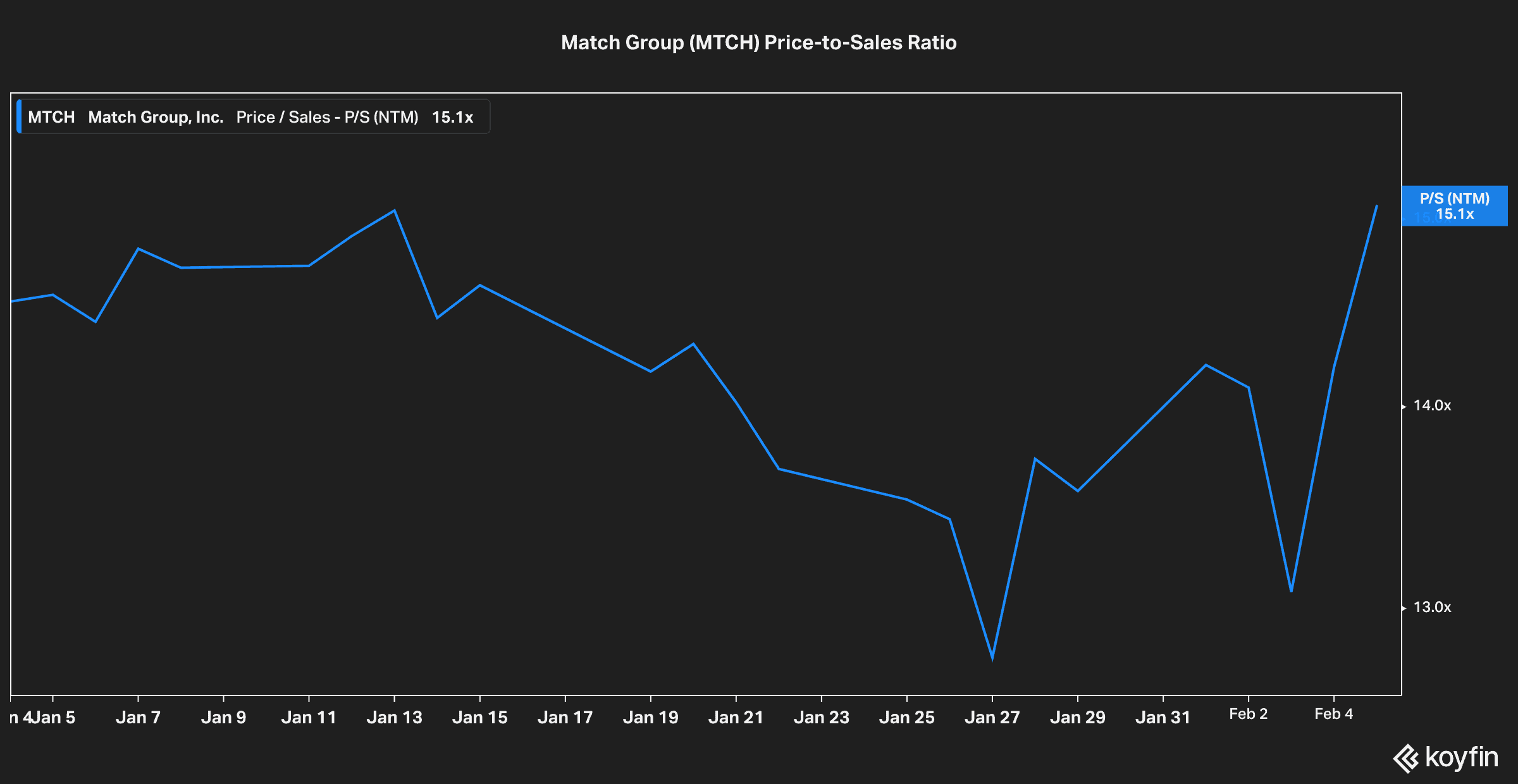

Meanwhile, at the current market capitalisation of $7.7 billion, the firm is being valued at roughly 14 times its estimated sales for 2020 – a lower valuation multiple compared to the 19 price-to-sales ratio given by the market to the firm’s toughest rival, the Match Group (MTCH).

Although Match’s sales are roughly five times higher than those of Bumble, the listing price may have failed to fully price in the market’s interest based on that ratio alone.

Is Bumble stock an attractive buy at the current price?

According to Bumble’s IPO filing, the firm has managed to grow its sales from $360 million in 2018 to potentially $500 million last year – using a simple run-rate of the sales it saw during the first nine-months of the year.

Meanwhile, the firm already managed to turn a profit in 2019, generating almost $85 million in after-tax earnings for its shareholders.

At this pace, with Bumble’s sales growing at a CAGR of approximately 17% over the past three years, the firm could be bringing a total of $1.1 billion in revenues by the end of 2025.

If we were to use a “conservative” price-to-sales multiple of 10 to value the firm – the market valuation by then would be around $11 billion – offering a potential 43% upside if that target were to be hit.

That said, achieving such a target would require that the company keeps growing its sales at that pace – roughly doubling the expected CAGR for the online dating market according to data compiled by research firm Valuates Report.

Question & Answers (0)