Boohoo shares are nose-diving today, with the online retailer stock losing roughly 16% at 265p per share in late stock trading activity in London, as PwC – the firm’s current auditor – declined to present a bid to continue providing its services to the firm.

Although PwC remains the auditing firm appointed by Boohoo (BOO) at the moment, the auditor will not be participating in the competitive tender process opened by the firm’s Audit Committee recently – a move that has raised eyebrows among investors as the company remains an important client given the size of its operations.

PwC’s decision to resign may be prompted by a move to protect the accounting giant’s reputation amid recent findings from an independent review, which revealed that Boohoo’s suppliers have failed to provide adequate working conditions to employees, including allegations that workers within Boohoo’s supply chain are reportedly receiving pay rates below the statutory minimum wage.

The review comes after reports from the Guardian and the Sunday Times released in July that revealed that Boohoo relied on factories that did not shut down their operations in Leicester – the firm’s primary third-party manufacturing hub – so it could maintain inventory during the pandemic, a move that benefitted the firm as online sales surged amid lockdowns.

The Sunday Times highlighted that workers were allegedly paid as little as £3.50 per hour, which is less than half the minimum wage of £8.72 per hour in the United Kingdom.

Boohoo shares dropped precipitously once the news broke, with the stock losing almost 50% of its value shortly after posting all-time highs as a result of the pandemic tailwind. The resignation of PwC is another setback for Boohoo’s already battered reputation.

What’s next for Boohoo shares?

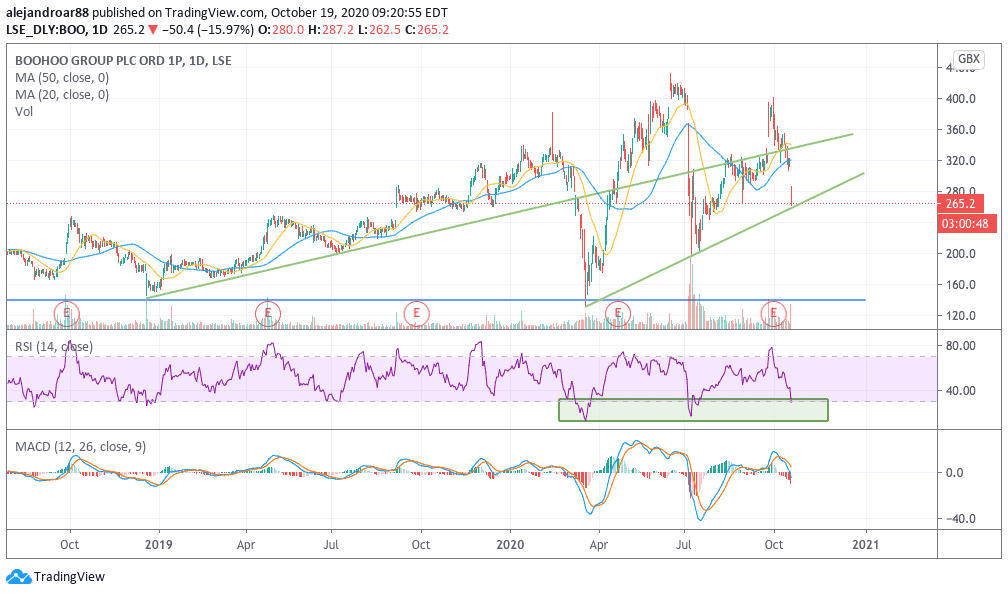

Boohoo shares seem to be finding support at the lower trend line shown in the daily chart above, which emerges from the combination of the stock’s March lows and the July lows that were triggered by the supply chain scandal.

A rebound off the trend line in the next few session could reinforce a bullish thesis, although a technical breather could cause the stock price to stall for a few days before another important move takes place – especially after considering that the stock is already stepping on oversold levels in the daily RSI.

That said, the MACD has already sent a sell signal, with the oscillator already headed to negative territory since the signal was provided in early October.

Perhaps the most troubling aspect of PwC’s resignation goes beyond the supply chain situation, as investors may be worried about reports from the UK’s National Crime Agency (NCA) as well, which uncovered alleged money laundering activities and VAT fraud among Leicester suppliers tied to Boohoo.

That said, Boohoo has fully acknowledged the findings of the Independent Review and the company said it is committed to implementing most of the measures recommended by Allison Levitt QC – the appointed investigator for the matter.

As part of those efforts, the company aims to improve its purchasing practices by appointing a group of directors who will oversee the firm’s responsible sourcing while Boohoo also stated it will raise its standards for suppliers to ensure working conditions and other elements remain in line with regulations.

If Boohoo manages to turn around the situation, the firm’s shares may once again take off to new highs, as the fundamentals of the business remain attractive with sales growing nearly six-fold in the past four years while earnings have jumped roughly 200% during that same period.

Question & Answers (0)