BAE Systems shares are trading 3.5% higher at 525p per share after Prime Minister Boris Johnson announced that the UK plans to invest an extra £16.5 billion in defence over the next four years. Johnson says the increased spending is aimed at providing the armed forces with “cutting-edge technology”.

Investors expect BAE will benefit from this increased spending, as the company is the second-largest defence contractor in the country, providing next-generation combat vehicles, air & missile defenses, space-related electronics components, and multiple other products and connected services.

That said, Prime Minister Johnson said this budget expansion will primarily focus on areas such as artificial intelligence, cybersecurity and space, while setting a deadline for the UK to launch its first rocket by the end of 2022.

An extra £4 billion – resulting from dividing £16.5 billion into four equal annual portions – per year added to the current £41.5 billion defence budget would increase the UK’s defence-to-GDP percentage to 2.5%, higher than the 2% estimate that BAE Systems had anticipated.

This latest news have added more fuel to the latest rally seen by Bae Systems shares, as the company’s recent trading update – released on 12 November – highlighted that the company was awarded a £1.3 billion contract from Germany to build 38 Eurofighter Typhoon aircraft.

This amount represents roughly 7% of the company’s 2019 revenues. The firm also told investors that earnings per share are expected to come in slightly above their previously forecast range for the full 2020 fiscal year.

Johnson’s remarks on the global geopolitical situation provide an optimistic outlook for the future of the defence industry, with the prime minister saying that “the international situation is more perilous and more intensely competitive [than at any time] since the Cold War”.

How have BAE Systems shares performed this year?

BAE Systems’ stock has seen a 7% loss so far this year, as the company’s valuation struggled to recover from the blow it received during the February-March sell-off.

Some of the poor performance of BAE Systems shares lately can be explained by concerns about a potential disruption in the company’s supply chain amid the pandemic, along with potential defence budget cuts resulting from efforts to trim fiscal deficits across the developed world.

However, with geopolitical tensions on the rise, the outlook for BAE Systems’ share price could be improving as countries like the US, the UK, Australia, and Saudi Arabia prioritise upgrading their military equipment.

What’s next for BAE Systems shares?

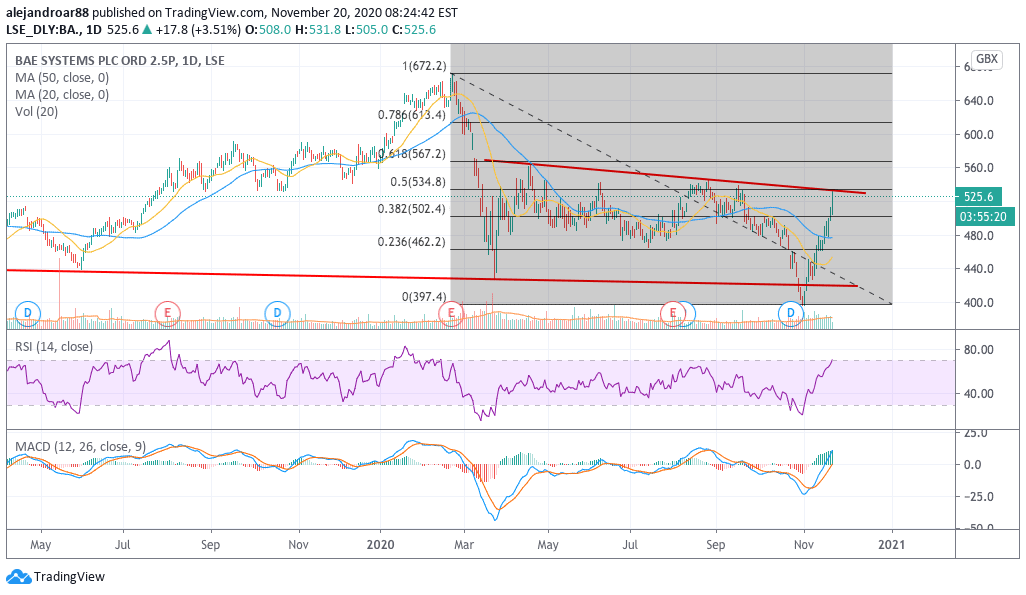

The latest rally in BAE Systems shares today reached the upper trend line shown in the chart – the fourth time this has happened since the April rebound.

This bull run comes after a deep plunge in the share price – with BAE shares trading at their lowest level since 2014 until early November – as rumours regarding this contract with Germany lifted the price off those lows.

The next few sessions remain crucial for BAE Systems shares, as the price action can either break above that long-term trend line or it can take a brief pause before the bull run resumes.

12 out of 17 analysts surveyed by CNN Money currently rate BAE Systems a buy, with the consensus 12-month price target currently sitting at 600p per share based on the forecasts given for the firm’s American Depositary Receipts (ADR).

The market’s positive sentiment towards the stock seems to support a bullish short-term thesis, providing a potential 14% upside if those targets are reached.

For now, on the technical front, trading volumes seem to be drying up, which could be the prelude to a temporary breather as traders take profits from the latest bull run.

Meanwhile, a break above the trend line could bring the shares towards their April high of 560p, with the next stop being the closing of a bearish gap left behind during the March sell-off at 600p per share.

Question & Answers (0)