AstraZeneca (AZN) shares are down slightly at 7,900p in afternoon stock trading action in London, following news that the firm’s COVID-19 vaccine is provoking the immune reaction that its developers intended.

Shares of the drugmaker have been slipping in the five of the past six sessions as US-based vaccine trials remain paused due to safety concerns.

However, the market appears to be reacting positively to a study that indicates that the vaccine developed alongside Oxford University is causing the immune system to respond as its developers intended, according to research conducted by Bristol University.

“Until now, the technology hasn’t been able to provide answers with such clarity, but we now know the vaccine is doing everything we expected and that is only good news in our fight against the illness”, said Dr. David Matthews, the head of the research team.

Meanwhile, Brazilian authorities announced yesterday that a patient enrolled in the firm’s trials in the South American country has died, although sources confirmed that the person was part of the control group, comprised of patients that took a placebo instead of the vaccine. Brazilian trials are set to continue as no safety issues were identified.

AstraZeneca (AZN) remains a front-runner in the race to find a cure for the pandemic, with the firm currently conducting Phase 3 clinical trials involving thousands of voluntaries in the United States, Brazil, and the United Kingdom.

The drugmaker has informed multiple times that the results from these late-stage studies will be released by the end of the year, although complications could still emerge in the process, as it happened a few weeks ago when trials were paused as a result of two patients reportedly falling ill of a rare neurological disease.

In other related news, AstraZeneca could stand to gain from Brazilian President Jair Bolsonaro’s decision of not buying a vaccine from Chinese drug maker Sinovac in response to commentaries from its supporters that rejected the inclusion of the Asian vaccine in the country’s federal immunization program.

How have AstraZeneca shares performed this year?

AstraZeneca shares in London have delivered a 3% gain to investors so far this year, a positive performance compared to the 24% drop the British FTSE 100 index has seen during the same period as the pharmaceutical giant stands to benefit from the current health crisis if its vaccine is ultimately approved.

Meanwhile, the firm’s American Depository Receipts (ADRs) have gained almost 6% so far this year, in line with the performance of the broad-market S&P 500 index.

That said, AstraZeneca’s latest price action has been forming a bearish pattern that has been confirmed by the declines seen by the stock in the past few days.

What is next for AstraZeneca shares?

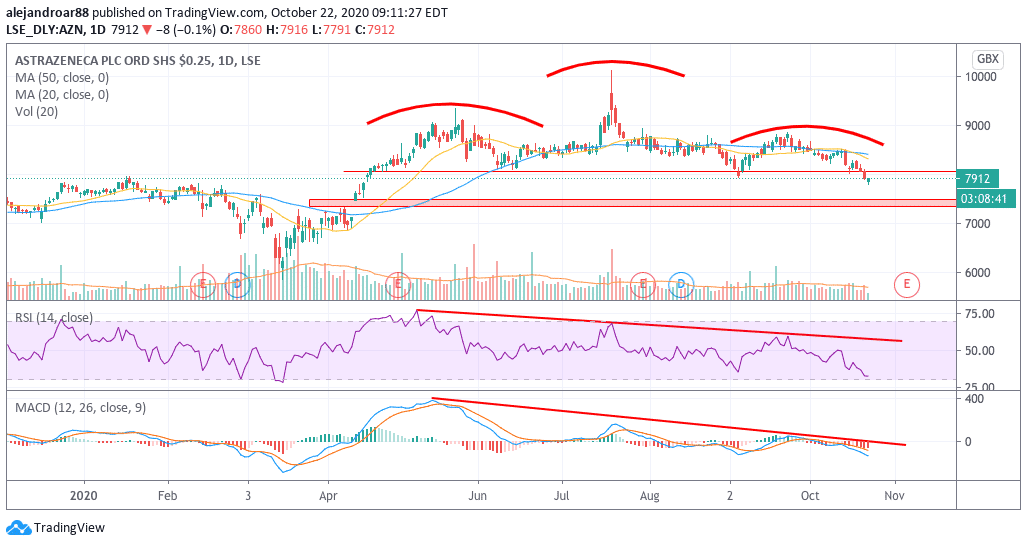

The daily chart above shows that a head & shoulders pattern, a bearish formation that could lead to a strong downward movement once the price breaks below the neckline, is currently in play, with shares of AstraZeneca potentially poised to trade lower in the coming weeks.

This pattern – which was brought to your attention in mid-August – could end up pushing the stock towards the 7,300 price gap shown in the chart as bears may be taking the lead.

This pattern seems to be confirmed by other indicators including the RSI and the MACD, both of which have been posting bearish divergences since the left shoulder formed.

At this point, it is highly unlikely that AstraZeneca shares will see any significant upside as a result of this bearish technical setup, although positive news on the vaccine front could end up turning the tables for short-sellers.

On the other hand, AstraZeneca will be reporting its earnings for the third quarter of 2020 on 5 November, an event that could either accelerate or reverse this current trend depending on how the firm’s results turn out vs. the market’s expectations.

Question & Answers (0)