At least two large investment banks have warned investors about potentially large material losses resulting from the debacle of a hedge fund called Archegos Capital after a series of leveraged trades backfired.

In a trading update released this morning, Swiss-based investment bank Credit Suisse informed investors that a US-based hedge fund had defaulted on a margin call enforced by the institution last week, which forced the bank to liquidate the fund’s positions to partially cover its losses.

The bank further stated that although it is still too early to know how big the losses from these transactions will be, their impact should be “highly significant and material” to their first-quarter financial results.

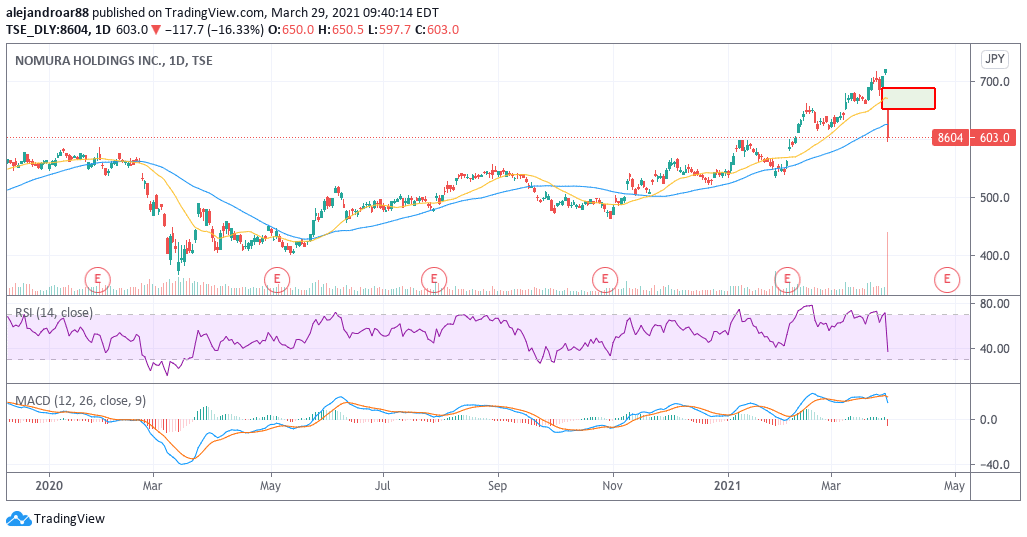

Meanwhile, Japanese investment bank Nomura also informed investors that one of its US subsidiaries experienced a “significant loss” as a result of a transaction with a US client.

The firm estimated that its total exposure to said client – reportedly Archegos – was around $2 billion by the end of last Friday, although it did not disclose the extent of the losses resulting from the unwinding of its previously-held positions.

As a result of the news, shares of both banks are pressure today, with Credit Suisse’s shares (SWX: CSGN) dropping almost 16% at CHF 10.5 in late stock trading action in Switzerland while Nomura Holdings (TYO: 8604) shares are also down 16% in Japan at 603 yen.

Archegos’ debacle seems to have started on 23 March, when the price of ViacomCBS shares dropped by nearly 9% as a result of a marked-down Class B common stock offering, while the price of several Chinese equities including Baidu (BIDU) and Nio (NIO) started to plunge following an announcement from the US Securities and Exchange Commission (SEC) that pointed to an upcoming crackdown towards US-listed Chinese companies.

The fund, run by the former head of Tiger Asia Management, Bill Hwang, reportedly held leveraged positions in many of these companies, which means that it borrowed money from banks to place its trades.

Credit Suisse and Nomura face big losses

Banks including Credit Suisse and Nomura may have reached out to other institutions like Goldman Sachs and Morgan Stanley to arrange a large-block offering, which involves selling huge blocks of stock privately to third parties.

Until now, reports point to a total of 30 million shares of ViacomCBS (VIAC) sold by Goldman along while another 15 million shares of Discovery Inc. (DISCA) – another company in which Archegos had invested – were reportedly negotiated by Morgan Stanley.

According to a report from Bloomberg, Goldman has already informed shareholders that losses resulting from the bank’s exposure to Archegos are likely to be “immaterial” although the American investment bank declined to make any official comments about the situation.

All in all, around $20 billion seems to have been liquidated as a result of Archegos’ margin call, possibly leaving the banks that provided these loans to the fund heavily battered as a result of the fund’s losses.

Bill Hwang is a former protegé of the now-retired hedge fund manager Julian Robertson, who led one of America’s most successful hedge funds, Tiger Management. In 2012, Hwang pleaded guilty to insider trading and market manipulation after being accused by the US Securities and Exchange Commission (SEC) of conducting illegal transactions with multiple Chinese bank stocks.

Banks’ involvement with Hwang despite his prior felonies has become one of the most controversial topics arising due to these latest developments, as it seems inappropriate that these institutions were willing to lend billions to a person who was convicted of security fraud in the past.

The dangers of an overly-leveraged market seem to be surfacing

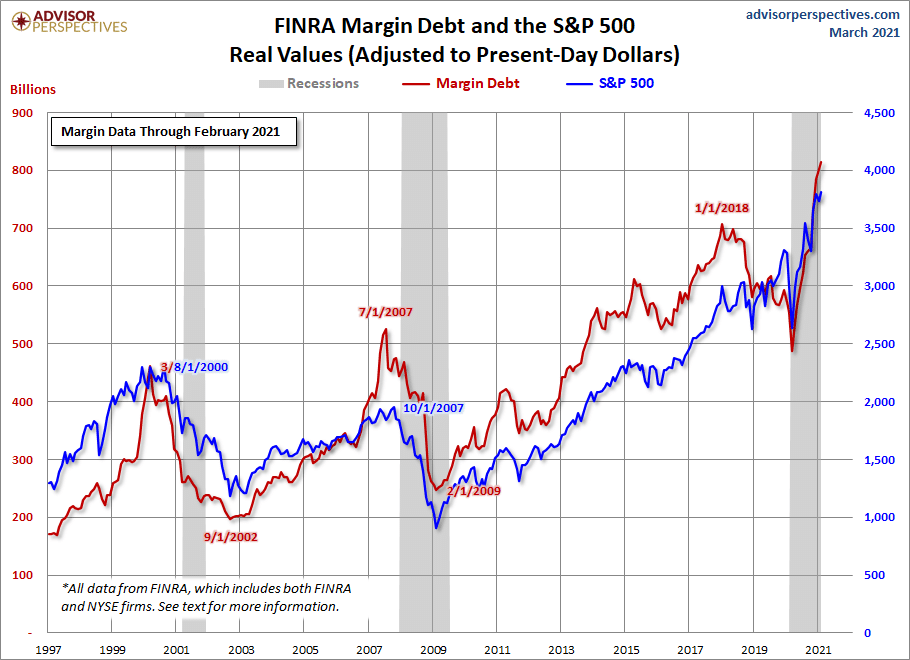

The Archegos’ debacle is illustrating the big dangers resulting from overly-leveraged stock markets, with the latest data from the US Financial Industry Regulatory Authority (FINRA) indicating that margin debt has continued to climb to all-time highs as market participants seem to be in full risk-on mode despite the well-known dangers of exuberant – and often irrational – market conditions and valuations.

The data from FINRA, as summarized by research firm Advisor Perspectives, shows a strong correlation between the S&P 500’s incredible comeback from its March bottom and a progressive build-up in margin debt, with the latter surging to more than $800 billion as of February 2021.

These extremes seem to be fueling rampant speculation among market participants, while this latest development from Archegos showing a worrying trend that involves the use of swaps – an instrument that lets investors get exposure to certain security without holding it directly – resulting in overly-leveraged trades that could quickly backfire if things go sideways.

Perhaps more worrying, FINRA data shows that excessive margin debt has often accelerated the extent of market crashes, as traders rush to unwind their positions to cut their losses when things go south.

In summary, the more leveraged the market gets, the riskier it is that even a mild pullback could trigger a sizable liquidation event as highly-leveraged market participants like Archegos may be forced to liquidate their holdings on short notice to cover their losses.

Question & Answers (0)