The consensus among analysts on Wall Street is for a year-over-year increase in earnings on lower revenues for AON for the quarter ended June 2020. Since March, Aon plc (NYSE: AON) has been in 47 hedge funds’ portfolios – a powerful factor that could impact its near-term stock price if the actual results compare to the estimates for the Q2.

A total of 51 hedge funds held positions in Aon at the end of the previous quarter, marking a modest decrease in the interest in Aon shares as one the most popular stocks among hedge funds.

Who is Buying Aon Shares?

The largest stake in Aon plc (NYSE:AON) was held by Eagle Capital Management, which reported holding $971.3 million worth of stock at the end of September. Viking Global followed with a $378 million position. Other investors bullish on the company included Cantillon Capital Management, BlueSpruce Investments, and Iridian Asset Management.

A number of other hedge funds have also bought and sold shares of Aon. Victory Capital Management Inc. grew its position in AON by 280.4% in the fourth quarter to 11,226 shares after acquiring an additional 8,275 shares in the last quarter. Oxford Asset Management LLP bought a new stake in AON in the fourth quarter worth approximately $518,000. Meeder Asset Management Inc. grew its position in AON by 38.3% in the fourth quarter. Meeder Asset Management Inc. now owns 166 shares after acquiring an additional 46 shares in the last quarter. Guggenheim Capital LLC grew its position in AON by 18.6% in the fourth quarter. Guggenheim Capital LLC now owns 76,755 shares after buying additional 12,059 shares in the last quarter. Finally, First Republic Investment Management Inc. grew its position in AON by 16.2% in the fourth quarter. First Republic Investment Management Inc. now owns 26,751 shares of the financial services provider’s stock worth $5,572,000 after acquiring an additional 3,729 shares in the last quarter. 84.75% of the stock is owned by institutional investors.

In terms of the portfolio weights assigned to each position, BloombergSen allocated the biggest weight to Aon plc (NYSE:AON), around 9.48% of its 13F portfolio. Night Owl Capital Management is also relatively very bullish on the stock, designating 6.22% of its 13F equity portfolio to AON.

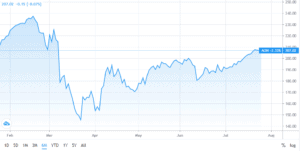

Company Past Performance

AON posted its first earnings results on Friday, May 1st. The financial services provider reported $3.68 earnings per share for the quarter, topping the Thomson Reuters’ consensus estimate of $3.67 by $0.01. During the same quarter in the prior year, the firm earned $3.31 EPS. The firm’s quarterly revenue was up 2.4% compared to the same quarter last year.

The company also recently announced a quarterly dividend, which will be paid on Friday, August 14th. Stockholders of record on Monday, August 3rd will be issued a $0.44 dividend. This represents a $1.76 annualized dividend and a dividend yield of 0.85%. The ex-dividend date of this dividend is Friday, July 31st. AON’s payout ratio is 19.19%.

Ahead of the Q2 earnings report, a number of brokerages have weighed in on AON. Royal Bank of Canada reaffirmed a “hold” rating and issued a $200.00 price objective on the shares in a research note on Monday. William Blair restated a “buy” rating on shares of AON in a research note on Tuesday, June 9th. Morgan Stanley cut their target price on shares of AON from $225.00 to $216.00 and set an “equal weight” rating for the company in a research note on Wednesday, July 15th.

As a group, sell-side analysts anticipate that the professional services company will post 9.76 EPS for the current fiscal year.

If you want to buy shares in Aon or another company, you will need to use one of the best online stock brokers to guarantee the safety of your investment. The consensus among analysts points to the current moment presenting a good opportunity to invest and hold AON shares, at least until the Q2 earnings report of the company.

Question & Answers (0)