Antofagasta shares were trading lower in early London price action today despite the company reporting record earnings for the first half of 2021. Mining companies have seen a rebound in earnings amid the steep rise in commodity prices over the last year.

Antofagasta reported revenues of $3.59 billion in the first half of 2021 which was 68% higher than the corresponding period in 2020. While the company’s copper production in the first half of 2021 was 2.8% lower than what it produced in the first half of 2020, it was more than offset by higher copper prices.

Copper prices have soared

Copper prices soared to their all-time highs earlier this year. While prices have since retreated from the highs, they are still much higher than what they averaged last year. Also, supply disruptions in Latin America could support prices in the near term.

Higher copper prices helped propel Antofagasta’s earnings to a record high and it posted an EBITDA of $2.35 billion in the first half of 2021 which was 133% higher than the corresponding period in 2020. Thanks to the higher copper prices and the resultant surge in cash flows, Antofagasta reported net cash of $701 million at the end of June. The company had net debt at the end of 2020.

Antofagasta dividend

There has been a dividend bonanza for mining investors. Earlier this week, BHP Billiton declared a record final dividend of 145 per share. Previously, miners like Rio Tinto, Glencore, and Anglo American also increased their shareholder payouts. Both BHP and RIO ditched their progressive dividends policy in 2016 and have since kept the payout variable depending on the earnings.

Antofagasta also announced an interim dividend of 23.6 cents per share which is in line with its policy of an interim payout of 35% of net earnings. Meanwhile, the company’s dividend yield is below that of companies like RIO and BHP.

Antofagasta saw cost inflation

Antofagasta reported unit copper production costs before by-product credits of $1.73 per pound which was 14.6% higher than the corresponding period in 2020. Mining companies have been battling higher costs, especially from rising diesel and fuel costs amid the steep rise in crude oil prices. Also, a strengthening Chilean peso negatively impacted the company’s unit cash costs. Typically, for mining companies, while the sales are priced in US dollars, most of the costs are in domestic currencies. A rise in domestic currency versus the dollar leads to higher costs.

Guidance

Antofagasta lowered its full-year copper production guidance to 710,000-740,000 metric tons as compared to the previous guidance of 730,000-760,000 metric tons. It blamed the drought situation in Chile for the lower guidance.

“As water is essential to the operation of Los Pelambres’s concentrator plant, if there is only minimal precipitation during the balance of winter full year Group copper production would be impacted,” it said in its release. The company is expanding the Los Pelambres mine which is expected to be complete by the second half of 2022. During the quarter, Antofagasta completed labour negotiations at the mine.

Copper prices

Copper prices have fallen amid concerns over the economic recovery. Some of the recent data points from the biggest consumer China have been soft which has dampened copper market sentiments. US July retail sales data was also below expectations. However, the infrastructure bill in the US coupled with continued fiscal support from governments globally should help propel copper demand.

Over the medium to long term, copper is a play on the green economy. The copper intensity in electric cars and renewable energy is higher which would help support copper demand. The average copper content in an ICE (internal combustion engine) car is about 23 kilograms, while it’s 83 kilograms for a battery-electric vehicle. Also, the copper supply might not keep pace after years of underinvestment.

Antofagasta is a good play on copper

Antofagasta is among the miners that you can trade in to get exposure to copper. Brokerages have a bullish forecast for copper and Goldman Sachs expects prices to hit $15,000 per metric ton.

Bank of America is also bullish on copper and said in a note that “If our expectation of increased supply in secondary material, a non-transparent market, did not materialize, inventories could deplete within the next three years, giving rise to even more violent price swings that could take the red metal above $20,000/t ($9.07/lb).”

China also sees copper as a strategic metal as the country lacks quality copper deposits. Copper mining is concentrated in Latin America where leading miners like Antofagasta operate. Many see copper as the new oil and tepid supply growth and strong demand could take copper much higher this decade. The rise in copper prices would also mean better days for investors in mining companies like Antofagasta.

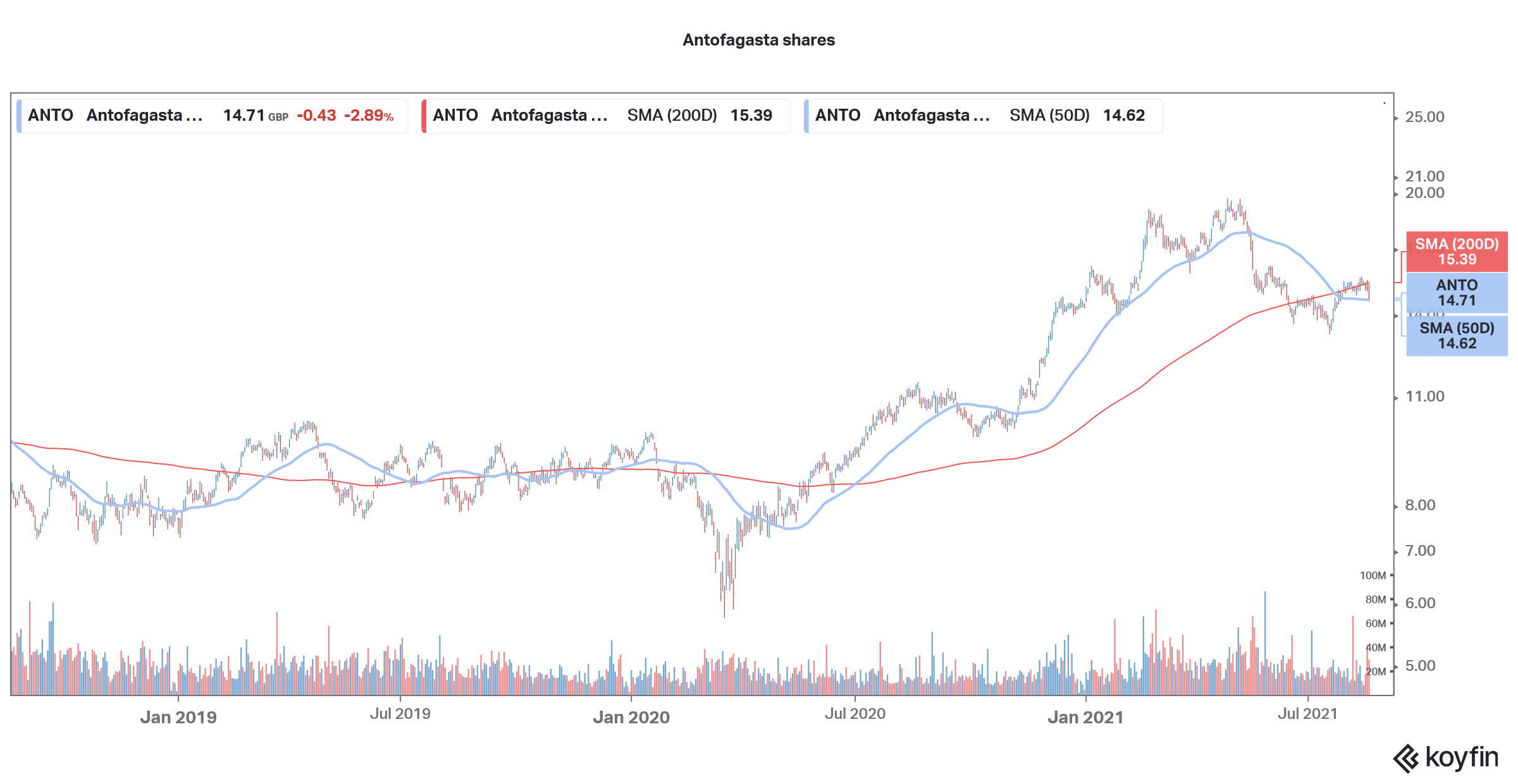

Antofagasta is trading lower

Meanwhile, Antofagasta shares were trading 5.1% lower at 1,395p at 10 AM London time today. The fall looks mainly due to the slump in copper prices. US-based copper miner Freeport-McMoRan was also trading lower in premarket price action. The guidance cut from Antofagasta and the conservative dividend could also be dampening sentiments.

Question & Answers (0)