Genetic testing firm 23andMe (NYSE: ME) has voluntarily filed for Chapter 11 bankruptcy and the company’s co-founder and CEO Anne Wojcicki has quit from the position. As the company explores its options there are also concerns over the data privacy of DNA samples of millions of people that 23andMe possesses.

“After a thorough evaluation of strategic alternatives, we have determined that a court-supervised sale process is the best path forward to maximize the value of the business,” said Mark Jensen, Chair and member of the Special Committee of the Board of Directors in his prepared remarks.

The company also announced that its CFO Joe Selsavage will be the interim CEO and would replace Wojcicki who would still hold her position on the company’s board. In its court filings, ME said that it has $277.4 million in assets and $214.7 million in liabilities.

Concerns over data of 23andMe customers

There are meanwhile concerns that DNA samples of millions of people would be up for sale as 23andME tries to maximize the value of its assets even as the company stressed that “There are no changes to the way the company stores, manages or protects customer data.”

In his remarks, Jensen noted, “we are committed to continuing to safeguard customer data and being transparent about the management of user data going forward, and data privacy will be an important consideration in any potential transaction.”

The company added, “Any buyer will be required to comply with applicable law with respect to the treatment of customer data.” However, privacy advocates are not too impressed and have called upon customers to delete their profiles.

23andMe data breach

In 2023 23andMe suffered a massive data breach that affected millions of its customers with hackers particularly targeting Ashkenazi Jewish and Chinese communities.

Those behind the breach had unrestricted access to its systems and it only came to light when someone posted on Reddit that data of 23andMe users was being sold on the dark web.

23andMe settled the lawsuit by paying $30 million and the judgment called upon the company to implement changes to its business practices.

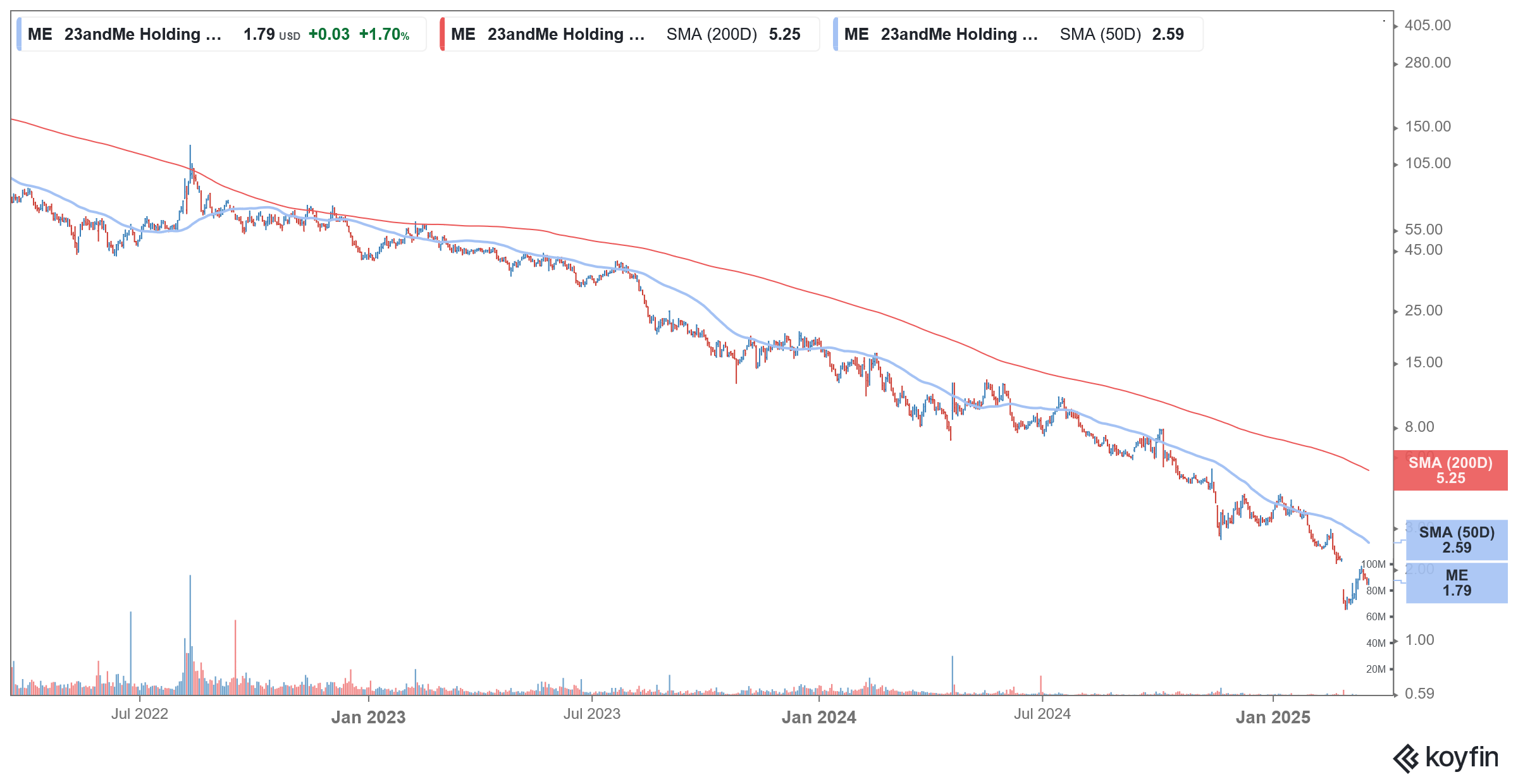

ME shares have tanked

23andMe went public in June 2021 on the NASDAQ, riding the special purpose acquisition company (SPAC) wave and raised $592 million in gross proceeds from the merger transaction that valued the company at a mammoth $3.5 billion, and at its peak, the company was valued at $6.4 billion.

Meanwhile, the month after the merger, the stock price fell below the SPAC IPO price of $10. The price did go above that price level in October of that same year, but the price hasn’t crossed $10 again since November 2021 after peaking at $17.65 in February 2021.

The company’s market cap was below $50 million based on yesterday’s closing prices and looks set to crash even further looking at the premarket price action.

SPAC bubble has burst with a flurry of bankruptcies

While the world economy was grappling with the COVID-19 pandemic in 2020, a hitherto little-known investing vehicle SPAC rose to prominence.

These blank cheque or shell companies were in existence for long but were never quite popular as most companies opted for traditional IPOs to go public.

However, 2020 was a pivotal year for SPACs and there were 248 SPAC IPOs that year raising over $83 billion. To put that number in perspective, the IPO count was higher than the previous ten year combined.

The SPAC mania continued in 2021 and there were 613 SPAC IPOs raising over $162 billion in aggregate. During the pandemic, money raised by SPAC IPOs surpassed that by traditional IPO.

Some of the respected names like private equity giant SoftBank and billionaire fund manager Bill Ackman also launched their SPACs.

Through SPACs, companies can reduce the listing period from a few months to a few weeks. There is also the regulatory arbitrage as in a SPAC merger companies can provide financial forecasts while doing so is prohibited under a traditional IPO.

Reverse mergers with blank cheque companies helped loss-making and pre-revenue companies in emerging industries like EVs, green energy, genetic testing, autonomous driving, and space travel to list in quick time.

Investors, both retail and institutional were bending over backward to invest in blank cheque companies. The merger presentations in most cases provided too rosy forecasts and practically none of the companies could even come closer.

Wojcicki offered to take 23andMe private

Notably, Wojcicki was looking to take 23andMe private but the board turned down her offer multiple times. While rejecting one of her bids last year, the board said that it was turning down the proposal as it “lacks committed financing, and it is conditional in nature. Accordingly, we view your proposal as insufficient and not in the best interest of the non-affiliated shareholders.” Importantly, her offer did not offer any premium over 23andMe’s stock price which is quite the norm in such take-private transactions.

In her latest bid earlier this month, Wojcicki offered to acquire the company for just about $11 million which was below the company’s market value. The offer was rejected again by the board which noted that the offer was 84% lower than what she and her co-bidder submitted in February.

“The Special Committee has reviewed Ms. Wojcicki’s acquisition proposal in consultation with its financial and legal advisors, and has unanimously determined to reject the proposal,” said the board while refusing to comment further on the matter.

Meanwhile, 23andMe shares are crashing in US premarkets price action after the reports of bankruptcy.

Question & Answers (0)