The price of Airbnb shares went down sharply during yesterday’s stock trading session in New York, only a few days after the company reported its earnings for the first quarter of its 2021 year as lock-up arrangements for insiders appear to have expired.

According to the company’s initial public offering (IPO) SEC filing, Airbnb insiders and the financial services firms that advised the company during the process agreed not to sell their shares until “the opening of trading on the second trading day immediately following our public release of earnings for the second quarter following the most recent period for which financial statements are included in this prospectus”.

Back then, Airbnb (ABNB) reported its financial statements covering the first nine months of 2020, which means that the first quarter of this year would be the period in which this lock-up arrangement would expire. Meanwhile, the firm reported its earnings on 13 May, which means that yesterday was the second trading day after the release.

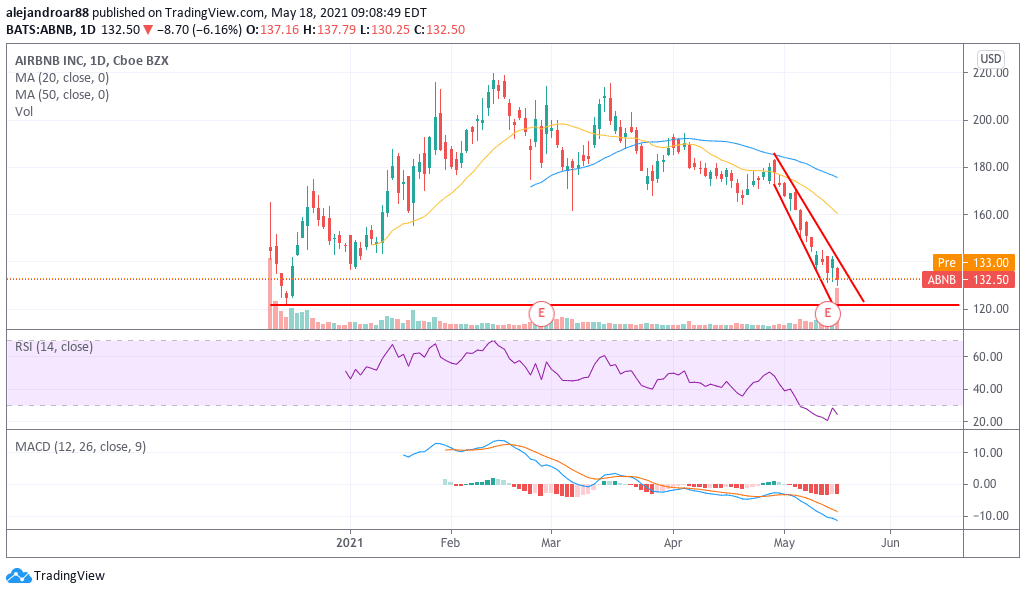

This explains why the stock fell more than 6% yesterday in a high-volume trading session that saw a total of 39.76 million shares exchange hands – almost three times the stock’s average daily trading volume for the past 10 days.

Insider selling could put further pressure on the stock price in the following days, although the extent of the impact of that scenario is yet to be determined given that it will depend on how eager insiders are to get rid of a portion of their holdings.

Airbnb performance has disappointed investors

So far this year, Airbnb shares are dropping 9.7% despite the fact that vaccinations have helped in lifting the market’s sentiment towards virus-battered sectors of the economy including travel and leisure stocks.

This performance is quite disappointing for a company that has disrupted an entire industry but it appears to be the result of investors’ overly optimistic expectations as the stock opened its first trading session with a 114% gain at $146 per share.

From that point forward, the stock progressively climbed to as much as $220, pushing the valuation of Airbnb to approximately $131 billion or around 27 times the firm’s 2019 revenues.

This extreme valuation eventually succumbed, with the firm’s market capitalisation being slashed by half since then while leaving investors who bought back then holding a bag of expensive ABNB stock.

What’s next for Airbnb shares?

During the first quarter of 2021, gross booking values (GBV) for Airbnb jumped 52% compared to 2020 – back when the pandemic was ravaging the industry – but stood flat at $10.3 billion compared to the firm’s 2019 figures.

However, the gross value per night and experience-booked expanded from $122.4 in Q1 2019 to $159.8, which helped lift the firm’s revenues for the period to $887 million. However, the company reported a net loss of $1.17 billion during the first quarter of the year as administrative costs more than doubled while the San Francisco-based firm booked $300 million in other expenses.

Meanwhile, the firm declined to provide guidance for the full year 2021 as the management believes it is still “too early to predict if the recovery will continue at the same pace in the second half of 2021”.

From a technical standpoint, the stock is nearing its post-IPO lows of $121.5 per share and this is a key support to watch if the momentum for the ticker continues to be negative.

The expiration of the lock-up period is an important catalyst that could further depress the share price and traders should keep an eye on the price action in the following days to see if the selling spree continues.

For now, the outlook seems bearish, although the possibility of a double bottom at the $121.50 would turn things for Airbnb shares if the price bounces of that level.

Question & Answers (0)