How to Pick Stocks and Shares – Ultimate Guide for Beginners

Buying stocks in the UK has never been easier – as there are heaps of share dealing platforms that allow you to do this at the click of a button. With that being said, the difficult part is actually knowing which shares to pick. After all, there are hundreds of companies listed on the London Stock Exchange – and thousands more located on international markets.

To help clear the mist, this guide will explain how to pick the best shares to buy in 2021. We cover key metrics to look out for – such as the type of industry the firm operates in, how it has traded historically, and whether or not it pays dividends.

-

-

Step 1: Assessing the fundamentals

The stocks and shares space is a vast battleground, so before we get to the financials we need to explore some of the key fundamentals that you need to consider.

This includes:

UK or international shares?

First and foremost, you need to assess whether you are looking to focus on UK stocks, international companies, or a combination of the two. In the UK market, the main stock exchange is that of the London Stock Exchange. The exchange consists of hundreds of companies from every sector imaginable.

First and foremost, you need to assess whether you are looking to focus on UK stocks, international companies, or a combination of the two. In the UK market, the main stock exchange is that of the London Stock Exchange. The exchange consists of hundreds of companies from every sector imaginable.Big players include British American Tobacco, Royal Mail, BP, HSBC, Tesco, and many others. With that being said, it is also worth considering companies from outside of the UK. In particular, the main two stock exchanges in the US contain some of the largest firms in the world.

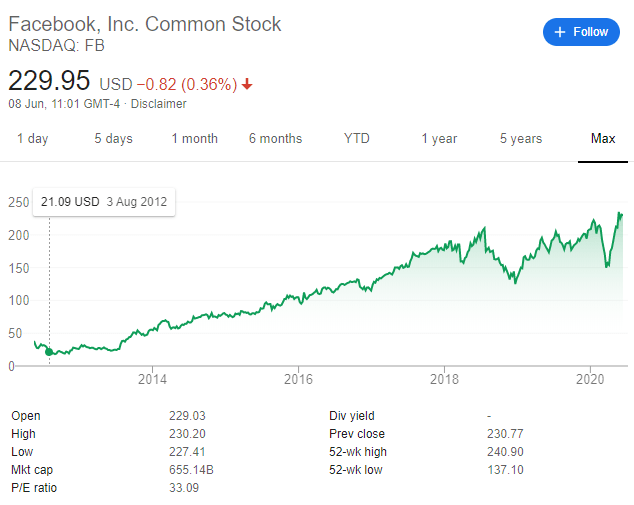

Across the NASDAQ and New York Stock Exchange, you have the likes of Facebook, IBM, Ford Motors, Disney, Microsoft, and Coca Cola. As we discuss in more detail later, broadening your horizons when choosing shares to invest in will allow you to diversify more effectively.

The size of the company

You then need to consider the type of company that you wish to invest in – with respect to its size. At one end of the spectrum, you have blue-chip stocks. These are large-scale companies that have multi-billion-pound valuations – and they have stood the test of time for many, many decades. Although such companies are typically less susceptible to market downturns, the upside potential is going to be much smaller.

At the other end of the spectrum, you might want to consider small-to-medium firms. Although such companies are publicly-listed, they might only possess a market capitalization in the tens of millions of pounds. While it is true that small-to-medium sized firms are riskier than blue-chip companies, the upside potential is much bigger.

Does the company pay dividends?

One of the most important metrics that will allow you to assess whether or not you should invest in a company is that of dividends. In a nutshell, dividend stocks entitle you to a share of the profits that the company makes. In fact, dividends can also help lighten the load when a stock investment goes down in value. In the UK, the average dividend payment amounts to an annualized yield of 3-4%. It is possible to get more than this, with the likes of BP paying 10.2% in 2019 alone.

On the flip side, there is nothing wrong with investing in a company if it doesn’t pay dividends. On the contrary, some of the largest and most successful stocks in a world have never paid a single penny in dividends. You might be surprised to learn that this includes Amazon, Facebook, and Alphabet (Google)!

How much is a single share going to cost me?

Although this point is not so relevant these days – you might still need to consider how much a single share is going to cost you. A prime example of this is Berkshire Hathaway – the company owned by stock trading legend Warren Buffet. Amazingly, the company has a 52-week stock price high of $347,000.

This isn’t a typo – as a single Berkshire Hathaway share really will set you back six figures., which is going to be out of reach for the vast majority of us. The good news for you is that a number of ‘new-age’ online stock brokers no longer require you to buy whole shares.

What industry does the company operate in?

An additional point of consideration that you need to make is the industry that the stock operates in. For example, if you’re looking to buy shares in tech stocks, you might be looking at the likes of Amazon, Uber, Netflix, Facebook, and Twitter. Alternatively, if you’re more interested in food and beverage stocks, you might be considering McDonald’s, Kellogg’s, Coca Cola, and Pepsi.

Either way, being extra vigilant with the industry you are exposed to is crucial – especially in times of economic woes. For example, you likely wouldn’t have invested in travel-related stocks during the coronavirus pandemic, much in the same way that you wouldn’t have selected real estate stocks during the 2008 financial crisis.

Step 2: Looking at the viability of the shares

Once you have assessed the type of stock that you wish to invest in, you then need to look at the viability of the company from an investment perspective. That is to say, you should be asking yourself questions like “where will the company be in 5 years’ time?” or “is the company ever likely to regain its former all-time high stock price?”.

To help you along the way, below you will find some tips to point you in the right direction.

How are the shares priced in relation to its all-time high?

A great starting point is to assess the current stock price of the company in relation to its all-time high. In theory, although a stock will always go through ups and downs, the company in question should increase its valuation indefinitely. After all, companies are in business to make money. If it does, the general rule of thumb is that it should be worth more than it was in the 12 months prior.

Unfortunately, this isn’t always the case in the world of stocks and shares, as the value of a company is determined by the markets. In other words, if there are more buyers than sellers, then the stock price will increase. If sellers outweigh buyers, the opposite will happen. This can lead to companies being severely overvalued, meaning that there is never any guarantee that its stock price will return to its former glory.

Let’s look at a quick example to help clear the mist.

As you can hopefully see from the above screenshot, HSBC stocks are not in good shape. Crucially, although much of the UK banking sector took a major hit in the financial crisis of 2008, HSBC’s woes actually started much earlier in January 2001. This is the period that the bank last hit its all-time high stock price – where it peaked at 1,067p.

Fast forward to mid-2020 and the shares are priced at just over 420p – which is less than half of its 2001 peak. Is there any reason to believe that the stocks will ever recover? Not really, no.

Can you purchase the shares at a discount?

When we refer to buying shares at a discount, this means that you are getting a good deal based on current prices. A prime example of this would have been the fall-out from the financial crisis of 2008, where some of the largest companies in the world lost tens of percentage points in value.

Most of these companies have since hit all-time highs, meaning that shrewd investors would have been able to buy the stocks at a significant discount. An additional example is that of the coronavirus pandemic that saw blue-chip stocks lose 20-30% in the space of a few weeks. As soon as the markets stopped panicking, the stocks quickly recovered. Once again, shrewd investors would have purchased some of the stocks at a major discount.

How much bigger can the company get?

Although this point might sound somewhat contradictory, a select segment of publicly-listed companies can only grow so much. In other words – companies like IBM, Ford Motors, and Microsoft have grown to such a large extent that eventually – growth begins to plateau out.

Sure, the aforementioned companies can continue to grow indefinitely, but the days of double-digit annualized returns are unlikely to be seen again. The only exception to this is if you are buying the stocks during a market downfall – as we discussed above.

At the other end of the spectrum, certain companies are only at the very start of their stock journey. This includes the likes of Uber, Pinterest, Lyft, Netflix, and to some extent – Facebook. What this means is that you still stand the chance to experience significant growth with these companies – as they are still relatively new.

Step 3: Consider instant diversification

Make no mistake about it – choosing the best shares to buy is no easy feat. In reality, you will need to have a firm grasp of both technical and fundamental analysis. You will also need to know how to read financial reports, interpret earnings reports, and much, much more. Unless you are a seasoned investor, it can take you a substantial amount of time to be able to do these things and thus – effectively choose your own shares.

The good news for you is that there are a number of methods that will allow you to choose a basket of stocks and shares without you needing to do an ounce of research – all of which centers on diversification.

This includes:

Stock Market Indexes

The easiest – and potentially most effective way to invest in shares is to consider a stock market index. For those unaware, a stock market index allows you to invest in dozens, if not hundreds of companies via a single investment. For example, let’s suppose that you were to invest in the FTSE 100 index.

This means that you would by buying shares in the 100 companies that make up the FTSE 100. This will consist of firms from virtually every industry and sector imaginable. Then you have the S&P 500, which is an index that tracks the 500 largest companies listed in the US.

The key point here is that there is no requirement to have any knowledge of how stocks and shares work, as you are simply creating a diversified portfolio of the largest firms listed on the respective stock market. Best of all, you will still be entitled to dividend payments as and when they are distributed.

ETFs

In a similar nature to stock market indexes, ETFs (exchange-traded funds) allow you to invest in a basket of companies via a single trade. The ETF will be managed by a financial institution, who will subsequently buy and sell shares on behalf of you and your fellow investors.

Some ETFs will track specific stock market indexes the Dow Jones and FTSE 100, while others will target certain sectors or characteristics.

For example, there are ETFs that track tech stocks specifically, and ETFs which track companies that pay high dividends. Either way, there is no requirement for you to choose individual stocks yourself, as everything is taken care of by the ETF provider!

Copy Trading

An additional option that is worth considering in your quest to choose stocks on a DIY basis is that of a CopyTrading feature.

The best thing about it is that you get to research the historical trading results and risk rating of the investor in question. For example, you might come across an investor that has been successfully buying and selling stocks on the platform for many years.

If you like the look of the trader, you can instantly copy their portfolio – as well as all ongoing trades. Once again, this will allow you to gain exposure to the stocks and shares space without needing to have any skills, knowledge, or background in the arena.

Step 4: How to Pick Stocks by Looking at the Financials

Seasoned investors will spend a considerable amount of time analyzing the financial performance of a company. In doing so, they can make an informed decision on the long-term viability of its stocks. Although it can take many years to master, this is one of the most effective ways to determine whether or not to buy a particular share. It can also help time the market well.

Here’s what you need to know:

Debt-to-Equity

A good starting point is to assess how much debt the company has in relation to its shareholder equity. Before we explain how this works, it is important to note that all companies have debt. In fact, even the likes of Apple – which has cash reserves of over $250 billion, carries an element of debt (most of which is through bonds).

Nevertheless, there is often a fine line between some debt and too much debt. To help you assess which side of the line your chosen stock is on, you will need to take a look at the firm’s balance sheet.

In particular, you’ll need to:

- Add up each and every liability that the company has. This will include short-term and long-term loans, bond obligations, creditors, and more.

- Then, divide this number into the total amount of shareholder equity.

You will then be left with a debt-to-equity ratio of between 0 and 1. In Layman’s terms, the higher the number is to 1, the more debt the company has in relation to its equity. Generally speaking, this could be a red flag, as it might indicate that the firm has too much debt on its books.

With that being said, some industries, in particular, will typically carry a much higher debt-to-equity ratio. For example, the real estate development sector relies on large-scale borrowing to fund new projects. As such, always consider why a company might have a higher-than-average ratio before making a decision.

Price-to-Earnings Ratio

As the name suggests, the price-to-earnings ratio – or simply P/E, looks at the company’s current share price in relation to its earnings. The overarching objective with the P/E ratio is to ascertain whether the company is over or undervalued. In order to obtain the P/E ratio, you simply need to take the current stock price of the company, and then divide this into the firm’s ‘earnings per share’.

For example:

- Let’s suppose that the company has a current stock price of $80.

- The company’s stock carries an earnings per share of $7.50

- This means that the P/E ratio is 10.6

As is the case with any financial ratio, you then need to know what the calculation actually means. Historically, companies listed on the S&P 500 have an average P/E ratio of between 13-15. As such, if the ratio sits below this range, the stocks could be undervalued. Similarly, if its P/E ratio is higher, the stock could be overpriced.

Once again, there isn’t a hard and fast rule on the price-to-earnings ratio, as you sometimes need to look at the bigger picture. For example, at the time of writing Tesla has a P/E ratio of over 230, which is significantly higher than the aforementioned averages. However, it’s a growing company that is just about making a profit, which explains the anomaly!

Stability

There are several ways to assess the stability of a company – both in the technical and fundamental sense. With that said, one of the most effective ways of doing this is to see how the company has historically responded to a wider stock market downfall and thus – look at:

- Whether or not it recovered

- If so, how long it took to recover

- And where the stock price is now in comparison to pre-recession levels

Let’s look at two examples to help clear the mist – both of which will focus on the financial crisis of 2008.

Amazon

- On January 1st 2008, Amazon was trading in and around $90 per share

- In the following year, the stock hit lows of $48 per share

- This represents a huge decline of just over 46%

- However, Amazon stocks opened at $139 on January 1st 2010

- As such, the company not only recovered from its pre-2008 highs in just two years, but it increased in value by a further 54%

- Fast forward to June 2020 and Amazon stocks are now priced at over $2,545!

HSBC

- On January 1st 2008, HSBC was trading in and around $74 per share (NYSE – Secondary Market)

- In the following year, the stock hit lows of $23 per share

- This represents a huge decline of just over 68%

- 12 years on, HSBC stocks are yet to recover from its pre-2008 levels

- At the time of writing, HSBC stocks are priced at $23.98 per share

As you can see from the above two examples, there is a significant disparity in the stability of Amazon and HSBC. While the former recovered in just 2 years and continues to smash through new all-time highs, HSBC is in dire straights.

Earnings Growth

In simple terms, the earnings growth percentage tells us whether or not the company has grown in comparison to the previous year, and by how much.

In order to perform the calculation, you need to take the company’s most recent earnings per share (EPS), divide it by the EPS from the year prior, and then subtract the figure by 1. This will then give you a percentage.

For example:

- Let’s suppose that the company reported an EPS of $3 in 2020

- In 2019, the company reported an EPS of $2.50

- This means that the earnings growth amounts to 20%

It is important to note that there is no one-size-fits-all percentage that we can use to determine the strength of the company’s earnings growth. This is because there are multiple variables that need to be factored in. At the forefront of this is the average EPS for the industry the company operates in.

For example, while earnings growth of 10% might sound good in practice, if the industry average stands at 25%, this could represent a potential red flag.

Step 5: Getting started with a shares investment today

Whether you want to pick shares on an individual basis or you decide to diversify via a stock market index, ETF, or CopyTrading portfolio – you will need to find a suitable UK stock broker.

With hundreds of platforms active in the UK investment space, below we list two brokers in particular that stand out from the crowd. This is because both platforms are regulated by the FCA, allow you to invest on a DIY basis or through a pre-packaged portfolio, and support lots of everyday UK payment methods.

1. IG – Trusted UK Share Dealing Platform With Over 10,000 Stocks

The second option that is worth considering in your hunt for the best share dealing site is that of IG. The UK broker has a long-standing reputation in the global brokerage scene, with the firm first opening its doors back in 1974.

Add in the fact that IG holds multiple regulatory licenses (including with the FCA), and you have yourself a platform that is trusted by more than 178,000 users. In terms of the fundamentals, IG makes our list because it hosts over 10,000 stocks.

Not only does this include UK-listed companies, but thousands of international shares, too. As a result, you stand the best chance possible of creating a diversified portfolio. On the other hand, IG also gives you access to pre-packaged portfolios, stock market indexes, and even ETFs.

When it comes to pricing, IG allows you to buy and sell individual shares at just £3 per trade. This goes up to £8 per trade if you are unable to make more than three buy or sell orders in the prior month. If you like the sound of IG, you can get started with a £250 deposit via a debit/credit card or bank account transfer.

Pros

- Trusted UK broker with a long-standing reputation

- Good value share dealing services

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to UK and international markets

- Great research department

Cons

- Minimum deposit of £250

- US stocks have a $15 minimum commission

The Verdict

If you’re fairly new to the world of stocks and shares, knowing which companies to invest in can be super difficult. As we have discussed throughout our guide, you really need to have a firm understanding of how investments work to be able to choose stocks effectively.

This includes everything from technical and fundamental analysis, and being able to read and interpret earnings reports. With that being said, you have the opportunity to bypass this long and drawn-out learning process by instead considering a pre-packaged portfolio of companies. This can come in the form of an ETF or stock market index, and even a CopyTrading portfolio.

FAQs

How do people find the best shares?

There really isn't a 'Secret Sauce' that can applied to the process of choosing shares. On the contrary, the most successful investors in the world rely on their own research fundings when choosing companies to invest in.

How to pick stocks for long term investments?

If you are looking to find stocks that represent a long-term investment, you still need to weigh up what your goals are. For example, are you looking to invest in dividend-paying stocks, or are you looking to achieve growth?

How do I choose dividend stocks?

There is no longer a need to choose dividend-paying stocks on an individual basis. Instead, there are now dedicated ETFs that focus exclusively on companies that have a long-standing track record of paying dividends.

Can you recommend a stock market guru?

We would strongly advise you to avoid picking shares on the back of somebody else's advice. The internet is jam-packed with so-called experts, most of whom do not make money in the long run. Crucially, if you do not have the experience to research companies yourself, you might want to consider a stock market index or ETF.

What is a diversified portfolio of stocks?

Creating a diversified portfolio of stocks in crucial. In a nutshell, it means that you will be adding dozens, if not hundreds of companies to your portfolio. Furthermore, this will be companies from multiple sectors and economies.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Although this point is not so relevant these days – you might still need to consider how much a single share is going to cost you. A prime example of this is Berkshire Hathaway – the company owned by stock trading legend Warren Buffet. Amazingly, the company has a 52-week stock price high of $347,000.

Although this point is not so relevant these days – you might still need to consider how much a single share is going to cost you. A prime example of this is Berkshire Hathaway – the company owned by stock trading legend Warren Buffet. Amazingly, the company has a 52-week stock price high of $347,000.

The easiest – and potentially most effective way to invest in shares is to consider a stock market index. For those unaware, a stock market index allows you to invest in dozens, if not hundreds of companies via a single investment. For example, let’s suppose that you were to invest in the FTSE 100 index.

The easiest – and potentially most effective way to invest in shares is to consider a stock market index. For those unaware, a stock market index allows you to invest in dozens, if not hundreds of companies via a single investment. For example, let’s suppose that you were to invest in the FTSE 100 index.