Best Ethical Investments UK to Watch

In a world where people are looking to become socially and environmentally responsible, ethical investing is getting more popular in the UK. This simply refers to investments that still target financial gain, but in assets that aim to bring positive social change. The general consensus is that ethical investments are those that strive to improve, or do not harm social and environmental concepts.

In this guide, we explore ethical investments to watch in the UK.

-

-

5 Popular Ethical Investments to Watch

We picked out 5 assets that made the cut in our list of ethical investments:

- Tesla

- Weyerhaeuser

- Canadian Solar

- Beyond Meat

- Muhab Hasan

Ethical Investments in the UK

You might be surprised to learn that there are hundreds of ethical investments to choose from in the UK.

1. Tesla

Tesla is a US-based electric car maker.

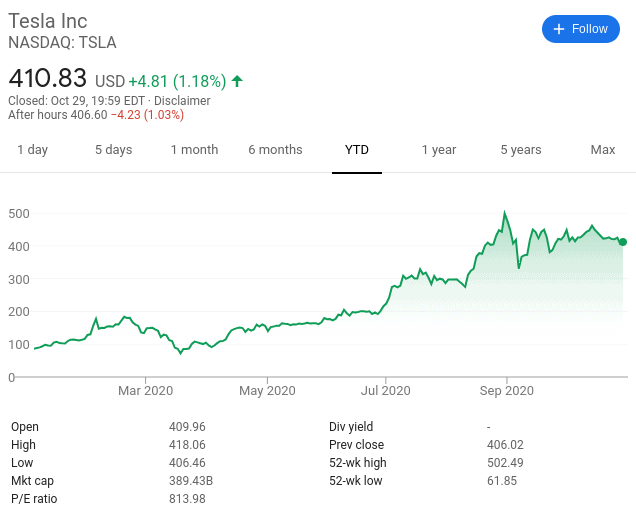

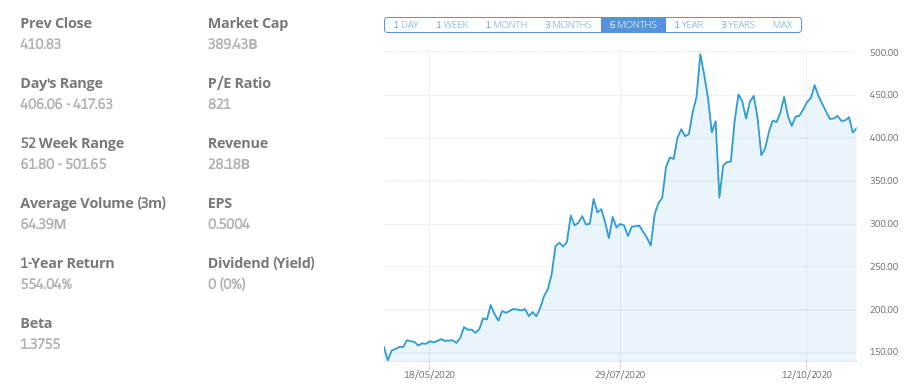

Even at today’s price of $410 per share, investors are reluctant to offload their Tesla shares. Tesla is an ethical investment for more reasons than one.

Tesla cars are not only beneficial for the environment in terms of how they are powered, but they are built to last. Although the project is still a work-in-progress, Tesla is looking to launch a next-gen model that will have a lifespan of up to 1 million miles. You then have Tesla’s Powerwall division. In a nutshell, this is a project that allows everyday consumers to store solar-based energy when it is not required.

The underlying technology learns to adapt to your everyday needs, subsequently ensuring that your home is as energy-efficient as possible. The Powerwall project is also suitable for those that do not have regular access to solar energy. This is because it will charge only when electricity costs are low, and discharge when the opposite happens.

Going back to the financials, many would argue that at a market capitalization of $330 billion, this is still an undervalued stock.

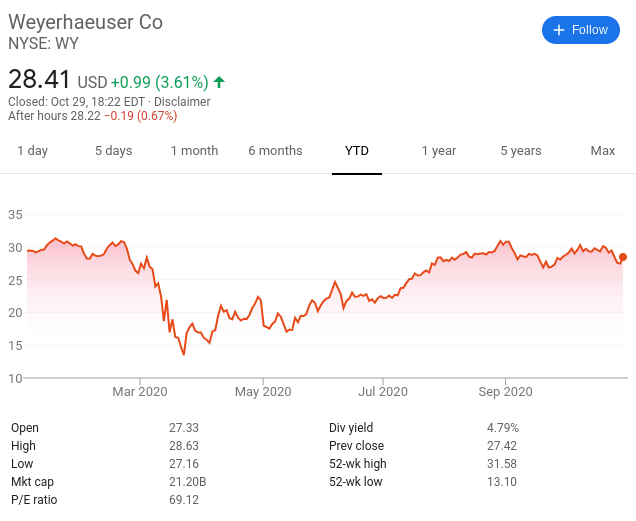

2. Weyerhaeuser

Launched way back in 1900, Weyerhaeuser is a US-based supplier of timberland. The firm has over 26 million acres of timberlands across the US and Canada and employs almost 10,000 people. Now, you might be somewhat perplexed to see a company on our list of ethical investments that is involved in chopping down trees.

However, Weyerhaeuser actually meets all of the requirements as an ethical and socially responsible stock. At the forefront of this is the 1 billion+ trees it has planted over the past decade. Crucially, the company notes that its overarching aim is to make sure its forests last forever.

This isn’t only the case with at the source of its production journey. On the contrary, Weyerhaeuser promotes sustainable housing. This centres on ensuring that homes are not only affordable but in line with social and governance ethics. This means building homes with ethically sourced materials and ultimately – that have the capacity to obtain energy in an efficient and renewable manner.

In terms of the financials, Weyerhaeuser shares are listed on the New York Stock Exchange with a current market capitalization of over $21 billion. Much like the rest of the timberland and wider construction sectors, Weyerhaeuser was hit badly by the pandemic.

In fact, its shares hit 52-week lows of $13 in March – translating into a decline of 56% in a matter of weeks. Fortunately for stockholders, Weyerhaeuser shares have since recovered. At the time of writing in early November, the shares are priced at just over $28.

When it comes to dividends, the firm has been making distributions since 1974. As such, this is a suitable dividend stock to add to your portfolio. However, we should note that in May 2020, management at Weyerhaeuser suspended its dividend policy as a result of the pandemic.

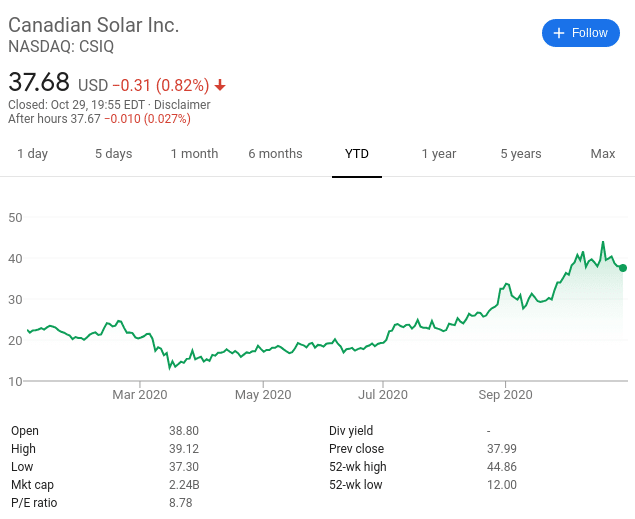

3. Canadian Solar

Canadian Solar is also moving into other, climate change-related products and services that aim to bring solar energy to the masses.

This includes the ever-growing energy storage solution arena. Put simply, the firm is looking at ways in which we can better store the energy that solar panels yield. In turn, this ensures that consumers only spend what they need, and when they need it. Although the company was launched almost two decades ago, it is only just about finding its feet on the stock market.

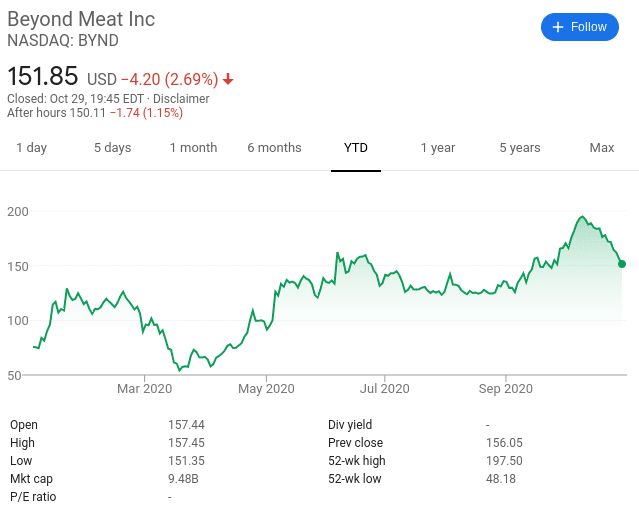

4. Beyond Meat

Beyond Meat is an American food and beverage company that specializes in plant-based meat. That is to say, the firm is famous for manufacturing traditional meat-based food products without using meat. Instead, all ingredients are 100% plant-based.

The underlying technologies that are used by their firm ensure that popular food products like burgers, sausages, and beef taste “just like meat”.

None of its products contains antibodies, hormones, or cholesterol, either. This opens up a whole new marketplace for those seeking foods that would other be bad for one’s diet.

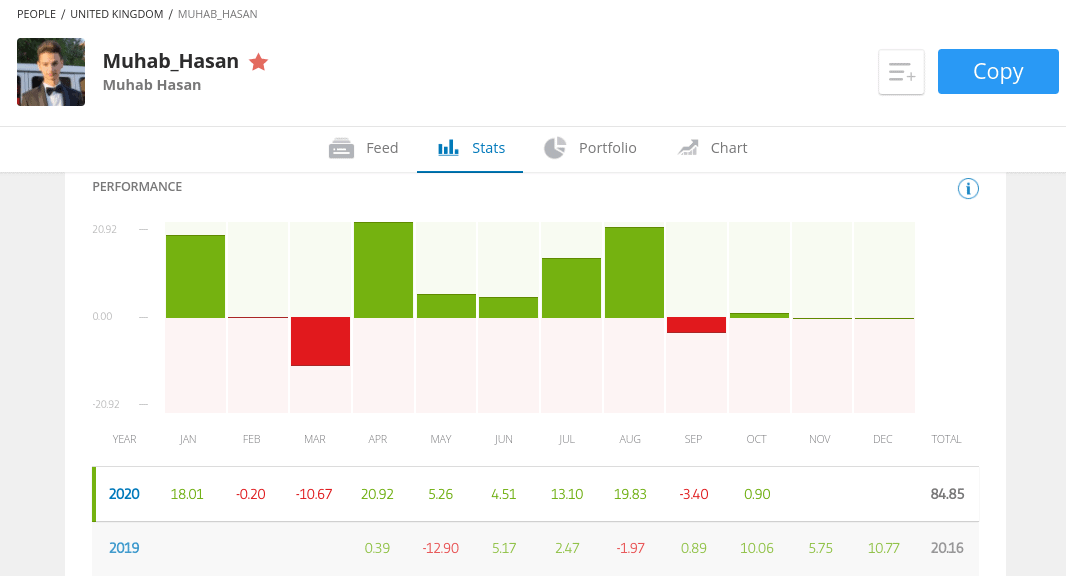

5. Muhab Hasan

As the name implies, you get to copy the trader’s portfolio like-for-like, as well as all ongoing positions.

So, one such trader that we have been following for some time now is Muhab Hasan. He is involved solely in ethical investing. Each and every investment made by the trade follows AAOIFI Guidelines. All investments are halal, too.

In terms of strategy, the SRI sustainability investor (Socially Responsible Investing) practices a long-term ‘buy and hold’ system. This means that he only buys shares that have high growth potential. This is evident in the fact to date, the trader has an average trade duration of 9 months.

In fact, the trader is over 80% in the green for 2020, and 2019 closed in at 20%. Taking a closer look at the trader’s current portfolio, 18% is held in Facebook shares while 15% is in Alibaba. There are also holdings in Tesla, Fiverr, Alphabet, Adobe, Barrat Developments, and MasterCard.

What we also like about the copy trading system that unlike other managed ethical funds in the responsible investing space, you can add and remove stocks as you wish. By having full control over your portfolio, you can ensure that each and every investment sits in line with your personal ethical views.

Platforms to Invest in Ethical Investments

Once you have had a chance to think about which UK ethical investments you are interested in, your next port of call is to find an online broker. Not only does your choice of the platform need to offer your preferred ethical investment, but it needs to meet a range of important requirements. This centres on low fees, low minimum investments, and a strong regulatory standing.

To save you hours of independent research, below we have listed UK stock brokers to make ethical investments.

1. IG

This broker does offer one of the largest asset suites at over 12,000 markets. This covers thousands of stocks from dozens of UK and international markets. You can also invest in ETFs, index funds, and mutual funds.

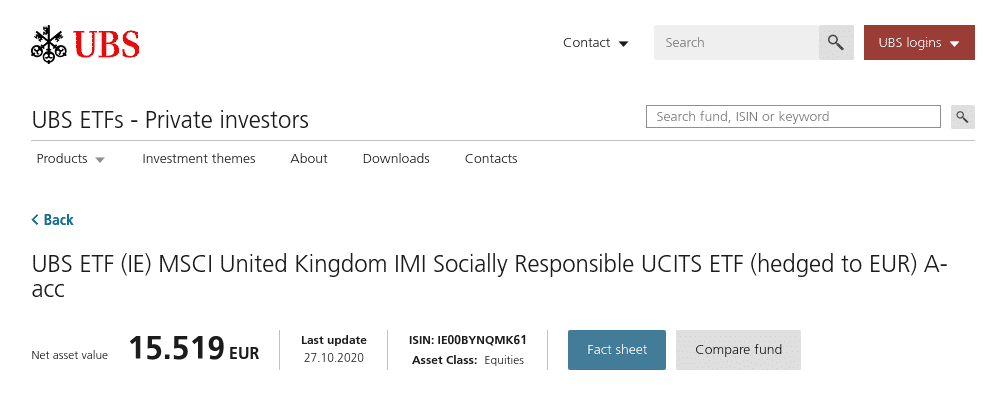

In fact, IG offers a range of ETFs that are 100% focused on ethical investments. This includes the iShares Dow Jones Global Sustainability Screened UCITS ETF and the UBS MSCI United Kingdom IMI Socially Responsible UCITS ETF. When it comes to dealing fees, you’ll need to pay £8 per trade at IG. If you place three or more positions in a 30-day window, then this is reduced to £3 per trade in the following month.

Sponsored ad. Your capital is at risk.

What are Ethical Investments?

There is no universally accepted definition of what constitutes an ethical investment, so it can be somewhat subjective depending on the source material. With that said, there are some core principles that need to be met. At the forefront of this are investment decisions that not only take into account financial returns but some form of moral principle.

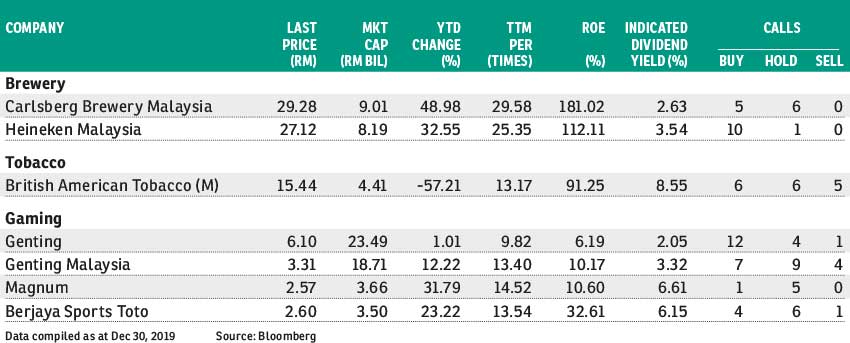

However, we should note that there can be a significant disparity in how ethical an investment is. For example, at the lower end, this might simply be a stock investment that is not involved in certain sectors. This might include alcohol, tobacco, gambling, or ammunition.

A prime example of this is Tesla. Not only is the US stock involved in electric vehicles – but is now the largest car manufacturer globally. This is uncanny when you factor the likes of Fiat, Renault, Mercedes-Benz, Peugeot, and many others that have been around for well over a century.

You then have companies like First Solar and Canadian Solar – both of which are looking to take consumers away from harmful energy sources through cutting-edge solar technologies. All in all, the overarching objective of making ethical investments in the UK is to combine the fruits of profit and social/environmental responsibility.

As we have noted with the five ethical investments discussed on this page – this is something that can be achieved with ease.

How to Choose Ethical Investments

Finding the right ethical investments for you and your financial and moral compass can be challenging. After all, not only do you need to assess how ethical the asset in question is, but what its long-term prospect is in terms of financial returns.

To ensure that you are able to find ethical investments on a do-it-yourself basis, below we discuss some important metrics that you need to research.

How Ethical do you Want to go?

As we discussed in the section above, there is no hard-and-fast rule as to what makes an investment ethical. After all, it really depends on personal views. At an absolute minimum, this will need to avoid so-called ‘sin stocks’ that operate in controversial industries. Once again, this will likely include defence stocks, alcohol stocks, tobacco stocks, and gambling stocks.

Ethical Investment Fund

While diversification takes the pressure off of selecting individual companies, you still need to perform lots of research to ensure you add the right stocks to your ethical investment portfolio.

In a nutshell, these are ETFs that focus primarily on ethical stocks. Once again, the ‘level of ethical’ will vary quite widely. For example, while some ethical funds might ensure that they only buy shares outside of the ‘sin stock’ ecosystem, others will focus exclusively on companies involved in ethical and socially responsible products and services.

For example, the UBS MSCI United Kingdom IMI Socially Responsible UCITS ETF gives you access to over 160 companies.

In fact, we have come across several ethical funds that charge expense ratios in excess of 4-5% annually. This is a result of the enhanced due diligence required, insofar that the fund must ensure that all new and existing holdings remain ethical.

Conclusion

In summary, this guide has demonstrated that financial gain and being ethical and socially responsible do not have to be mutually exclusive. On the contrary, there are countless examples of companies involved in ethical niches – such as those centred on solar, plant-based meat, and electric vehicles – that have made unprecedented returns this year.

FAQs

What is ethical and responsible investment?

Generally speaking, ethical investments are that meet and exceed the three core principles surrounding environmental, social, and governance change. However, this is somewhat of a subjective term, as some view ethical investments as those that sit outside of the ‘sin stock’ spectrum. This means avoiding companies involved in gambling, alcohol, tobacco, and ammunition.

How do you know if a stock is ethical?

There is no simple answer to this question because ultimately – it all depends on how you view ethical. In other words, what is ethical to one person might not be to the next.

Are mutual funds ethical?

Once again, this will ultimately depend on the mutual fund itself. In other words, the types of investments that the mutual fund makes will dictate whether or not it can be viewed as ethical. With that said, there are some mutual funds that are focused entirely on ethical investments.

What is an ethical fund?

An ethical fund refers to an ETF or mutual fund that only invests in ethical companies.

Are index funds ethical?

Index funds are simply tasked with tracking the performance of a particular stock market – such as the London Stock Exchange or NASDAQ. As such, index funds make no distinction between the ethics of the companies in which they track.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

There is no universally accepted definition of what constitutes an ethical investment, so it can be somewhat subjective depending on the source material. With that said, there are some core principles that need to be met. At the forefront of this are investment decisions that not only take into account financial returns but some form of moral principle.

There is no universally accepted definition of what constitutes an ethical investment, so it can be somewhat subjective depending on the source material. With that said, there are some core principles that need to be met. At the forefront of this are investment decisions that not only take into account financial returns but some form of moral principle.