Best Money Market Funds UK to Watch

If you are looking to park your money in a low-risk asset class – perhaps to protect your wealth from inflation, falling stock markets, or low interest rates – a money market fund could be a potential option.

In this guide, we review some popular Money Market Funds in the UK. We also explain what money market funds are and how you can invest in one from the comfort of your home.

Popular Money Market Fund UK List

The 5 popular money market funds UK can be found below. By scrolling down, you can read our full financial analysis of each MMF.

- Vanguard Sterling Short-Term MMF

- Vanguard Treasury Money Market Fund

- Federated Hermes Prime Cash Obligations Fund

- Invesco Money Fund (UK)

- iShares Core U.K. Gilts UCITS

Money Market Fund UK

When searching for money market funds UK – there are several key metrics that you need to focus on.

This should include:

- What investment vehicles the money market fund holds

- How much risk is associated with the underlying money market instruments

- The performance of the money market funds over the past 5-10 years

- How much liquidity the money market fund attracts

- What pricing structure the money market fund has in place

1. Vanguard Sterling Short-Term MMF

As the name suggests, the MMF concentrates on financial instruments that are priced in pound sterling.

In terms of what instruments the Vanguard Sterling Short-Term MMF holds – this is a combination of UK Gilts (government-issued bonds), certificates of deposits issued by banks and financial institutions, fixed-rate bonds, and short-term corporate bonds. According to Vanguard itself, this money market fund carries a risk rating of 1/5 – which ensures your exposure to loss is minimal.

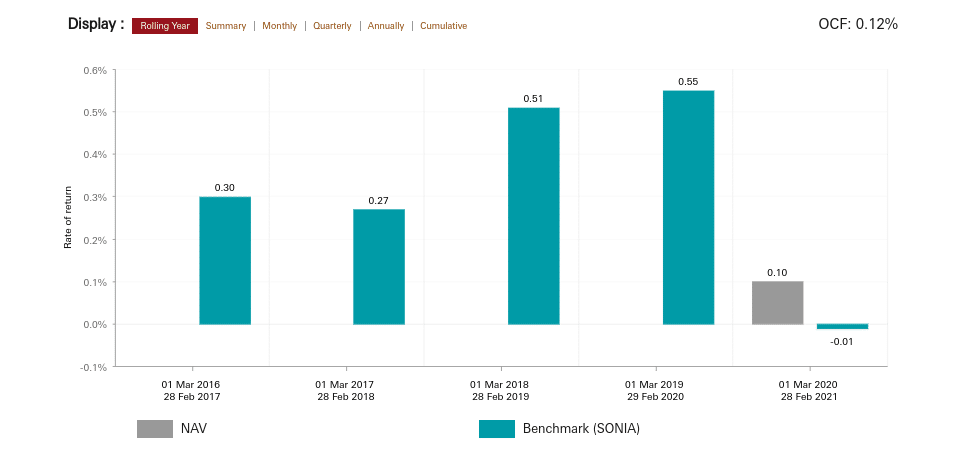

Looking at the financials, this Vanguard fund carries an ongoing expense ratio of 0.12%. The Sterling Short-Term Money Market Fund was actually only launched in 2019 – so we have limited data in terms of financial performance.

What we do know is that since its inception date – the fund was grown by 0.55%. Although such small returns are just the nature of MMFs, this is below the rate of inflation. As such – and as advised by Vanguard itself, this fund is not suitable for long-term growth.

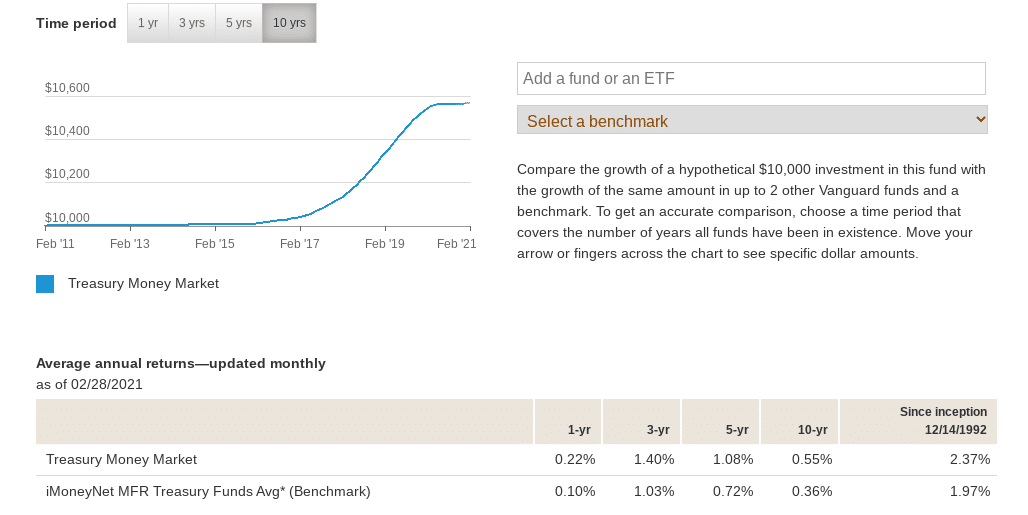

2. Vanguard Treasury Money Market Fund

Although no financial instruments are truly risk-free – US Treasury Bills are arguably the go-to safe haven during times of economic unknowns. For those unaware, Treasuries are bonds issued by the US government. They come with various maturity dates – ranging from a few months up to a hundred years.

Crucially, as US Treasuries are backed by the US Federal Reserve, the chances of default are virtually zero.

The fund – which comes with an annual expense ratio of just 0.09%, has over 80% of its holdings in US government-issued debt. Once again, don’t expect any sizable returns on this MMF, as over the past 10 years it has averaged annual gains of just 0.55%. With that said, if you go back to its inception date of 1992 – the fund has averaged 2.37%.

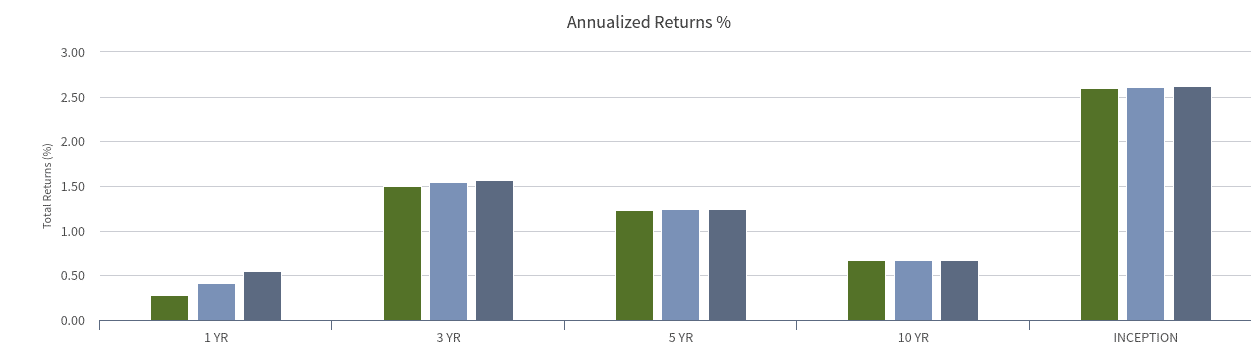

3. Federated Hermes Prime Cash Obligations Fund

What we like about the Federated Hermes Prime Cash Obligations Fund is that it offers a more diversified approach to hedging. For example, the MMF holds short-term debt instruments from both corporations and the US government. Regarding the latter, this includes a variety of US Treasury debt and US government agency repurchase agreements.

More than 26% of the portfolio is held in asset-backed commercial papers, and 18% in financial company commercial papers. There are also holdings in bank certificates of deposits, tender option bonds, and variable rate demand notes. Looking at its corporate-based short-term debt – these are issued by major players in the investment banking space.

This includes JPMorgan Chase, Credit Suisse Group, Mizuho Financial Group, and Societe Generale. For example, since its inception, this stands at 2.60% per year. Over the past three years, the fund has averaged 1.50% annually.

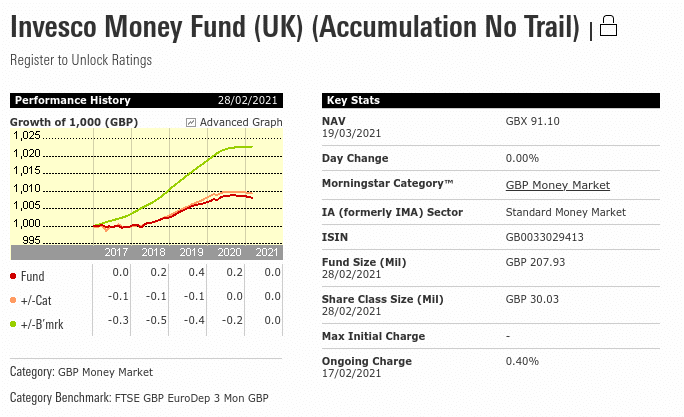

4. Invesco Money Fund (UK)

The Invesco Money Fund (UK) is another MMF that focuses on high-grade debt securities that are issued in pound sterling.

There is a fairly even split between bonds and cash at 53% and 47% respectively. Regarding the former, some of the largest debt issuers include Societe Generale (5.36%), Nestle Holdings (5.26%), Volkswagen Financial Services (5.00%), and the European Investment Bank (4.85%). As you likely know, these are highly stable institutions with a rock-solid balance.

Looking at the returns of this UK money market fund – average annual returns over a 10-year period stand at just over 0.42%. This translates into 10-year growth of 4.32% – which doesn’t get anywhere close to UK inflation levels.

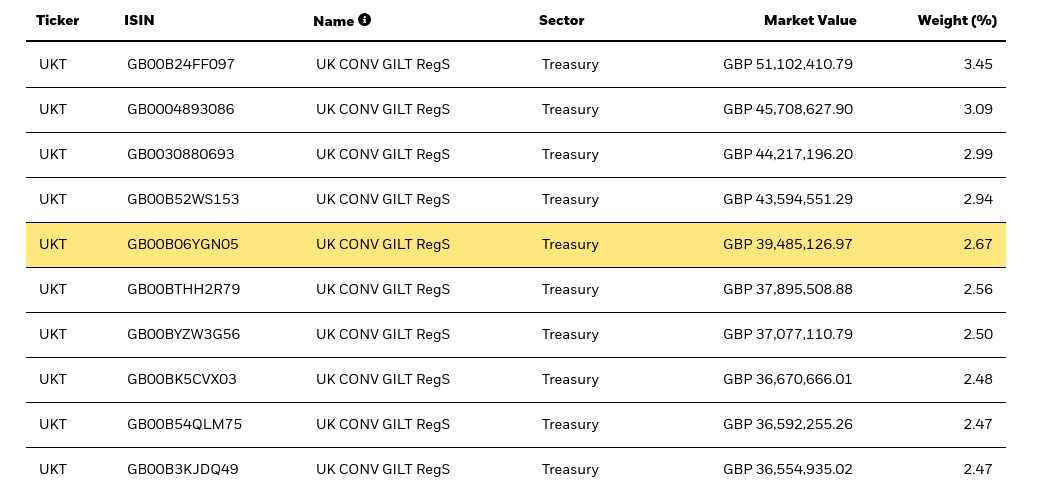

5. iShares Core U.K. Gilts UCITS

Technically, this iShares fund is actually an ETF. However, it carries all of the same characteristics as a conventional money market fund.

After all, you are investing in high-grade UK Gilts – so your exposure to risk is minimal. Additionally, this is one of the cheapest money maker funds available in the market – with iShares charging just 0.07% per year. In terms of maturity, there are Gilts with a duration of less than 12 months – right up to 20 years and more.

What are Money Market Funds?

Money market funds are an investment product that focuses on short-term securities. These securities are deemed very low-risk – and typically include a blend of government-issued bonds like US Treasuries and UK Gilts, alongside high-grade corporate bonds. The purpose of investing in a money market fund is not to generate long-term investment or growth.

On the contrary, they offer a way to protect and hedge your wealth. For example, if it appears that the stock markets are in a downtrend trend – institutional investors might move their capital into a money market fund. In doing so, this allows them to ‘hold fire’ until it becomes clearer whether the downward trend is temporary or signs of a prolonged bear market.

- In essence, a money market fund works much the same as a conventional mutual fund or ETF.

- This is because the fund will be managed by a large-scale investment house – such as Vanguard or iShares.

- In turn, you can enter and exit a money market fund investment at any time – so your capital is liquid.

- Plus, you will be entitled to your share of any dividends that the money market fund receives.

However, unlike an ETF or mutual fund – the overarching objective with an MMF is capital preservation – and not financial gain.

Fundamentals of Money Market Funds

If you’re looking to target long-term financial growth – then money market funds will not be for you. This is because they offer a much lower rate of return than other fund types – such as major stock indices like the FTSE 100 or Dow Jones. Although money market funds are not suitable for long-term capital growth – there are many reasons why they might be suitable for your short-term investment financial goals.

This includes:

Record Low Bank Interest Rates

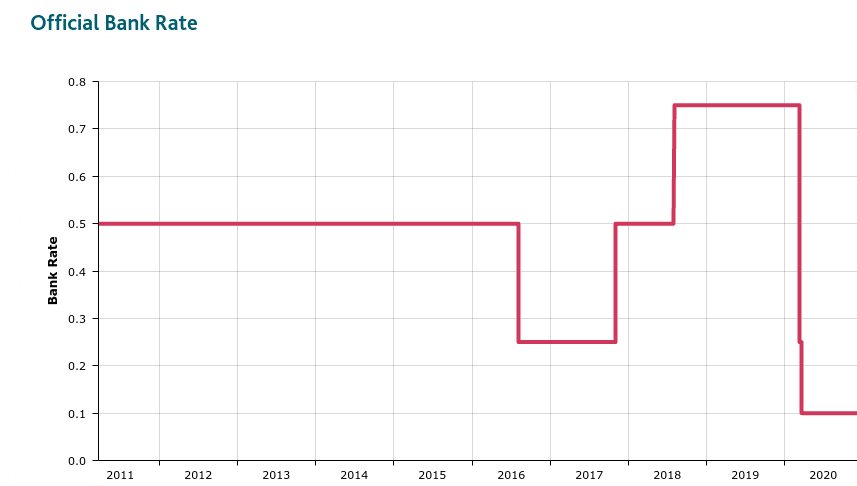

The vast majority of UK current accounts pay just a fraction of 1% per year in interest. You might come across a headline offer that claims to pay a more attractive return on your savings, albeit, there are often unfavourable conditions attached.

For example, there is usually a very small limit on how much of your current account balance benefit from the higher rate. In other cases, you need to have a premium current account – which defeats the objective as you need to pay a monthly fee. Taking all of this into account, some UK investors will instead look to put their cash into a money market account.

On the one hand, the rate of return will still be very modest. But, in most cases, the UK money market funds will pay more than a traditional current account.

MMFs Possess High Liquidity Levels

As we briefly covered earlier, MMFs are liquid – even though they often hold illiquid assets like corporate bonds. This is because money market funds UK is traded publicly – meaning that you can cash out your investment at any time during standard market hours.

This is crucial – as it means your money is never tied up for more than a couple of days – taking into account brokerage withdrawal times.

Hedge Against the Stock Markets

The stock markets – especially those located in the US, have been on an upward trend for almost a decade. As history suggests, the wider markets will always go through trends – both upwards and downwards.

As such, many argue that it is only a matter of time before we see the next prolonged bear market. When it does appear that this is the case, experienced investors will look to take their capital out of the stock market and put it into a low-risk fund such as an MMF. This allows investors to preserve their capital until it’s time to re-enter the stock market.

Are Money Market Funds Insured?

Yes. Money Market accounts are insured up to £250,000 by the FDIC and NCUA. However, Money Market mutual funds do not have any FDIC coverage themselves. Therefore, there is some risk involved with investing in Money Market Funds. Money Market account insurance means that investors can take steps to claim their money back if it gets lost. However, this is not guaranteed and the exact amount that you will be able to claim back is circumstance- dependent.

Can Money Market Funds lose money?

Like any other type of investment account, it is possible to lose money when investing into a Money Market Fund. While this risk of losing money may be small, investors should always develop a strong risk strategy before investing into any financial instrument.

Money Market Funds invest in securities which are not entirely risk free. If a bank or financial institution makes a wrong call, the funds in your Money Market account could be at risk. Luckily, Money Market accounts are insured up to £250,000 which offers a layer of protection against potential loss.

Do Money Market Funds Pay Dividends?

Yes, Money Market funds do pay dividends that reflect sort term market growth and interest rates. Some Money Market Funds pay dividends each month to investors which can be re-invested into the fund or cashed out. Money Market funds are often smaller than traditional dividend stocks because the securities are less volatile. The dividends that are paid out by Money Market funds represent the returns on your investment.

Money Market Funds vs ETFs

We mentioned earlier that money market funds are not too dissimilar to ETFs. This is because both financial instruments are run and operated by large-scale institutions,which will often hold a basket of diversified assets, and generate returns via an increased NAV (Net Asset Value) and dividends.

However, it must be noted that ETFs are typically tasked with tracking a specific market – meaning that they are passively managed.

On the other hand, money market funds are actively managed – as the provider will determine which low-risk debt securities to buy and sell. After all, the main objective of a money market fund is to preserve capital – so it must proactively make risk-averse investment decisions.

Money Market Funds Brokers UK

1. Fineco Bank

For example, you won’t pay any dealing fees when you buy and sell money market funds at Fineco. You will, however, need to pay 0.25% on an investment balance of less than £250,000. This will be charged in addition to the expense ratio of your chosen MMF.

The only way that you can get your annual fee down to 0% is to invest more than £2 million. The minimum fund investment at Fineco Bank is a reasonable £100.

Fineco Bank also gives you access to a huge library of traditional stocks. This will cost you £2.95 on each UK stock trade you place, and $3.95 on US-listed stocks. The main disadvantage of using Fineco Bank is that it doesn’t support debit or credit cards. Instead, it’s only bank transfers that are permitted.

Sponsored ad. Your money is at risk.

Conclusion

While money market funds are certainly not a substitute for long-term capital growth – they do serve a clear purpose. Whether you’re looking to mitigate the risk of a falling stock market or you simply wish to make more interest than traditional current accounts pay – there are dozens of money market funds to choose from.