Best Index Funds UK to Watch

By investing in an index fund, you will be buying a basket of stocks through a single investment. Most UK index funds come in the form of ETF, which will track a particular marketplace. For example, you might invest in an index that tracks companies on the AIM. With so many options on the table, this guide will discuss some popular index funds UK in 2022.

We cover a variety of funds across several UK and international marketplaces.

Key Points on Index Funds in UK

- When you invest in an index fund, you’re effectively investing in a basket of underlying assets.

- Low fees and passive investing – Since an index fund tracks the performance of an underlying benchmark index, no fund managers or extensive market analysis is needed.

- By investing in index funds you’ll gain broad market exposure with the added benefit of certain tax exemptions.

10 Popular Index Funds UK List

Don’t have time to read our guide in full? Below you will find 10 popular index funds based on trading volumes.

- iShares FTSE 100 UCITS ETF

- SPDR S&P 500 Index

- Vanguard Total Stock Market Index Fund

- FTSE SmallCap Index

- iShares MSCI China ETF

- Vanguard Growth ETF

- Vanguard Real Estate ETF

- Vanguard Russell 2000 ETF

- Schwab Emerging Markets Equity ETF

- Fidelity U.S. Sustainability Index Fund

Index Funds UK 2022 Reviewed

With so many index funds available to UK investors, it can be challenging to separate the wheat from the chaff. In particular, you need to assess what your long-term investing goals are.

For example, are you looking to invest in an index fund that tracks major UK companies? Or, are you looking to target higher returns by choosing an index that tracks the AIM? Alternatively, you might be looking to take a more diversified approach by choosing an index fund that covers both UK and international firms.

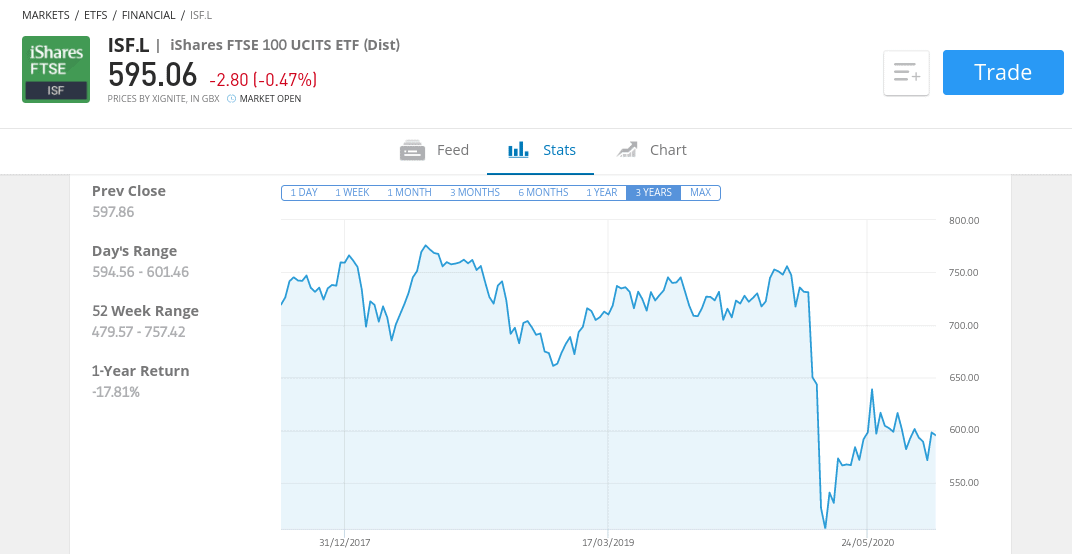

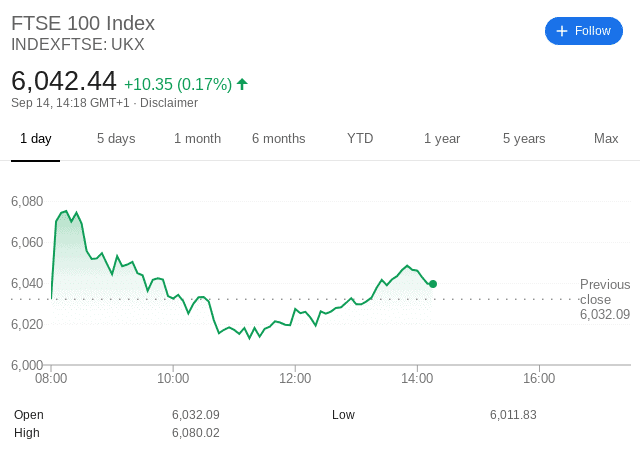

1. iShares FTSE 100 UCITS ETF

This index fund will allow you to buy shares in all 100 companies that represent the FTSE 100.

With this in mind, the Shares FTSE 100 UCITS ETF is 100% passive. When it comes to weighting its portfolio, iShares will look to replicate the FTSE 100 like-for-like. This ensures that your investment mirrors the performance of the London Stock Exchange in the closest manner possible.

2. SPDR S&P 500 Index

The S&P 500 is a stock market index that tracks 500 of the largest companies listed in the US. First launched in 1926, the index has made average annualized gains of over 10% per year since its inception.

The S&P 500 consists of companies from both the NASDAQ and NYSE. Regarding the former, this means that your index fund investment will consist of shares such as Apple, Amazon, IBM, and Microsoft. Over on the NYSE, you’ll be holding shares in the likes of Johnson & Johnson, Disney, Ford Motors, and Novartis.

The thing about the SPDR S&P 500 is that you be diversified across dozens of individual sectors at the click of a button. Attempting to do this on a DIY basis would not only be time-consuming, but extremely expensive when you factor in brokerage fees, so there’s no doubt this is one of the index tracker funds of 2022.

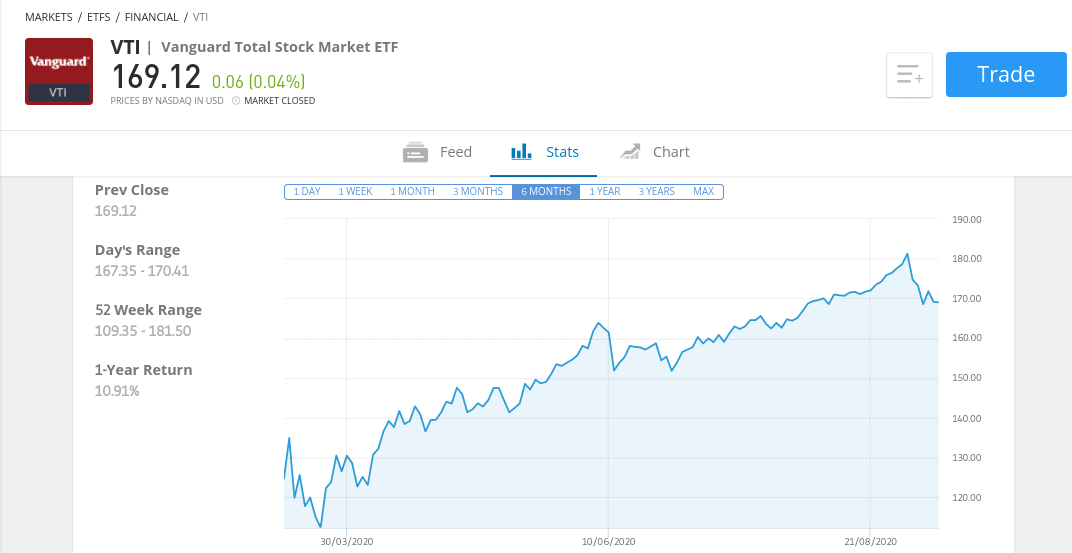

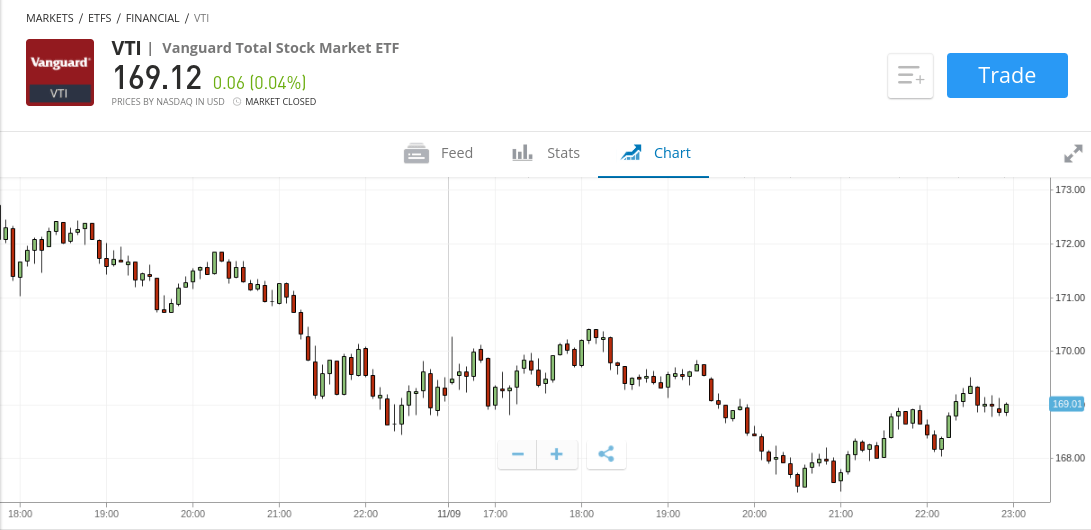

3. Vanguard Total Stock Market Index Fund

While the S&P 500 is focused on the largest stocks in the US in terms of market capitalization, this particular tracker fund is a lot broader. This is because the index tracks small, medium, and large-cap firms. Each and every stock held by Vanguard will be publicly-listed in the US, so this is one potential way to gain exposure to the American economy.

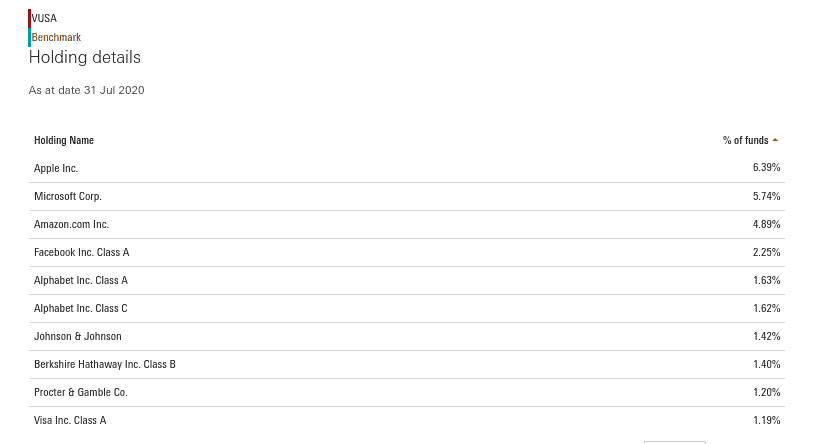

To ensure the index fund is reflective of the wider US markets, Vanguard weights its portfolio heavily in favour of dominant players. For example, its 10 holdings include Apple, Visa, Alphabet, Berkshire Hathaway, and Amazon. With that being said, the Vanguard Total Stock Market Index Fund also allocates capital across a significant number of high-growth shares.

These are typically companies that are yet to make it big in their respective sector, so both the risks and rewards are much higher.

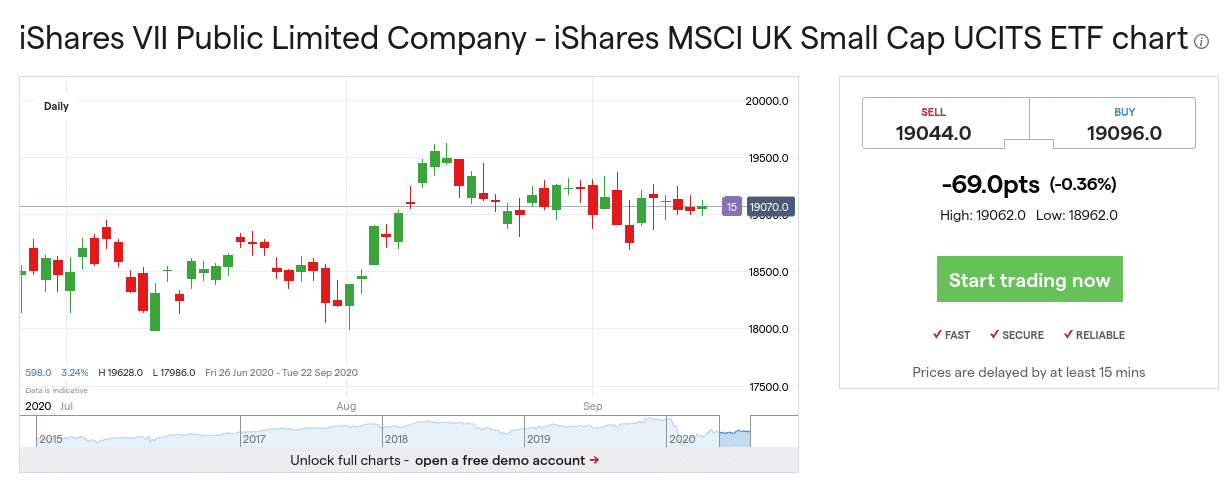

4. FTSE SmallCap Index

In a similar nature to the Vanguard Total Stock Market Index Fund, the FTSE Small Cap Index gives you exposure to smaller companies. However, you will be focusing exclusively on firms listed in the UK such as the FTSE 250. Furthermore, this index does not contain any large-cap stocks.

Instead, you will be investing in a full basket of up-and-coming firms, or established companies that have smaller market capitalizations. On the one hand, this does mean that the FTSE SmallCap Index comes with much higher risk levels. After all, you are potentially investing in companies that are yet to prove their business model.

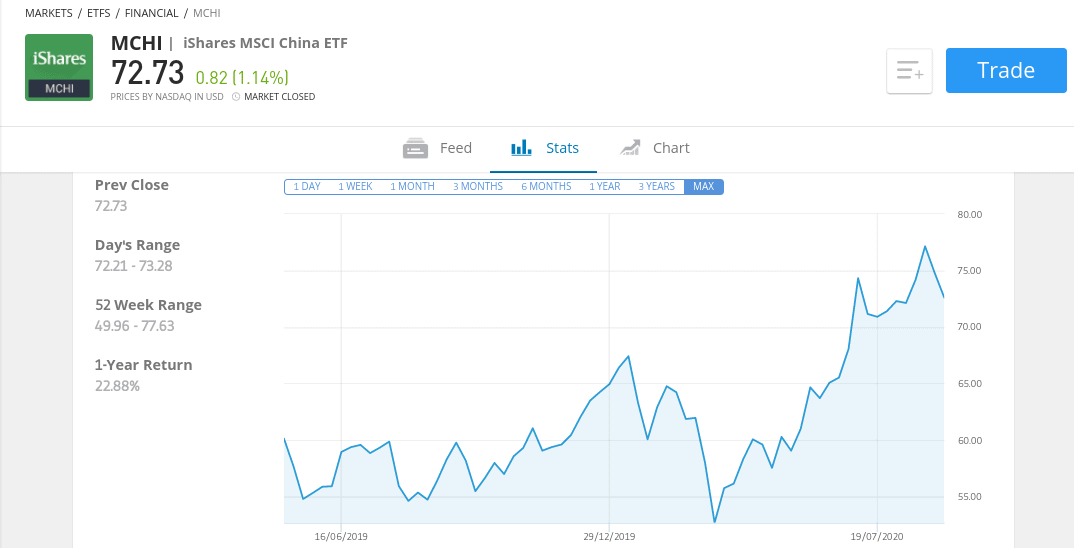

5. iShares MSCI China ETF

This is another one of the index tracker funds of 2022. China is home to one of the largest stock markets globally. In a time not so long ago, being able to invest in Chinese firms would have been a difficult task as an everyday UK retail client. However, with the introduction of the iShares MSCI China ETF – you can now do this at the click of a button.

The index itself consists of over 600 Chinese stocks, so you will be investing in a completely diversified manner. In terms of weighting, the ETF provider allocates funds based on market capitalization. For example, Alibaba Group and Tencent each contribute 19.21% and 14.38%, respectively.

Then you have the likes of Meituan Dianping and China Construction Bank at 4.20% and 2.51%. If you like the sound of the iShares MSCI China ETF, the provider charges a rather steep expense ratio of 0.59%, making it a pick for an MSCI world index ETF.

6. Vanguard Growth ETF (NYSEMKT:VUG)

The Vanguard Growth ETF (NYSEMKT:VUG) is a possible choice if you want to take on more investment risk in exchange for some returns. The index fund follows the CRSP US Large Cap Growth Index, which is similar to the S&P 500 Growth Index in terms of performance. This ETF holds 255 large-cap US growth stocks.

Tech stocks account for 47 percent of the fund’s holdings, followed by consumer discretionary stocks at 22.7 percent and industrial stocks at 13.4 percent. Energy stocks and utility stocks combined account for just 0.7 percent of the index fund’s total value.According to Vanguard, the VUG ETF has an expense ratio of just 0.04% and has seen its market price grow by +28.07% year-over-year. At the time of writing, it has a market price of $300.81 and a 30 Day Median Bid/Ask Spread of 0.01%.

7. Vanguard Real Estate ETF (NYSEMKT: VNQ)

The Vanguard Real Estate ETF (NYSEMKT:VNQ) is a possible alternative if you want to gain exposure to the US real estate market. It’s also the largest real estate index fund, with over $78.3 billion in assets under management and an expense ratio of 0.12%. The YTD return for the ETF is 27.68%. Its inception date is 09/23/2004, highlighting the index fund’s strong track record of 17 years.

The MSCI US Investable Market Real Estate 25/50 Index, which broadly tracks the US real estate market, is its benchmark index. Although a few real estate management and development companies are included in the index, it is primarily made up of equity REITs, which own and run income-yielding real estate.

This ETF is especially appealing to dividend investors, as the fund’s 12-month dividend yield is 2.71% percent at the time of writing.

8. Vanguard Russell 2000 ETF (NASDAQ:VTWO)

For investors looking to take advantage of the potential upside of investing in small-cap firms, the Vanguard Russell 2000 ETF (NASDAQ: VTWO), which tracks the Russell 2000, is an excellent place to start. The fund owns shares in over 2,000 small and mid-cap firms with an average market cap of $3.3 billion.

Consumer discretionary companies (17.8%), healthcare companies (17.6%), and industrial enterprises (15.8%) made up the majority of this index fund’s holdings as of Q2 2021. The fund’s expense ratio is very low, at 0.1 percent, especially for a fund that invests in firms with growth potential.

With a total return of 20.2% in 2020, the Vanguard Russell 2000 ETF outperformed the S&P 500 benchmark index.

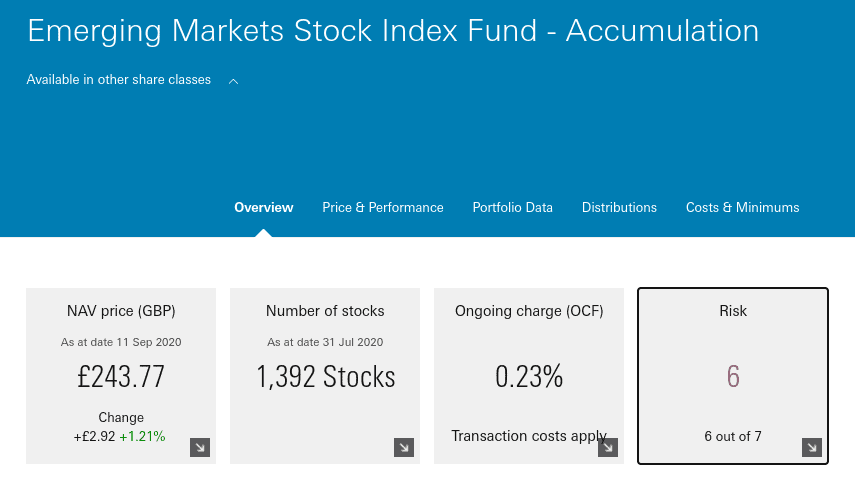

9. Schwab Emerging Markets Equity ETF (NYSEMKT:SCHE)

The Schwab Developing Markets Equity ETF (NYSEMKT:SCHE) may be a suitable option if you want portfolio exposure to high-growth emerging markets but don’t want your risk concentrated in a particular economy or area.

It follows the FTSE Emerging Index, which is made up of large and mid-cap equities from over 20 developing nations. The fund has 1,641 holdings, with China, Taiwan, India, Brazil, and South Africa having the highest concentrations. It has a 0.11 percent expense ratio.

In comparison to U.S. stocks, emerging market stocks have generally underperformed. The Schwab emerging market funds have combined total returns of roughly 45 percent over the last decade, compared to roughly 300 percent for the S&P 500. However, given that developing countries account for roughly 85% of the world’s population, long-term investors who can stomach volatility might want to give the SCHE ETF some attention.

10. Fidelity U.S. Sustainability Index Fund

Fidelity U.S. Sustainability Index Fund is a mutual fund that invests in the sustainability of the United States.

The Fidelity U.S. Sustainability Index Fund is a option for investors interested in sustainable investments (NASDAQMUTFUND: FITL.X). The MSCI USA ESG Leaders Index serves as the fund’s benchmark, tracking the performance of large and mid-cap domestic stocks with superior environmental, social, and governance (ESG) ratings. The index has a 0.11 percent expense ratio and no minimum investment requirement.

At the time of writing, the fund’s highest holdings are in technology (27.11 percent), healthcare (13.43 percent), and consumer discretionary (12 percent). Microsoft (NASDAQ:MSFT), the parent company of Google, is the holding in this sustainability ETF.

How do Index Funds UK Work?

UK index funds offer a simple and cost-effective way to buy a basket of shares. Whether you’re keen on UK stocks or a portfolio of international firms, index funds likely have a market to suit your requirements.

However, it’s important to first have an understanding of how index funds work in the UK before parting with your money. With this in mind, we would suggest reading through the sections outlined below.

Index Funds Track Multiple Companies

First and foremost, by investing in an index fund you will be buying shares in multiple companies. Most indexes look to track a specific marketplace – such as the London Stock Exchange. For example, an index tracking the FTSE 100 would consist of the 100 largest companies publicly listed in the UK.

Over in the US, popular indexes include the Dow Jones – which tracks 30 large-scale American firms from several industries. You then have the NASDAQ 100, which is an index that tracks the 100 largest stocks listed on the respective exchange. However, we should note that there are also index funds that track stocks from several international exchanges.

For example, the FTSE All-World UCITS ETF will track the stock price of over 3,400 companies from 50 different countries. This allows you to create a huge portfolio of international stocks with ease.

You’ll be investing in an ETF

ETFs allow you to invest in a basket of assets via a single trade. They are run and managed by large-scale financial institutions. Think along the lines of Vanguard and iShares.

The provider in question will offer an ETF that seeks to track a specific marketplace. This might be something simple like the FTSE 100, or a broader area of the investment space like dividend stocks or corporate bonds. In fact, ETFs can track virtually anything – which makes them highly conducive for investing in an index.

Here’s an example of how an index fund investment would work when utilizing the services of an ETF.

- You invest £2,000 into a Vanguard ETF that tracks the Dow Jones

- Vanguard will personally purchase and hold stocks in all 30 companies that make up the Dow

- The Dow Jones finishes the year 20% higher

- As such, your investment is now worth £2,400

On the above, you will also be entitled to your share of any dividends that are paid by companies listed on the Dow Jones.

Index Fund Weighting

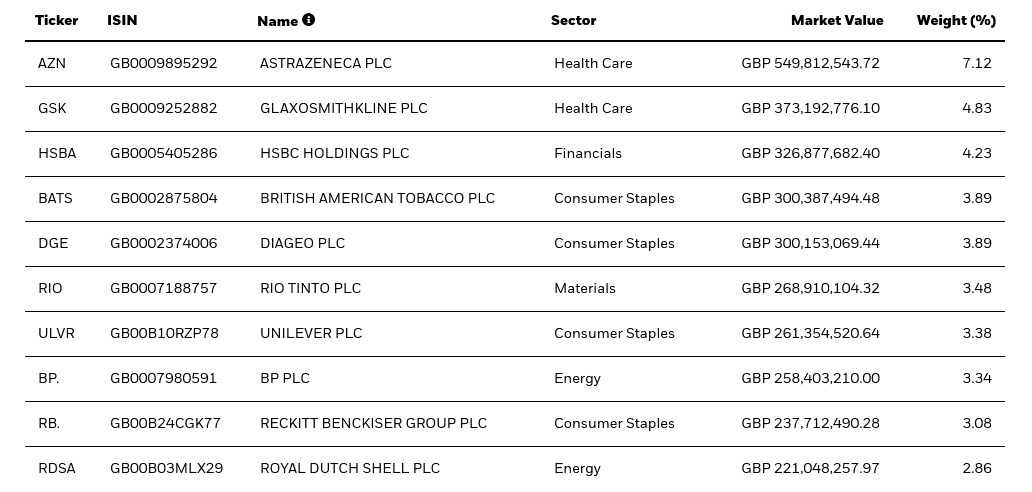

Irrespective of the index fund you are looking to invest in, all ETF providers will ‘weight’ their portfolio. In simple terms, this means that companies with a larger market capitalization will constitute a higher percentage of the index fund.

For example, if you were to invest in the NASDAQ 100, then companies like Apple, Microsoft, and Alphabet would have a much larger weight than the likes of Skyworks, Verisign, and Alexion Pharma.

The specific weighting of each company will have a direct impact on where your money goes.

For example, let’s suppose that HSBC has a 4% weighting on the FTSE 100. If you invested £10,000 into an ETF that tracks the index, then you would effectively be holding £400 worth of shares in HSBC. Similarly, if BP had a weighting of 3%, then you would hold £300 worth of BP shares.

Although most index funds in the UK base their weighting system on market valuation, some will take a more unconventional route. For example, the Dow Jones gives preference to constituents with a larger share price, even though they might have a much smaller market capitalization.

Fundamentals of Index Funds

So now that you know how UK index funds work, we need to explain how you stand to make money from your investment. In a nutshell, this comes in two forms. Firstly, you will make money when the net asset value (NAV) of your portfolio increases. Secondly, you will make money if and when companies within the index pay dividends.

Let’s explore each revenue stream in a bit more detail.

Net Asset Value (Nav)

The NAV is the most common way to calculate the value of an index fund investment. In its most basic form, the NAV takes all of the assets held by the provider, multiplied by the current value of each asset.

For example, if the index fund was tracking the FTSE 100, then you would need to take the stock price of each constituent, and then multiply it by the number of shares held by the ETF provider. The main premise here is that if the value of the shares goes up, as will the NAV. In turn, this will increase the value of your investment.

For example:

- Let’s suppose you invest £10,000 into an ETF index fund that tracks the S&P 500

- At the time of the investment, the fund has a NAV of £1.5 billion

- At the end of year one, the NAV has increased by 10%

- This means that the total NAV now stands at £1.65 billion

- Your investment would have also increased by 10%

- As such, your £10,000 investment is now worth £11,000

You do, however, also need to factor in potential index fund fees – which we will discuss later.

Dividends

If you invest in an index fund that contains dividend stocks, then you will be entitled to your share of any proceeds. The amount that you are entitled to will depend on:

- The weighting that the dividend-paying company has in the index fund

- The amount that you have invested in the index fund

For example:

- Let’s suppose that you invest £10,000 into a FTSE 100 index fund, which contains shares in AstraZeneca

- We’ll say that AstraZeneca has a weighting of 7% on the index

- In effect, this means that you hold £700 worth of shares in AstraZeneca

- Throughout the year, AstraZeneca pays a dividend yield of 5%

- On a total holding of £700 in AstraZeneca shares, you will receive £35 in dividends

It is important to note that you will not receive your share of dividend payments on the same day that they are distributed by the respective company. After all, UK index funds might contain dozens, if not hundreds of individuals dividend-paying companies.

This would make it highly inefficient for the ETF provider to keep making individual payments to its investors. With this in mind, ETF index funds will typically make a batch payment on a quarterly basis. This is also the case with ETFs that invest in coupon-paying bonds.

Important Features of UK Index Funds

There are dozens of ways to access the financial markets from the comfort of your home. But, are index funds right for you and your long-term investing goals?

To help clear the mist, below you will find a number of reasons why index funds are popular with UK investors.

Passive Income

In theory, by investing in an index fund, you stand the chance of earning passive income. We say ‘in theory’, as there is no guarantee that you will make money from your investment. However, the key point here is that once you inject funds into your chosen index fund, there is nothing more for you to do.

This is in stark contrast to a DIY investment strategy. After all, you will be required to constantly monitor the financial markets. You will also need to perform in-depth research on a company before making an investment. This is hugely time-consuming, so index funds are a way to invest without needing to be active.

Diversifying in a Low-Cost Environment – Portfolio Diversification

When you use a traditional stock broker, diversifying can be challenging. For example, let’s imagine that you wanted to invest in the 100 companies that make up the FTSE 100.

In doing this on a DIY basis, you would need to place 100 individual orders. If using a broker that charges a flat commission fee, this would be extremely expensive. When it comes to withdrawing your investment, you would need to repeat the same process – but in reverse.

What are the Risks of Investing in Index Funds UK?

Although index funds are a way to gain exposure to the financial markets in a simple and low-cost manner, there are several risks that you need to keep in mind before making an investment.

This includes:

You Might Miss out on Other Investment Opportunities

When you invest in an index fund, the ETF provider is tasked with one objective – tracking the index. This means that you are somewhat limited in which stocks you can invest in. A prime example of this Tesla. Although the US electric car maker is now one of the largest companies in the world in terms of market capitalization, it was recently snubbed by the S&P 500 index.

As such, you would need to go and make a separate investment into Tesla if you wish to add it to your portfolio. This isn’t a major issue, but more of a reminder that by relying exclusively on an index fund, you might be missing out on other opportunities.

You Won’t be Protected by a Market Downfall

Investing in an index fund does not protect you from a market downfall. On the contrary, the index fund will drag you down with it. After all, you are investing in a financial instrument that is tasked with tracking a group of stocks. If, for example, you were invested in the FTSE 100 during the 2008 financial crisis, you would have been looking at double-digit losses by the end of 2009.

The only way to have avoided this would have been to exit your position. With this in mind, some argue that UK index funds aren’t fully passive. This is because you still need to have a firm understanding of what is happening in the wider markets. Ultimately, the ETF provider will continue to track the index irrespective of how it is performing!

Some Index Funds are Involved in High-Risk Investments

All index funds carry an element of risk – more so than others. This is especially the case with index funds that are tasked with tracking stocks from the emerging markets. Sure, high-growth shares in India and South Africa can net you amazing returns.

But equally, they can also be responsible for major losses. Similarly, index funds that track small and medium-cap stocks are fraught with risk. This includes firms listed on the UK’s AIM and the Russell 2000 in the US.

UK or Foreign Stocks?

You first need to assess which marketplace you wish to target. For example, some investors prefer to stick with what they know by investing in an index fund that tracks UK companies. In other cases, some investors prefer to gain exposure to international stocks – such as those based in the US.

Each index fund will come with its own perceived risk levels. Think along the lines of Amazon, Apple, Coca Cola, GlaxoSmithKline, and British American Tobacco.

These are companies that have gone through recession after a recession – but have always recovered. If this is what you are interested in, then you’ll be best suited for index funds that track the likes of the Dow Jones, S&P 500, or FTSE 100.

At the other end of the spectrum, there are higher risk index funds – such as those that track small-to-medium companies or stocks based in the emerging markets. Ultimately, you need to assess the level of risk that you are comfortable taking before choosing an index fund.

Growth or Income?

You then need to decide whether you prefer UK index funds that are focused on growth or income. Regarding the former, these are index funds that have a chance of outperforming the market.

A prime example of this is the UK’s secondary stock exchange – the AIM. That is to say, while very few stocks listed on the AIM pay dividends, they do offer much higher growth potential. If this is what you are after, you’ll need to select an index fund that tracks smaller companies.

However, if you are more interested in income, this means that you will need to focus on index funds that track dividend-paying companies. A example of this is the Dow Jones. This is because of all 30 companies that make up the index pay dividends. While these firms might have plateaued in the growth department, you’ll benefit from a stable dividend policy.

UK Brokers for Index Funds

By this point in our guide, you should have a firm idea of the type of index fund that you wish to invest in. If so, you now need to find a UK broker that not only lists your chosen fund – but one that meets a range of important requirements. For example, your choice of broker needs to be FCA regulated, offer competitive fees, and support your preferred payment method.

To help point you in the right direction, below you will find a selection of UK brokers that allow you to invest in index funds in a simple and cost-effective manner.

1. IG

IG is a well-known brokerage house that offers over 10,000 shares and ETFs. This means that you will have access to an extensive library of index funds. Its share dealing department charges £8 per trade, or £3 per trade when you surpass three buy or sell orders in a month. Additionally, IG also allows you to trade index funds via CFD instruments or through its spread betting facility.

Both trading options can be accessed with leverage of up to 1:20 and 1:10 on major and minor indexes – respectively. Once again, going the CFD-route allows you to choose whether you think the index will increase or decrease in value. We should also note that IG offers a couple of ways to reduce or completely avoid capital gains tax. Firstly, if you choose to invest in an index fund ETF – you can shield the first £20,000 from tax by opening an ISA.

Alternatively, by trading index funds via its spread betting marketplace, all profits are exempt from tax. This is because spread betting falls within the remit of gambling. You will need to meet a slightly higher account minimum of £250 at IG. You can meet this with a UK debit card or by transferring funds from your bank account. In terms of safety, IG was first launched in 1974 and is now a public company listed on the London Stock Exchange. It holds several licenses – including with the FCA.

IG fees:

| Commission | 0% commission on all CFD instruments apart from shares. Fees vary depending on the exchange. |

| Deposit Fee | Free (0.5%-1% fee on credit cards) |

| Withdrawal fee | Free |

| Inactivity fees | £12 a month after 2 years of inactivity |

Sponsored ad. Your capital is at risk.

2. Plus500

This flexibility ensures that you can target profits even when the wider index is down. This stands at up to 1:20 if you’re UK retail client and trading major index funds. As such, a £200 deposit would allow you to trade with up to £4,000. If trading a minor index – such as those based in South Africa, Norway, or Italy – you’ll get leverage of 1:10.

All tradable instruments at Plus500 – including its index fund CFDs, are commission-free. You will also benefit from free deposits and withdrawals and tight spreads. Getting started with Plus500 will require a small deposit of just £100. You can instantly fund your account with your UK debit/credit card or Paypal. Plus500UK Ltd is authorised & regulated by the FCA (#509909). Its parent company is listed on the UK stock market.

Plus500 fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | $10 per quarter after 3 months of inactivity |

Conclusion

With hundreds of index funds to choose from, knowing which provider to go with can be difficult. As such, we hope that our list of UK index funds has helped point you in the right direction. If none of the options listed on this page are of interest, we have also outlined some handy tips on how to find an index fund yourself.