European markets could be about to face strong obstacles to keep advancing as a spike in the number of daily cases and growing hospitalisation numbers in key countries in the euro area are threatening to slow down the region’s economic recovery.

Last week, France entered a third nationwide lockdown as virus cases have continued to climb at a fast pace with the number of daily contagions landing above 60,000 just yesterday while Germany reported approximately 23,000 daily cases on 1 April – the highest tally since January this year back when a second wave of the virus was weakening in the country.

Meanwhile, complications in the process of securing and distributing vaccines among countries in the Eurozone are adding an extra degree of uncertainty to the situation as the rate at which treatments are being deployed was deemed “unacceptably slow” by the World Health Organization (WHO) with the institution voicing its concerns about the reappearance of a potentially “more worrying” virus crisis in the region.

In this particular context, multiple stock indexes in the region are approaching key resistances, with the question remaining, is the path of least resistance up for European stocks? Or could these indexes be about to face a turning point as the virus situation continues to worsen?

This is what the charts are currently suggesting

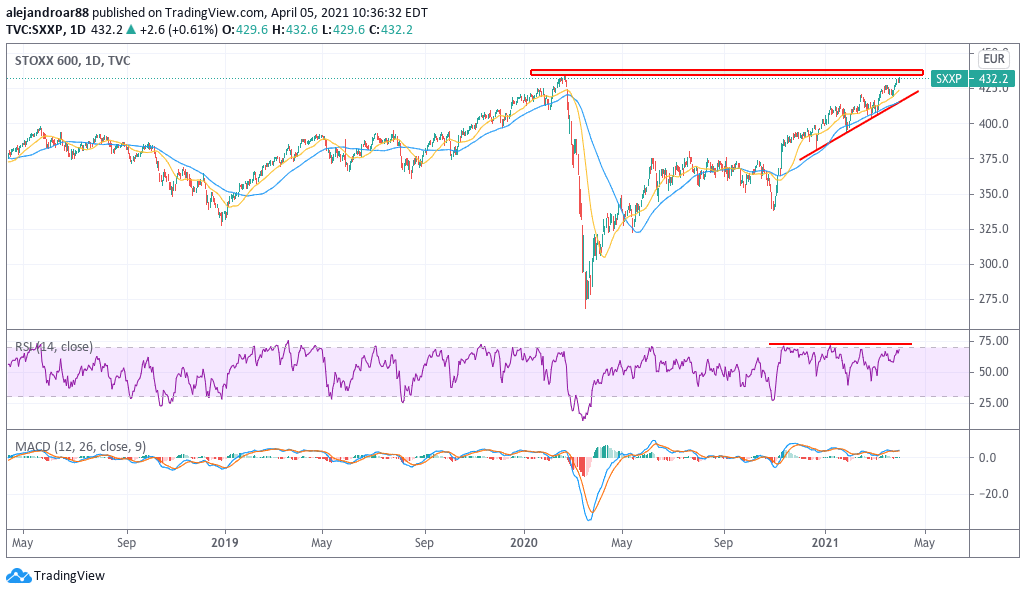

Starting with the Stoxx® Europe 600 index, which is primarily comprised of stocks in the United Kingdom, France, and Germany, the technical setup shown in the chart reflects that the index is steadily approaching its pre-pandemic levels despite the current headwinds.

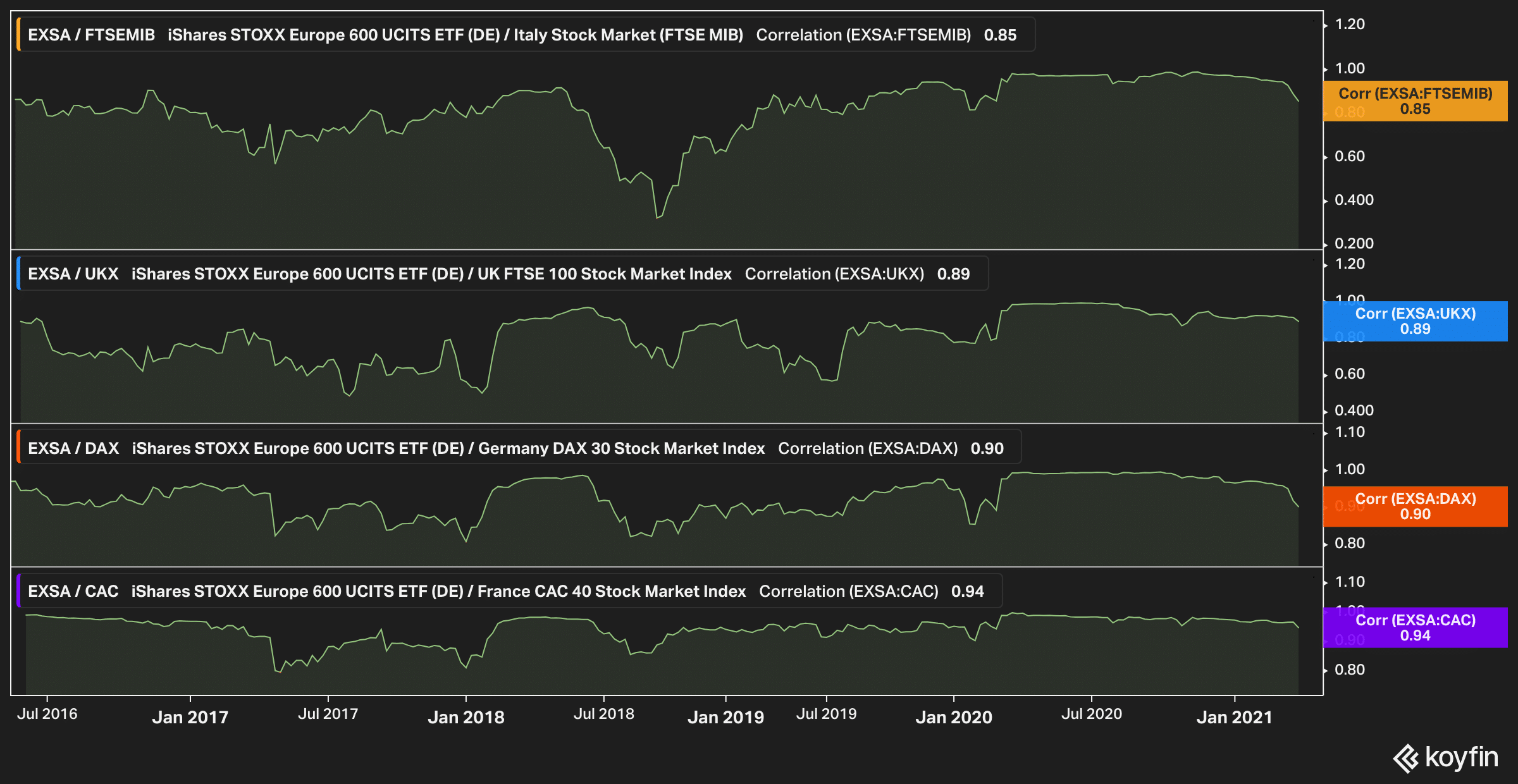

This performance seems in line with the advance of individual country-specific stock indexes including the German DAX and the CAC 40, both of which are either near or above their pre-pandemic highs as investors continue to trust in vaccines as an end-game solution to the pandemic.

This latest approach of the Stoxx 600 index to its pre-pandemic highs is accompanied by a series of higher lows in the price action, which reinforces a short-term bullish outlook, although it remains to be seen if market participants believe that the economic situation is healthy enough to justify higher valuations in the companies that comprise the index compared to a year ago.

One particularly positive indication that shows the potential for a successful break above this resistance is the sustained positive momentum seen in both the RSI and the MACD oscillators, which indicates that the uptrend has not lost steam at any given point since the November Pfizer (PFE) vaccine rally.

Given the strong correlation that exists between the performance of this benchmark and that of the major indexes in the region – as indicated by the chart above – we could extrapolate our analysis of the Stoxx 600 index to its peers, meaning that the outlook continues to be bullish unless a strong reversal follows after hitting this short-term threshold.

The situation with US Treasury yields remains a concern for equity markets

The latest spike in US Treasury yields is a particularly worrying development for equity markets outside the United States as well as domestically as the continuation of the latest uptrend could weaken the amount of inflows going to European equities as investors perceive a more appealing risk/reward ratio on bonds at these higher rates.

Last week, the chief investment officer of UBS Global Wealth Management, Mark Haefele, addressed these concerns by stating the following:

“We don’t think that inflation or yields are a risk. What I will say is that if you get yields moving significantly higher, maybe above 2.25% on the U.S., then that does potentially start to have implications for the valuations of equities, and then it would become a discussion about whether the earnings growth is strong enough to offset a valuation impact or not”.

Question & Answers (0)