Best Oil and Gas ETFs UK to Watch

Exchange Traded Funds (ETFs) are a way for investors to invest in the oil industry. They allow investors to speculate on the future value of the asset without needing to worry about ownership or storage. There are several oil ETFs available in the UK.

In this guide, we review some of the popular oil and gas ETFs based on trading volumes.

List of Popular Oil and Gas ETFs in the UK 2022

Here’s a list of popular oil ETFs UK in 2022 based on trading volumes and market caps. You can read our full analysis of each oil ETF by scrolling down.

- SPDR S&P Oil & Gas Exploration & Production ETF

- United States Oil Fund

- ProShares UltraShort Bloomberg Crude Oil

- Energy Select Sector SPDR ETF

- MicroSectors US Big Oil 3x Leveraged ETN

Popular Oil ETFs in the UK Reviewed

There are many metrics that you need to consider in your search for ETF that track oil and gas companies. For example, is the ETF backed by futures, swaps, stocks, or another complex financial instrument? You also need to check the past performance of the respective oil ETF and what annual fees it charges.

1. SPDR S&P Oil & Gas Exploration & Production ETF

As the name suggests, the SPDR S&P Oil & Gas Exploration & Production ETF focuses on companies that are active in the oil and gas industries. This means that you will be investing in a basket of oil and gas stocks – all of which are listed in the US.

To give you an idea of how this ETF is weighted, the largest holdings consist of Diamondback Energy, Marathon Oil Corporation, Devon Energy Corporation, Pioneer Natural Resources Company, and Exxon Mobil. There are also holdings in Occidental Petroleum Corporation, Valero Energy Corporation, and EOG Resources Inc.

It is important to note that the correlation between oil prices and the value of the respective stocks is not an exact science. This is because there are plenty of other metrics at bay.

For example, many oil shares within the SPDR S&P Oil & Gas Exploration & Production ETF are involved in mining. As such, the costs involved in extracting the oil and distributing it to the end market will vary quite considerably.

Over a 10-year period, the fund is actually down. This reflects the volatility of the asset class. Investors enter and exit the market at the right time – based on the direction of global oil prices.

2. United States Oil Fund – Access the West Texas Intermediate Benchmark

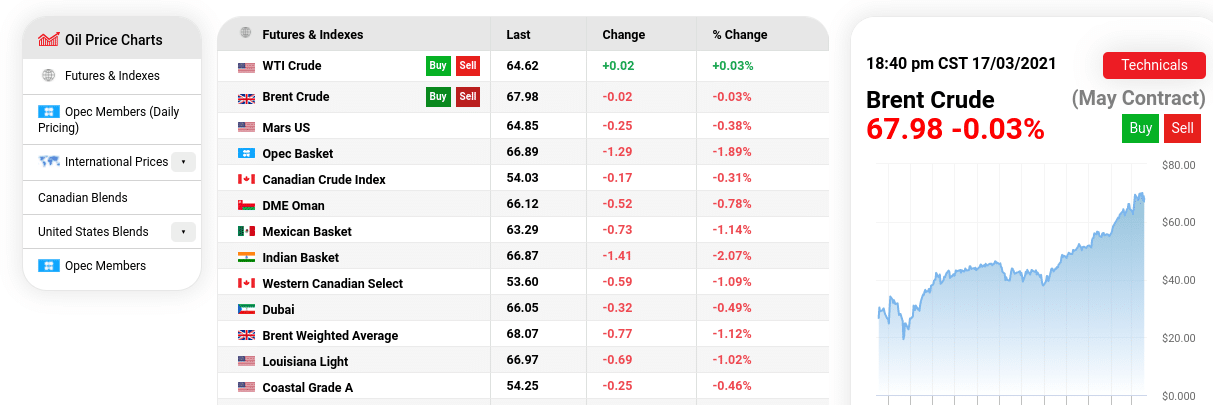

There are two key oil benchmarks that provide prices to the global trading scene. The first is Brent Crude Oil – which covers most of Europe. You then have the West Texas Intermediate (WTI) – which is primarily based on US oil prices. The United States Oil Fund provides exposure to the latter.

Put simply, this oil ETF is able to closely mirror the WTI benchmark by buying and selling futures. The ETF provider takes cares of the oil futures settling and investors remain indirect. In terms of the specifics, you will pay an annual expense ratio of 0.79%.

3. ProShares UltraShort Bloomberg Crude Oil – Short-Sell Crude Oil (Leveraged)

The ProShares UltraShort Bloomberg Crude Oil ETF allows you short-sell oil. That is to say, this is an ‘inverse’ fund – meaning that investors make money if the value of oil goes down.

Oil is a volatile commodity that moves up and down based on wider demand and supply forces. As such, if you think that the price of oil has hit a ceiling, this ETF allows you to profit from this.

This ETF is leveraged by a factor of 2x. So, if the value of the oil ETF went down by 5% in the open marketplace – you would be looking at gains of 10%. This is because you are speculating on the value of oil decreasing. However, if the oil ETF increased in value by 5%, your losses would amount to 10%. As such, this oil ETF is only suited to those of you that understand the risks of leveraged products.

4. Energy Select Sector SPDR ETF – Oil ETF UK for the Wider Energy Sector

As we have noted several times on this page, oil is a volatile asset class. With that in mind, some investors may choose an ETF that diversifies into several different fields from within the wider energy sector. For example, the Energy Select Sector SPDR ETF.

This ETF will give you access to 23 stocks that are actively involved in the US energy arena. This SPDR ETF exposed to Exxon Mobil and Chevron – with a weight of 24.5% and 21.1%. There are also more modest holdings in the likes of ConocoPhillips, Schlumberger NV, EOG Resources Inc., and Pioneer Natural Resources Company.

Although this ETF focuses on oil and gas stocks, there is also exposure to other niches in this space. This includes energy equipment and supplies, as well as consumable fuels. The Energy Select Sector SPDR fund has returned gains of 11.8% over the past 12 months.

Year-to-date, which takes us up to mid-March 2021 – the fund is up 27%. In terms of fees, this particular ETF charges an annual expense ratio of just 0.12%.

5. MicroSectors US Big Oil 3x Leveraged ETN – Leveraged Oil ETF UK

The MicroSectors US Big Oil 3x Leveraged ETN is an ETN (Exchange-Trade Note) as opposed to a conventional ETF. This means that part of the fund consists of debt. As such, not only do you have to consider market risk (i.e. the value of oil going down), but also the financial risk associated with the debt instruments held by the provider.

As the name suggests – the MicroSectors US Big Oil 3x Leveraged ETN is leveraged by a factor of three. This means that any gains and losses that you encounter will be tripled. For example, if the fund increases in value by 20% – you will make gains of 60%, less fees.

However, if the fund went down by just 10%, your losses would stand at 30% making it a high-risk investment. Nevertheless, in terms of how this ETN works, you will be investing in 10 large-cap stocks that are actively involved in the oil industry. Each of the 10 stocks has an equal weighting of 10%.

This includes Phillips 66, Marathon Petroleum Corp, Occidental Petroleum, Exxon Mobil Corp, Chevron Corp, and five other equities.

List of Oil ETFs

There are many other ETFs to choose from that we have covered.

Below you will find a list of alternative oil ETFs.

- Direxion Daily S&P Oil & Gas Exp. & Production

- VanEck Vectors Oil Services ETF

- Credit Suisse X-Links Crude Oil Shares

- Invesco Dynamic Oil & Gas Services ETF

- United States Brent Oil Fund LP

- ProShares K-1 Free Crude Oil Strategy ETF

- iShares MSCI Global Energy Producers ETF

- iPath Pure Beta Crude Oil ETN

If one of the entries from the above list of oil ETFs is of interest – you can head over to the provider’s website to find out how it works.

Important Features of Oil ETFs

There are dozens of oil ETFs to choose from – each of which will have its own risks, potential rewards, and overall objectives. As we have covered, there are oil ETFs to suit all taste buds – including the ability to invest with leverage and even short-sell the asset.

Oil ETF Objective

The objective of a fund reflects the funds aims. Understanding this could help you to recognise which funds align with your own personal objectives.

For example, many ETFs will look to buy shares in stocks that are involved in the oil and gas sectors. This might include large-cap companies like Exxon Mobil, BP, or Royal Dutch Shell, as well as oil tanker stocks such as Euronav.

With that said, some oil ETFs will also look to invest in much smaller stocks. This might include small oil operations that are involved in mining and exploration. In other cases, the oil ETF might give you access to this marketplace via futures. This is the case with the United States Oil Fund – which buys and sells futures to mirror the WTI benchmark index.

Long or Short

As we discussed in our list of Brent Oil ETFs, there are options that allow you to go long and short on this volatile asset class.

However, there are also ETFs like the ProShares UltraShort Bloomberg Crude Oil – which allows you to do the opposite. That is to say, by investing in this ETF you are speculating on the value of oil going down. If it does, you make a profit.

Leveraged

There are also a number of oil ETFs that are leveraged financial products. This means that both your profits and gains will be multiplied by a certain factor.

- For example, the previously discussed ProShares UltraShort Bloomberg Crude Oil ETF is leveraged at 2x.

- As such, 2% gains will stand at 4%, while 1% losses will stand at 2%.

- You then have the MicroSectors US Big Oil ETN, which is leveraged at a factor of 3x.

Once again, you do need to tread with caution when investing in leveraged oil ETFs. This is because your losses can spiral out of control should you not install sensible risk-management tools – such as a stop-loss order.

Performance vs Benchmark

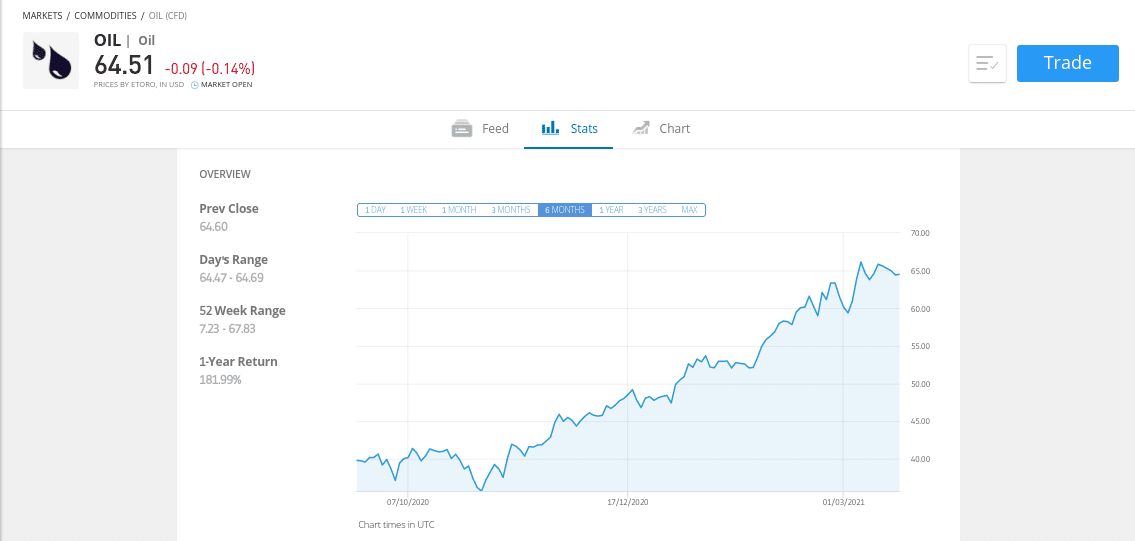

If you are looking for a financial instrument that tracks the value of Crude Oil or WTI Oil. This is because CFDs track the underlying market benchmark like-for-like. However, when you invest in an ETF – this won’t be the case.

After all, the ETF isn’t buying and storing barrels of oil. Instead, it will hold relevant shares, futures, or swaps. With this in mind, there will always be a disparity between the rise and fall of global oil prices against that of your chosen ETF. This is important, as by choosing the wrong ETF, your correct speculation on the future price of oil might not be financially realized.

There can and will be a huge disparity between the growth (or decline) of an oil ETF against that of actual benchmark prices.

Fees

All ETF providers charge a fee for giving you access to your chosen marketplace. In the vast majority of cases, oil ETF fees – known as the ‘Expense Ratio’, will cost you less than 1% per year.

You also need to consider the fees charged by your chosen stock broker. This is because the provider might charge an ETF dealing fee. If they do, you will pay this when you buy the oil ETF and again when you cash out.

Brokers offering Access to Oil ETFs

Once you have found an oil ETF that you like the look of, you then need to find a UK share dealing account that gives you access. Take note, you should never sign up with a brokerage site just because it offers the asset you wish to invest in.

On the contrary, you need to check key metrics like minimum account balances, ETF dealing fees, payment methods, regulation, and customer support.

Below we review a couple of regulated brokers and investment apps that allow you to invest in these oil ETFs.

1. Fineco Bank

Fineco allows you to buy assets in a low-cost environment.

In fact, the platform offers a list of 200 ETFs each month that you can invest in commission-free. If, however, your chosen oil ETF isn’t on the commission-free list, you will pay just £3.95 per trade. This is also charged when you cash your ETF investment out. There is also an annual fee of 0.25% charged by Fineco (in addition to the ETF expense ratio).

Fineco Bank gives you access to a large number of oil ETF markets. Fineco Bank is also a useful option if you want to diversify into other asset classes. This includes thousands of shares from dozens of stock markets, investment funds, and CFD trading facilities.

In terms of the fundamentals, Fineco Bank is authorized and regulated by the FCA, and your capital is covered by the FSCS. The minimum deposit to get started at this brokerage platform is just £100. There are no fees to deposit or withdraw funds. However, the only supported payment method is bank wire – meaning no debit/credit cards.

Sponsored ad. Your money is at risk.

How to Open a Brokerage Account

If you’re ready to invest in your chosen oil ETF from the comfort of your home – we are now going to walk you through the process step-by-step.

Step 1: Open an Account and Upload ID

First open an account at a regulated ETF broker. This will require some personal information – such as your name, address, etc.

Once you have verified your email address and mobile phone number, you then need to upload a copy of your passport or driver’s license. You also need to supply a recently issued bank account statement or utility bill to prove your home address.

Step 2: Make a Deposit

Once you have registered, you can then proceed to make a deposit.

This includes:

- Debit Card

- Credit Card

- E-Wallet (Paypal, Skrill, Neteller)

- Bank Transfer

Step 3: Search for an Oil ETF

You can now head over to the ‘Trade Markets’ section and find the ETF that you wish to invest in. With that said, if you already know which ETF is of interest – you can search for it.

In our example above, we are looking to invest in the SPDR S&P Oil & Gas Exploration & Production ETF.

Step 4: Complete Oil ETF Investment

You should now see an order box like the image below.

Then, click on the ‘Open Trade’ button to complete your commission-free investment!

Step 5: Oil ETF Dividends

If you are investing in an oil ETF that consists of stocks – there is every chance that you will also earn dividends. This is the case with the SPDR S&P Oil & Gas Exploration & Production ETF, which makes a distribution every three months.

Conclusion

In summary, oil is a volatile asset class that reacts very quickly to wider economic and geopolitical events. Oil ETFs allow investors to gain exposure to the oil market without buying any physical products.