Buy Bitcoin with Credit Card – Cheapest Providers 2026

There is often a misconception that you are unable to buy Bitcoin with a credit card in the UK. However, this couldn’t be further from the truth. As long the online broker in question is regulated by the FCA – then it’s all systems go.

In this guide, we discuss the easiest, safest, and most cost-effective way to buy Bitcoin with a credit card. On top of reviewing the best platforms to complete the investment with, we also walk you through the purchase process step-by-step.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

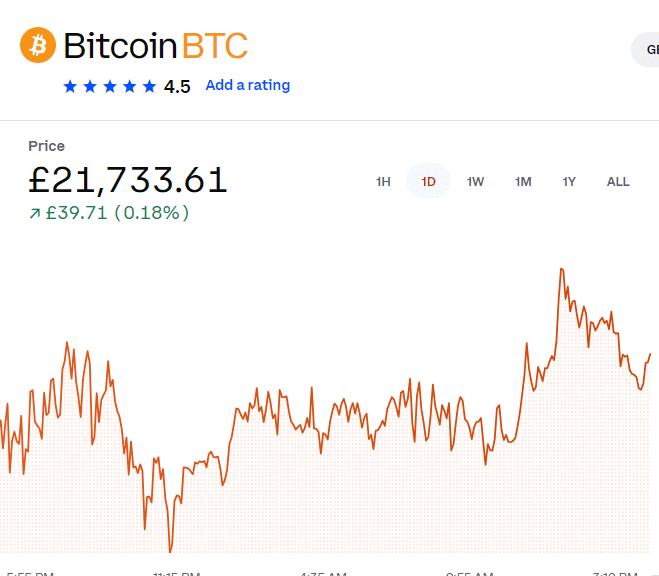

-

-

How to Buy Bitcoin with Credit Card Instantly – Step by Step Guide 2023

If you’ve got your heart set on buying Bitcoin with a UK credit card right now – the five steps outlined below show you what you need to do. In fact, the process at Coinbase not only takes 10 minutes – but the platform allows you to buy Bitcoin commission-free.

Here are the steps that you need to follow to buy Bitcoin with a credit card right now!

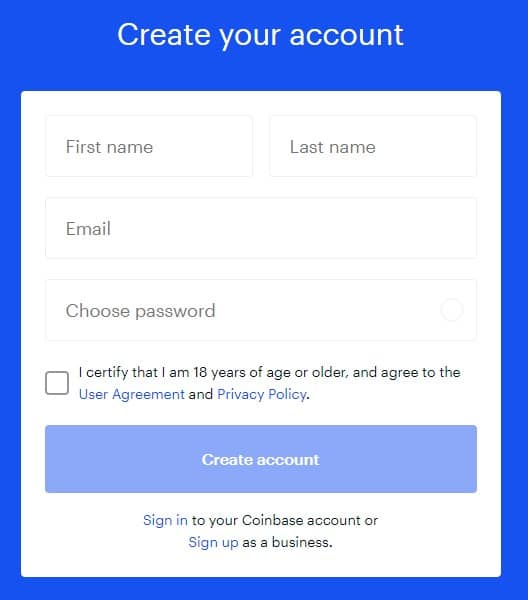

Step 1: Sign Up and Verify Your Account

To access Coinbase, go to their website (coinbase.com) or download their mobile app. To create an account, you must provide an email address, create a password, and agree to the service terms.

Ensure compliance with Know Your Customer (KYC) and anti-money laundering (AML) regulations by providing personal information and documents.

Secure Your Account: Add an extra layer of security to your Coinbase account by enabling two-factor authentication (2FA).

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Step 2: Deposit Funds With Credit Card

Coinbase is able to facilitate Bitcoin investments via credit card purchases because it is authorized and regulated by the FCA. As a result of this, Coinbase is required to verify your identity.

The two documents that you need to upload are:

- Government-issued ID, such as your passport or driver’s license

- Proof of address, such as a utility bill or bank account statement

Before you can purchase Bitcoin on Coinbase, you need to link a payment method to your account. Depending on where you live, you can use your bank account, credit/debit card, or any other method accepted by Coinbase in your area.

Step 3: Place an Order

Log into your Coinbase account after setting up and verifying your account.

- Click on “Buy/Sell”.

- Choose Bitcoin (BTC):

- Enter the payment method and amount

- Choose whether you want to buy Bitcoins in BTC or your local currency.

- Please select your previously linked payment method (credit card).

- Review the amount and fees associated with your purchase.

- Click “Buy” if everything looks correct.

Step 4: Buy Bitcoin

You may be required to confirm your purchase if you have enabled two-factor authentication. Your Coinbase account will be credited with Bitcoin once your purchase has been confirmed.

With over 35 million customers, Coinbase is the world’s most popular Bitcoin trading platform.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Benefits of Buying with Credit Card

There are several pros and cons of buying Bitcoin with a credit card. To ensure this payment method is right for you, we are going to discuss these points in more detail.

Let’s start with the benefits.

The Fastest way to buy Bitcoin

As is the case with any other online purchase, if you buy Bitcoin with a credit card you will benefit from an instantly processed transaction. This is in stark contrast to performing a bank account transfer.

Even if your bank is partnered with the Faster Payment Network – it usually takes online brokers 3-7 days to process the funds.

After all, the broker is likely to have thousands, if not millions of clients under its books – so the transaction needs to validated before it can be credited.

As you might know, Bitcoin operates in a super fast-paced environment, so bank wire is only going to delay proceedings. All in all, if you want to buy Bitcoin right now, a credit card can facilitate the process in minutes.

Credit Card Payment Protection

A lot of people in the UK are unaware that credit card providers offer greater protections against fraud in comparison to debit cards. Put simply, Section 75 of the Consumer Credit Act covers all purchases between £100 and £30,000.

As a result, if your credit card was used fraudulently, the provider is legally required to cover the transaction. On the contrary, debit card transactions are not covered by the aforementioned Section 75, meaning that the risks of misuse are slightly higher.

Payments are Encrypted

Leading on from the above section, an additional layer of security is added to credit card deposits via encryption.

Cashback and Rewards

An additional benefit that UK consumers often forget about is that some credit cards come with generous rewards. For example, every time you make a purchase with your card, you might get a certain amount of cashback.

In other cases, you might get points that can later be redeemed for rewards. Either way, you should contact your credit card provider to see if online brokerage deposits are eligible for this. If they are, this is a great way to gain exposure to Bitcoin.

Easy Withdrawals

When you invest in Bitcoin – cashing out can be easy or difficult depending on the method you use. Regarding the latter, some prefer to buy Bitcoin and then withdraw the coins to a private wallet.

Then, when it comes to cashing out, they first need to transfer the Bitcoin back to a third-party crypto exchange. After converting Bitcoin back to cash, they then need to withdraw the funds via bank wire. As you can imagine, this is not only a cumbersome way of investing in Bitcoin but is often the most costly, too.

Buy Bitcoin on Credit

This particular point is both a benefit and a risk. Put simply, by using a credit card to buy Bitcoin, you are effectively investing with borrowed funds. Although you need to tread with caution, this does allow you to gain exposure to the Bitcoin market even if you don’t have access to readily available cash.

In fact, your card provider will allow you to deposit right up to your agreed credit limit. In theory, as long as Bitcoin increases in value by more you pay in interest, then the process is financially viable. This particular is particularly appealing to those seeking leverage, too.

This is because as of January 2021 – the FCA prohibits UK retail clients from trading cryptocurrency CFDs. Before, these complex financial instruments allowed you to trade Bitcoin with twice the amount that you had in your CFD broker account. As such, a credit card deposit is potentially a back-door way of obtaining leverage on Bitcoin.

Drawbacks of Buying Bitcoin With Credit Card

We want our readers to make informed financial decisions – so it makes sense that we also cover the drawbacks of buying Bitcoin with a credit card.

The main risks that you need to consider are listed below:

Cash Advance Fee

This particular drawback is not a certainty, as not all credit card providers have such a policy in place. Nevertheless, it should be noted that online broker deposits are sometimes classed as a ‘Cash Advance’ by the provider. So what does this mean?

Well, cash advance payments typically refer to ATM withdrawals that are made with your credit card. When you do this, a cash advance fee of between 3% and 5% is usually incurred. Furthermore, unlike standard purchases, the interest on cash advance payments kicks in from day one.

If your credit card provider does associate your brokerage deposit as a cash advance – as it does with gambling-related transactions, then this is going to add an extra 3-5% on your investment costs. In other words, if you need to pay 3%, then you need to see Bitcoin increase by at least this value just to break even.

You Might Need to Pay Interest

Even if you are able to buy Bitcoin with your credit card without it being classed as a cash advance, you still need to factor in the impact of interest. After all, credit card companies are in the business of making money – which they do when interest is paid on top of what you borrow.

Now, there are a couple of things to note about the potentiality of payable interest on your Bitcoin purchase. Firstly, if it is not considered a cash advance payment, then the interest won’t kick in until the end of the statement month. As such, as long as you clear the Bitcoin investment amount in full, you won’t pay any interest.

Secondly, some credit card providers offer a generous interest-free period on purchases (sometimes up to 2-3 years). If your provider offers this, then this will give you a decent amount of time to repay the balance in full and thus – avoid interest.

Negative Equity is a Real Possibility

Negative equity is a term aligned with the property game. That is to say, you enter negative equity when the valuer of your home is less than what you owe to your mortgage provider.

However, you can also enter into negative equity when you buy Bitcoin with a credit card.

This will happen if the value of your investment goes down – meaning that your outstanding balance is higher than what your Bitcoin purchase is worth.

For example:

- Let’s suppose that you buy £3,000 worth of Bitcoin with your credit card

- At the time of the purchase, Bitcoin is worth £15,000

- A few weeks later, Bitcoin capitulates – declining to just £9,000

- This means that your £3,000 Bitcoin investment is worth 40% less – down to £1,800

- You receive your monthly statement from the credit card company for the £3,000 Bitcoin purchase

As you can see from the above, at the end of the month you receive the statement for your £3,000 purchase. However, your Bitcoin investment is now worth just £1,800. This means that even if you sold your Bitcoin you wouldn’t be able to cover the payment. This can then spiral out of control once the interest kicks in.

Bitcoin Credit Card Regulation

Buying Bitcoin with a credit card in the UK is somewhat confusing from a regulatory standpoint. First and foremost, the FCA is clear in its guidance that online platforms can sell Bitcoin to UK consumers via a credit card purchase.

However, the main barrier that you might face is that some credit card issuers do not allow you to make cryptocurrency purchases – even if the platform is FCA-regulated. This is from a risk management perspective, insofar that some financial houses do not want their customers investing in high-risk assets.

KYC

Even if your credit card issuer does support Bitcoin purchases, there is no avoiding the mandatory Know-Your-Customer (KYC) process. For those unaware, this is a verification exercise that sees FCA brokers ask for identity documents.

As we covered earlier, this includes a valid passport or driver’s license at a minimum. However, you will also likely need to provide proof of address.

This can be a recently issued bank account statement or utility bill. Ultimately, this is to ensure that the Bitcoin broker remains complaint with the FCA and that it does not jeopardize its regulated status.

Where to Buy Bitcoin With a Credit Card in the UK

Looking for the best platform to buy Bitcoin with a credit card? If so, check out the pre-vetted list of brokers listed below.

1. Coinbase – Best Crypto Trading Plarform to Buy Bitcoin in the UK

Cryptocurrency and trading knowledge are not required to use the platform. All you need to do is open an account, upload your ID, and deposit money. If you use a UK debit card to add funds to the platform, you will be charged a 3.99% transaction fee.

With Coinbase, you can easily buy Bitcoin using a credit card. Registering an account and uploading your passport or driver’s license takes only a few minutes. You will need to deposit $50 with your credit card as a minimum deposit.

The result is that if you purchase £1,000 of Bitcoin, you’ll lose £39.99. Your Bitcoin will be stored in your Coinbase web wallet once you make the purchase.

In addition, if you know how to use a private cryptocurrency wallet, you can withdraw your coins. No matter what you do, when it’s time to cash out your Bitcoin, you must pay a 1.49% trading commission. Again, this is an expensive undertaking.

Although Coinbase is a safe cryptocurrency brokerage, it is regulated by the FCA and has a great reputation. In addition, you’ll be able to choose from various other digital currencies. Several cryptocurrencies are included in this list, including Litecoin, Bitcoin Cash, Ethereum, Ripple, and others.

Need more information about Coinbase? If so, you can read our in-depth Coinbase review here!

Pros

- A great reputation and more than 35 million customers

- A very user-friendly interface

- Transfer funds via bank transfer or debit card

- A private wallet can be used to withdraw your coins

- A handy mobile application

- FCA-licensed

Cons

- 99% fee applies to debit card deposits

- Bitcoin trading fee of 1.49%

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

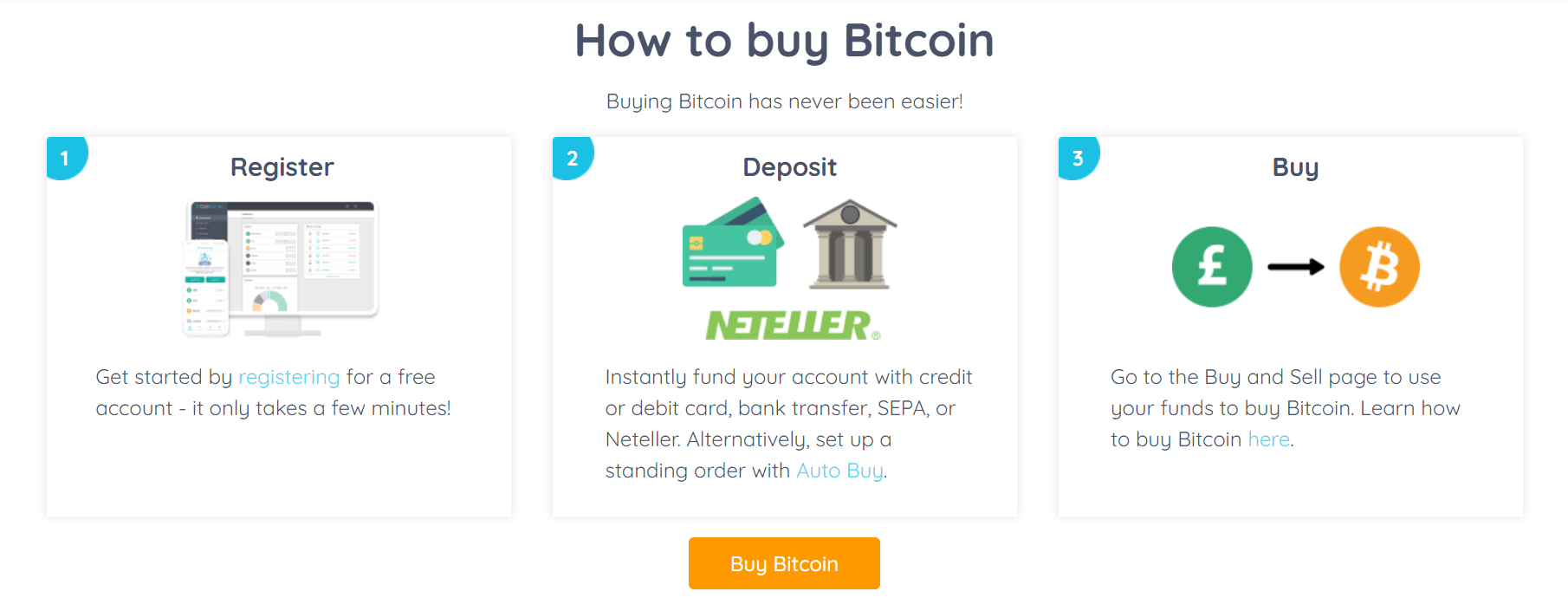

2. CoinCorner – Best UK Bitcoin Trading Platform for Fast Account Set-Up

If you’re looking to consider other options, CoinCorner is worth a mention. The online cryptocurrency specialist allows you to buy Bitcoin with a credit card, debit card, or bank transfer.

From our experience, the end-to-end process of registering, making a deposit, and buying Bitcoin should take no more than a few minutes. The minimum deposit at this platform is just £5, which is great if you want to start off with small amounts.

In terms of fees, this is where CoinCorner is lacking. After all, you will need to pay 2.5% to use your credit card. In addition to this, you also need to pay a trading fee when you buy and sell Bitcoin. If you are investing more than £300, then this amounts to 1%.

For example, if you buy £500 worth of Bitcoin with your credit card, you’ll pay a 2.5% fee of £12.50, and then a 1% commission of £5. Finally, CoinCorner is regulated by the FCA, so the safety of your funds should not be a concern.

Pros

- Very fast to start trading

- Supports a wide variety of payments

- Set up recurring cryptocurrency investment

- Reward program with 1,000+ businesses

Cons

- Extremely high trading fees

- Minimal charting and trading tools

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

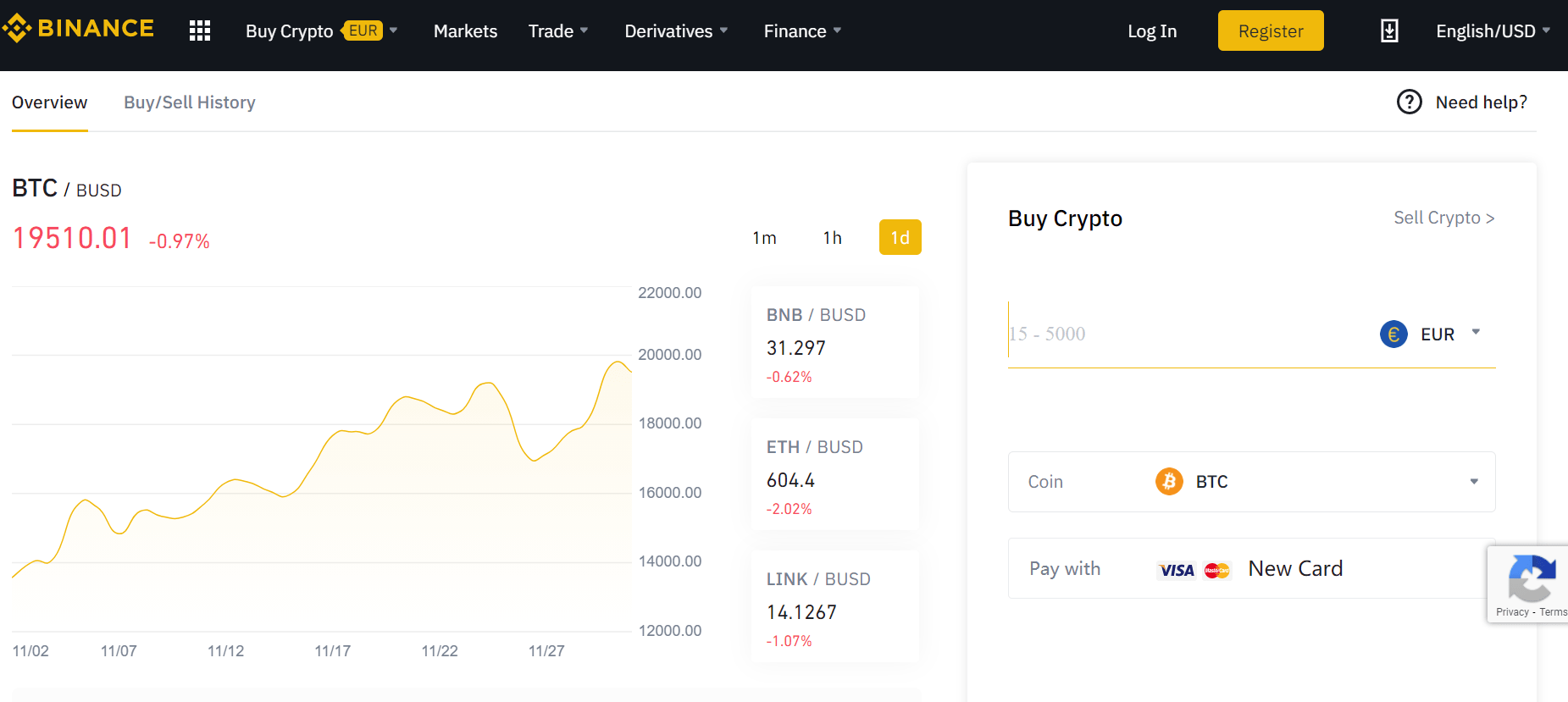

3. Binance – Popular Bitcoin Trading Platform With Hundreds of Cryptocurrency Pairs

Binance is a good option if you want to buy Bitcoin with a credit card and then engage in short-term trading. This is because the cryptocurrency exchange offers hundreds of tradable pairs.

In fact, Binance facilitates billions of dollars worth of cryptocurrency trades each and every day, making it one of the largest platforms in the space.

If you’re based in the UK, then you will pay a 2% transaction fee to buy Bitcoin with your credit card. After that, you can keep your coins in the Binance wallet or withdraw them out. Alternatively, you might decide to trade your Bitcoin with another cryptocurrency like Ethereum or Ripple.

We should note that Binance isn’t really suitable for newbie investors. This is why the platform should only be used if you have some experience in the cryptocurrency trading scene.

Pros

- Largest cryptocurrency exchange in terms of trading volume

- Hundreds of cryptocurrency pairs supported

- Trading commission of just 0.1%

- Supports UK debit/credit cards and bank transfers

- Great reputation in the cryptocurrency scene

- Ideal for advanced traders that seek sophisticated tools and features

Cons

- Not great for newbie investors

- A standard charge of 2% on debit/credit card deposits

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Conclusion

A small selection of brokers can facilitate the purchase of Bitcoin in the UK with a credit card. However, you should consider the risks of purchasing Bitcoin with a credit card.

If the Bitcoin value falls below what you owe to the card provider, you might incur interest on the purchase.

Coinbase, however, is by far the best FCA-regulated broker for purchasing Bitcoin with a credit card. Your Bitcoin investment will be processed instantly, and you will never pay a penny in commissions.

Click the link below to buy Bitcoin online in less than 10 minutes with a credit card at Coinbase!

Coinbase – Buy Bitcoin With a Credit Card Instantly

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

FAQs

How do I buy Bitcoin with a credit card with no ID?

In order for online platforms to sell Bitcoin to UK clients with a credit card, it must be regulated by the FCA. Conversely, all FCA brokers must verify the identity of all account holders. As such, you won’t be able to buy Bitcoin with a credit card without uploading a copy of your ID.

If I buy Bitcoin with a credit card, is there a cash advance fee?

This will depend on the policy of your credit card issuer. Crucially, ATM withdrawals, gambling transactions, and some online brokerage deposits will be classed as a cash advance. If it is, you will likely pay an additional fee of between 3% and 5%.

Is it legal to buy Bitcoin with a credit card?

Yes, it is legal to buy Bitcoin with a credit card in the UK. However, the broker in question must be licensed by the FCA. Additionally, some credit card providers do not allow you to buy Bitcoin with your card.

What is the minimum Bitcoin credit card purchase?

This depends on which broker you decide to use. If you buy Bitcoin from Coinbase, you only need to meet a $0.10 minimum investment.

How do you cash out Bitcoin back to a credit card?

If using Coinbase, you can cash out your Bitcoin investment back to the same credit card that you used to deposit.

What credit cards fees apply when you buy Bitcoin?

You need to factor in the potentiality of the purchase being marked as a cash advance, as well as interest being applied on your next statement. Additionally, most brokers will charge you a trading commission on the purchase.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Buying Bitcoin with a credit card in the UK is somewhat confusing from a regulatory standpoint. First and foremost, the FCA is clear in its guidance that online platforms can sell Bitcoin to UK consumers via a credit card purchase.

Buying Bitcoin with a credit card in the UK is somewhat confusing from a regulatory standpoint. First and foremost, the FCA is clear in its guidance that online platforms can sell Bitcoin to UK consumers via a credit card purchase.