Best Crypto Exchanges UK 2026 – Cheapest Options Revealed

These days there is an abundance of crypto exchanges to choose from due to the ever-growing popularity of the cryptocurrency market. These exchanges allow users to buy, sell, and exchange cryptos from the comfort of their own homes – although it’s crucial that you choose an exchange that will suit your unique needs and investment goals.

This guide will discuss the best crypto exchange UK in detail, touching on the top exchange available to traders today and highlighting how you can begin trading crypto right now – with low fees!

Key Points on Crypto Exchanges in UK

- Crypto exchanges are platforms where traders can buy and sell cryptocurrency using FIAT currency or crypto.

- There are many crypto exchanges in operation these days, most of them offering a wide array of coins, tokens, and crypto/crypto pairs to trade.

- When choosing a crypto exchange, it’s crucial to consider factors such as the exchange’s safety, fee structure, and trading tools.

- Our recommended broker for trading cryptocurrency is eToro.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Best Crypto Exchange UK 2026

If you’re looking to starting buying and selling digital currencies right now, below you will find the best crypto exchanges in the UK.

- eToro – Overall Best Crypto Broker in the UK with Copy Trading Tools

- MEXC – Cryptocurrency Exchange Offers 0% Spot Trading Fees

- Coinbase – User-Friendly Crypto Exchange UK With Over 35 Million Customers

- Binance – Popular UK Exchange With Hundreds of Cryptocurrency Pairs

- PrimeXBT – Global Digital Exchange Catering to Traders of all Levels

- Margex – Leveraged Trading and Perpetual Futures Alongside Spot Markets

- Bybit – Popular Crypto Exchange with Derivatives Markets

- Kucoin – 18 Million Global Users

- Kraken – Ideal Crypto Exchange for Advanced Traders

- Gate io – 1300 + Tokens Available to Trade

- BingX – Diversified trading with a broad range of features

- Bitget – Popular exchange with celebrity endorsement

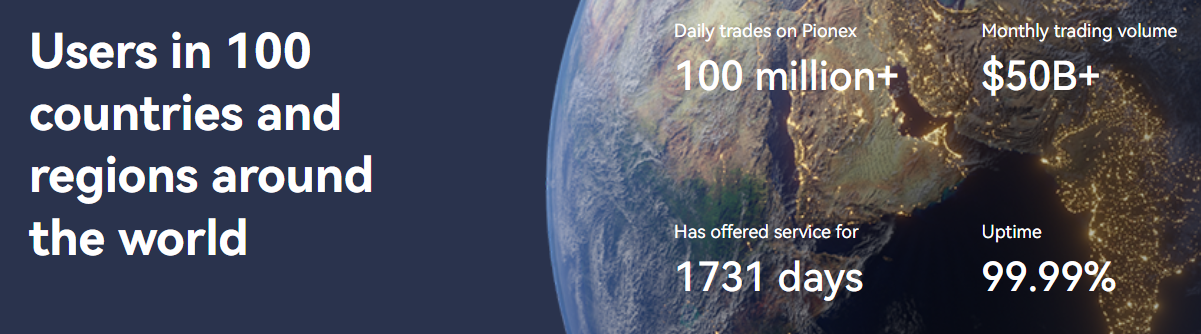

- Pionex – 2019 launched exchange that focuses on automated trading

While not on our list, AQRU is a popular and trusted crypto exchange that offers competitive interest rates on several crypto assets. For more details you can read our in-depth AQRU review.

Best Platform To Buy Cryptocurrency UK Reviewed

With so many crypto exchanges active in the UK trading scene, there are certain metrics in particular that can help you separate the wheat from the chaff.

On top of regulation and safety, this should also include supported cryptocurrencies, fees, commissions, payment methods, and more.

1. eToro – Reputable Bitcoin Broker UK with Copy Trading Features

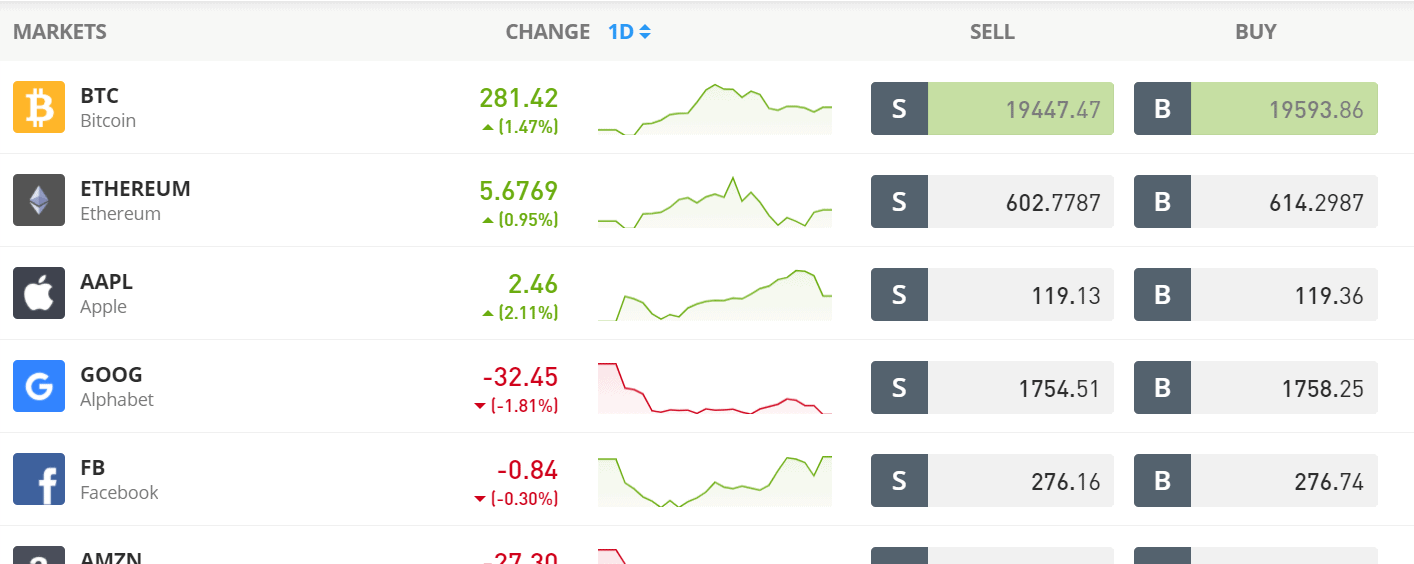

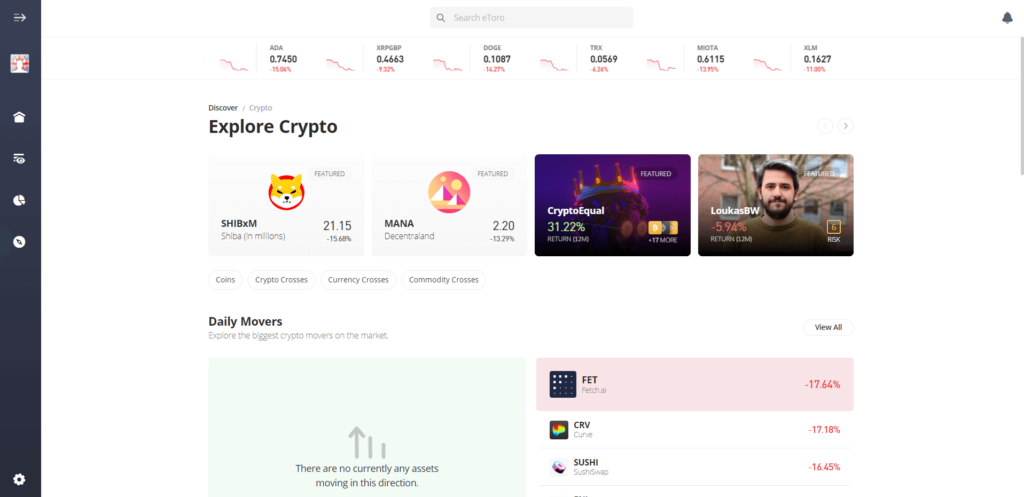

eToro is a popular Bitcoin broker with a solid reputation as one of the leading social trading providers. On top of stocks, ETFs, and thousands of CFD markets, eToro allows you to buy and sell over 80 cryptocurrencies, including many of the best new crypto coins. This includes everything from Bitcoin and Ethereum to Ripple and EOS.

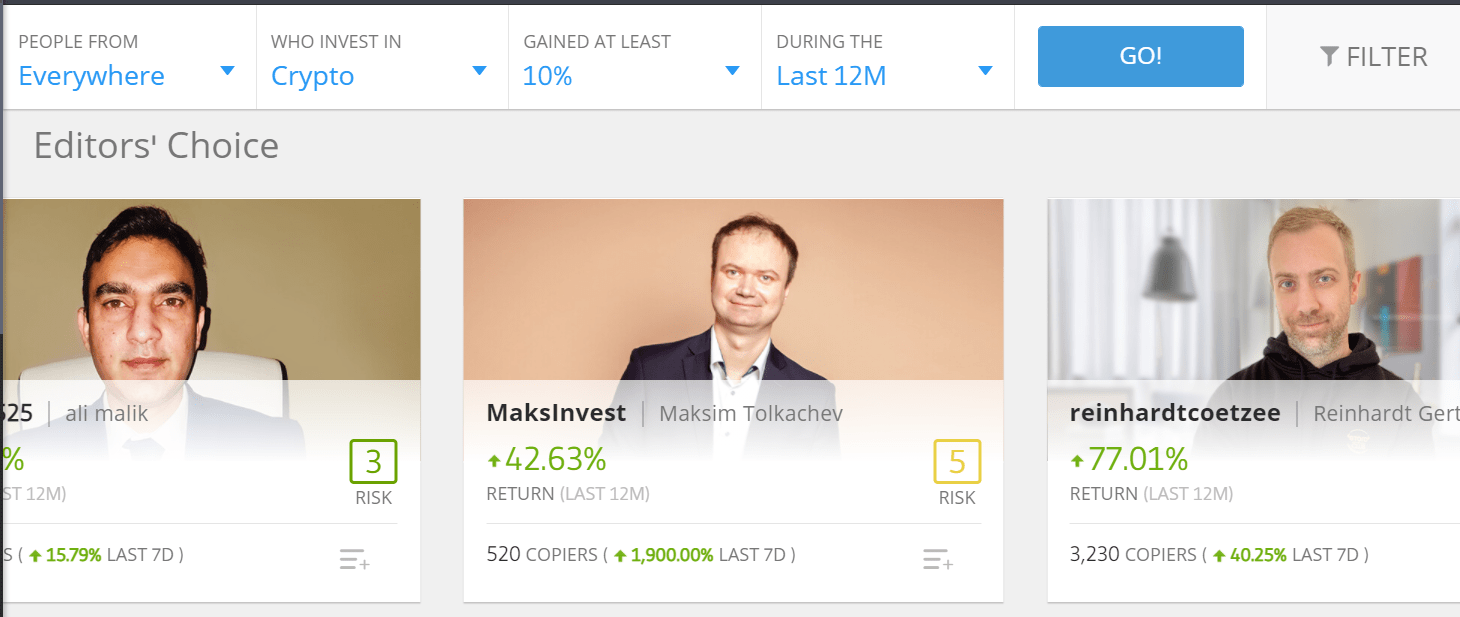

One of the most appealing things about eToro – which is now home to over 30 million traders, is that the platform offers copy trading tools. You will, however, need to pay a small 0.5% FX fee when you make a deposit in non-USD fiat.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

You can also add funds to your account with a wide range of payment methods. Once you go through the account opening process, eToro also gives you the option of trading cryptocurrencies passively. This is through its ‘Copy Trading‘ feature, which allows you to copy the trades of experienced digital currency investors.

Additionally, it also offers fully managed portfolios. In what it calls ‘CopyPortfolios’, this includes an investment strategy that focuses on cryptocurrencies. What we also like about eToro is that you can buy, sell, and trade digital currencies at this top-rated platform online or via the eToro investment app.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2. MEXC – Best Crypto Exchange Offering 1,000+ Assets with 0% Spot Trading Fees

Our top pick for the best cryptocurrency in the UK is MEXC. Offering a strategic edge, MEXC boasts a fee structure that caters to both novices and seasoned traders alike. With 0% spot trading fees and minimal charges—merely 0.02% taker fee for futures trading (0% for limit orders)—MEXC becomes the go-to hub for crypto day traders.

Offering a strategic edge compared to other top crypto exchanges, MEXC offers a fee structure that caters to beginner investors and seasoned traders. Offering spot trading fees of 0% and taker fees for futures trading starting at just 0.02% – MEXC has become the go-to-trading platform for millions of traders.

Furthermore, investors can start trading more than 1,000 crypto assets with as little as $5. Advanced traders can leverage the advanced trading and chatting patterns that MEXC has to offer. Investors can also apply leverage to maximize their returns.

Beginners can take advantage of the educational materials that MEXC offers. They can also access copy trading features – allowing them to copy the exact trades of more senior and professional traders on the platform.

Users can lock their assets for attractive Annual Percentage Rates (APRs) such as up to 8.8% for USDT. This is similar to staking but with the flexibility to unlock tokens at will. Other features such as 24/7 customer support and 2FA security protocols makes MEXC a reliable cryptocurrency exchange.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

3. Coinbase – User-Friendly Crypto Exchange UK With Over 35 Million Customers

Coinbase is a crypto exchange and Bitcoin trading platform that is particularly popular with inexperienced traders. As soon as you head over to the provider’s website, you’ll see that the platform is simple, clean, and easy to navigate.

This is also the case when it comes to opening an account, which in most cases – should take you no more than 10-15 minutes. You will find an assortment of digital currencies at Coinbase Pro – which includes both large and small-cap projects.

For example, while most investors will stick with major cryptocurrencies like Bitcoin, Ethereum, and Litecoin, Coinbase also hosts Kyber Network, OMG, and LOOM. Irrespective of which digital currency you decide to buy at this top-rated exchange, Coinbase allows you to deposit funds with ease.

This is because you can choose from a UK debit card or bank account transfer. With that said, it is important to note that Coinbase charges 3.99% when you deposit funds with a debit card.

Additionally, Coinbase is expensive when it comes to trading commissions. This stands at 1.49% on all buy and sell orders. For example, if you bought £1,000 worth of Bitcoin, Coinbase would charge you £14.90. Then, if you sold your Bitcoin when it was worth £3,000, your 1.49% commission would amount to £44.70.

Nevertheless, once you have made a crypto purchase at Coinbase, you can leave the coins at the platform or withdraw them to a private wallet. If you opt for the former, Coinbase is known for its institutional-grade security practices. This includes keeping 98% of client funds in cold storage, meaning they are held offline.

There are several user-centric security controls that you can set up, too. For example, you can place a 48-house time-lock on all withdrawal requests, and automatically block account log-ins that don’t come from your registered device or IP address. Finally, Coinbase also offers a mobile trading app that also doubles-up as a Bitcoin wallet.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

4. Binance – Popular UK Crypto Exchange with Hundreds of Cryptocurrency Pairs

Binance is great if you are planning to day trade or swing trade. This is because the crypto exchange gives you access to hundreds of tradable pairs.

This makes it highly conducive for actively trading digital currencies, as opposed to buying and storing them for several years. Although Binance was only launched in 2017, it is home to the largest daily trading volume and liquidity in the cryptocurrency industry.

In fact, in the 24 hours prior to writing this guide, the platform facilitated more than $17 billion worth of cryptocurrency trades. On top of offering one of the most extensive numbers of cryptocurrency trading markets, Binance is also renowned for offering super competitive fees.

This actually starts at just 0.10% – meaning that a £1,000 buy or sell position would cost just £1 in commission. If you find yourself trading large volumes, your fees will be reduced even further. You can also lower your trading commission by holding a quantity of BNB coins, which is the cryptocurrency native to the Binance platform.

On the flip side, Binance is a bit expensive if you are planning to fund your account with a UK debit card. This is because you’ll need to pay 2% of the transaction amount. Although cheaper than the 3.99% required by Coinbase.

Nevertheless, the Binance trading suite itself is jam-packed with tools and features that will suit the seasoned pro. This covers a full range of chart reading tools, technical indicators, and the ability to connect your API to a third-party provider. The latter allows you to deploy automated trading strategies and robots.

In terms of safety, the main Binance exchange isn’t a regulated entity. It does, however, have a great reputation for security and customer care. We like the SAFU (Safe Asset Fund for Users), which is an emergency insurance fund to cover the unfortunate event of an external hack.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

5. Prime XBT – Established Investment Platform Offering Access to Crypto

Founded in 2018, Prime XBT in active in more than 150 countries worldwide. Known for its wide range of features, top tier liquidity and security, Prime XBT provides a robust trading platform for those looking for reliable market data and performance. Furthermore, the platform is highly customizable so you can adapt it to your personal trading style.

All trades are executed via Amazon AWS Servers in London. By accessing multiple liquidity sources, Prime XBT can ensure all trades have low latency and smooth pricing. As an exchange to trade crypto, Prime XBT offers all of the leading assets and tokens.

Trading fees are competitive and market spreads are tight. The platform offers a wide range of advanced charting tools and so appeals to everyone from beginner to expert. Furthermore, Prime XBT has recently enabled trading of crypto futures giving traders even more choice.

With over 1 million satisfied customers and the winner of a variety of industry awards, Prime XBT defines the modern cryptocurrency trading experience.

It is quick and easy to start crypto trading. Users just need to register and pre-fund their account. Opening an account is free and within minutes you have complete access to all PrimeXBT trading features.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

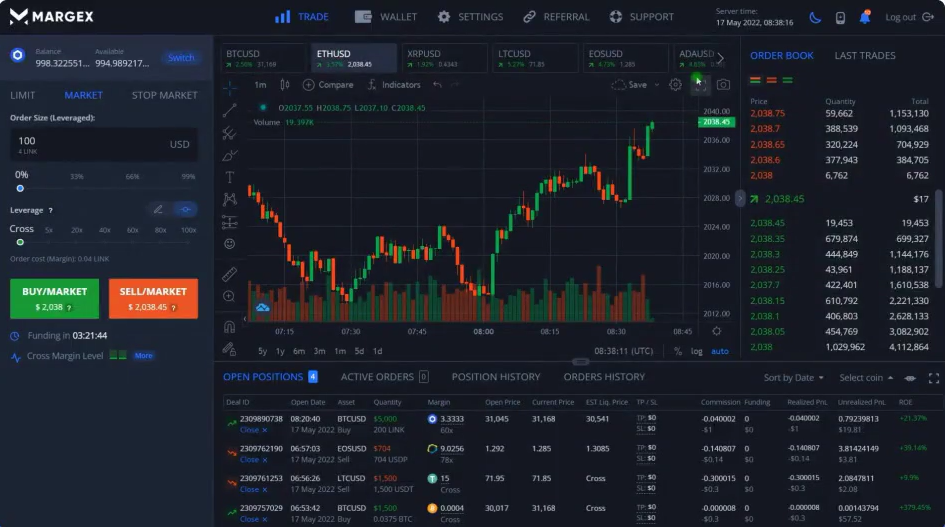

6. Margex – Sophisticated Crypto Trading Providing a Range of Spot and Leveraged Markets

Margex is a leading digital asset trading and investment platform providing cutting edge features to customers worldwide. The platform has a mission to provide fair, secure and easy to use trading tools that enables its clients direct access to a wide range of cryptocurrencies and digital assets.

The platform features 24/7 customer support, up to $40 million in order book liquidity and is capable of processing 100,000 + trades per second. Margex clients are able to open both spot and leverage trades and also have access to staking services.

The platform makes use of over 12 external crypto exchanges to ensure that liquidity is always on hand. All assets are held under bank grade security and because the platform isnt holden to Know Your Customer (KYC) requirements, users can open an account with no personal details.

In an effort to combat market manipulation, Margex has designed an innovative price manipulation system called the MP Shield System. By closely monitoring all price feeds, the program uses AI driven algorithmic technology to identify any pump and dump scammers. Alongside an ethos of avoiding illiquid markets, Margex offer some of the safest trading facilities on the market today.

The platform has been designed with user friendliness in mind. Therefore, the trading screen is intuitive and easy to learn.

Margex prides itself on data security and avows not to disclose any personal information. Furthermore, the platform assures its clients that 100% of all assets are kept in offline cold storage.

Unlike other platforms, Margex users have access to every possible piece of trading information meaning client have complete control over their trading experience.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

7. Bybit – Popular Crypto Exchange with Derivatives Markets

Another great crypto exchange to consider is Bybit. Although it has only been around for a few years, Bybit has grown exponentially in that time and now has over 3 million registered users. Bybit is based in Singapore and offers a myriad of markets to trade on, including the spot market and various derivatives markets. Notably, users can trade ‘inverse perpetual futures’, which provides exposure to the future value of specific trading pairs – with the option to use leverage too.

At present, Bybit has over 80 cryptocurrencies available to trade, ranging from popular options such as BTC and ETH, to lesser-known coins such as Tezos and Aave. In terms of funding your account, Bybit allows users to deposit a large number of cryptos and also exchange FIAT currency into crypto using Bybit’s Fiat Gateway. The latter option will require some KYC checks to be completed with third-party providers, and a service fee will also be charged – although this will vary depending on the provider.

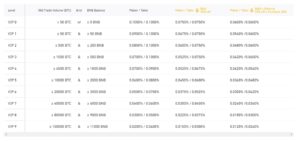

In terms of fees, Bybit utilises a ‘maker/taker’ structure, whereby users are charged a percentage fee when they buy and sell an asset. These fees are very low with Bybit – for example, taker fees are only 0.1%, whereas maker fees are 0.0% when trading the spot market. Finally, Bybit offers a web-based application and a mobile app for iOS and Android, with the latter featuring extensive price alerts and no server overload or downtime!

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

8. Kucoin – Flexible Trading Destination Offering a Wealth of Customizable Features

Kucoin is an established platform that provides everything the modern cryptocurrency trader needs. Its extensive feature set is popular among experienced crypto traders and those looking for low cap tokens that are not available else where. In total, Kucoin offer over 840 crypto pairs.

The platform provides access to futures and leveraged trading markets as well as pot. Furthermore, Kucoin users can also take their assets to earn passive income.

Fees at Kucoin are competitive with some of the lowest rates on the market. Holders of the native Kucoin Token (KCS) also qualify for further trade fee discounts. Kucoin charge maker-taker fees with takers paying a little more than liquidity adding makers. With prices starting at just 0.10% Kucoin continues to prove a popular destination among the cryptocurrency market.

Whist available in the UK, Kucoin is not fully licensed in the US meaning some functions are not completely available. The platform also features a built in wallet which makes trading between accounts easy.

With such a broad range of features and coins, Kucoin is popular among experienced traders. Furthermore, the mobile application makes it easy to trade on the go. Boasting over 70 payments methods and low minimum deposits, Kucoin continues to be an attractive destination for crypto traders.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

9. Kraken – Ideal Crypto Exchange for Advanced Traders

If you’re looking to buy cryptocurrency, you may also wish to consider Kraken. Kraken boasts over 6 million clients across nearly 190 countries, making it one of the largest exchanges in the world. In terms of regulation, Kraken is authorised by various entities worldwide, including FinCEN and FINTRAC.

Although not regulated directly by the FCA, Kraken’s well-known CryptoFacilities brand is – which adds more credibility to the platform.

Users can trade on Kraken using the Instant Buy feature or Kraken Pro, with the latter being the pure exchange element of the platform. If you use the former, there will be a 1.5% trading fee and a transaction fee, depending on which payment type you use.

To provide an example of this, credit card purchases will have a 3.75% fee plus a flat fee of €0.25. If you opt to trade on Kraken Pro, you’ll pay a maker or taker fee, which works out to be 0.16% or 0.26%, respectively.

At present, Kraken offers over 50 cryptos to trade and features various crypto indices and futures contracts. Users can fund their accounts in different FIAT currencies (including GBP) or digital currencies – with the latter allowing instant deposits.

Finally, Kraken really shines when it comes to educational content, with a whole library of guides, videos, and podcasts dedicated to explaining crypto concepts to beginners!

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

10. Gate io – Suited to Traders Looking For a Massive Range of Altcoins

With a reputation for a wide range of cryptocurrencies, Gate.io caters to a broad spectrum of crypto users. Founded in 2013 as BTER, Gate.io is headquartered in the Cayman Islands. The platform is free to use and is user friendly. With more than 1300 cryptocurrencies, Gate.io appeals to the crypto trader looking for new and obscure altcoins.

As a competitive crypto marketplace, Gate.io offers all the features you expect to find. Margin trading, perpetual futures and staking facilities accompany spot markets on all of the most popular coins. This flexibility in product offering is what makes Gate.io stand out from the competition.

The fees on Gate.io are low and further reductions can be activated through the in house Points Program and for those users who trade at high volumes. Using the maker-taker fee structure, the platform rewards users who add liquidity with lower fees. For takers, the fees are slightly higher. Holders of the native Gate Token (GT) also benefit from reduced fees.

Whilst not exactly suited to complete crypto beginners, Gate.io is favoured by those more experienced crypto traders due to its huge range of altcoins and variety of trading products. For anyone who runs into an issue, the platform has 24/7 customer support.

Traders who are looking to withdraw their profits from the platform can only do so with crypto. Whilst the platform is free and easy to register, to complete withdrawals, traders will need to undergo KYC registration. The exchange is unavailable in the UK.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

11. BingX – Leading Crypto Exchange With Advanced Derivative Features

Founded in 2018, BingX is a worldwide crypto exchange that provides a diverse range of products and services . Aimed at both beginners and professionals, BingX prioritizes user friendliness with an intuitive and easy to navigate platform making it an ideal choice for crypto newcomers.

A handy ‘Demo Mode’ allows new traders to experiment without the risk of lost funds while extensive educational resources help beginners build their confidence. BingX also features a ‘Copy Trading’ feature which allows users to mirror the trades of those more experienced. It really couldn’t be easier. All you have to do is choose a successful trader and follow their strategies.

Alongside spot markets, BingX offers access to advanced crypto derivatives such as futures contracts and leveraged trading. Whilst not suited to beginners, leveraged trading offers the chanced for amplified positions however it must be said that this can affect losses as well as profits.

Due to its global audience, BingX supports a massive range of fiat currencies such as the Brazilian Real (BRL). Such a global policy means many emerging markets are supported.

BingX appeals to both new and experienced traders and represents a good place for enthusiasts to explore their trading journey.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

12. Bitget – Respected Trading Platform With Celebrity Endorsement

Undergoing an extensive rebrand in July 2023, Bitget currently serve over 20 million customers across 100 countries. Through a focus on copy trading and smart trading tools, Bitget provide a wide range of crypto products. Alongside copy trading, the platform also provides access to margin trading, leveraged futures and AI trading bots.

Furthermore, registered users can also access earning products such as staking, interest on savings and crypto loans. For those looking to make a splash in the market, Bitget also provide launchpad services.

Bitget has its own native token (BGB) which grants users exclusive rights and privileges. These include fee discounts, voting rights and access to brand new listings. BGB has a total supply of 2 billion tokens of which 1.4 billion are in current circulation.

The platform boasts its own integrated wallet, Bitget Wallet, which is multi chain and decentralized and allows the user access to NFTs, dApp marketplaces and the exclusive Bitget Launchpad. With over 90 of the biggest chains supported, the Bitget Wallet provides users with convenience and flexibility.

Adopting the maker-taker fee structure, each spot trade charges a standard 0.1% fee for both. However, those traders using BGB to pay their fees only incur a charge of 0.08%. For those trading futures contracts, the charges are 0.02% and 0.06% respectively.

From a background in traditional finance Bitget evolved into crypto in late 2018. Although registered in the Seychelles, Bitget operates a decentralized policy while it looks for a permanent base to establish its HQ. With regional hubs in Asia and Latin America, Bitget plan to continue to expand their global presence.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

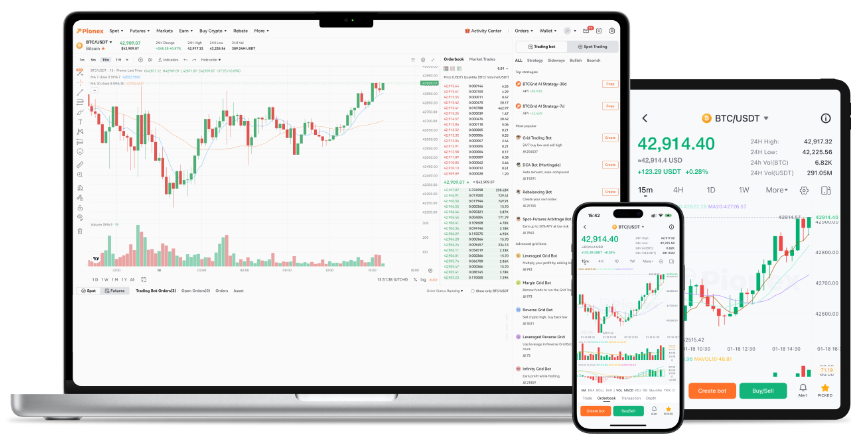

13. Pionex – Automated Trading Features Allow Users to Execute With Accuracy and Efficiency

Pionex isn’t your regular crypto exchange. The exchange has been designed to cater to traders who value automation and algorithmic trading strategies which makes it rather unique in the cryptocurrency arena.

In all there are 16 built-in automated trading bots which can execute a variety of strategies. From trailing stop losses to profit taking strategies, the Pionex platform allows you to execute your plans without constant monitoring of your positions.

Despite the focus on automation, Pionex maintains a user-friendly and intuitive interface making platform navigation relatively easy.

As you might expect, safety is a priority. By using multi-sig wallets, KYC/AML compliance and cold storage for the majority of customer funds, Pionex has an impressive safety record.

Like many of its competitors, Pionex has a transparent fee culture and uses the tried and tested maker-taker model. While not the lowest on the market, fees at Pionex are competitive.

Although Pionex offers the majority of the most popular cryptocurrencies, compared to other platforms the range on offer is rather limited at 379. However, as it is a relatively newcomer in the crypto space (2019) Pionex are making strides to compete in what is a ruthless market.

Pionex appeals to those traders who enjoy automated trading and as such it is a welcome addition. The tools available to the trader allow the platform to execute trades with accuracy and efficiency however this may not appeal to more experienced traders who prefer total control.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

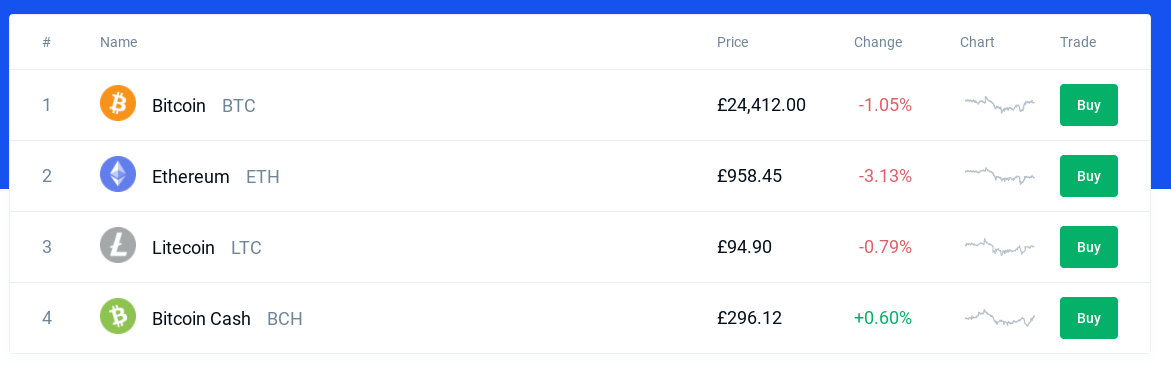

Best Crypto Exchange Comparison

| Platform Name | Number of Supported Cryptos | Fees to Buy Bitcoin |

| eToro | 80+ | 1% + Market Spread |

| MEXC | 1,000+ | 0% spot trading fee |

| Coinbase | 100+ | 0.5% spread + variable fee depending on trade size and payment method |

| Binance | 500+ | 0.1% |

| PrimeXBT | 40+ | 0.05% maker and taker |

| Margex | 9+ | 0.019% maker & 0.060% taker |

| Bybit | 80+ | 0.1% |

| Kucoin | 9177 | 0.1% maker |

| Kraken | 50+ | 1.5% + variable fee based on payment method |

| Gate.io | 1300 | 0.20% maker |

| BingX | 650+ | 0.10% |

| Bitget | 600 | 0.10% |

| Pionex | 379 | 0.05% |

Other Cryptocurrency Exchanges in the UK

Of course, there are many other cryptocurrency exchanges available in the market, you can see a full list of our crypto exchange reviews below:

- Bitstamp Review

- Bittrex Review

- Kraken Review

- Bithumb Review

- Huobi Review

- Bitfinex Review

- Coinfloor Review

- Coinone Review

- OKEx Review

- Poloniex Review

- EXMO Review

- Phemex Review

- Gate.io Review

- Nexo Review

What is a Crypto Exchange?

In a nutshell, the best crypto exchanges in the United Kingdom give you access to the ever-growing digital currency industry. Depending on your chosen provider, the exchange might offer brokerage and/or trading services. Regarding the former, this means that you will be using the exchange to buy or sell your chosen digital currency.

Crypto exchanges often add new cryptocurrencies to their offerings but there are some still in their pre-sale stage that have strong momentum moving into 2022. One such example is Lucky Block that stands to revolutionize the lottery industry as we know it.

For example, you might be looking to buy Bitcoin with a debit card – which is arguably one of the easiest and fastest ways of making an investment. When completing this transaction with eToro, you will be buying the coins directly from the provider. This means that you do not need to go and perform an additional exchange between pounds and cryptocurrencies.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Alternatively, some crypto exchanges in Britain specialize in trading services. This means that you will be trading cryptocurrency pairs – much like you would at a traditional forex broker. In simple terms, your objective here will be to speculate on the future value of a cryptocurrency pair like BTC/GBP or BTC/ETH.

We should also note that some crypto exchange platforms in the UK allow you to swap one digital currency to another. For example, you might be holding Ripple and you wish to exchange it for Ethereum. All in all, the best UK crypto exchanges allow you to buy, sell, and trade digital currencies from the comfort of your home.

New UK Crypto Trading CFD Regulations

As of January 2021, the FCA introduced new rules on cryptocurrency derivatives. At the forefront of this is CFD trading instruments that track the real-world value of digital currencies. These CFD products not only allow you to trade cryptocurrencies with leverage, but you can also engage in short-selling.

However, as leverage crypto CFDs are complex financial products, the FCA has since prevented UK retail clients from gaining access.

As such, any FCA-regulated broker or exchange that you use will not offer you these products. On the flip side, there are dozens of cryptocurrency exchanges that still offer leverage crypto assets to UK residents. But, these platforms operate without a regulatory license, so should be avoided.

How to Choose the Right UK Crypto Exchange for You

According to CoinMarketCap, there are more than 300 crypto exchanges currently active in the online space. There are likely hundreds more that the provider is yet to add to its data feed.

The key point here is that choosing the best crypto exchange in England is no easy feat – especially if you don’t know what you are looking for.

With this in mind, below we discuss the most important factors that you need to cross-check before choosing a provider.

Safety & Regulation

The good news, however, is that there are a select number of exchanges that do things by the book. By this, we mean that they are fully authorized and regulated by the FCA.

Ultimately, if you entrust your funds with an unregulated crypto exchange, there is every chance that your capital is at risk. Instead, you are advised to only use FCA-regulated platforms that put safety and customer care at the heart of everything.

Trading Options

As we briefly discussed earlier, there are many services that top crypto exchanges offer. As such, you need to check whether or not your chosen provider can facilitate the market you wish to access.

For example:

Buy/Sell Crypto

The best crypto exchanges allow you to buy cryptocurrency directly. This means that you can buy your chosen digital asset with an everyday payment method, like debit cards, bank account transfers, and even e-wallets. As soon as the transaction is complete, you might have the option of keeping your coins on the platform or withdrawing them to a private wallet.

Trade Crypto

Some exchanges are geared towards short-term trading. This would include strategies such as day trading, swing trading, and even scalping. In other words, your primary objective here is to speculate on the future value of a digital currency pair in the short-term. You will be looking to make modest, but regulated profits throughout the trading week.

Swap Crypto

You then have UK crypto exchange platforms that allow you to swap one digital currency to another. For example, you might have a number of Ethereum coins that you wish to swap for Bitcoin Cash. Usually, as soon as the transfer is made, you can then withdraw the respective coin out to a private wallet.

UK Crypto Exchange Fees

It goes without saying that even top crypto exchanges in the UK are in the business of making money. The way that platforms charge fees and commissions can vary quite considerably, so below we list the main charges that you should look out for.

Deposit Fees

The first fee that you need to be aware of is with respect to funding your account. After all, if you want to buy or trade cryptocurrencies online, you will initially need to make a deposit.

In a lot of cases, we found that UK crypto exchanges can charge handsomely when using a debit card. This is because of the perceived risk involved when facilitating cryptocurrency-related transactions.

Example debit card deposit fees include:

- Coinbase: 3.99%

- Binance: 2%

Trading Commission

Much like deposit fees, trading commissions can vary considerably from exchange to exchange. For those unaware, the commission relates to the fee that you pay when you buy, sell, or trade cryptocurrency. In all but a few rare cases, this is charged as a percentage against the size of your trading transaction.

- For example, Coinbase charges 1.49% – which you need to pay at both ends of the trade.

- This means that a £500 purchase of Bitcoin would cost £7.45.

- You would then need to pay 1,49% again when you sell your Bitcoin back to cash.

Spreads

The ‘spread’ is super important as it is often overlooked by first-time crypto traders. Much like any financial instrument – the spread is the difference between the buy and sell price of the digital currency market.

- For example, if Bitcoin has a buy price of $30,000 and a sell price of $30,500 – then the spread here is $500.

- The wider the gap between the two prices, the more you are indirectly paying.

Trading Tools & Features

Some of you might simply be looking to buy Bitcoin with a debit card and then hold on to your investment for several years. If this is the case, then you won’t be too concerned with trading features.

With that said, certain tools offered by the best crypto exchanges in the UK can enhance your end-to-end trading experience.

This includes:

Fractional Ownership

Irrespective of whether you are a newbie investor or a seasoned pro, fractional ownership is crucial in the cryptocurrency industry. After all, digital currencies are highly speculative asset classes, so you don’t want to be spending over £50,000 to buy a single Bitcoin.

Automated Trading

Cryptocurrencies are still understood by very few people in the UK. This makes the investment or trading process even more intimidating. This is why we like crypto exchange platforms that offer automated trading services.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

As we mentioned earlier, eToro allows you to copy a successful trader like-for-like. This will be at an amount proportionate to what you invest into cryptocurrencies.

- For example, if the eToro trader risks 5% of their capital buying Bitcoin and you invested £1,000, £50 worth of Bitcoin will be added to your portfolio.

- Then, when the trader sells their Bitcoin position, you will do the same.

Payment Methods

Don’t forget to check whether or not your chosen UK crypto exchange supports your preferred payment method. Crucially, as most exchanges operate without a license, very few can legally offer support for debit card or bank account transfers.

Even those that do typically charge excessive fees for the convenience of using fiat currency. Nevertheless, all of the best cryptocurrency exchange UK providers that we discussed on this page support debit cards and bank transfers.

Customer Service

Customer service is also an important metric to consider when searching for top bitcoin exchanges in the UK. For example, you might need assistance in how to make a deposit or complete a trade.

If the provider in question offers a live chat facility during standard UK hours, then this is a great bonus. This is because it allows you to speak with a customer service agent in real-time without needing to wait for an email reply.

What Is The Most Trusted Crypto Exchange?

The most trusted crypto exchange in the UK are exchanges that are regulated by the Financial Conduct Authority (FCA). The FCA is the main regulatory body in the UK that overseas the Financial Services industry in the UK. The regulator ensures that brokers adhere to security requirements that have been put in place to protect users. If a platform is regulated by the FCA, it will comply to anti-money laundering laws and customer safety regulations which is a sign that the platform can be trusted.

If the FCA believe that a platform is not trustworthy, the regulator may cut ties with the platform or demand that the platform put measures in place to adhere to requirements. The Financial Conduct Authority’s main responsibility is to ensure that financial markets and honest, competitive and fair.

How To Trade Cryptocurrency in the UK – eToro Guide

We are now going to show you how to get started on a crypto broker. The walkthrough below will explain how to open an account, make a deposit, and place your first trade with eToro.

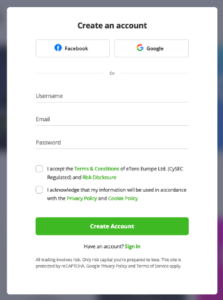

Step 1: Open a Crypto Trading Platform Account at eToro

Head over to the eToro website and start registering a new account. Be sure to have all your personal details to hand when setting up your account.

Step 2: Verify Your Account

After the account is created, eToro requires investors to complete a KYC (Know Your Customer) form. Upload your proof of identity documents such as a Passport Copy or Driver’s license to continue. This should only take a few minutes.

Step 3: Fund Your Account

After successfully creating and verifying a new account, you can deposit funds in your eToro account. eToro supports multiple payment options including SEPA transfers, VISA, MasterCard, Apple Pay, and bank accounts. Select your preferred payment option, enter the amount to deposit, and confirm the transaction.

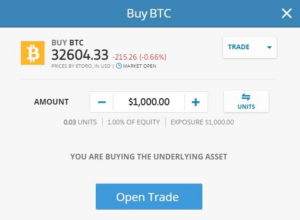

Step 4: Search and Buy Crypto

Now search for your preferred trading asset on the navigation bar. For instance, type ‘BTC’ on the search bar to access the Bitcoin trading market. On the order box, enter the amount of tokens you wish to receive, and click on open trade to confirm the transaction.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro– Best Crypto Exchange in the UK

In summary, although it’s great that UK residents now have access to hundreds of cryptocurrency exchanges – it is important to remember that cryptos are very volatile financial assets and the underlying risks of losing investing capital is considerably high.

After reviewing dozens of well-known providers, we found that the best crypto broker in the UK is eToro. This is because the platform offers all the leading cryptocurrencies, innovative copy trading tools, and charges 0% spot trading fees.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.