How to Buy Babcock Shares UK – with 0% Commission

Babcock International Group plc is a UK-based provider of complex engineering services. This covers three key regulated markets – emergency services, civil nuclear, and defense.

Babcock is listed on the London Stock Exchange and carries a market capitalization of over £1.7 billion. As such, the process of investing in Babcock shares can be completed online in minutes.

In this guide, we explain the easiest and most cost-effective way of how to buy Babcock shares online in the UK. We also discuss the best brokers to complete the investment process with and the steps required to buy Babcock shares right now.

-

-

Step 1: Find a UK Stock Broker to Buy Babcock Shares

Babcock (BAB) shares can be purchased at many UK stock brokers that have an online presence. As such, you should spend some time researching how much the broker charges in commission, what payment methods it supports, and how user-friendly the platform is.

Below you will find the best online brokers that allow you to buy Babcock shares with ease.

1. Fineco Bank – Buy Babcock Shares from £2.95

Fineco Bank is another low-cost brokerage firm that is worth considering. The provider is an investment bank based in Italy, albeit, it offers a popular share dealing platform to UK investors. In turn, it is fully regulated by the FCA and your funds are covered by the FSCS.

In terms of fees, it will cost you £2.95 to buy Babcock shares at Fineco. This commission will also need to be paid when you sell your shares. In addition to the flat rate commission, Fineco Bank also charges an annual fee of 0.25%.

This includes thousands of UK and international shares, ETFs, funds, and even pre-packed portfolios. Fineco Bank also offers a fully-fledged CFD trading suite. This means that you can trade Babcock shares with leverage. You can also engage in short-selling – which is useful if you think that Babcock shares are due to move southwards.

In terms of getting started, Fineco Bank allows you to open an account in minutes. The minimum investment at the platform is £100 – which you will need to fund with a bank transfer. Fineco Bank is also worth considering if you like to buy and sell shares on the move. This is because it offers a top-rated investment app that is compatible with both Android and iOS devices.

Pros:

- Charges just £2.95 per trade when buying and selling shares

- Access to thousands of UK and international shares

- Deposit funds with a UK bank account

- Heavily regulated, including an FCA license

- Suitable for both newbies and seasoned investors

- Great research and educational department

- Established way back in 1999

- All personal data protected

Cons:

- Does not accept deposits and withdrawals via debit/credit cards

- Still relatively unheard of in the UK investment scene

Your capital is at risk

Step 2: Research Babcock Shares

So now that we have discussed the two best brokers to buy shares of Babcock from, you now need to do a bit of research on the stock. After all, you will be risking your hard-earned money – so you need to be sure that Babcock represents a good long-term investment.

With this in mind, below we explore the past performance of Babcock’s shares, what its dividend policy looks like, and what fundamental factors might influence its future value.

What is Babcock plc?

Founded in 1981, Babcock is a London-based provider of engineering services. It focuses on three main critical sectors – defense, civil nuclear, and emergency services. For example, Babcock supports Royal Navy ships and delivers marine technology solutions.

It also supports British Army vehicles and provides technical training programs to the wider armed forces. Babcock is also behind a fleet of search and rescue planes and supports the Royal Air Force in its United Kingdom and overseas duties. Babcock is led by CEO David Lockwood – who began his role at the firm as recently as September 2020.

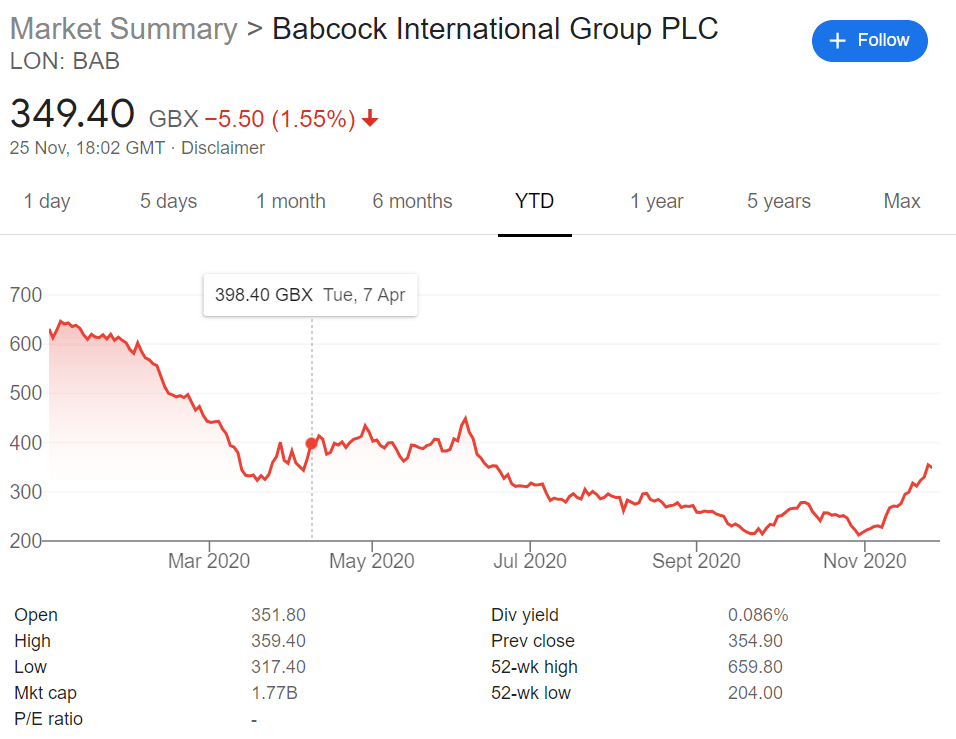

Babcock Share Price History & Market Capitalisation

Babcock first went public in the late 1980s – opting for the London Stock Exchange. Its shares have been on a rollercoaster journey every since – bypassing many peaks and troughs along the way. Post-IPO, you would have paid around 1,000p for a Babcock share.

The company experienced its first stock price capitulation in June 1995 – where the shares went from 718p to 135p in a matter of months. Fortunately for early backers, Babcock shares then enjoyed a slow and steady upward trajectory that lasted for almost a decade – with the stocks hitting 1,271p in 2014. However, this all-time high price hasn’t been breached since. In fact, the shares have been moving in the right direction for several years.

Nevertheless, we are more concerned with what the future holds for Babcock, so it makes sense to see how the stocks have performed YTD. At the start of 2020, you would have paid just over 650p per Babcock share. Fast forward to late November 2020 and the same shares are worth just 349p.

This represents YTD losses of 46%. While one could argue that much of the FTSE has struggled this year as per the coronavirus pandemic – it is somewhat concerning that Babcock hasn’t seen much of a recovery. With that being said, in the four weeks prior to writing this guide Babcock shares were valued at 246p. This means that the stocks are finally moving in the right direction – with a 1-month increase of 41%.

Babcock EPS and P/E Ratio

At the time of writing, Babcock shares have a P/E ratio of 5.14. This is actually quite low in comparison to the wider FTSE 250 average – meaning that the stocks could be undervalued. Based on its full financial year results of March 2020 – Babcock shares have an EPS of 69.10p. This is down from the 84p it achieved in the year prior.

Babcock Shares Dividend Information

Under normal circumstances, Babcock pays twice a year. The firm has a policy that seeks to initiate dividend cover of between 2.5 and 3 times. However, management at Babcock has since suspended its dividend policy – subsequently halting its intended full-year payment of 2020.

Type Ex-div date Payment date Amount Interim 05/12/2019 17/01/2020 7.20p Final 04/07/2019 09/08/2019 22.90p Interim 06/12/2018 16/01/2019 7.10p Final 28/06/2018 10/08/2018 22.65p Interim 07/12/2017 16/01/2018 6.8 It goes without saying that this was a result of the COVID-related slowdown. The board has made no indication of when it will resume its dividend policy. With this in mind, your main focus when buying Babcock shares is stock price growth.

Should I Buy Babcock Shares?

Whether or not you decide to buy Babcock shares should be based on what the future holds for the firm – as opposed to its historical price action. As such, below we list some of the most important considerations that you need to make before you proceed with an investment in Babcock.

Low P/E Ratio

The price-to-earnings (P/E) ratio is a great tool used by seasoned investors – as it allows us to assess whether a stock is potentially over and undervalued. In the case of Babcock shares, the firm currently carries a P/E ratio of just 5.1.

While at first glance this might not mean a lot to you – the general rule of thumb is that any UK stocks with a P/E ratio of less than 10 represent a bargain buy. As such, with Babcock still accessible at 5.1 – this could represent an unvalued stock.

Defense Budget has Been Increased

One of the main sectors that Babcock focuses on is that of the British armed forces. With that in mind, it is welcome news for Babcock stockholders that the UK government recently announced a huge defense budget increase.

In fact, it has pledged an additional £16.5 billion over the next four years. It is therefore likely that Babcock will benefit from this owing to the firm’s longstanding relationship with the British army, navy, and air force.

Investors Seem to be Warming to Babcock

On the one hand, it is super concerning that Babcock stocks are still 46% down for the year. On the flip side, the shares have encountered a major uplift over the past month. As we noted earlier, the stocks have gone from 246p to 349p in the space of a month.

This translates into a stock price rise of 41%. Not bad for those of you that caught the bottom. Crucially, there is no reason to believe that this upsurge will stop any time soon – especially when you consider the recent defense budget announcement.

Babcock Shares Buy or Sell?

Although Babcock shares have tanked on the London Stock Exchange this year, broker forecast ratings are somewhat bullish. This is because the stocks are potentially trading at an amount well below their fair value. Based on a P/E ratio of 5.1, this is further confirmed.

Additionally, not only is the UK government increasing military spending – but this is a trend happening globally. This is great news for Babcock as the firm has formed great relationships with defense ministries both domestically and internationally.

The Verdict?

If you want to buy Babcock shares online in the UK – you have plenty of brokers to choose from.

The FCA-regulated platform allows you to buy Babcock shares commission-free. The broker also waivers stamp duty tax on the purchase, so that saves you an additional 0.5%.

FAQs

Are Babcock shares a good buy?

Babcock has had a torid year - with its stocks plummeting by 46% since January. However, the stocks are now potentially undervalued - with the firm carrying a P/E ratio of just 5.1.

What stock exchanges are Babcock shares listed on?

Babcock is listed on just one marketplace - the London Stock Exchange. Its shares have been traded on this exchange since the late 1980s.

What is the Babcock P/E ratio?

At the time of writing, Babcock carries a P/E ratio of 5.1.

Does Babcock dividends?

Babcock ordinarily pays dividends twice per year. However, the firm suspended its dividend policy until further notice back in Q2 2020.

How much is Babcock valued at?

As of late November 2020 - Babcock has a market capitalization of just over £1.7 billion.

Who is the Chief Executive Director of Babcock?

David Lockwood became the Babcock CEO in September 2020.

Can I invest in Babcock via an ISA or SIPP?

Yes, if you are using a digital look UK broker that offers ISAs and SIPPs, you can easily add Babcock shares to benefit from a tax-efficient investment.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up