How To Buy Aviva Shares UK With Zero Commission

Aviva is a major insurance, asset management, and pension company with its headquarters in the UK. Listed on the London Stock Exchange, the firm has a current market capitalization of over £11 billion.

If you want to buy Aviva shares today, you will need to find a reliable stock broker that is regulated by the FCA. There are many platforms to choose from, so you’ll also need to consider metrics surrounding payment methods, fees, commissions, and customer support.

In this guide, we show you how to buy Aviva shares in the UK. We also discuss the best UK brokers to buy the shares from, as well as some background information on what the future holds for Aviva.

-

-

Step 1: Find a UK Stock Broker to Buy Aviva Shares

If you want to buy Aviva shares today, your first port of call will be to find a suitable UK stock broker. There are hundreds of platforms to choose from, so you’ll need to do some digging to ensure the provider is right for you.

Taking into account just how time-consuming this can be, below we discuss some of the best online platforms to buy Aviva shares from in 2020.

1. Plus500 – Commission-Free Stock CFD Trading Platform

If you are more interested in placing sophisticated trades on Aviva shares, it might be worth considering Plus500. This is because the online stock trading platform specializes in CFDs (contracts-for-differences). In Layman’s terms, this means that the CFD instrument will track the real-world price of Aviva shares, meaning that you can trade them without taking direct ownership.

This can be beneficial for a number of reasons. For example, Plus500 allows you to apply leverage of 1:5 when trading Aviva share CFDs. This means that you can trade with five times more than you have in your account. Plus500 also gives you the option of going long and short. The former means you are speculating on the price increasing, while the latter means that you are looking to profit when the value of the shares goes down.

Regardless of which way you think the markets will go, Plus500 allows you to trade on a commission-free basis. This is the case across thousands of financial instruments hosted at the platform. In the shares department, this covers over 2,000 stock CFDs. If you’re looking to access other asset classes, Plus500 also hosts commodities, indices, cryptocurrencies, forex, and bonds – all in the form of CFDs. You can trade all of these assets online or via the Plus500 mobile app.

In terms of the specifics, Plus500 allows you to open an account in minutes. Upon providing your personal information and uploading some ID – you will need to meet a £100 minimum deposit. You can do this with a debit card, credit card, bank account, or Paypal. There are no fees to deposit or withdraw funds, but a 0.5% currency conversion charge comes into play when accessing non-GBP markets. Finally, Plus500UK Ltd is authorized & regulated by the FCA (#509909).

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Retail clients can trade stock CFDs with leverage of up to 1:5

- You can short-sell a stock CFD if you think its value will go down

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- More suitable for experienced traders

72% of retail investors lose money trading CFDs at this site

Step 2: Research Aviva Shares UK

Whether you’re looking to invest in Aviva or other pension and insurance providers such as Legal and General, it’s always important to do your research. In doing so, you can be 100% sure that you understand both the risks and rewards of making an investment.

To point you in the right direction, below we discuss some of the most pertinent points to consider before you buy Aviva shares.

Aviva Share Price History

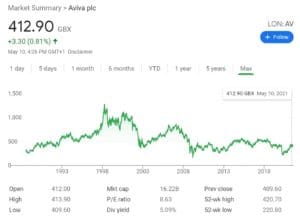

A good starting point when researching a company is to look at the firm’s historical share price. For this, we would need to go right back to the mid-1990s. Crucially, you would have paid 500p per Aviva share in 1995. Stockholders then enjoyed a fruitful three years, with the shares peaking at 1,280p in 1998. This represented a huge upswing of 156%.

However, Aviva shares are now worth just a fraction of their prior peaks. In fact, at the time of writing in May 2021, you will need to pay just 412p to buy an Aviva share. This means that the stocks are worth 68% less than they were in 1998. With that being said, it is much more pertinent to look at the recent Aviva share price history to determine whether or not the stocks are worth investing in.

Much like the rest of the insurance industry, Aviva shares fell off of a cliff in response to the COV-19 pandemic. In the space of just one month, the shares went from 404p to 205p. This translates into losses of almost 50%.

On the flip side, those that were shrewd enough to catch the bottom of the downward trend are now looking at gains of over 100%. The shares are now trading at 412p, right around the level that they were at prior to the pandemic.

Aviva Shares Dividend Information

Management at Aviva has been sending out mixed messages on its dividend policy in recent months. On the one hand, the firm announced that it would be resuming its dividend policy – with a planned interim payment of 6p per share. This was very welcome news for stockholders, with the announcement resulting in a share price increase of just under 5% by the close of trading.

On the other hand, management has since hinted at the possibility of a dividend cut. Whether or not a cut comes to fruition will ultimately depend on how the firm deals with the economic fallout of the pandemic.

Should I Buy Aviva Shares Today?

Still wondering whether Aviva shares are worth buying? In this section of the research phase, we are going to discuss where the shares are likely to move in the coming months and years.

Promising Recovery From 52-Week Lows

As we covered above, Aviva shares hit 52-week lows of 205p in March 2020. This represented a 50% drop in the space of just one month. The good news, however, is that the shares have since recovered fully – they are trading at the same level as they had before the pandemic. For investors who bought at the April bottom, that represents a profit of more than 100%.

Shares Might Still be Undervalued

Aviva is now trading at the same price the shares held before the pandemic. But that doesn’t mean they’re valued appropriately.

A lot has changed since last March. Aviva shares are in an ultra-hot market and access to money is relatively easy. The UK is also experiencing a home buying boom, which could increase policies and profits for the company. It remains to be seen whether life insurance policies take off in the wake of the pandemic, but it’s entirely possible that the scare caused by COVID-19 encourages more people to think about financial planning.

Half-Year Results

When attempting to assess the viability of a stock investment, it is crucial to look at the firm’s most recent earnings report. In the case of Aviva, the company recently published its half-year results. In terms of the positives, profits in the firm’s UK Life division increase by 9%.

Although Aviva saw its solvency ration drop from 206%, at 195% this is still somewhat healthy. This takes its solvency capital to around the £12 billion-mark. In less positive news, Aviva’s General Insurance division saw its operating profits drop by just under 50%.

With that being said, much of this was due to a hike in claims as per the COV-19 pandemic. Operating profits in the International Life division also suffered. This stood at a decline of 7.9% in Asia and 6.4% in Mainland Europe.

Aviva Shares Login

Once you go through the process of buying Aviva shares, you can access information about your investment from the Aviva website. The firm has partnered with Computershare, which allows you to:

- View the current value of your Aviva share portfolio

- Update your bank details for the purpose of dividends

- Create a dividend reinvestment plan

- Amend your home address

- Decide how you wish to receive information sent to shareholders

With that being said, there is no requirement to use the Aviva shares login system when using an FCA-broker. This is because everything is executed on your behalf by the platform that you buy the shares from. For example, your dividends will be paid into your brokerage account, you can change your personal information at any given time and easily reinvest your dividend payments.

Aviva Shares Buy or Sell?

Although Aviva shares are worth just a fraction of their prior peaks, the firm still offers an element of growth potential. Aviva shares are now priced at the same level they were prior to the pandemic, at just over 400p. However, the shares could move much higher.

That’s because the market in which Aviva is operating is so much different than the market of February 2020. Aviva now has access to easy cash and bullish economic policies. In addition, the company could see more policies being sold over the coming years as people respond to the financial effects of the COVID-19 pandemic.

Notably, Aviva is also dramatically undervalued from an earnings perspective. The company has a P/E ratio of just 8.6, which is much lower than the average for the insurance industry. In fact, at the current price, Aviva could be considered one of the top value stocks in the UK.

Given all that, we think Aviva shares are a buy right now. Look for the company to break strongly above the 400p level. From there, momentum could carry the share price much higher.

The Verdict?

If you like the sound of Aviva and wish to add its shares to your stock portfolio, the process couldn’t be easier. When using a top-rated FCA broker, you can buy Aviva shares today without paying any commission.

All you need to do is open an account and instantly deposit funds with a UK debit/credit card or e-wallet. Best of all, you can invest from just $50 (about £40) into Aviva, so you can still get a look in if you are on a budget.

Simply click the link below to get started!

FAQs

What does Aviva do?

Aviva's core business model centers on insurance. This covers everything from health, car, and home insurance - both to the consumer and business sectors. Additionally, Aviva is also involved in the asset management and pension arena.

What stock exchange are Aviva shares listed on?

Aviva shares are listed on the UK's primary exchange - the London Stock Exchange. It is also a FTSE 100 constituent.

Do Aviva shares pay dividends?

Although Aviva had previously suspended its dividend policy, management recently made the decision to resume it. It is planning to pay an interim dividend of 6p per share.

What is the minimum number of Aviva shares you can buy?

This depends on your choice of share dealing platform.

Can you short Aviva shares?

If you think that Aviva shares are overvalued, you can short the company via CFDs.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up